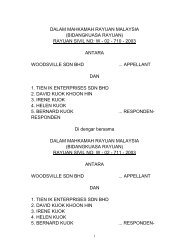

in the court of appeal malaysia (appellate jurisdiction)

in the court of appeal malaysia (appellate jurisdiction)

in the court of appeal malaysia (appellate jurisdiction)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12. Pursuant to <strong>the</strong> Jo<strong>in</strong>t Venture Agreement <strong>the</strong> Petitioner’s<br />

wholly owned subsidiary company, Sunyap Development<br />

Sdn Bhd (Co. No. 67231-M) also subleased <strong>the</strong> Premises<br />

at a special rent to <strong>the</strong> 1 st Respondent.<br />

THE FIDUCIARY RELATIONSHIP BETWEEN THE<br />

PETITIONER AND THE 2 ND RESPONDENT<br />

13. The jo<strong>in</strong>t venture relationship between <strong>the</strong> Petitioner and<br />

<strong>the</strong> 2 nd Respondent was ak<strong>in</strong> to partners <strong>in</strong> a jo<strong>in</strong>t venture<br />

bus<strong>in</strong>ess under <strong>the</strong> corporate umbrella <strong>of</strong> <strong>the</strong> 1 st<br />

Respondent.<br />

THE AFFAIRS AND CONDUCT OF THE 1 ST<br />

RESPONDENT<br />

Alleged Advance <strong>of</strong> RM3.78 million by <strong>the</strong> 2 nd Respondent and<br />

<strong>the</strong> <strong>in</strong>terests charged.<br />

14. The issue <strong>of</strong> <strong>the</strong> alleged advance <strong>of</strong> RM3.78 was first<br />

brought up to <strong>the</strong> board <strong>of</strong> directors at its meet<strong>in</strong>g on<br />

18.6.2003 that as at 31.5.2003 <strong>the</strong> Ngiu Kee Group (<strong>of</strong><br />

which <strong>the</strong> 2 nd Respondent is a part <strong>of</strong>) had advanced an<br />

amount <strong>of</strong> RM3.78 million to <strong>the</strong> 1 st Respondent for <strong>the</strong><br />

repayment to its suppliers. This issue was subsequently<br />

addressed at <strong>the</strong> board <strong>of</strong> directors meet<strong>in</strong>g <strong>of</strong> <strong>the</strong> 1 st<br />

Respondent on 26.9.2003.<br />

15. It was <strong>the</strong>n unanimously agreed on 17.11.2003 by <strong>the</strong><br />

entire board <strong>of</strong> directors <strong>of</strong> <strong>the</strong> 1 st Respondent, which<br />

<strong>in</strong>cluded both <strong>the</strong> representatives <strong>of</strong> <strong>the</strong> Petitioner and <strong>the</strong><br />

2 nd Respondent that <strong>the</strong> management <strong>of</strong> <strong>the</strong> 1 st<br />

Respondent be <strong>in</strong>structed to request <strong>the</strong> proposed auditors<br />

to <strong>in</strong>clude <strong>the</strong> verification <strong>of</strong> <strong>the</strong> said advance <strong>of</strong> RM3.78<br />

million and <strong>the</strong> alleged stock losses as part and parcel <strong>of</strong><br />

<strong>the</strong> forthcom<strong>in</strong>g annual audit for <strong>the</strong> f<strong>in</strong>ancial year<br />

end<strong>in</strong>g 31.12.2003 subject to a fee which is acceptable to<br />

<strong>the</strong> board <strong>of</strong> directors, and if <strong>the</strong> fee is too high, ano<strong>the</strong>r<br />

<strong>in</strong>dependent audit firm to be agreed upon by <strong>the</strong> parties<br />

be appo<strong>in</strong>ted.<br />

20