Download IPO Prospectus - GulfBase.com

Download IPO Prospectus - GulfBase.com

Download IPO Prospectus - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

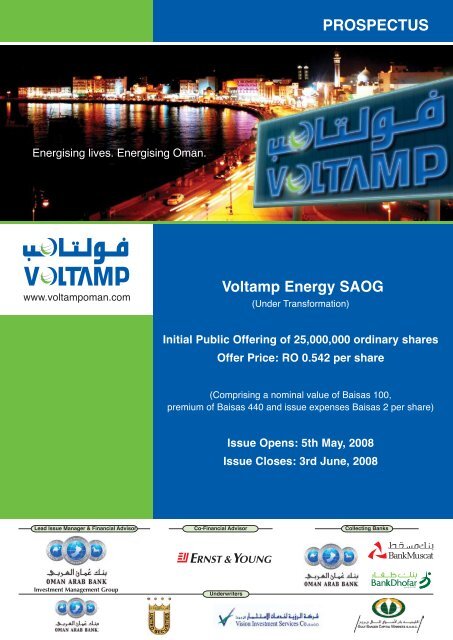

Energising lives. Energising Oman.<br />

www.voltampoman.<strong>com</strong><br />

Underwriters<br />

PROSPECTUS<br />

Voltamp Energy SAOG<br />

(Under Transformation)<br />

Initial Public Offering of 25,000,000 ordinary shares<br />

Offer Price: RO 0.542 per share<br />

(Comprising a nominal value of Baisas 100,<br />

premium of Baisas 440 and issue expenses Baisas 2 per share)<br />

Issue Opens: 5th May, 2008<br />

Issue Closes: 3rd June, 2008<br />

Lead Issue Manager & Financial Advisor Co-Financial Advisor<br />

Collecting Banks<br />

Investment Management Group

PROSPECTUS<br />

Voltamp Energy SAOG (under transformation)<br />

www.voltampoman.<strong>com</strong><br />

Postal Address: P.O.Box 75, P.C: 124,<br />

Rusayl, Sultanate of Oman<br />

Tel: 24446501<br />

Fax: 24446502<br />

Initial Public Offering of 25,000,000 (twenty five million) Ordinary Shares<br />

Total Offer Size: RO 13.55 million<br />

Offer price: RO 0.542 per share<br />

(Comprising a nominal value of Baisas 100, premium of Baisas 440<br />

and Issue Expenses Baisas 2 per share)<br />

Lead Issue Manager & Financial Advisor<br />

Oman Arab Bank,<br />

Investment Management Group<br />

P.O. Box 2010, Postal Code: 112, Sultanate of Oman<br />

Ph: 24762399 Fax: 24762377<br />

Underwriters<br />

Oman Arab Bank SAOC Vision Investment Services Co. SAOC<br />

United Securities LLC Gulf Baader Capital Markets SAOC<br />

Co-Financial Advisor<br />

Ernst & Young<br />

PO Box: 1750, Ruwi, 112,<br />

Qurum, Muscat, Sultanate of Oman<br />

Ph: 24559599 Fax: 24566043<br />

Collecting Banks<br />

Oman Arab Bank SAOC<br />

Bank Muscat SAOG<br />

Bank Dhofar SAOG<br />

OFFERING PERIOD<br />

Opening Date: May 5, 2008<br />

Closing Date: June 3, 2008<br />

Lead Issue Manager & Financial Advisor Co-Financial Advisor<br />

Collecting Banks<br />

Investment Management Group<br />

Underwriters<br />

The Capital Market Authority (“CMA”) assumes no responsibility for the accuracy and adequacy of the statements and<br />

information contained in this <strong>Prospectus</strong> nor shall it have any liability for any damage or loss resulting from the reliance<br />

upon or use of any part of the same by any person. This <strong>Prospectus</strong> has been prepared in accordance with the<br />

requirements as prescribed by the CMA. This is an unofficial English translation of the original <strong>Prospectus</strong> prepared in<br />

Arabic and approved by the CMA in accordance with the Administrative Decision no. F/19/2008 dated 27/4/2008.<br />

1

Important Notice to Investors<br />

The aim of this <strong>Prospectus</strong> is to present material information that may assist investors to make<br />

an appropriate decision as to whether or not to invest in the securities offered.<br />

This <strong>Prospectus</strong> includes all material information and data and does not contain any misleading<br />

information or omit any material information that would have a positive or negative impact on<br />

the decision of whether or not to invest in the offered securities.<br />

The issuer entity represented by the Founders/Selling Shareholders are jointly and severally<br />

responsible for the integrity and adequacy of the information contained in this <strong>Prospectus</strong> and<br />

confirm that, according to the best of their knowledge, due diligence has been observed in<br />

the preparation of this <strong>Prospectus</strong> and further confirm that no material information has been<br />

omitted, the omission of which would render this <strong>Prospectus</strong> misleading.<br />

All investors should examine and carefully review this <strong>Prospectus</strong> in order to decide whether<br />

or not it would be appropriate to invest in the securities offered by taking into consideration all<br />

the information contained in this <strong>Prospectus</strong> in the context. Investors should not consider this<br />

<strong>Prospectus</strong> a re<strong>com</strong>mendation by the issuer entity of the offered securities to buy the offered<br />

securities. Every investor shall bear the responsibility of obtaining independent professional<br />

advice on the investment in the offered securities and conduct his/her/its own independent<br />

valuation of the information and assumption contained herein using whatsoever analysis or<br />

projections he sees fit as to whether or not to invest in the securities offered.<br />

It is to be noted that no person has been authorised to make any statements or provide<br />

information on the Company or the offered securities other than the persons whose names<br />

are indicated herein. In the event that any other person makes representations or provides<br />

any such information it should not be taken as authorised by the issuer entity or the issue<br />

manager.<br />

2

ADDITIONAL POINTS TO BE NOTED<br />

This <strong>Prospectus</strong> includes relevant information that is deemed important and does not include<br />

any misleading information nor exclude any principal information, the omission of which may<br />

materially influence any investor’s decision pertaining to the investment in Shares through this<br />

<strong>Prospectus</strong>. All summaries of documents or provisions of documents provided in this <strong>Prospectus</strong><br />

should not be relied upon as being <strong>com</strong>prehensive statements in respect of such documents<br />

and are only to be seen as being a brief summary of such documents.<br />

All equity investments carry market risks to varying degrees. The value of any security can fall as<br />

well as rise depending on the market conditions.<br />

FORWARD-LOOKING STATEMENTS<br />

This <strong>Prospectus</strong> contains forward-looking statements, including statements about the Company’s<br />

beliefs and expectations. These future statements are based on the Company’s current plans,<br />

estimates and projections as well as its expectations of external conditions and events. They<br />

have implementable plans in place and thus have realistic expectations of achieving these.<br />

Forward-looking statements involve inherent risks and uncertainties and speak only as at the<br />

date they are made. The Company cautions investors that a number of important factors could<br />

cause actual results or out<strong>com</strong>es to differ materially from those expressed in any forward-looking<br />

statements. These factors include, but are not limited to, the following:<br />

♦ level of demand for the Company’s products and services;<br />

♦ actions of the Company’s <strong>com</strong>petitors;<br />

♦ regulatory, legal and fiscal developments;<br />

♦ success of the Company’s investments and capital expenditure programs;<br />

♦ performance of the Omani economy; and<br />

♦ other factors described under "Risk Factors and Mitigants" as given in chapter 16 of this<br />

<strong>Prospectus</strong>.<br />

The Company will follow the rules and regulations of the Capital Market Authority, after it is listed<br />

in the Muscat Securities, and will <strong>com</strong>municate to its share holders periodically the progress of<br />

the new projects as mentioned in this prospectus including any changes in their plans if any. The<br />

Company will update the shareholders either directly from the Company or through the website<br />

of the Muscat Securities Market.<br />

3

TABLE OF CONTENTS<br />

4<br />

Page No<br />

IMPORTANT NOTICE TO INVESTORS ........................................................... 2<br />

CHAPTER 1 – Definitions ................................................................................ 5<br />

CHAPTER 2 – General Information on the Issue and Issuer ........................... 6<br />

CHAPTER 3 – Share Split and its Effect ........................................................ 13<br />

CHAPTER 4 – Issue Expenses .............................................................................. 15<br />

CHAPTER 5 – Underwriting Arrangements ................................................... 16<br />

CHAPTER 6 – Purpose of the Issue and Utilisation of the Proceeds ........... 17<br />

CHAPTER 7 – Objectives of the Company and Approvals ........................... 18<br />

CHAPTER 8 – Shareholding Details ............................................................... 21<br />

CHAPTER 9 – Market and Economic Overview ............................................ 26<br />

CHAPTER 10 – Description of the Company and Business Overview<br />

and Activities .................................................................................................. 34<br />

CHAPTER 11 – Summarised Historical Consolidated Financial Statements 50<br />

(For Financial Years 2005-2007)<br />

CHAPTER 12 – Summarised Prospective Consolidated Financial Statements 73<br />

(For Financial Years 2008-2014)<br />

CHAPTER 13 – Dividends Policy .................................................................... 92<br />

CHAPTER 14 – Valuation and Price Justification .......................................... 93<br />

CHAPTER 15 – Related Party Transactions .................................................. 98<br />

CHAPTER 16 – Risk Factors and Mitigants ................................................... 100<br />

CHAPTER 17 – Corporate Governance ......................................................... 105<br />

CHAPTER 18 – Rights and Liabilities of Shareholders ................................. 111<br />

CHAPTER 19 – Conditions and Procedures of the Subscription of the Shares 115<br />

CHAPTER 20 – Undertakings ......................................................................... 122

CHAPTER 1<br />

DEFINITIONS<br />

The Board : means the board of directors of the Company elected<br />

in accordance with the Articles of Association of the<br />

Company.<br />

Business Day : means any day on which <strong>com</strong>mercial banks are open for<br />

business in the Sultanate of Oman.<br />

CCL : means the Commercial Companies Law of the Sultanate of<br />

Oman issued by Royal Decree 4/74 and the amendments<br />

thereto.<br />

Company : means Voltamp Energy S.A.O.G (under transformation).<br />

LLC : means Limited Liability Company<br />

SAOC : means Closed Omani Joint Stock Company<br />

SAOG : means General Omani Joint Stock Company<br />

Employees : employees means those employees of the Company who<br />

have joined the Company on or before 29 th February 2008<br />

and continue to be in the employment of the Company at<br />

the Closing Date.<br />

5

CHAPTER 2<br />

GENERAL INFORMATION ON THE ISSUE AND THE ISSUER<br />

Name of the Issuer: Voltamp Energy SAOG (under transformation)<br />

Commercial Registration No: 1262947 dated 03/08/1987 issued by the Ministry of<br />

Commerce & Industry<br />

Principal Place of Business Postal Address : P.O.Box 75, P.C 124, Rusayl, Sultanate<br />

of Oman Tel: 24446501 Fax: 24446502<br />

Company’s Duration: Unlimited<br />

Financial Year: Commences on the first day of January and ends on the<br />

thirty first day of December of each year<br />

Type of Shares and Voting<br />

Rights:<br />

All the Equity Shares issued by the Issuer and the entire<br />

equity capital of the <strong>com</strong>pany consist of only Ordinary<br />

shares and each single share carrying the right to one<br />

vote at the Constitutive General Meeting of the Company<br />

and any General Meeting of the Company including any<br />

Extraordinary General Meeting.<br />

Ordinary Shares: Equity Shares issued by the Issuer with a nominal value<br />

of one hundred Baisas (RO 0.100) and each share<br />

carrying the right to one vote at the Constitutive General<br />

Meeting of the Company and any General Meeting of the<br />

Company including any Extraordinary General Meeting.<br />

Authorised Share Capital of the<br />

Company:<br />

Existing Ordinary Shares<br />

Before the <strong>IPO</strong>:<br />

The Authorised share capital of the Company shall be<br />

RO. 10,000,000 (Rial Omani Ten Million), divided into<br />

100,000,000 (One Hundred Million) Ordinary Shares.<br />

RO 3,500,000 (Rial Omani Three Million Five Hundred<br />

Thousand) divided into 35,000,000 (35 Million) ordinary<br />

shares.<br />

Offered Shares: Offer of 25,000,000 (Twenty Five Million) shares that<br />

consists of<br />

1. Offer of 10 Million shares to the public selling by the<br />

promoters<br />

2. Issue of 15 Million New Ordinary Shares (after the<br />

<strong>com</strong>pletion of <strong>IPO</strong>) for public subscription by the<br />

Company<br />

3. The Company will allot 5% (1,250,000) of the offered<br />

shares for the Company employees and Managers<br />

as per the details given in this <strong>Prospectus</strong><br />

6

The Issued and Paid up Caital<br />

after <strong>IPO</strong>:<br />

Par Value for the share: 100 Baisa for each share<br />

RO 5,000,000 (Rial Omani Five Million) dividend in to 50<br />

Million shares<br />

Restrictions on the shares: Restrictions imposed on the Promoters:<br />

In accordance with Article 77 of the CCL, the Promoters<br />

of the Company shall not withdraw from the Company<br />

or dispose of their Shares prior to publication of two<br />

Balance Sheets pertaining to two consecutive financial<br />

years, effective from the date of listing of the Shares on<br />

the Muscat Securities Market. An exception to this shall<br />

be the cases of assignment of the Shares amongst the<br />

Shareholders themselves and cases of inheritance.<br />

The period during which the Promoters are not<br />

permitted to withdraw or dispose off their Shares may<br />

be extended for a further one year by a decision of the<br />

Minister of Commerce & Industry, at the request of the<br />

Capital Market Authority, without prejudice to the right<br />

held by the Promoters to make second grade pledge on<br />

those Shares.<br />

If any defect has taken place in the procedures pertaining<br />

to incorporation of the Company, the party concerned<br />

may within a period of five years from the incorporation<br />

of the Company, serve notice to it for remedying such<br />

a defect as per article 71 of the CCL. However, if the<br />

Company fails to take the initiative within one month<br />

of such notice for necessary remedial measures, the<br />

person concerned may have recourse to the <strong>com</strong>petent<br />

court to pass a decision for dissolution of the Company.<br />

The Promoters, members of the Board of Directors<br />

and the first Auditors shall be held liable severally and<br />

jointly for the damages arising from the dissolution of<br />

the Company and which are attributable to their illegal<br />

acts or their negligence or omission in the incorporation<br />

of the Company.<br />

Restrictions imposed on the Employees and<br />

Managers<br />

The Employees and Managers have no right to sell or<br />

transfer shares acquired pursuant to the <strong>IPO</strong> before six<br />

months. Thereafter, the Employees and the Managers<br />

may sell or transfer such shares without any restriction.<br />

7

Promoters/Selling Shareholders: The current partners/shareholders of the Company prior<br />

to the <strong>IPO</strong> who are offering a portion of their Shares through<br />

an Offer for Sale under this <strong>Prospectus</strong> to the extent of<br />

a maximum of 10,000,000 (Ten Million) Ordinary Shares<br />

out of their <strong>com</strong>bined holding of 35,000,000 (Thirty Five<br />

Million) Ordinary Shares. Details of the number of Shares<br />

being offered by the Selling Shareholders are set out in<br />

the Chapter 7 of this <strong>Prospectus</strong>.<br />

Shares held by the Promoters<br />

after the <strong>IPO</strong>:<br />

25,000,000 (Twenty Five Million) Ordinary Shares i.e.<br />

50% of the capital after the <strong>com</strong>pletion of <strong>IPO</strong>. Details<br />

of the individual holdings are set out in the Chapter 8 of<br />

this <strong>Prospectus</strong>.<br />

Subscription Price of the Shares: Baisas 542 (Five Hundred and Forty Two) per Share<br />

consisting of Baisas 100 (One Hundred) nominal value,<br />

Baisas 440 (Four Hundred and Forty) share premium<br />

and Baisas 2 towards Issue Expenses.<br />

Ratio of Offered Shares (25 Million<br />

Shares) to post <strong>IPO</strong> issued and<br />

paid up Share Capital (50 Million<br />

Shares) :<br />

Main Purpose for which the<br />

proceeds of the Subscription<br />

would be utilised:<br />

50% of the Issued and Paid Up Share Capital of the<br />

Company.<br />

1) Proceeds from the Issue of New Ordinary Shares<br />

Issue proceeds under this category aggregating to<br />

RO 8,100,000 (Rial Omani Eight Million, One Hundred<br />

Thousand) will accrue to the Company, and will be<br />

utilised by the Company for financing the ongoing<br />

capital expenditure, for meeting its long term working<br />

capital requirements and investment in future strategic<br />

projects.<br />

2) Proceeds from the Offer for Sale of Existing<br />

Ordinary Shares<br />

Issue proceeds under this category aggregating to<br />

RO 5,400,000 (Rial Omani Five Million, Four Hundred<br />

Thousand) will accrue to the Selling Shareholders only<br />

and not to the Company.<br />

3) Issue Expenses Collected<br />

The amount of RO 50,000 (Rial Omani Fifty Thousand)<br />

being collected towards part of the Issue Expenses from<br />

the total issue will accrue to the Company.<br />

8

Persons Qualified to Subscribe<br />

for the Shares Offered:<br />

Permissible Level of Non-Omani<br />

Shareholding after Listing:<br />

Commencement Date of the<br />

Subscription:<br />

Closing Date of the<br />

Subscription:<br />

Subscription shall be open to Omanis, Non-Omanis,<br />

Individuals, Non-Indviduals, Corporate Bodies/<br />

Institutions/Investment Funds/Pension Funds.<br />

Once the Shares are listed for trading on Muscat<br />

Securities Market, it will be permissible for non Omanis<br />

to own up to 70% of the Share Capital of the Company<br />

in accordance with the Law and the Memorandum &<br />

Articles of Association.<br />

May 5, 2008<br />

June 3, 2008<br />

Listing: The Shares will be listed for trading on the Muscat<br />

Securities Market<br />

First Day of Trading: The first day the Shares are traded on the Muscat<br />

Securities Market<br />

Minimum Limit for the<br />

Subscription under One<br />

Application:<br />

Maximum Limit for the<br />

Subscription under One<br />

Application:<br />

Overall Offering Split and<br />

Allotment Procedures:<br />

Individuals including Employees & Board of Managers:<br />

1,000 (One Thousand) Shares and in multiples of 100<br />

thereafter<br />

Non-Individuals: (Corporate Bodies/Institutions/<br />

Investment Funds) 10,100 (Ten Thousand One Hundred)<br />

Shares and in multiples of 100 thereafter<br />

Individuals & Non-Individuals: (Corporate Bodies/<br />

Institutions/Investment Funds) up to or equal to 10%<br />

of the total issue size which works out up to or equal<br />

to 2,500,000 (Two Million Five Hundred Thousands)<br />

Shares;<br />

Employees: maximum eligible value of shares will be<br />

up to 19 (nineteen) times his/her basic salary as on 29th February 2008;<br />

Managers: up to 50,000 (Fifty Thousand) Shares per<br />

Manager. Total of five managers.<br />

In case of over-subscription, the Offering of 25,000,000<br />

(Twenty Five Million) Ordinary Shares shall be split among<br />

the eligible investor groups, in the following portions:<br />

9

Overall Offering Split and<br />

Allotment Procedures:<br />

(Contd.)<br />

Category I – Individuals<br />

17,500,000 (Seventeen Million Five Hundred Thousand)<br />

shares, being 70% of the Offered Shares for Retail<br />

applicants applying for a maximum of 10,000 (Ten<br />

Thousand) shares. Distribution of shares shall be on<br />

pro-rata basis. Individual Investors shall <strong>com</strong>prise of<br />

only natural persons.<br />

Category II – Non Individual Investors<br />

6,250,000 (Six Million Two Hundred Fifty Thousand)<br />

shares, being 25% of the Offered Shares for both<br />

natural and juristic persons including Individual<br />

applicants applying for more than 10,000 shares and<br />

for Corporate bodies/ Institutions / Investment Funds.<br />

Distribution of shares will be on pro-rata basis.<br />

Category III – Employees and Managers<br />

Employees: 1,000,000 (One Million) shares, being 4%<br />

of the Offered Shares for employees upto a maximum<br />

value of 19 times of their basic salary on firm allotment<br />

basis.<br />

Managers: 250,000 (Two Hundred Fifty Thousand)<br />

shares, being 1% of the Offered Shares for Managers<br />

upto maximum of 50,000 shares for each Manager of<br />

five Managers on firm allotment basis.<br />

Any undersubcription in Category I shall be added to<br />

shares allocated for Category II and vice versa. Any<br />

undersubcription in Category III shall be added to<br />

Category I.<br />

Allotment for Foreign Nationals will be limited to a<br />

maximum of 70% of the total shares offered. Foreign<br />

Corporate Body/ Institution/ Investment Fund is defined<br />

as one which is not incorporated in the Sultanate of<br />

Oman or in any of the GCC countries.<br />

The final allocation on the above basis will be decided<br />

by the Lead Issue Manager and the Company in<br />

consultation with the CMA.<br />

Underwriting Arrangements: The issue of 25 million shares aggregating issue amount<br />

of RO 13.50 million is underwritten by Gulf Baader<br />

Capital Markets S.A.O.C, Vision Investment Services<br />

Co. S.A.O.C, Oman Arab Bank S.A.O.C and United<br />

Securities L.L.C. The details are given in Chapter 5.<br />

10

Basis for Undersubscribed<br />

Shares:<br />

Prohibitions with regard to the<br />

Applications for Subscription:<br />

Lead Issue Manager & Financial<br />

Advisor<br />

In case of a shortfall in subscription, the shortfall shall<br />

be subscribed by the Underwriters.<br />

The subscribers to the shares issued as mentioned<br />

hereunder shall not be permitted to participate in the<br />

subscription:<br />

1) Sole Proprietorship Establishments. Whereas, the<br />

owner of a Sole Proprietorship Establishment would be<br />

required to subscribe in his name only if he so desires.<br />

2) Trust Accounts. Whereas, the Brokerage Companies<br />

would be required to address the Customers for the<br />

subscription in their personal names.<br />

3) Multiple Applications for the subscription. Whereas,<br />

it is prohibited for any person to submit more than one<br />

application for subscription in his personal name.<br />

4) Applications made under joint names, including the<br />

applications made in the name of legal heirs. Whereas,<br />

they or their legal attorney would be required to apply<br />

in their personal names.<br />

All such applications shall be rejected without contacting<br />

the applicant.<br />

Oman Arab Bank SAOC<br />

Investment Management Group<br />

P.O. Box 2010, PC 112, Ruwi<br />

Sultanate of Oman<br />

Email: corporatefinance@oabinvest.<strong>com</strong><br />

Co-Financial Advisor: Ernst &Young<br />

P.O. Box: 1750, Ruwi, PC 112,<br />

Ernst & Young Building,<br />

Qurum, Muscat, Sultanate of Oman<br />

www.ey.<strong>com</strong>/me<br />

Reporting Accountants: KPMG<br />

PO Box 641<br />

P.C. 112, Ruwi<br />

Sultanate of Oman<br />

11

Statutory Auditors: Statutory Auditors: (2006 & 2007)<br />

KPMG<br />

P.O. Box 641<br />

PC 112, Ruwi<br />

Sultanate of Oman<br />

For the year: 2005<br />

Mazars Chartered Accountants & Co. LLC<br />

Muscat Gold Market Building<br />

P.O. Box 1092, PC 131<br />

Sultanate of Oman<br />

Internal Auditors: BDO Jawad Habib<br />

P.O. Box 1176<br />

Ruwi, PC 112<br />

Sultanate of Oman<br />

Legal Advisor for the <strong>IPO</strong>: Al Busaidy, Mansoor Jamal & Co., Muscat International<br />

Centre, Mezzanine Floor, Central Business District, Bait<br />

Al Falaj Street, P.O. Box 686, Ruwi, PC 112, Sultanate of<br />

Oman, Email: mj-co@amjoman.<strong>com</strong><br />

Legal Advisors for the<br />

Company<br />

Collecting Banks: Bank Muscat SAOG<br />

Bank Dhofar SAOG<br />

Oman Arab Bank SAOC<br />

Hamdan Al Durey<br />

Barristers and Legal Consultants<br />

Central Business District,<br />

Building No 978, Flat No 53,<br />

P.O. Box 1633 PC 112,<br />

Ph: 24787667 Fax: 24787889, Sultanate of Oman<br />

Transfer and Registration Agent: Muscat Depository & Securities Registration Co. SAOC<br />

P.O. Box 952, PC 112, Ruwi, Sultanate of Oman<br />

Tel: 24814827, Fax: 24817491<br />

12

CHAPTER 3<br />

Introduction<br />

SHARE SPLIT AND ITS EFFECT<br />

The Company has split the nominal value of the shares from RO 1.000 to Baisas 100 resulting<br />

in splitting each share into ten shares. This chapter elaborates on the effect of this decision. It is<br />

re<strong>com</strong>mended that each subscriber read and understand it.<br />

Definition of Share Split<br />

Share Split refers to the intention of a Company to split its existing shares to number of shares<br />

by reducing the nominal value of the share and increasing the number of shares without any<br />

effect on the total value of the Company’s paid up Capital, or the total market capitalisation of<br />

the shares owned in the Company, even if the total of the number of shares will increase as a<br />

result of this division.<br />

Objectives of Share Split<br />

The Company is of the view that Share Split will achieve the following goals:<br />

• Reduce the nominal value of the share making it affordable for a larger number of retail<br />

investors.<br />

• Increase liquidity by multiplying the number of shares available for trading; and<br />

• Facilitate a larger participation by the small/individual shareholders<br />

Impact of Share Split<br />

The decision of Share Split will not have any impact on the shareholding or the extent of each<br />

shareholders’ liabilities in the Company. The only direct impact is an increase in the number of<br />

shares. The Company considers that the benefits gained from the Share Split such as increase<br />

in liquidity and the shares that will be available for trading for all investors and participants in the<br />

Muscat Securities Market, will be in the best interest of the public.<br />

The following table presents the impact of Share Split for the Company according to the financial<br />

statement for the year ended 31 December, 2007:<br />

Before Split After Split<br />

Nominal value per Share RO 1 Baisas 100<br />

Number of Issued Capital Shares 3,500,000 35,000,000<br />

Paid up Capital RO 3,500,000 RO 3,500,000<br />

Shareholders Equity RO 4,362,271 RO 4,362,271<br />

Book Value per Share RO 1.246 Baisas 124<br />

Net Annual Profit RO 2,422,215 RO 2,422,215<br />

Earning per Share Baisas 692 Baisas 69<br />

13

Effect of Share Split<br />

The decision to split shares does not have any impact on the total market capitalisation of the<br />

shares. In fact, Share Split is dividing the nominal value of the share in the same percentage.<br />

The following is an explanation:<br />

Assume,<br />

- number of shares before split: 100 shares<br />

- share price in MSM on the date of the general meeting: RO 5.420<br />

Therefore after dividing one share into 10 shares, the result will be as follows:<br />

Number of shares<br />

Share price<br />

Total nominal share value<br />

Share Split effects on dividend:<br />

Before Split<br />

100 shares<br />

RO 5.420<br />

RO 542<br />

14<br />

After Split<br />

1000 shares<br />

RO 0.542<br />

RO 542<br />

The decision of Share Split will not affect the Company’s policy regarding dividend distribution<br />

or dividend ratio. The dividend distribution system in the Sultanate of Oman is based upon<br />

accounting dividend as a percentage of nominal paid up value per share. Thus the nominal paid<br />

up value per share will be Baisas 100 after split and not RO 1.000; e.g. if the Company declared<br />

previously (before Share Split) dividend distribution of Baisas 350 per share (35% of nominal<br />

value before split), and presumably the Company decided to maintain this policy, this dividend<br />

will be after Share Split Baisas 35 per share (35% of the nominal value after split). For instance, if<br />

the shareholder holds 100 shares before Share Split, dividend distribution will be as follows:<br />

Before Share Split After Share Split<br />

Number of holding shares 100 shares 1000 shares<br />

Nominal value of the share RO 1.000 Baisas 100<br />

Dividend per share Baisas 350 Baisas 35<br />

Dividend ratio to nominal value 35% 35%<br />

Total distributed dividend RO 35 RO 35

CHAPTER 4<br />

ISSUE EXPENSES<br />

The costs of the Issue are estimated at RO 276,600 (Rial Omani Two Hundred and Seventy Six<br />

Thousand and Six Hundred Only), which equates to approximately 2.049% of the total proceeds<br />

of the Offering. The breakdown of the estimated expenses is contained in the table below:<br />

Estimated Cost and Expenses Amount (RO)<br />

Issue Managers & Financial Advisors 80,000<br />

Collecting Banks 70,000<br />

Underwriting fees 40,500<br />

CMA & MDSRC Fees 10,100<br />

Legal Advisor 20,000<br />

Reporting Accountant 6,000<br />

Marketing, Advertising and Publicity 40,000<br />

Mailing and Postage 2,500<br />

Other expenses and contingencies 7,500<br />

Total Issue Expenditure 276,600<br />

Issue Expenses collected @ 2 Baisas per share (50,000)<br />

Difference between Estimated Expenses & the<br />

collection of Issue Expenses<br />

15<br />

226,600<br />

The costs of the Issue will be partially met out of additional subscription amount of Baisas 2 per<br />

share paid by the applicants towards Share Issue Expenses.<br />

The actual costs of the Issue less Issue Expenses collected, estimated at RO 226,600 will be<br />

charged to the Shareholders’ Equity of the Company.

CHAPTER 5<br />

UNDERWRITING ARRANGEMENTS<br />

In case of a shortfall in the subscription of the Offered Shares, the shortfall shall be underwritten<br />

as under:<br />

Underwriter<br />

Gulf Baader Capital<br />

Markets SAOC<br />

Vision Investment<br />

Services Co. SAOC<br />

Number of<br />

Ordinary Shares<br />

underwritten<br />

16<br />

Percentage shares<br />

underwritten<br />

Amount<br />

Underwritten@540<br />

Baisas per share (RO)<br />

9,109,000 36.44% 4,918,860<br />

6,747,400 26.99% 3,643,596<br />

Oman Arab Bank SAOC 5,000,000 20.00% 2,700,000<br />

United Securities LLC 4,143,600 16.57% 2,237,544<br />

Total 25,000,000 100.00% 13,500,000<br />

The Company has entered into underwriting arrangements with the above entities. The<br />

underwriting fee is estimated at RO 40,500 (Rial Omani Forty Thousand Five Hundred)<br />

In the event of any devolvement, the underwriters will subscribe to the extent of the shortfall<br />

as stated above, at a price of 540 Baisas per share and the Company shall not claim the issue<br />

expense of 2 Baisas per share, from the underwriters on such devolved shares.

CHAPTER 6<br />

PURPOSE OF THE ISSUE AND UTILISATION OF THE PROCEEDS<br />

Objectives of the Issue:<br />

• Raising capital for the purposes which are already mentioned in the <strong>Prospectus</strong>.<br />

• Listing the Company’s Shares on the MSM.<br />

• Partial divestment of Shares by the Selling Shareholders.<br />

Utilisation of the Proceeds of the Issue:<br />

• The Company will receive the proceeds of public subscription, amounting to RO 8,100,000<br />

(Rial Omani Eight Million, One Hundred Thousand) relating to the issue of the new Ordinary<br />

Shares, which will be utilised for setting-up a 132 kv transformers manufacturing project in Oman<br />

in technical collaboration of Tatung Co. of Taiwan, to fund the ongoing capital expenditure for the<br />

distribution transformers project in Qatar, meeting long-term working capital requirement and<br />

to invest in the future strategic projects. The target timetable of the Company for the use of the<br />

proceeds of public subscription as follows:<br />

Type of Expenses Amount Date<br />

Capital Expenditure RO 6 Million 2008/09<br />

Working Capital RO 2.1 Million 2008<br />

Total RO 8.1 Million<br />

• The Company will receive the proceeds of public subscription, amounting to RO 5,400,000<br />

(Rial Omani Five Million, Four Hundred Thousand) relating to the offer for sale of the Existing<br />

Ordinary Shares, which will be distributed to the Selling Shareholders through this offering,<br />

which is at an offer price of RO 0.540 (Baisas Five Hundred and Forty) per share excluding<br />

Issue Expenses.<br />

• The baisas 2 per share collected towards Issue Expenses will cover a portion of the expenses<br />

incurred by the Company in relation to the <strong>IPO</strong>.<br />

17

CHAPTER 7<br />

Overview<br />

OBJECTIVES OF THE COMPANY AND APPROVALS<br />

The Company was incorporated in the Sultanate of Oman on 3 August 1987 as a Limited Liability<br />

Company (“LLC”) and is currently undergoing the due process of transformation from an LLC<br />

into a “SAOG’’ organised under the laws of the Sultanate of Oman. The Company is the flagship<br />

Company of the well established and well diversified Al Anwar Holdings SAOG in the Sultanate<br />

of Oman. The Company has manufacturing facilities in Rusayl Industrial Area, Sultanate of Oman<br />

for Transformers and LV Switchgear Panels. The Company is on the fast growth path in the field<br />

of Electrical Products enjoying international acceptance and a preferred source status for its<br />

products and services in the Utilities & Oil & Gas sector throughout the MENA region.<br />

The Company holds the following material permits and licenses:<br />

1 Ministry of Commerce and Industry: Commercial<br />

Registration<br />

2 Ministry of Commerce and Industry: Industrial<br />

License<br />

3 Oman Chamber of Commerce & Industry:<br />

Membership<br />

18<br />

Commercial Registration<br />

Number: 1262947<br />

Date of Registration:<br />

3/8/1987<br />

Expiry date: 2/8/2012<br />

Registration Number: 2547<br />

Expiry Date: 02/08/2012<br />

Registration Number: 1614<br />

Expiry Date: 31/12/2008<br />

4 Ministry of Environment & Climate Affairs : License License Number: 3674<br />

Expiry Date: 04/06/08<br />

ISO 9001:2000 Certification<br />

The Company holds an ISO 9001:2000 Certification for marketing, design, manufacturing, testing<br />

and <strong>com</strong>missioning of all its products.<br />

Company Objectives<br />

The objects for which the Company is established are:<br />

(i) to carry on all or any of the business of purchasing, importing, generating, transmitting,<br />

transforming, converting, distributing, supplying, selling, exporting and dealing in electricity<br />

and all other forms of energy and products or services associated therewith;<br />

(ii) to locate, establish, construct, equip, operate, use, manage and maintain transforming,<br />

switching, conversion transmission and distribution facilities, cables, overhead lines,<br />

substations, switching stations, tunnels, cable bridges, link boxes, tele<strong>com</strong>munications stations,<br />

masts, aerials and dishes, fibre optic circuits, satellites and satellite microwave connections,<br />

heat pumps, plant and equipment used for <strong>com</strong>bined heat and power schemes;

(iii) to acquire (whether by usufruct, lease, concession, grant, or otherwise) establish, develop,<br />

exploit, operate and maintain land, any estates in land, which may seem to the Company<br />

capable or possibly capable of affording or facilitating the purchase, transmission,<br />

transformation, conversion, supply distribution, generation, development, production<br />

or manufacture of electricity or any other forms of energy in accordance with the laws of<br />

Oman;<br />

(iv) to carry on all or any of the business of designers, developers, manufacturers, constructors,<br />

installers, operators, users, inspectors, testers, maintainers, repairers, servicers, suppliers,<br />

distributors, importers and exporters of and dealers in cables, wires, meters, pylons, tracks,<br />

rails, pipelines, and any other plant, apparatus, equipment, systems and things used in<br />

connection with the transmission, transformation, conversion, supply, distribution, control<br />

and generation of electricity or any other forms of energy;<br />

(v) to provide or procure the provision of such facilities and services as may be necessary or<br />

desirable to forecast electricity/energy demand and to satisfy such demand;<br />

vi) to appoint and enter into agreements or arrangements with any person to represent the<br />

Company or any other organisation or person at meetings of local, national and international<br />

organisations and bodies concerned with activities connected or associated with any of<br />

the businesses or activities of the Company and to provide services of all kinds to such<br />

organisations and bodies;<br />

vii) to carry on all or any of the business of and provide services associated with, engineers<br />

(including without limitation, electrical, mechanical, heating, ventilation, civil, chemical,<br />

tele<strong>com</strong>munications and gas engineers), mechanics, technicians, draftsmen, designers,<br />

surveyors, architects and builders for achievement of the Company’s abovementioned<br />

objects in <strong>com</strong>pliance with the prevailing laws;<br />

Resolutions Passed<br />

The Shareholders of the Company unanimously passed the following resolutions in their meetings<br />

held on 10 th December 2007 and 24 th February 2008.<br />

1. Approved the proposal for conversion of the Company from an LLC to an SAOG as per the<br />

provisions of the CCL.<br />

2. Approved the new Authorised Share Capital of the Company which would be RO 10,000,000<br />

(Rial Omani Ten Million) and the Issued Share Capital of RO 5,000,000 (Rial Omani Five<br />

Million) divided into 50,000,000 (Rial Omani Fifty Million) Ordinary Shares of 100 Baisas each<br />

(RO 0.100).<br />

3. Approved the transformation as a part of the process of selling/issuing the Offered Shares<br />

to the public through an <strong>IPO</strong> which would <strong>com</strong>prise of two (2) <strong>com</strong>ponents:-<br />

i) Offer for sale of 10,000,000 (ten million) Ordinary Shares of face value Baisas. 100 each<br />

at an issue price of Baisas 542 per share to the public by the existing Shareholders<br />

(Promoters).<br />

ii) Fresh issue of 15,000,000 (fifteen million) new Ordinary Shares by the Company, to the<br />

public of face value Baisas 100 each at an issue price of Baisas. 542 per share.<br />

19

iii) Out of the total 25,000,000 (twenty five million) Shares which would be offered to<br />

the public, up to 1,250,000 (one million two hundred fifty thousand) Shares would be<br />

reserved for the Managers and the Employees of the Company.<br />

4. Approved that post <strong>IPO</strong>, the current shareholders (Promoters) would hold 50% of the issued<br />

share capital of the Company and the public including the Employees and the Managers<br />

would hold the remaining 50%.<br />

5. Approved the consent of the current shareholders’ in the LLC Company to offer a portion of<br />

their Ordinary Shares to the public as part of the <strong>IPO</strong>. The number of shares to be offered by<br />

each of the Promoters is as shown hereunder.<br />

Promoter’s Name No. of shares before<br />

transformation<br />

Face value Bz 100<br />

20<br />

No. of Shares to be<br />

Offered For Sale<br />

Face value Bz 100<br />

Al Anwar Holdings SAOG 20,097,000 5,742,000<br />

SABCO LLC 7,451,500 2,129,000<br />

Mr. Mushtaq bin Abdullah bin Jaffer 3,160,500 903,000<br />

H.H. Seyyid Shihab bin Tariq Al Said 2,597,000 742,000<br />

Mr. Mohammed bin Abdul Rasool Al Jamali 1,130,500 323,000<br />

Dr. Ali bin Jaffar bin Mohammed 563,500 161,000<br />

Total 35,000,000 10,000,000<br />

6. Approved to form a constitutive <strong>com</strong>mittee consisting of the following members:<br />

i) Mr. Qais bin Mohamed Al Yousef, Chairman<br />

ii) Mr. Abdulredha bin Mustafa Sultan, Director<br />

iii) Mr. Saibal Sen, Director<br />

iv) Mr. Sebastian Manavalan, Director<br />

v) Mr. Krishna Kumar Gupta, Director<br />

The above <strong>com</strong>mittee is authorised to do all such acts and deeds required for the <strong>IPO</strong><br />

such that the <strong>IPO</strong> shall be in <strong>com</strong>pliance with statutory and regulatory requirements and<br />

approvals.<br />

7. Approved the draft Memorandum & Articles of Association of the Company as per the<br />

requirements of the CCL pertaining to SAOG Companies for the submission to the <strong>com</strong>petent<br />

authorities and their approval.<br />

8. Approved the appointment of Oman Arab Bank SAOC as Lead Issue Manager and authorised<br />

them or their representatives to <strong>com</strong>plete the due diligence and all legal, financial and<br />

accounting matters pertaining to conversion and transformation of the Company from an<br />

LLC to an SAOG Company and the preparation and finalisation of the <strong>IPO</strong> documents as<br />

required by the concerned official bodies and also to appoint a Co-Financial Advisor.<br />

9. Approved the appointment of KPMG as the reporting Accountants and Al Busaidy, Mansoor<br />

Jamal & Co. as Legal Advisors for the <strong>IPO</strong>.

CHAPTER 8<br />

SHAREHOLDING DETAILS<br />

Promoters and Selling Shareholders of the Company (before transformation):<br />

Name of Shareholder Number of shares* Percentage<br />

Al Anwar Holdings SAOG 20,097,000 57.42%<br />

SABCO LLC 7,451,500 21.29%<br />

Mr. Mushtaq bin Abdullah bin Jaffer 3,160,500 9.03%<br />

H.H. Seyyid Shihab bin Tariq Al Said 2,597,000 7.42%<br />

Mr. Mohammed bin Abdul Rasool Al Jamali 1,130,500 3.23%<br />

Dr. Ali bin Jaffar bin Mohammed 563,500 1.61%<br />

Total 35,000,000 100%<br />

* after split<br />

Pursuant to a unanimous resolution of the Shareholders, the Share Capital of the Company<br />

was increased from RO 1,500,000 (Rial Omani One Million Five Hundred Thousand) to<br />

RO 3,500,000 (Rial Omani Three Million Five Hundred Thousand) through an issue of Bonus<br />

Shares of RO 2,000,000 (Rial Omani Two Million) to the Promoters/Selling Shareholders.<br />

The Shares were issued by way of Bonus Shares.<br />

Post Offer Equity Structure:<br />

The Public shareholding and the minimum Promoters’/Selling Shareholders’ shareholding<br />

after the <strong>IPO</strong> is envisaged as under:<br />

Sl.<br />

No<br />

Promoter/Selling<br />

Shareholder and Public<br />

1. Al Anwar Holdings SAOG<br />

2. SABCO LLC<br />

3.<br />

4.<br />

5.<br />

Mr. Mushtaq bin Abdullah<br />

bin Jaffer<br />

H.H. Seyyid Shihab<br />

bin Tariq Al Said<br />

Mr. Mohammed bin<br />

Abdul Rasool Al Jamali<br />

Nationality No. of<br />

Ordinary<br />

Shares<br />

Omani<br />

Company<br />

Omani<br />

Company<br />

21<br />

Nominal<br />

Value by RO<br />

Ratio to<br />

Capital<br />

14,355,000 1,435,500 28.71%<br />

5,322,500 532,250 10.65%<br />

Omani 2,257,500 225,750 4.52%<br />

Omani 1,855,000 185,500 3.71%<br />

Omani 807,500 80,750 1.62%<br />

6. Dr. Ali bin Jaffar bin Mohammed Omani 402,500 40,250 0.81%<br />

7.<br />

Public (including Employees<br />

and Managers)<br />

Omani /<br />

Non Omani<br />

25,000,000 2,500,000 50.00%<br />

Total 50,000,000 5,000,000 100%

Promoters’ Voting Rights<br />

Pursuant to the <strong>IPO</strong> and conversion into a Public Joint Stock Omani Company, the issued and<br />

paid-up share capital of the Company will be RO 5,000,000 (Rial Omani Five Million) divided into<br />

50,000,000 (fifty million) Ordinary Shares with a nominal value of One Hundred Baizas each (RO<br />

0.100). Each single share will carry the right to one vote at the Constitutive General Meeting of the<br />

Company and any General Meeting of the Company including any Extraordinary General Meeting.<br />

The Promoters and Selling Shareholders will hold 25,000,000 (twenty five million) Ordinary Shares<br />

which will have one vote per share, the same as other Ordinary Shares issued to the public. The<br />

Promoters and the Selling Shareholders will effectively have 50% of the voting rights.<br />

Restrictions imposed on the Promoters:<br />

In accordance with Article 77 of the CCL, the Promoters of the Company shall not withdraw from<br />

the Company or dispose of their Shares prior to publication of two Balance Sheets pertaining<br />

to two consecutive financial years, effective from the date of listing of the Shares on the Muscat<br />

Securities Market. An exception to this shall be the cases of assignment of the Shares amongst<br />

the Shareholders themselves and cases of inheritance. The period during which the –Promoters<br />

are not permitted to withdraw or dispose of their Shares may be extended for a further one<br />

year by a decision of the Minister of Commerce & Industry, at the request of the Capital Market<br />

Authority, without prejudice to the right held by the Promoters to make second grade pledge on<br />

those Shares.<br />

If any defect has taken place in the procedures pertaining to incorporation of the Company, the<br />

party concerned may within a period of five years from the incorporation of the Company, serve<br />

notice to it for remedying such a defect as per article 71 of the CCL. However, if the Company<br />

fails to take the initiative within one month of such notice for necessary remedial measures, the<br />

person concerned may have recourse to the <strong>com</strong>petent court to pass a decision for dissolution<br />

of the Company. The Promoters, members of the Board of Directors and the first Auditors shall<br />

be held liable severally and jointly for the damages arising from the dissolution of the Company<br />

and which are attributable to their illegal acts or their negligence or omission in the incorporation<br />

of the Company.<br />

Brief profile of the Main Promoters:<br />

AL ANWAR HOLDINGS SAOG<br />

Al Anwar Holdings SAOG is establised in 1994 by a group of prominent institutions and business<br />

houses. Al Anwar was instrumental in pioneering industrial development in Oman in various<br />

industrial segments including Transformers and Switchgears.<br />

Al Anwar has promoted, nurtured, created and shared wealth with the investing populace of this<br />

country in the past. In its current business model with a well diversified and geographically dispersed<br />

investments in industrial and non-industrial sectors such as financial services and insurance.<br />

Al Anwar has invested in several <strong>com</strong>panies of repute. Some of Al Anwar’s current and past<br />

investments include: National Aluminum Products Co SAOG, Al Anwar Ceramic Tiles SAOG, Al<br />

Maha Ceramic Tiles SAOC, Falcon Insurance SAOC and Taageer Finance Co SAOG.<br />

22

Board of Directors:<br />

SL. No Name of the Director Independent/Non<br />

Indepedent<br />

23<br />

Position<br />

1 Brig. Masoud Humaid Al Harthy Independent Chairman<br />

2 Mr. Qais Mohammed Musa Al Yousef Independent Dy. Chairman<br />

3 Mr. Shabir Musa A. Al Yousef Independent Director<br />

4 Mr. Abdulredha Mustafa Sultan Independent Director<br />

5 Mr. Nawwaf Ghubash Ahmed Al Merri Independent Director<br />

6 Mr. Hamed Rashid Al Dhaheri Independent Director<br />

7 Mr. Mohamed A. M. Al Khonji Independent Director<br />

AL ANWAR HOLDINGS SAOG<br />

SHAREHOLDERS HOLDING 1% AND MORE AS ON 31 MARCH 08<br />

Sl. No. Name No.of shares %<br />

1 Fincorp Investment Co.LLC 22,574,290 25.49%<br />

2 Financial Services Co. Trust-Gulf 17,995,800 20.32%<br />

3 Al Khonji Investment LLC 7,000,000 7.91%<br />

4 Mohammed & Ahmed Al Khonji Co 4,457,470 5.03%<br />

5 Mohamed Hafedh Ali Dhahab 3,005,490 3.39%<br />

6 Oman Arab Bank- Asset Mgt-Trust Gulf 1,050,351 1.19%<br />

7 Oman Construction Co. LLC 889, 295 1.00%<br />

8 Others 31,577,304 35.66%<br />

Total 88,550, 000 100%<br />

The Board of Al Anwar is <strong>com</strong>prised of eminent personalities from business and industry and it<br />

has a highly professional management team.<br />

Details of its current investments, financial performance and vision can be accessed through its<br />

website, www.alanwarholdings.<strong>com</strong>. As the <strong>com</strong>pany is listed, its financial performance can also<br />

be accessed through the MSM website.<br />

SABCO LLC / SABCO Group<br />

Established during the early Renaissance years of the 70s with a capital of RO 500,000, SABCO<br />

Group has grown into an integrated investment, <strong>com</strong>mercial, industrial and service organisation<br />

to day. It is registered with the Ministry of Industry and Commerce and also the Oman Chamber<br />

of Commerce. The SABCO group has more than 100 employees today.<br />

SABCO group has made its presence in the field of services, manufacturing, real estate,<br />

contracting, distribution and oil and gas and security and defence through Direct and Associate<br />

Businesses.

SABCO Commercial Centre, Voltamp Manufacturing Company LLC (Presently Voltamp Energy<br />

SAOG (under transformation), National Mineral Water Co. SAOG and Oman Marketing and<br />

Services Company deserve special mention among the group <strong>com</strong>panies of SABCO Group.<br />

Shareholders of SABCO.<br />

a. Sayyid Badr Bin Hamad Bin Homood Al Bu Said – Secretary General - Ministry of Foreign<br />

Affairs (Rank of a minister)<br />

b. Sayyid Khalid Bin Hamd Bin Hamood Al Bu Said – Chairman of SABCO Group and Al Ahli<br />

Bank SAOG.<br />

c. Sayyid Aymen Bin Hamad Bin Hamood Al Bu Said – Vice Chairman of SABCO Group.<br />

d. Zawan Bint Hamad Suleiman Al Nabhani<br />

e. Sayyida Waffa Bint Hamad Al Nu Said.<br />

Direct Businesses<br />

Sabco LLC: A holding <strong>com</strong>pany involved in private and public sector project development<br />

and representation of world renowned <strong>com</strong>panies.<br />

Oman Perfumery LLC / Amouage Limited – The House of Amouage : Manufacturer,<br />

International distributor and retailer of luxury “Amouage” perfumes, home fragrances, skincare<br />

and accessories . The website is www.amouage.<strong>com</strong><br />

SABCO Commercial Centre: Oman’s pioneering boutique shopping mall opened in 1984.<br />

SABCO Art LLC / SABCO Press LLC: A full service <strong>com</strong>munication and entertainment<br />

solutions provider. www.sabcoart.<strong>com</strong><br />

Oman Expo LLC: A pioneer in Oman’s events industry organising diversified exhibitions,<br />

events and conferences. The website is www.omanexpo.<strong>com</strong><br />

Al Hail Investments LLC : A property development and Asset Management Company. The<br />

website is www.alhailinvestments.<strong>com</strong><br />

Sabco Media SAOC : A media <strong>com</strong>pany which owns, manages and operates Radio, TV and<br />

other media related activities.<br />

MUSHTAQ ABDULLAH JAFFER AL SALEH<br />

v Born in 1951<br />

v Master of International Politics, U.L.B. Brussels, Belgium<br />

v His Majesty The Sultan conferred upon him First Order of Al-Nouman Decoration in 1990<br />

v Languages: Fluent in Arabic, English and French<br />

Official Profile:<br />

v Joined The Ministry of Foreign Affaires in 1974. Served and promoted to several positions till<br />

appointed Ambassador Extraordinary and Plenipotentiary to Djibouti in 1977, Japan in 1980,<br />

Algeria in 1983 and China in 1987<br />

v Upon the request of GCC, The Government of Oman seconded him to serve as the very first<br />

Ambassador Extraordinary & Plenipotentiary of GCC to the European Union (1992-1996)<br />

24

v Opted for an early retirement plan in 2002<br />

v Appointed in 1998 One of the Five Representatives, representing Oman in the newly created<br />

GCC Consultative Council for a term of three years<br />

v Re-appointed for second term in 2001<br />

Business Profile:<br />

Participated and chaired several renowned <strong>com</strong>panies listed on Muscat Securities Market (1996-<br />

2005), mainly:<br />

v Chairman of Board of Directors of Oman Orix Leasing<br />

v Vice Chairman of Board of Directors of Gulf Hotels<br />

v Vice Chairman of Board of Directors of Commercial Bank<br />

v Vice Chairman of Board of Directors of Oman Carpets<br />

v Vice Chairman of Board of Directors of Hilton Salalah<br />

v Member of Board of Directors of AlKhaleej Polypropylene<br />

v Member of Board of Directors of Oman National Holdings<br />

25

CHAPTER 9<br />

MARKET AND ECONOMIC OVERVIEW<br />

With an established base in Oman and currently entering into Qatar, the Company is looking to<br />

diversify to cover other countries within the Gulf and the wider MENA region.<br />

An overview of the projected macroeconomic growth in some of the key markets in which the<br />

Company operates and/or expects to have a presence is shown below:<br />

GCC’s Nominal GDP and the Expected Growth in the GCC and MENA Region<br />

USD Billion 2008 2009 2010 2011<br />

MIDDLE EAST 1,544 1,705 1,865 2,013<br />

Growth 11% 10% 9% 8%<br />

Oman 41 43 46 49<br />

Growth 6% 6% 7% 7%<br />

Qatar 70 77 83 89<br />

Growth 14% 9% 8% 7%<br />

Saudi Arabia 400 429 460 490<br />

Growth 8% 7% 7% 7%<br />

NORTH AFRICA 513 551 588 625<br />

Growth 11% 7% 7% 6%<br />

Source: Global Insight, 2007<br />

Oman Economic Overview<br />

Total Nominal GDP<br />

Oman is currently witnessing a period of significant economic growth. The country’s economy<br />

has expanded by 10.64%, measured in Gross Domestic Product (“GDP”) terms, from 2005 to<br />

2007 <strong>com</strong>pared to 9.29% during the preceding 3 years. As a result, nominal GDP has increased<br />

from RO 7.9 billion in 2002 to RO 14.6.billion in 2007 1 . This economic growth has been primarily<br />

driven by the contribution of petroleum activities which has increased by 47.8 % to the total GDP<br />

due to rising oil prices in the world markets.<br />

In RO Million<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

1 Figures 8,000 for 2007 are preliminary<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

Nominal GDP, 2002-2007<br />

2002 2003 2004 2005 2006 2007<br />

Nominal GDP Grow th<br />

Source: Statistical Yearbook 2007, Ministry of National Economy; www.mone.gov.om, 2008<br />

9,000<br />

26<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%

In RO Million<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

9,000<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Oman Economic Activities<br />

Source: Statistical Yearbook October 2007, Ministry of National Economy<br />

The contribution from non-petroleum activities rose by 18% in 2006 principally on the strength<br />

of the 45% growth in manufacturing, 20% in building and construction activities and 24% in<br />

transport, storage and <strong>com</strong>munication. Oman’s non-oil exports have increased by 39% from RO<br />

1.1 billion in 2005 to RO 1.6 billion in the year 2006.<br />

Economic Drivers<br />

2002 2003 2004 2005 2006 2007<br />

2002 2003 2004 2005 2006 2007<br />

Petroleum Activ ities Non Petroleum Activ ities<br />

Oman’s long-term economic growth plans are embodied in the Vision 2020 (“Vision”) document<br />

which sets out the strategic goals to be achieved by the year 2020. The fundamental goals of<br />

the Vision are as follows:<br />

Ñ To develop and upgrade Omani human resources in order to cope with technological<br />

progress and attain international <strong>com</strong>petitiveness.<br />

Ñ To develop a private sector capable of optimum use of human and natural resources in an<br />

efficient and ecologically sound way, in close collaboration with the government.<br />

Ñ To utilise the geo-strategic location of the Sultanate, optimise the use of its natural resources<br />

and promote economic diversification.<br />

Ñ To distribute the fruits of development among all regions and all citizens.<br />

Ñ To preserve, safeguard and develop the achievements ac<strong>com</strong>plished in the past twenty- five<br />

years.<br />

From a planning perspective, the Government links developmental priorities and budgetary plans<br />

to five-year planning cycles. The current five-year plan is an important stepping-stone towards<br />

achieving the Vision through which the Government is seeking to achieve a GDP growth rate of<br />

7.4% for the period 2000-2020 2 . The Vision’s aim is that by 2020, Oman’s economy will have<br />

limited reliance on oil revenues and would have diversified into non-oil sectors such as natural<br />

gas, downstream industries and tourism.<br />

It is projected that by 2020, the share of oil revenues in Oman’s GDP would be around 9%<br />

(<strong>com</strong>pared to 48% in 2006) while natural gas revenues will contribute 10% (<strong>com</strong>pared to 3.6%<br />

in 2006) to the GDP.<br />

1 Ministry of National Economy<br />

Nominal GDP Grow th<br />

27<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%

Economic Diversification<br />

The non-oil industrial sector’s contribution to GDP is expected to rise from the current level in<br />

2006 of 14.2% to 29% in 2020. This structural shift is expected to have a significant impact on<br />

Oman’s future economic development. To achieve these goals, the Government is focusing on<br />

the following economic drivers:<br />

Ñ Increasing Foreign Direct Investment: During the past few years, positive steps towards<br />

privatisation have been taken as part of the structural reform program. These steps are aimed<br />

at supporting the country’s development strategy and making the Omani economy more<br />

attractive to foreign and local investors. Some key steps that have been taken include the lifting<br />

of foreign direct investment-related restrictions relating to most sectors, streamlining business<br />

regulations and adopting a “one-stop” investment approach. The ratification of the Free<br />

Trade Agreement (“FTA”) with the United States in 2006 is an indication of the Government’s<br />

<strong>com</strong>mitment to economic reform and diversification. Oman’s membership in the World Trade<br />

Organisation (“WTO”) in 2000 is an effort towards the liberalisation of its markets.<br />

Ñ Industrialisation: The industrial sector is also expected to help Oman realise its Vision<br />

2020. In 1994, the industrial sector accounted for only 4.3% of GDP, while today nearly<br />

8.5% of GDP is accounted for by this sector. Oman is planning to raise the contribution of<br />

manufacturing to the GDP to 15% by 2020. Currently, Muscat, Sohar and Salalah are the<br />

key centres of the process of industrialisation. Sohar is undergoing a huge transformation<br />

with around USD 12 billion worth of developments. Five major projects have been already<br />

announced namely Sohar Refinery Project, Sohar Methanol Project, Oman-India Fertilizer<br />

project, Ferro-Chrome project and Sohar Fertilizer project. Continued activity in the industrial<br />

sector is anticipated with the Government’s <strong>com</strong>mitment to its long term target of diversifying<br />

away from the oil and gas sector. A key <strong>com</strong>ponent of this diversification includes various<br />

proposed aluminium-related downstream projects.<br />

Ñ Tourism: Vision 2020 stresses the importance of diversifying the economic base of the<br />

country and identifies tourism as one of the important economic drivers which can help<br />

realise the Vision. In order for the Government to meet its long-term targets, a tourism<br />

growth rate of 15% to 20% per annum 3 needs to be achieved. As a step in this direction,<br />

the Government is enhancing the role of the private sector in projects and activities. The<br />

Ministry of Tourism (“MoT”), established in 2004, has already signed agreements with private<br />

developers for implementing 14 projects worth more than RO 6.6 billion.<br />

Qatar Economic Overview<br />

Nominal GDP<br />

Qatar’s economy is in a high growth phase. The nominal GDP in Qatar grew significantly by<br />

24.2% in 2006 after witnessing a strong growth of 33.8% in 2005 and 34.8% in 2004. In 2006,<br />

Qatar’s GDP per capita increased by 15.5% to reach USD 57,350, and is expected to reach USD<br />

68,467 by the year 2008 4 .<br />

Qatar’s Nominal GDP<br />

QR Million 2003 2004 2005 2006<br />

Total GDP (Million Rial Qatari) 85,663 115,512 154,564 191,909<br />

% Change 21.5% 34.8% 33.8% 24.2%<br />

Source: Annual Report 2005, 2006, Qatar Central Bank<br />

3 “Vision Oman 2020”, Ministry of National Economy<br />

4 Qatar National Bank<br />

28

Contribution to GDP (QR million)<br />

140,000<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

Qatar’s GDP as Oil and Non-Oil Activities<br />

Source: Qatar Economic Review 2007, Qatar National Bank<br />

Economic Activities<br />

The oil and gas sector has grown to QR 118,707 million in 2006 from QR 92,071 million in 2005<br />

which is equivalent to a growth rate of 29%. The non-oil sector has increased by 17.14% in 2006<br />

to reach QR 73,202 million. In 2006, finance, insurance and real estate represented 21.5% of<br />

the total non-oil sector and manufacturing sector represented 19.3%. Building and construction<br />

sector has increased by 17.7% in 2006 and reached QR 10,291 million <strong>com</strong>paring to QR 8,744<br />

million in 2005.<br />

The table below provides the break down of the non-oil sector in Qatar for 2005 and 2006:<br />

GDP for Non-Oil Sector<br />

QR Million 2005 Share 2006 Share Growth<br />

Agriculture & Fishing 216 0.6% 233 0.3% 7.9%<br />

Manufacturing 13,042 20.9% 14,098 19.3% 8.1%<br />

Electricity & Water 2,209 3.5% 2,424 3.3% 9.7%<br />

Building & Construction 8,744 14.0% 10,291 14.1% 17.7%<br />

Trade, Rest, & Hotels 6,869 11.0% 7,616 10.4% 10.9%<br />

Transport & Communication 5,114 8.2% 5,612 7.7% 9.7%<br />

Finance, Ins. & Real Estate 14,785 23.7% 15,760 21.5% 6.6%<br />

Other Services 11,514 18.4% 17,168 23.5% 49.1%<br />

Total 62,493 100.0% 73,202 100.0% 17.1%<br />

Source: Qatar Economic Review 2007, Qatar National Bank<br />

Economic Drivers<br />

-<br />

2003 2004 2005 2006<br />

The main drivers that contribute to Qatar’s strong economic performance are highlighted<br />

below:<br />

Ñ Qatar’s oil production averaged 800,000 bpd 5 during the first half of 2007. Qatar’s oil<br />

production increased by 31,000 bpd during the year 2006, to average 810,000 bpd,<br />

<strong>com</strong>pared to an average of 779,000 bpd produced during 2005.<br />

5 Barrel per day<br />

Oil & Gas sector Non-oil sector<br />

29

Ñ Qatar’s exports have increased by 32.2% in 2006, to reach QR 123.9 billion. The oil and<br />

gas exports reached QR 111.2 billion of which 57% is accounted for by oil exports and the<br />

balance 43% by gas exports.<br />

Ñ Qatar’s oil price averaged USD 61.1 during the first half of 2007. In 2006, oil price has<br />

increased by 21.7% to reach USD 62.9 <strong>com</strong>pared to USD 51.7 in 2005.<br />

Ñ The population in Qatar was 522,023 as per the 1997 census, and has grown in 2004 by<br />

43% to reach 744,029 according to the 2004 census.<br />

Ñ The total assets of Qatari banks have increased by 46.7% in 2006 to reach QR 167.6 billion,<br />

and their net profits increased by 28.9% to reach QR 5,523 million in the same year.<br />

Ñ Many development projects in sectors such as infrastructure, health, education and tourism<br />

have further contributed to the economic performance. Mega projects are undergoing<br />

development:<br />

- Infrastructure: the New Doha International Airport project is estimated to cost USD 2.5<br />

billion and will be <strong>com</strong>pleted in three phases (2009, 2012 and 2015). Several roads and<br />

expressways projects are under implementation. Amongst the major road projects is the<br />

Qatar-Bahrain Bridge with an estimated value of USD 2 billion.<br />

- Gas and LNG 6 : Al-Khaleej Gulf Project, the Dolphin project and Kuwait-Qatar gas supply<br />

project are expected to enhance Qatar’s gas production capabilities and increase gas sales<br />

to the domestic consumers and gas export market. RasGas LNG 3,4 and 5, RasGas LNG<br />

6 and 7 Qatargas II and III projects are aimed at enhancing the production and export of<br />

LNG.<br />

- Leisure and tourism: the Pearl of the Gulf project, estimated at USD 2.5 billion, is a manmade<br />

island which is expected to include over 7,500 dwelling units, 3 luxury hotels and<br />

entertainment centres, restaurants and parks. The project master plan focuses on the<br />

creation of new hotels and tourist attractions, and it is designed to develop a tourism base<br />

of 1.4 million by 2010. The total additional spending is expected at USD 15 billion.<br />

- Healthcare: Hamad Medical City project is estimated to cost around USD 0.4 billion and<br />

will include a 300-bed unit, a dialysis unit, medical staff ac<strong>com</strong>modation and laboratories.<br />

Hamad Southern Area Hospital estimated to cost USD 57 million will include 200-bed<br />

facility. The USD 26 million Cardiology Hospital which <strong>com</strong>prises of a 110-bed facility is<br />

being developed at Rumailah.<br />

Industry Information<br />

Power Industry in the GCC<br />

The power and utility sector in all GCC countries is witnessing significant growth. The current<br />

economic development, increasing industrial capacity and population growth is outstripping<br />

demand for electricity in the region. According to the World Energy Council, an additional 100<br />

gigawatts of power generation capacity would be needed by 2020, which is projected to cost an<br />

estimated USD 150 billion.<br />

6 Liquefied Natural Gas<br />

30

The current GCC power capacity is illustrated in the following graph:<br />

Kuw ait<br />

Qatar<br />

Saudi Arabia<br />

Bahrain<br />

Oman<br />

UAE<br />

Source: The Power of Watt, ABQ Zawya Ltd, 2007<br />

Present GCC Power Capacity<br />

- 5,000 10,000 15,000 20,000 25,000 30,000 35,000<br />

The future GCC power capacity is illustrated in the following graph:<br />

Kuw ait<br />

Qatar<br />

Saudi Arabia<br />

Bahrain<br />

Oman<br />

UAE<br />

Source: The Power of Watt, ABQ Zawya Ltd, 2007<br />

Market Demand for Transformers<br />

Future GCC Power Capacity<br />

The high demand for power has resulted in a significant increase in demand for power<br />

transformers. During 2006, the market demand for power transformers in the MENA region was<br />

32,595 MVA (Megavolt Ampere). Oman represented 8% of the total MENA demand; KSA has<br />

the biggest share of 19%, Qatar 6%, UAE 15%, Kuwait 6% and Bahrain 2%. At present, more<br />

than 90% of the transformer demand in the GCC is met by imports. This represents a significant<br />

business potential for existing players to replace imported products.<br />

31<br />

MW<br />

- 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000<br />

MW<br />

Installed Capacity Additional Capacity

The power transformer market demand for 2006 is illustrated in the following graph:<br />

E g ypt<br />

1,525<br />

S u dan<br />

5 20<br />

Transformer Market Size, MVA<br />

T urke y<br />

2 ,4 00<br />

S yria<br />

Source: Feasibility Study for Power Transformers, A. F. Ferguson & Co., 2007<br />

The power transformer market for the MENA region is projected to reach 75,080 MVA (Megavolt<br />

Ampere) in 2012 as per the following graph:<br />

MVA<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

-<br />

Saudi Arabia<br />

Power Transformer Demand Forecast 2012<br />

UAE<br />

Iraq<br />

Oman<br />

Source: Feasibility Study for Power Transformers, A. F. Ferguson & Co., 2007<br />

6 00<br />

Jorda n<br />

64 0<br />

Qatar<br />

Iraq<br />

3,41 5<br />

Kuwait<br />

K S A<br />

6,3 75<br />

It is this significant growth in the demand for power transformer that the Company endeavours<br />

to capture with its new projects in Oman and Qatar.<br />

32<br />

K uw ait<br />

1,965<br />

Egypt<br />

B a hrain<br />

7 55<br />

Q a ta r<br />

1,8 05<br />

Y em e n<br />

2 10<br />

Sudan<br />

Ira n<br />

4 ,86 0<br />

U A E<br />

4 ,9 15<br />

Bahrain<br />

O m a n<br />

2,610<br />

Yemen<br />

Other countries

Customer Sectors<br />

In 2006, 73% of the MENA demand for power transformers came from entities in the utility<br />

sector, 16% of demand was contributed by the oil and gas sector and 11% by heavy industry.<br />

The graph below illustrates the demand for the three main sectors in the GCC countries:<br />

Market demand<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Demand for Power Transformers by Sector<br />

Oman KSA Qatar UAE Kuw ait Bahrain Yemen<br />

Utility Oil and Gas Heav y Industry<br />

Source: Feasibility Study for Power Transformers, A. F. Ferguson & Co., 2007<br />

33

CHAPTER 10<br />

Overview:<br />

DESCRIPTION OF THE COMPANY AND<br />

BUSINESS OVERVIEW AND ACTIVITIES<br />

Established in 1987, the Voltamp Energy is the flagship <strong>com</strong>pany of the Al Anwar Group. It<br />

manufactures low voltage switchgear panels through a franchisee agreement with Schneider-<br />

France.<br />

Al Anwar Holdings<br />

SAOG<br />

0.01%<br />

Voltamp Transformers<br />

Oman LLC<br />

Current Ownership Structure<br />

57.42%<br />

SABCO LLC<br />

21.29%<br />

Voltamp Energy LLC<br />

99.99% 51%<br />

Voltamp Energy is to be converted from LLC to SAOG as part of the <strong>IPO</strong> process. The proposed<br />

ownership structure, incorporating the additional project, is expected to be as follows:<br />

Al Anwar<br />

Holdings<br />

SAOG<br />

0.01%<br />

Voltamp Transformers<br />

Oman LLC<br />

Planned Ownership Structure*<br />

SABCO LLC<br />

Voltamp Energy SAOG<br />

(under transformation)<br />

99.99% 99.99% 51%<br />

Voltamp Power Oman<br />

LLC (proposed)<br />

The 0.01% shareholding held by Al Anwar Holdings SAOG in VTO is under trust of VE. A similar<br />

structure is anticipated for the shareholding structure of VPO whereby 100 shares of VPO will be<br />

held by VTO under trust of VE.<br />

34<br />

Other<br />

Shareholders<br />

(pre-<strong>IPO</strong>)<br />

28.71% 10.65% 10.65% 50.00%<br />

0.01%<br />

Other Shareholders<br />

21.29%<br />

Voltamp Manufacturing<br />

Company Qatar (under<br />

construction)<br />

New<br />

Shareholders<br />

(post-<strong>IPO</strong>)<br />

Voltamp Manufacturing<br />

Company Qatar (under<br />

construction)

Brief Profile of Subsidiaries of the Company<br />

Voltamp Transformers Oman LLC (“VTO”)<br />

Established in 1991 in collaboration with Babcock Transformers UK, VTO is a certified ISO 9001<br />