Merchandising Operations and the Accounting Cycle - Pearson

Merchandising Operations and the Accounting Cycle - Pearson

Merchandising Operations and the Accounting Cycle - Pearson

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

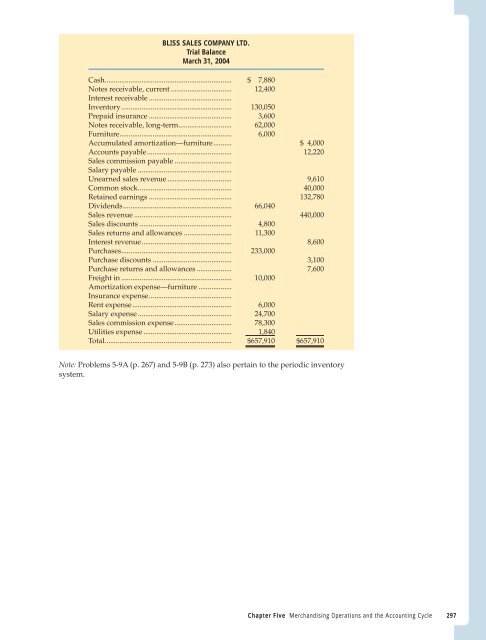

BLISS SALES COMPANY LTD.<br />

Trial Balance<br />

March 31, 2004<br />

Cash..................................................................... $ 7,880<br />

Notes receivable, current ................................. 12,400<br />

Interest receivable .............................................<br />

Inventory............................................................ 130,050<br />

Prepaid insurance ............................................. 3,600<br />

Notes receivable, long-term............................. 62,000<br />

Furniture............................................................. 6,000<br />

Accumulated amortization—furniture.......... $ 4,000<br />

Accounts payable.............................................. 12,220<br />

Sales commission payable ...............................<br />

Salary payable ...................................................<br />

Unearned sales revenue ................................... 9,610<br />

Common stock................................................... 40,000<br />

Retained earnings ............................................. 132,780<br />

Dividends........................................................... 66,040<br />

Sales revenue ..................................................... 440,000<br />

Sales discounts .................................................. 4,800<br />

Sales returns <strong>and</strong> allowances .......................... 11,300<br />

Interest revenue................................................. 8,600<br />

Purchases............................................................ 233,000<br />

Purchase discounts ........................................... 3,100<br />

Purchase returns <strong>and</strong> allowances ................... 7,600<br />

Freight in ............................................................ 10,000<br />

Amortization expense—furniture ..................<br />

Insurance expense.............................................<br />

Rent expense...................................................... 6,000<br />

Salary expense ................................................... 24,700<br />

Sales commission expense ............................... 78,300<br />

Utilities expense ................................................ 1,840<br />

Total..................................................................... $657,910 $657,910<br />

Note: Problems 5-9A (p. 267) <strong>and</strong> 5-9B (p. 273) also pertain to <strong>the</strong> periodic inventory<br />

system.<br />

Chapter Five <strong>Merch<strong>and</strong>ising</strong> <strong>Operations</strong> <strong>and</strong> <strong>the</strong> <strong>Accounting</strong> <strong>Cycle</strong> 297