Merchandising Operations and the Accounting Cycle - Pearson

Merchandising Operations and the Accounting Cycle - Pearson

Merchandising Operations and the Accounting Cycle - Pearson

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KEY POINT<br />

Closing entries for a<br />

merch<strong>and</strong>ising company<br />

accomplish <strong>the</strong> same tasks as in<br />

Chapter 4 <strong>and</strong> also replace<br />

beginning inventory with <strong>the</strong><br />

ending inventory balance. The<br />

debit <strong>and</strong> credit to Income<br />

Summary match <strong>the</strong> income<br />

statement column totals from <strong>the</strong><br />

work sheet.<br />

286 Part One The Basic Structure of <strong>Accounting</strong><br />

Many companies report <strong>the</strong>ir operating expenses in two categories.<br />

• Selling expenses are those expenses related to marketing <strong>the</strong> company’s products—sales<br />

salaries; sales commissions; advertising; amortization, rent, utilities,<br />

<strong>and</strong> property taxes on store buildings; amortization on store furniture;<br />

delivery expense; <strong>and</strong> so on.<br />

• General expenses include office expenses, such as <strong>the</strong> salaries of office employees;<br />

<strong>and</strong> amortization, rent, utilities, <strong>and</strong> property taxes on <strong>the</strong> home office<br />

building.<br />

Gross margin minus operating expenses <strong>and</strong> plus any o<strong>the</strong>r operating revenues<br />

equals operating income, or income from operations. Many businesspeople view<br />

operating income as <strong>the</strong> most reliable indicator of a business’s success because it measures<br />

<strong>the</strong> entity’s major ongoing activities.<br />

The last section of Austin Sound’s income statement is o<strong>the</strong>r revenue <strong>and</strong> expenses,<br />

which is h<strong>and</strong>led <strong>the</strong> same way in both inventory systems. This category reports<br />

revenues <strong>and</strong> expenses that are outside <strong>the</strong> company’s main line of business.<br />

Journalizing <strong>the</strong> Adjusting <strong>and</strong> Closing Entries in<br />

<strong>the</strong> Periodic Inventory System<br />

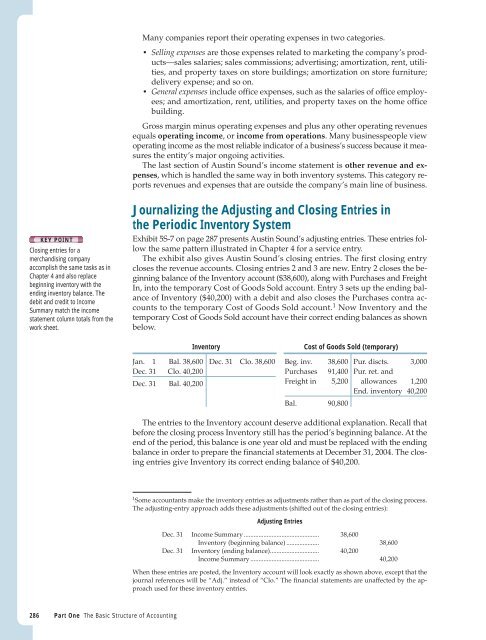

Exhibit 5S-7 on page 287 presents Austin Sound’s adjusting entries. These entries follow<br />

<strong>the</strong> same pattern illustrated in Chapter 4 for a service entry.<br />

The exhibit also gives Austin Sound’s closing entries. The first closing entry<br />

closes <strong>the</strong> revenue accounts. Closing entries 2 <strong>and</strong> 3 are new. Entry 2 closes <strong>the</strong> beginning<br />

balance of <strong>the</strong> Inventory account ($38,600), along with Purchases <strong>and</strong> Freight<br />

In, into <strong>the</strong> temporary Cost of Goods Sold account. Entry 3 sets up <strong>the</strong> ending balance<br />

of Inventory ($40,200) with a debit <strong>and</strong> also closes <strong>the</strong> Purchases contra accounts<br />

to <strong>the</strong> temporary Cost of Goods Sold account. 1 Now Inventory <strong>and</strong> <strong>the</strong><br />

temporary Cost of Goods Sold account have <strong>the</strong>ir correct ending balances as shown<br />

below.<br />

Inventory Cost of Goods Sold (temporary)<br />

Jan. 1 Bal. 38,600 Dec. 31 Clo. 38,600 Beg. inv. 38,600 Pur. discts. 3,000<br />

Dec. 31 Clo. 40,200 Purchases 91,400 Pur. ret. <strong>and</strong><br />

Dec. 31 Bal. 40,200 Freight in 5,200 allowances 1,200<br />

End. inventory 40,200<br />

Bal. 90,800<br />

The entries to <strong>the</strong> Inventory account deserve additional explanation. Recall that<br />

before <strong>the</strong> closing process Inventory still has <strong>the</strong> period’s beginning balance. At <strong>the</strong><br />

end of <strong>the</strong> period, this balance is one year old <strong>and</strong> must be replaced with <strong>the</strong> ending<br />

balance in order to prepare <strong>the</strong> financial statements at December 31, 2004. The closing<br />

entries give Inventory its correct ending balance of $40,200.<br />

1 Some accountants make <strong>the</strong> inventory entries as adjustments ra<strong>the</strong>r than as part of <strong>the</strong> closing process.<br />

The adjusting-entry approach adds <strong>the</strong>se adjustments (shifted out of <strong>the</strong> closing entries):<br />

Adjusting Entries<br />

Dec. 31 Income Summary .............................................. 38,600<br />

Inventory (beginning balance) .................... 38,600<br />

Dec. 31 Inventory (ending balance).............................. 40,200<br />

Income Summary .......................................... 40,200<br />

When <strong>the</strong>se entries are posted, <strong>the</strong> Inventory account will look exactly as shown above, except that <strong>the</strong><br />

journal references will be “Adj.” instead of “Clo.” The financial statements are unaffected by <strong>the</strong> approach<br />

used for <strong>the</strong>se inventory entries.