Merchandising Operations and the Accounting Cycle - Pearson

Merchandising Operations and the Accounting Cycle - Pearson

Merchandising Operations and the Accounting Cycle - Pearson

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Summary<br />

Requirement 4<br />

254 Part One The Basic Structure of <strong>Accounting</strong><br />

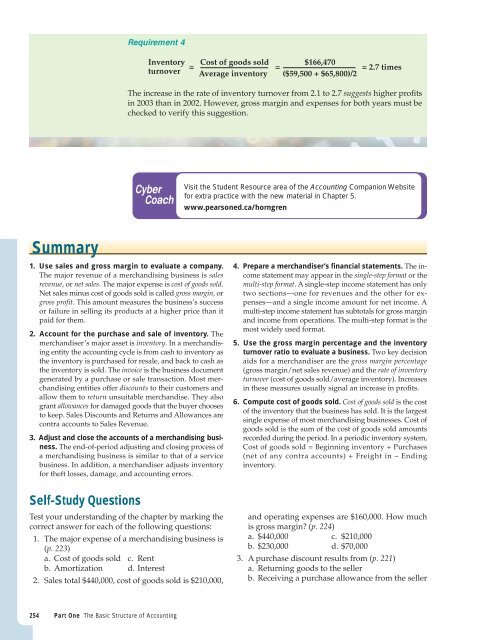

Inventory Cost of goods sold $166,470<br />

turnover<br />

= =<br />

= 2.7 times<br />

Average inventory ($59,500 + $65,800)/2<br />

The increase in <strong>the</strong> rate of inventory turnover from 2.1 to 2.7 suggests higher profits<br />

in 2003 than in 2002. However, gross margin <strong>and</strong> expenses for both years must be<br />

checked to verify this suggestion.<br />

Cyber<br />

Coach<br />

1. Use sales <strong>and</strong> gross margin to evaluate a company.<br />

The major revenue of a merch<strong>and</strong>ising business is sales<br />

revenue, or net sales. The major expense is cost of goods sold.<br />

Net sales minus cost of goods sold is called gross margin, or<br />

gross profit. This amount measures <strong>the</strong> business’s success<br />

or failure in selling its products at a higher price than it<br />

paid for <strong>the</strong>m.<br />

2. Account for <strong>the</strong> purchase <strong>and</strong> sale of inventory. The<br />

merch<strong>and</strong>iser’s major asset is inventory. In a merch<strong>and</strong>ising<br />

entity <strong>the</strong> accounting cycle is from cash to inventory as<br />

<strong>the</strong> inventory is purchased for resale, <strong>and</strong> back to cash as<br />

<strong>the</strong> inventory is sold. The invoice is <strong>the</strong> business document<br />

generated by a purchase or sale transaction. Most merch<strong>and</strong>ising<br />

entities offer discounts to <strong>the</strong>ir customers <strong>and</strong><br />

allow <strong>the</strong>m to return unsuitable merch<strong>and</strong>ise. They also<br />

grant allowances for damaged goods that <strong>the</strong> buyer chooses<br />

to keep. Sales Discounts <strong>and</strong> Returns <strong>and</strong> Allowances are<br />

contra accounts to Sales Revenue.<br />

3. Adjust <strong>and</strong> close <strong>the</strong> accounts of a merch<strong>and</strong>ising business.<br />

The end-of-period adjusting <strong>and</strong> closing process of<br />

a merch<strong>and</strong>ising business is similar to that of a service<br />

business. In addition, a merch<strong>and</strong>iser adjusts inventory<br />

for <strong>the</strong>ft losses, damage, <strong>and</strong> accounting errors.<br />

Self-Study Questions<br />

Test your underst<strong>and</strong>ing of <strong>the</strong> chapter by marking <strong>the</strong><br />

correct answer for each of <strong>the</strong> following questions:<br />

1. The major expense of a merch<strong>and</strong>ising business is<br />

(p. 223)<br />

a. Cost of goods sold c. Rent<br />

b. Amortization d. Interest<br />

2. Sales total $440,000, cost of goods sold is $210,000,<br />

Visit <strong>the</strong> Student Resource area of <strong>the</strong> <strong>Accounting</strong> Companion Website<br />

for extra practice with <strong>the</strong> new material in Chapter 5.<br />

www.pearsoned.ca/horngren<br />

4. Prepare a merch<strong>and</strong>iser’s financial statements. The income<br />

statement may appear in <strong>the</strong> single-step format or <strong>the</strong><br />

multi-step format. A single-step income statement has only<br />

two sections—one for revenues <strong>and</strong> <strong>the</strong> o<strong>the</strong>r for expenses—<strong>and</strong><br />

a single income amount for net income. A<br />

multi-step income statement has subtotals for gross margin<br />

<strong>and</strong> income from operations. The multi-step format is <strong>the</strong><br />

most widely used format.<br />

5. Use <strong>the</strong> gross margin percentage <strong>and</strong> <strong>the</strong> inventory<br />

turnover ratio to evaluate a business. Two key decision<br />

aids for a merch<strong>and</strong>iser are <strong>the</strong> gross margin percentage<br />

(gross margin/net sales revenue) <strong>and</strong> <strong>the</strong> rate of inventory<br />

turnover (cost of goods sold/average inventory). Increases<br />

in <strong>the</strong>se measures usually signal an increase in profits.<br />

6. Compute cost of goods sold. Cost of goods sold is <strong>the</strong> cost<br />

of <strong>the</strong> inventory that <strong>the</strong> business has sold. It is <strong>the</strong> largest<br />

single expense of most merch<strong>and</strong>ising businesses. Cost of<br />

goods sold is <strong>the</strong> sum of <strong>the</strong> cost of goods sold amounts<br />

recorded during <strong>the</strong> period. In a periodic inventory system,<br />

Cost of goods sold = Beginning inventory + Purchases<br />

(net of any contra accounts) + Freight in – Ending<br />

inventory.<br />

<strong>and</strong> operating expenses are $160,000. How much<br />

is gross margin? (p. 224)<br />

a. $440,000 c. $210,000<br />

b. $230,000 d. $70,000<br />

3. A purchase discount results from (p. 221)<br />

a. Returning goods to <strong>the</strong> seller<br />

b. Receiving a purchase allowance from <strong>the</strong> seller