Complaint 4 26 13 Final - OakBridge Insurance Services

Complaint 4 26 13 Final - OakBridge Insurance Services

Complaint 4 26 13 Final - OakBridge Insurance Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Case 3:<strong>13</strong>-cv-0<strong>13</strong>28-CCC Document 1 Filed 04/<strong>26</strong>/<strong>13</strong> Page 12 of 31<br />

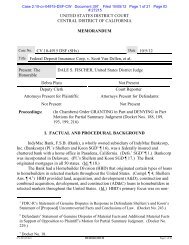

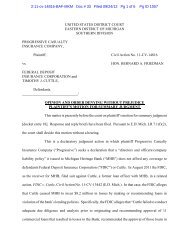

VI. THE LOSS LOANS<br />

34. The following table lists the Loss Loans at issue in this suit and indicates which of<br />

the Director Defendants approved each loan. The FDIC is only seeking damages from each<br />

Director Defendant for the loans that he or she approved:<br />

Borrower<br />

Loan Amount<br />

(millions)<br />

Approval<br />

Date<br />

12<br />

Loss<br />

(millions)<br />

Loan Approval Votes<br />

Arillaga<br />

Torres<br />

Hernández<br />

Levy<br />

Pavía<br />

Feliciano<br />

Gonzalez<br />

Gómez<br />

1. Skylofts<br />

Skylofts<br />

$4.3<br />

$1.0<br />

Mar. 6, 2006<br />

Jun. 27, 2007<br />

$4.73<br />

x x x x x x x x<br />

x x x x x x x<br />

2. La Ciudadela $20.00 Apr. 24, 2006 $19.51 x x x x x x x x x<br />

3. Hillstone<br />

Hillstone<br />

$4.10<br />

$0.30<br />

Sept. 27, 2006<br />

Sept. 29, 2008<br />

$4.<strong>13</strong><br />

x x x x x x x x<br />

x x x x x x x x<br />

4. Acor Se $9.8 Mar 19, 2007<br />

x x x x x x x x<br />

Acor Se $2.56 Mar. 25, 2008 $6.22 x x x x x x x x<br />

Acor Se $0.69 Feb. 19, 2009 x x x x x x x x<br />

5. Jocar Inc. $5 Dec. 21, 2007 $4.69 x x x x x x x x x<br />

6. City Walk $5.2 Dec. 28, 2007 $4.81 x x x x x x x x x<br />

7. Marat LLC<br />

Marat LLC<br />

$<strong>13</strong>.3<br />

1.9<br />

Nov. 24, 2008<br />

Dec. 22, 2008<br />

$11.38<br />

x x x x x x x x<br />

x x x x x x x x<br />

TOTAL $68.15 $55.47<br />

35. In connection with the Loss Loans, the Director Defendants routinely overlooked<br />

extreme and obvious departures from sound underwriting practices and the Bank’s own lending<br />

policies, and by all appearances approved the loans based on little more than hope. The Loss<br />

Loans violated the underwriting standards set forth in 12 C.F.R. § 364.101, Appendix A, and the<br />

real estate lending standards in 12 C.F.R. § 365.2, Appendix A. Thus, the Director Defendants<br />

breached their fiduciary duty of care to the Bank when failing to exercise due care or any<br />

business judgment while ignoring the obvious risks posed by these specific loans.<br />

Lopez