2007 Annual Report - Sun Life Financial

2007 Annual Report - Sun Life Financial

2007 Annual Report - Sun Life Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

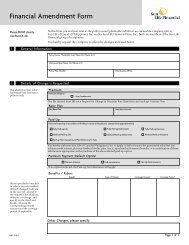

DOLLAR ABUNDANCE FUND<br />

GS FUND<br />

<strong>2007</strong><br />

<strong>2007</strong><br />

Weighted Average<br />

Effective Interest<br />

Rate<br />

Weighted<br />

Average<br />

Effective<br />

Interest Rate<br />

Less than One<br />

Less than One<br />

Month<br />

Month<br />

three Months<br />

to One year<br />

One-Five<br />

One-Five years Five+ years total<br />

Non-interest bearing - P 6,827 P - P - P 6,827<br />

Fixed interest rate<br />

instruments 7.08% 16,620 50,265 15,113 81,998<br />

2006<br />

P23,447 P50,265 P15,113 P88,825<br />

Non-interest bearing<br />

Fixed interest rate<br />

- P 3,699 P - P - P 3,699<br />

instruments 7.38% 39,320 23,157 28,551 91,028<br />

P43,019 P23,157 P28,551 P94,727<br />

Credit risk<br />

Credit risk refers to the risk that counterparty will default on its contractual obligations resulting<br />

in financial loss to the Companies. The Companies have adopted a policy of only dealing with<br />

creditworthy counterparties, and only transacts with entities that are rated the equivalent of<br />

investment grade of AAA down to minimum BBB. This information is supplied by independent<br />

rating agencies when available and if not available, the Companies use other publicly available<br />

financial information and its own trading records to rate its major customers. The Companies<br />

exposure and the credit ratings of its counterparties are continuously monitored and the aggregate<br />

value of transactions concluded is spread amongst approved counterparties.<br />

The Companies do not have any significant credit risk exposure to any single counterparty or any<br />

group of counterparties having similar characteristics. The Companies define counterparties as<br />

having similar characteristics if they are related entities. Concentration of credit risk did not exceed<br />

10% of gross monetary assets at any time during the year. The credit risk on liquid funds is limited<br />

because the counterparties are commercial banks with high credit-ratings assigned by international<br />

credit-rating agencies.<br />

years<br />

Five+ years total<br />

Non-interest bearing - $1,061 $ - $ - $ - $ 1,061<br />

Fixed interest rate instruments 6.49% 3,267 202 1,318 22,478 27,265<br />

2006<br />

$4,328 $202 $1,318 $22,478 $28,326<br />

Non-interest bearing - $1,149 $- $- $- $1,149<br />

Fixed interest rate instruments 7.33% 3,486 - 1,563 16,749 21,798<br />

$4,635 $- $1,563 $16,749 $22,947<br />

<strong>2007</strong> <strong>Annual</strong> <strong>Report</strong> 39