JCDA - Canadian Dental Association

JCDA - Canadian Dental Association

JCDA - Canadian Dental Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

C a n a d i a n d en t i s t s’ i n v e s t m en t P r o gr a m<br />

CDA Funds<br />

check out our performance<br />

Leading Fund Managers Low Fees<br />

cDa funds can be used in your cDa rSp, cDa rIf, cDa Investment account, cDa reSp and cDa Ipp.<br />

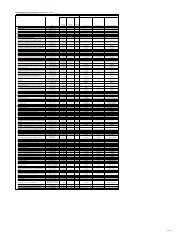

CDA Fund Performance (for period ending July 31, 2008)<br />

MER 1 year 3 years 5 years 10 years<br />

CDA <strong>Canadian</strong> Growth Funds<br />

Aggressive Equity Fund (Altamira) 1.00% -28.9% -1.7% 4.7% 5.0%<br />

Common Stock Fund (Altamira) 0.99% 4.6% 12.0% 14.7% 8.9%<br />

<strong>Canadian</strong> Equity Fund (Trimark) 1.50% -15.4% 0.0% 5.5% 5.7%<br />

Dividend Fund (PH&N) † 1.20% -11.9% 2.4% 8.5% 9.9%<br />

High Income Fund (Sceptre) † 1.45% 1.0% 5.0% 14.4% n/a<br />

Special Equity Fund (KBSH) 1.45% -9.3% 3.8% 10.0% 6.7%<br />

TSX Composite Index Fund (BGI) †† 0.67% 0.6% 11.4% 15.2% n/a<br />

CDA International Growth Funds<br />

Emerging Markets Fund (Brandes) 1.77% -18.6% 8.7% 12.4% 8.3%<br />

European Fund (Trimark) † 1.45% -21.4% 3.6% 3.6% -2.8%<br />

International Equity Fund (CC&L) 1.30% -16.7% 0.9% 2.4% -0.9%<br />

Pacific Basin Fund (CI) 1.77% -16.0% 4.6% 4.6% 0.3%<br />

US Large Cap Fund (Capital Intl) † 1.46% -21.9% -8.1% -3.1% n/a<br />

US Small Cap Fund (Trimark) 1.25% -30.3% -7.9% 2.3% n/a<br />

Global Fund (Trimark) 1.50% -18.4% 1.0% 3.3% 5.0%<br />

Global Growth Fund (Capital Intl) † 1.77% -15.3% 2.3% 6.5% n/a<br />

S&P 500 Index Fund (BGI) †† 0.67% -15.5% -4.1% -0.6% -1.9%<br />

CDA Income Funds<br />

Bond and Mortgage Fund (Fiera) 0.99% 5.6% 2.6% 3.5% 4.4%<br />

Bond Fund (PH&N) 0.65% 6.4% 3.5% 5.1% 5.8%<br />

Fixed Income Fund (McLean Budden) † 0.97% 5.9% 2.6% 4.4% 5.0%<br />

CDA Cash and Equivalent Fund<br />

Money Market Fund (Fiera) 0.67% 3.5% 3.2% 2.7% 3.2%<br />

CDA Growth and Income Funds<br />

Balanced Fund (PH&N) 1.20% -5.1% 2.9% 5.7% 4.3%<br />

Balanced Value Fund (McLean Budden) † 0.95% -5.3% 2.9% 6.1% 6.1%<br />

CDA Managed Risk Portfolios (Wrap Funds) MER 1 year 3 years 5 years 10 years<br />

Index Fund Portfolios<br />

CDA Conservative Index Portfolio (BGI) † 0.85% -0.1% 3.5% 5.5% 4.0%<br />

CDA Moderate Index Portfolio (BGI) † 0.85% -3.1% 4.5% 7.5% 5.0%<br />

CDA Aggressive Index Portfolio (BGI) † 0.85% -5.9% 5.5% 9.1% 5.2%<br />

Income/Equity Fund Portfolios<br />

CDA Income Portfolio (CI) † 1.65% -0.1% 2.8% 5.6% 4.8%<br />

CDA Income Plus Portfolio (CI) † 1.65% -2.7% 3.4% 7.0% 5.5%<br />

CDA Balanced Portfolio (CI) † 1.65% -5.5% 3.8% 8.0% 5.6%<br />

CDA Conservative Growth Portfolio (CI) † 1.65% -7.6% n/a n/a n/a<br />

CDA Moderate Growth Portfolio (CI) † 1.65% -8.7% 3.0% 7.0% n/a<br />

CDA Aggressive Growth Portfolio (CI) † 1.65% -10.3% n/a n/a n/a<br />

Figures indicate annual compound rate of return. All fees have been deducted. As a result, performance results may differ from those published<br />

by the fund managers. CDA figures are historical rates based on past performance and are not necessarily indicative of future performance.<br />

† Returns shown are for the underlying funds in which CDA funds invest.<br />

†† Returns shown are the total returns for the indices tracked by these funds.<br />

For current unit values and GIC rates visit www.cdspi.com/values-rates.<br />

To speak with a representative, call CDSPI toll-free at 1-800-561-9401, ext. 5020.<br />

666 <strong>JCDA</strong> • www.cda-adc.ca/jcda • September 2008, Vol. 74, No. 7 •