Download PDF - Minera Frisco

Download PDF - Minera Frisco

Download PDF - Minera Frisco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Minera</strong> <strong>Frisco</strong><br />

ANNUAL REPORT 2011

Contents<br />

01 Introduction<br />

02 Overview of MINERA FRISCO<br />

04 Key Financial and Operating Data<br />

06 Letter to Shareholders<br />

08 Units in Operation<br />

22 Projects in Installation and Expansion<br />

36 Projects under feasibility and implementation studies<br />

38 Exploration<br />

40 Sustainability Studies<br />

42 Human Resources<br />

46 Board of Directors<br />

47 Report of the Corporate and Auditing Practices Committee<br />

49 Consolidated Financial Statements<br />

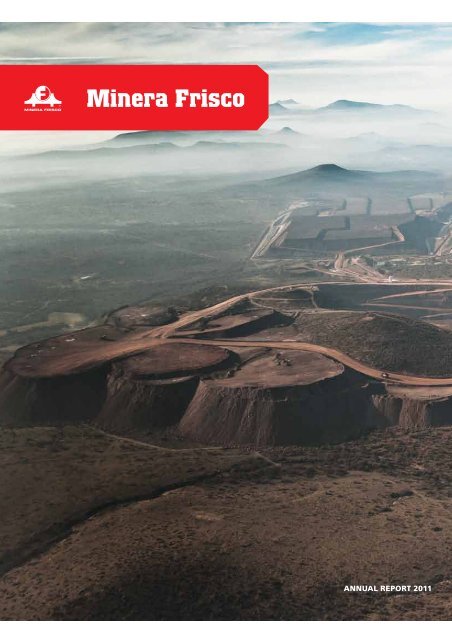

El Coronel / Aerial view

CORPORATE PROFILE. MINERA FRISCO is a company with a deep history<br />

dedicated to the exploration and exploitation of mining lots for the production and<br />

sale of mainly gold doré and silver bars, as well as cathode copper and copper,<br />

lead-silver and zinc concentrates.<br />

The company currently has 3,500 employees and six mining units in Mexico: El Coronel,<br />

San Felipe, María, San Francisco del Oro, Tayahua and Asientos, developing six projects<br />

including new mines and expansions, as well as several exploration projects.<br />

Through alliances and its own resources, the company uses cutting-edge technology<br />

for the localization and processing of minerals and carries out environmental<br />

administration initiatives focused on minimizing the generation of residues and water<br />

consumption, while compensating for adverse environmental impacts.

VISION, MISSION AND PRINCIPLES<br />

Vision:<br />

To be a strong mining company in the global<br />

arena of the extraction of precious and base<br />

metals with processes that have minimal<br />

risks to guarantee the rate of return to<br />

shareholders and favor the development of<br />

sustainable communities.<br />

Mission:<br />

To work in a harmonious way with all<br />

stakeholders, promoting a culture of<br />

innovation and practices of technological<br />

and environmental efficiency that allow<br />

us to grow toward common objectives.<br />

Principles:<br />

• Commitment with shareholders<br />

• Integral human development<br />

• Teamwork<br />

• Environmental, security and hygiene<br />

consciousness<br />

• Quality and ongoing improvement<br />

El Concheño / Open-pit

2011 was a milestone year for <strong>Minera</strong> <strong>Frisco</strong>.<br />

The company continued an ambitious investment<br />

plan to increase production at all of its mining<br />

units and increased exploration activities<br />

and metallurgical research with the goal of<br />

expanding reserve and resource bases across all<br />

of its projects.<br />

MINERA FRISCO has a long history that dates back to the<br />

17 th century, when the first mineral deposits were discovered in<br />

San Francisco del Oro. Throughout the years the company has<br />

incorporated different mines to its portfolio and was constituted in<br />

1962 as a 100% Mexican company. Since its founding to the present,<br />

<strong>Frisco</strong> has maintained its positioning as a solid mining company with<br />

the constant goal of high standards of efficiency, quality and security.<br />

San Felipe / Aerial view<br />

1

Overview of <strong>Minera</strong> <strong>Frisco</strong><br />

2<br />

2<br />

6<br />

12<br />

Breakdown of Sales by Product<br />

45% Gold and silver doré bars<br />

19% Lead-silver concentrates<br />

15% Zinc concentrates<br />

9% Copper concentrates<br />

12% Cathodic copper<br />

History Timeline<br />

Mining begins in<br />

Chihuahua during<br />

the second half of<br />

the 17 th century,<br />

with a mineral<br />

deposit discovery<br />

by Francisco de<br />

Molina.<br />

7<br />

As a result of the<br />

new Mining Law,<br />

foreign and Mexican<br />

companies partner<br />

to create <strong>Minera</strong><br />

<strong>Frisco</strong>, S.A.<br />

5<br />

9<br />

13<br />

16<br />

1<br />

4 11<br />

14<br />

3<br />

8<br />

<strong>Minera</strong> Lampazos<br />

begins mining silver<br />

ore (closed in 1987).<br />

1658 -1961 1962 1972 1978 1980 1985<br />

10<br />

<strong>Minera</strong> Cumobabi,<br />

S.A. de C.V. begins<br />

operations, mining<br />

copper ore and<br />

molybdenum (closed<br />

in 1989).<br />

15<br />

<strong>Minera</strong> María begins<br />

operations in the town<br />

of Cananea in Sonora,<br />

mining copper ore<br />

(closed in 1981).<br />

Empresas <strong>Frisco</strong>,<br />

S.A. de C.V. is created<br />

and acquired by<br />

Grupo Carso.

Mining Units<br />

Name<br />

Units in Operation<br />

Metals Exploitation Type Process<br />

1 El Coronel Au, Ag Open-Pit Heap Leaching<br />

2 San Felipe Au, Ag Open-Pit Heap Leaching / Dynamic Leaching<br />

3 Asientos Au, Ag, Pb, Zn, Cu Underground Milling and Flotation<br />

4 Tayahua Au, Ag, Pb, Zn, Cu Underground Milling and Flotation<br />

5 San Francisco del Oro Au, Ag, Pb, Zn, Cu Underground Milling and Flotation<br />

6 María Cu Open-Pit Heap Leaching<br />

Expansion Projects<br />

1 El Coronel - Secondary Crusher Crushing circuit, expansion of settling ponds and heap formation<br />

2 San Felipe II Crushing circuit, settling ponds, heap formation and Merrill Crowe plant<br />

4 Tayahua - Primary Copper Access ramp of 5.6 kms, crushing, grinding and flotation plant<br />

Installation Projects<br />

7 El Concheño Au, Ag Open-Pit Dynamic Leaching<br />

8 El Porvenir Au, Ag Open-Pit Heap Leaching<br />

9 San Francisco del Oro Open-pit Au, Ag Open-Pit Flotation and Dynamic Leaching<br />

Projects under Feasibility and Implementation Studies<br />

10 Espejeras Au, Ag Open-Pit Dynamic Leaching<br />

11 Calcosita - Tayahua Cu Open-Pit Heap Leaching<br />

12 Lampazos Au, Pb Open-Pit / Underground Flotation<br />

13 Clarines Au, Ag Open-Pit Flotation and Dynamic Leaching<br />

14 Vetas Negras Au, Ag Open-Pit Dynamic Leaching<br />

15 Santa Fe Au, Ag Open-Pit Bulk Flotation<br />

16 Federicos Au, Ag Open-Pit Heap Leaching<br />

Compañía<br />

San Felipe begins<br />

operations in Baja<br />

California (closed<br />

in 2001).<br />

<strong>Minera</strong> Tayahua is<br />

acquired (51%),<br />

located in Mazapil,<br />

Zacatecas.<br />

The Unidad de<br />

Manejo para la<br />

Conservación de la<br />

Vida Silvestre (UMA)<br />

(Unity of Conservation<br />

Management<br />

of Wildlife) creates<br />

the “Reserva San<br />

Francisco del Oro”<br />

in Chihuahua.<br />

The second phase<br />

of <strong>Minera</strong> María<br />

begins operations,<br />

mining copper ore<br />

for the production<br />

of cathodes.<br />

The Asientos unit<br />

in Aguascalientes<br />

and the El Coronel<br />

unit in Zacatecas<br />

begin operations to<br />

produce gold doré<br />

and silver bars.<br />

Beginning in the<br />

second half of 2010<br />

<strong>Frisco</strong> begins a<br />

program of strong<br />

investment in six<br />

projects that contemplate<br />

expansions<br />

as well as new<br />

plants and facilities.<br />

1994 1998 2001 2004 2008 2010<br />

3

Key Financial and<br />

Operating Data<br />

4<br />

MINERA FRISCO<br />

(Thousand pesos at December 31, 2011*)<br />

2011 2010 Change %<br />

Revenues 8,544,566 7,141,703 19.6%<br />

Operating Income 3,669,712 3,237,612 13.3%<br />

Operating Margin 42.90% 45.30% -2.4<br />

EBITDA 4,309,534 3,657,054 17.8%<br />

EBITDA Margin 50.40% 51.20% -0.8<br />

Controlling participation in Net Income 545,750 1,397,208 -60.9%<br />

Percentage to Sales 6.40% 19.60% -13.2<br />

Total Assets 24,303,232 20,097,799 20.9%<br />

Total Liabilities 12,300,424 18,339,381 -32.9%<br />

Consolidated Stockholder’s Equity 12,002,808 1,758,418 582.6%<br />

CapEx 7,984,478 3,087,281 158.6%<br />

Total Debt 8,350,000 12,616,045 -33.8%<br />

Net Debt 3,488,644 6,276,013 -44.4%<br />

Net Debt/EBITDA (times) 0.8 1.7 -0.9<br />

CapEx/Revenues 93.4% 43.2% 50.2<br />

Shares Outstanding (thousand) 2,545,382 0 NA<br />

Income per Share** 0.22 0 NA<br />

Stock Price at year end*** 50.71 0 NA<br />

* Except outstanding shares and Income per share.<br />

** Controlling Participation in Net Income divided by the compounded average number of oustanding shares.<br />

*** Price at the beginning of its trading on January 6, 2011 was of $30.14 pesos per share.<br />

EBITDA: Earnings before interest, taxes, depreciation and amortization.<br />

NA: Not applicable

7,142<br />

8,545<br />

3,238<br />

3,670<br />

3,657<br />

4,309<br />

3,087<br />

7,984<br />

6,276<br />

10 11 10 11 10 11 10 11 10 11<br />

Revenues<br />

(Million pesos)<br />

Operating<br />

Income<br />

(Million pesos)<br />

EBITDA<br />

(Million pesos)<br />

CapEx<br />

(Million pesos)<br />

3,489<br />

Net Debt<br />

(Million pesos)<br />

5

Letter to shareholders<br />

Global Economic Outlook<br />

The economic outlook since 2000 includes structural problems,<br />

mainly in developed countries, which have not been<br />

resolved and have only been faced with aggressive monetary<br />

and fiscal policies.<br />

With the change in civilizations from industrial to service<br />

societies, as well as rapid technological advances that have<br />

allowed large productivity increases and the ability to produce<br />

goods and services at lower costs, we should be seeing<br />

the generalized creation of value and wealth. However, fiscal<br />

and structural trade deficits, as well as an unsustainable<br />

welfare state and problems with the financial system that do<br />

not appropriately guide change are provoking high levels of<br />

unemployment that are most evident even among the bestprepared<br />

youth.<br />

Despite a global economic situation that is unfavorable for the<br />

exports of developed nations, the monetary policies of these<br />

nations have allowed important capital access and long-term,<br />

low-interest financing for developing nations. It has also permitted<br />

developing countries to focus on domestic economies<br />

and impulse the activities necessary for development with the<br />

formation of human and physical capital, as well as the promotion<br />

of activities that will be intensive job engines in coming<br />

years. Investments in coming years that are equivalent to<br />

25% of GDP would create high sustained economic growth,<br />

as well as sustained job growth, which would allow developing<br />

countries to cross the threshold of per capita income of<br />

$15,000 dollars. This in turn would result in a larger middle<br />

class and bring currently marginalized and poverty-stricken<br />

groups to the benefits of better education and health, leading<br />

to a virtuous cycle of development for our countries.<br />

Even with the negative effects of the global economy, Mexico<br />

and other emerging countries are facing more growth opportunities<br />

than developed nations. Mexico has an adequatelycapitalized<br />

banking system, better public finances, low interest<br />

rates, long-term peso and dollar-indexed financing, and<br />

most importantly, many needs that become investment opportunities<br />

for the private sector, which in turn lead to potential<br />

for development and more employment.<br />

6<br />

Metals Market<br />

In 2011, the precious metals market experienced an important<br />

increase in prices. In the case of gold, the global economic<br />

situation, negative real interest rates and the growing demand<br />

for the physical metal —especially in China— as well as<br />

the growing demand of exchange-traded funds have pushed<br />

prices to maximum historic levels. Gold traded at $1,925 USD/<br />

Oz in September of 2011 and prices for the year were 25%<br />

above 2010 levels. Meanwhile, global production was 2,801<br />

tons, a 5.7% increase from 2010.<br />

In the case of silver, it is being considered an investment in<br />

addition to industrial uses. Global mining production was<br />

24,150 tons in 2011, a similar level to 2010. Throughout the<br />

year, there were large periods of volatility, with prices closing<br />

the year at 60% above 2010.<br />

In the case of base metals, copper has had an important upturn<br />

in recent years. Demand in China for the metal increased<br />

in 2011 to almost 8.0 Mt, which is 40% of global consumption.<br />

Meanwhile, the supply of deposits has been affected in<br />

recent years by labor strikes, climate and decreases in production<br />

laws. Global mining production was 16.30 Mt for 2011.<br />

As for zinc and lead, there has been an increase in global supply<br />

in recent years, creating historically high inventories, with<br />

China as the principal consumer and producer.<br />

MINERA FRISCO<br />

Within this context there is a historic opportunity for the company,<br />

which in addition to having many years of operation,<br />

has a portfolio of important mining lots in Mexico and important<br />

growth potential for its operational units. Thanks to the<br />

experience of the company in executing and installing projects<br />

and taking advantage of specialization in process engineering,<br />

construction and the build-out of structures from affiliated<br />

companies, there are currently six expansion projects as well<br />

as the simultaneous installation of new mines. These projects<br />

are the principal present and near future challenge for the<br />

company. These projects represent an important increase in<br />

the production capacity of over 200% and a CapEx of $7.984<br />

billion pesos for 2011, a figure that will be surpassed in 2012.

<strong>Frisco</strong> currently has one of the most aggressive expansion programs<br />

in the world for now and the near future, executing<br />

with the highest levels of quality, in record time and cost efficiency,<br />

offering experience and equipment integration that is<br />

fundamental for the execution of future projects.<br />

In the operation of our mining units, we have made an important<br />

effort to continue metallurgical investigation and the<br />

optimization of our processes. This translates into production<br />

cost improvements, efficiency in the recovery of metallurgical<br />

values, processes with better environmental sustainability and<br />

in general better economic viability of the projects.<br />

In terms of exploration, in 2011 we significantly increased<br />

the economic resources, equipment and specialists to increase<br />

our reserve base and mineral resources to support<br />

the operation of current projects, expansion plans and the<br />

viability of projects that are being installed. Additionally,<br />

there are many mining lots from our portfolio that are in<br />

geological study and exploration seeking viability to be exploited<br />

in the future.<br />

In terms of operations, higher year-on-year metals prices in<br />

2011 and increases in produced volumes of mainly copper,<br />

gold and lead caused revenue to increase 20% to $8.545<br />

billion pesos, while EBITDA increased 18% with a slight decrease<br />

of 0.8 percentage points in EBITDA margin, which<br />

was 50.4%.<br />

Total assets were $24.303 billion pesos, while controlling<br />

stockholders’ equity was $12.003 billion pesos. Debt to equity<br />

was 1.0 time, while net debt was 0.8 times 2011 EBITDA.<br />

Debt coverage was 7.1 times.<br />

Given the relevance of the investments in installation projects,<br />

the company considered the guarantee of minimum level of<br />

José Humberto Gutiérrez-Olvera Zubizarreta<br />

Chairman of the Board<br />

profitability to be fundamental and has hedged the price of<br />

metals. As the projects near operation and the new projects<br />

have a lesser weight with respect to the total production base,<br />

the company has significantly decreased its position of hedges<br />

with respect to production.<br />

Among the most important corporate events, at the beginning<br />

of the year the acquisition was completed of 39% of the<br />

shares of <strong>Minera</strong> Tayahua, raising the participation of <strong>Minera</strong><br />

<strong>Frisco</strong> to 90.2% of equity. At the same time, an Extraordinary<br />

Shareholders’ Meeting was held to decree a capital increase<br />

of 250 million shares at a price of $47.00 pesos per share, of<br />

which 242.6 million shares were subscribed.<br />

Sustainability activities in 2011 included environmental control<br />

operative plans, sustainability of water and energy resources,<br />

management of environmental liabilities, certifications, integral<br />

management systems and the analysis of stakeholders.<br />

Additionally, we increased our labor force by 30%, benefitting<br />

the communities where we operate with job creation.<br />

The labor climate and relation between the company and the<br />

unions remains healthy and cordial.<br />

<strong>Minera</strong> <strong>Frisco</strong> has a solid financial position that allows it to<br />

face its current, immediate and future expansion plans that<br />

will convert it into a company with world-class production levels,<br />

as well as the operating experience to achieve these goals<br />

with the highest standards.<br />

On behalf of the Board of Directors and the management<br />

team at <strong>Minera</strong> <strong>Frisco</strong>, we thank all of our employees, their<br />

effort, commitment, and our shareholders for their trust.<br />

<strong>Minera</strong> <strong>Frisco</strong> will seek to maintain the successful course to<br />

contribute to the development of our country.<br />

Sincerely,<br />

Alejandro Aboumrad González<br />

Chief Executive Officer<br />

7

Operational Units<br />

MINING UNITS<br />

<strong>Frisco</strong> is the fastest-growing Mexican mining company,<br />

establishing an exceptional portfolio of high-quality assets.<br />

In recent years due to the recovery of metals prices, the<br />

company significantly increased exploration in the lots<br />

that has conserved, such as San Francisco del Oro, María,<br />

Tayahua and San Felipe. Additionally, new units were<br />

put into operation such as Asientos and El Coronel, both<br />

property of <strong>Minera</strong> Real de Ángeles and which began<br />

activities in 2008.<br />

As of the second half of 2010, the company began<br />

an important investment program in six projects that<br />

contemplates expansions as well as new facilities and plants<br />

to increase capacity of crushing and production.<br />

8<br />

Units in Operation<br />

Installed Capacity Expansion Current + Start-Up of Ore Milled 2011<br />

Name TPD at Dec 31, 2011 Projects Project Operations (t)<br />

El Coronel 35,000 30,000 65,000 2 nd Semester 2012 13,750,130<br />

San Felipe 7,500 15,000 22,500 2 nd Semester 2012 3,354,832<br />

Asientos 4,000 0 4,000 - 1,148,986<br />

Tayahua Pb - Zn 1,500 0 1,500 - 596,277<br />

Tayahua Cu 3,700 20,000 23,700 2013 989,950<br />

San Francisco del Oro 4,000 0 4,000 - 993,909<br />

María 27,000 0 27,000 - 6,046,713<br />

Total 82,700 65,000 147,700 26,880,797<br />

Units in Installation<br />

Name Nominal Installed Start-Up of<br />

Capacity Operations<br />

El Concheño 20,000 2 nd Semester 2012<br />

El Porvenir 10,000 3 rd Quarter 2012<br />

San Francisco del Oro Tajo 10,000 3 rd Quarter 2012<br />

Total 40,000<br />

Annual estimated utilization factor 88%

STRATEGY<br />

<strong>Minera</strong> <strong>Frisco</strong> is making a great effort to continue<br />

metallurgical investigation, improvement of processes<br />

and explorations, which allow us:<br />

1. To be more efficient in our operations<br />

2. To increase our reserves<br />

3. To consolidate sustainability activities<br />

4. To improve recoveries<br />

5. To lower costs<br />

Also create solid fundamentals for economic, operational<br />

and environmental viability of the projects in operation<br />

and installation, as well as those in the process of geological<br />

evaluation, exploration or beginning exploitation.<br />

Production of Metal Contents<br />

At December 31, 2011<br />

Name Gold % Silver % Lead % Zinc % Copper %<br />

(Oz) total (Oz) total (t) total (t) total (t) total<br />

El Coronel 197,631 84.1 20,419 0.4 0 0.0 0 0.0 0 0.0<br />

San Felipe 24,478 10.4 392,757 7.4 0 0.0 0 0.0 0 0.0<br />

Asientos 4,442 1.9 1,656,871 31.2 8,953 39.9 37,458 45.6 605 2.8<br />

Tayahua 5,117 2.2 1,837,328 34.6 5,282 23.6 27,097 33.0 8,159 38.1<br />

San Francisco del Oro 3,401 1.4 1,401,938 26.4 8,181 36.5 17,580 21.4 1,176 5.5<br />

María 0 0.0 0 0.0 0 0.0 0 0.0 11,455 53.5<br />

Total 2011 235,069 100 5,309,313 100 22,416 100 82,135 100 21,395 100<br />

Total 2010 199,791 5,496,360 20,744 91,571 16,830<br />

Var% 17.7 -3.4 8.1 -10.3 27.1<br />

9

El Coronel<br />

Aerial view of the mining unit<br />

Crushing circuit including mineral conveyor belts<br />

screening and hopper<br />

10

Aerial view of the pit<br />

The El Coronel mining unit is located in Zacatecas. It is an<br />

open-pit mine that uses heap leaching and recovers the mineral<br />

through carbon absorption, stripping and electrolysis. Then<br />

the ore is sent to the foundry to be processed into doré gold<br />

and silver bars for sale.<br />

11

San Felipe<br />

Panoramic view<br />

Crushing circuit<br />

12

Loading a truck with mineral to be transported to the<br />

crushing process<br />

San Felipe is located in Baja California. It is an open-pit mine<br />

that uses heap leaching. Its milling capacity at the end of the<br />

year was 7,500 tons daily and it produces doré gold and silver<br />

bars for sale.<br />

13

Asientos<br />

Aerial view of the plant<br />

Underground drilling<br />

14

Night view of the milling area<br />

Asientos is located in the state of Aguascalientes. This is an<br />

underground mine that uses a milling and flotation process.<br />

In November of 2011 a new mill, floatation cells and a settling<br />

tank were installed to guarantee an installed milling capacity<br />

of 4,000 daily tons for the production of lead, zinc and copper.<br />

15

Tayahua<br />

Milling and Flotation plant<br />

Rock transportation in the mine<br />

16

Underground drilling in the mine<br />

Tayahua is in Zacatecas and is a polymetallic underground<br />

operation that exploits mainly bodies of primary copper and zinc.<br />

17

San Fco. del Oro<br />

Underground mining<br />

Transportation system by aerial ropeway buckets<br />

18

Milling and classification process<br />

San Francisco del Oro is where <strong>Minera</strong> <strong>Frisco</strong> gets its name and<br />

is a polymetal underground mine.<br />

19

María<br />

Crushing circuit<br />

<strong>Minera</strong>l conveyor belt to the stockpile<br />

Production of cathode copper<br />

20

<strong>Minera</strong> María is a copper mine. The mineral is extracted and<br />

sent to the crushing area to reduce its size and be stockpiled<br />

or terraced.<br />

21

Installation and expansion projects<br />

MINERA FRISCO has formed a specialized team with an<br />

important execution capacity, which is fundamental for<br />

simultaneously installing six projects of the dimensions<br />

of those currently being built in record time, maintaining<br />

quality, cost and process efficiency. This has resulted in<br />

a CapEx of $7.984 billion pesos in 2011, a figure that is<br />

expected to be surpassed in 2012. Today <strong>Frisco</strong> is a mining<br />

company with one of the highest levels of investment<br />

in the world and is positioning itself in the near future<br />

as a company with the best capacity to face and execute<br />

these growth rates.<br />

<strong>Minera</strong> <strong>Frisco</strong> has one of the most aggressive expansion<br />

programs in the world today and in the near future, executing<br />

with the highest levels of quality, record execution<br />

times and cost efficiencies, generating an experience and<br />

integration of teams that are fundamental for the execution<br />

of the following projects:<br />

22<br />

Mining Units<br />

Name Metals Exploitation Type Process<br />

Installation Projects<br />

7 El Concheño Au, Ag Open-Pit Dynamic Leaching<br />

8 El Porvenir Au, Ag Open-Pit Heap Leaching<br />

9 San Francisco del Oro pen-pit Au, Ag Open-Pit Flotation and Dynamic Leaching<br />

Expansion Projects<br />

1 El Coronel - Secondary Crusher Crushing circuit, expansion of settling ponds and heap formation<br />

2 San Felipe II Crushing circuit, settling ponds, heap formation and Merrill Crowe plant<br />

4 Tayahua - Primary Copper Access ramp of 5.6 kms, crushing, grinding and flotation plant<br />

Numeration corresponding to map on page 2

El Concheño<br />

Crushing area and leaching tanks / Installation<br />

Located in Chihuahua, El Concheño is a new unit for gold and<br />

silver ores, which will be exploited by open-pit and underground<br />

mine, recovering metals through dynamic leaching.<br />

23

El Concheño<br />

General view of the plant / Installation<br />

Foundation of the grinding and hydrocyclone area<br />

24

Foundation of the thickening tanks and leaching area<br />

25

El Porvenir<br />

Formation of beds / Installation<br />

Installation of crushing circuits<br />

26

Screening and crushing area<br />

El Porvenir is a new project located in Aguascalientes that<br />

consists of an open mining pit, using heap leaching. The plant<br />

will use the Merrill Crowe process and the metals will be smelted<br />

in an induction oven to produce doré bars of gold and silver.<br />

27

San Fco. del Oro Tajo<br />

Open-pit / Installation<br />

Crushing area of 10 thousand tons per day<br />

28

Installation of leaching tanks<br />

Within the San Francisco del Oro unit, a new project is being<br />

installed that includes open-pit mine extraction in areas such<br />

as <strong>Frisco</strong>, Sainas and Clarines.<br />

29

El Coronel-Secondary Crusher<br />

Conveyor belts / Expansion<br />

Explosion to prepare the area for the second<br />

crushing circuit<br />

30

Within the expansion plans of El Coronel, the installation of<br />

a new fixed crushing circuit began at the end of 2011 with an<br />

estimated capacity of 30,000 tons daily. This will increase the<br />

crushing capacity of El Coronel to 65,000 tons daily, almost<br />

doubling the current capacity.<br />

31

San Felipe II<br />

Panoramic view / Expansion<br />

Screening and crushing area<br />

32

Grinding area and conveyor belt to the stock-pile<br />

San Felipe II is an expansion project that contemplates the<br />

installation of a new crushing circuit, stockpiling and Merrill<br />

Crowe plant.<br />

33

Tayahua-Primary Copper<br />

Access tunnel / Expansion<br />

Subterranean extraction equipment<br />

34

Entry to the “Gloria Estela” access ramp<br />

This project contemplates the development of a 5,600 meter<br />

access ramp, a beltway around the ore body and the installation<br />

of an internal crusher with a capacity of 20,000 tons daily.<br />

35

Feasibility studies and<br />

implementation projects<br />

The work plan to assess the viability of mining lots is<br />

centered on ongoing metallurgic research, geological<br />

studies and the evaluation of the environmental and<br />

social impact of projects. Seven exploration projects are<br />

currently being evaluated, in which probable gold and silver<br />

resources have been identified. Geological and geophysical<br />

exploration, as well as diamond tipped and reverse<br />

circulation drilling, are being carried out with copper and<br />

basic sulfur projects. <strong>Minera</strong>logical and metallurgical test<br />

are continuously being done.<br />

36<br />

Mining Units<br />

Name Metals Exploitation Type Process<br />

Projects under Feasibility and Implementation Studies<br />

10 Espejeras Au, Ag Open-Pit Dynamic Leaching<br />

11 Calcosita - Tayahua Cu Open-Pit Heap Leaching<br />

12 Lampazos Au, Pb Open-Pit / Underground Flotation<br />

13 Clarines Au, Ag Open-Pit Flotation and Dynamic Leaching<br />

14 Vetas Negras Au, Ag Open-Pit Dynamic Leaching<br />

15 Santa Fe Au, Ag Open-Pit Bulk Flotation<br />

16 Federicos Au, Ag Open-Pit Heap Leaching<br />

Numeration corresponding to map on page 2

Topography Metallurgical tests<br />

Drilling<br />

37

Exploration<br />

During 2011 the exploration budget was six times larger<br />

than the prior year. These resources were assigned to<br />

equipment as well as personnel, increasing the number of<br />

professionals with vast experience in mining and diamond<br />

drilling and inverse circulation equipment.<br />

The current and future exploration programs are focused<br />

on locating gold and silver deposits to increase reserves<br />

that can be mined with open-pit techniques. Geological<br />

and geophysical works, as well as drilling, are currently<br />

being carried out. In the more advanced exploration<br />

projects, surface land is being acquired for modeling of<br />

geological resources.<br />

38

Conducting geological tests<br />

We have significantly increased the economic resources and exploration<br />

equipment, as well as specialists to increase the base<br />

of reserves and mineral resources to support the current operation,<br />

expansion plans and the feasibility of installation projects.<br />

39

Sustainability activities<br />

A fundamental part of the strategy and culture<br />

of <strong>Minera</strong> <strong>Frisco</strong> is social responsibility, a commitment<br />

that —beyond business activity— maximizes<br />

the positive impact of its activities and transfers<br />

resources to benefit the communities where it operates.<br />

With this objective, in 2011 the following<br />

activities were carried out:<br />

In the area of hazardous waste management, we<br />

introduced an initiative so that all of our units<br />

have a registered plan with the Environmental<br />

and Natural Resources Ministry, with San Francisco<br />

del Oro receiving the first validation. We also began<br />

the process to identify and quantify environmental<br />

liabilities in all mining units to reduce the<br />

environmental footprint to comply with Mexican<br />

norms and the NIF C-18.<br />

CIDEC, Microm and Sinergia —companies<br />

dedicated to the production of efficient energy<br />

technologies—, diagnosed the lighting needs in<br />

all business units to soon implement eco technologies<br />

and solar and wind power to reduce greenhouse<br />

effects.<br />

As part of the activities aimed at the conservation<br />

of biodiversity, there was a second monitoring<br />

of the Royal Eagle in the Altamira hill in Aguas-<br />

40<br />

calientes, in accordance with the protection and<br />

conservation program that Asientos co-sponsors.<br />

In the El Concheño project, construction of the<br />

native plant nursery has begun according to<br />

the initiatives of the other units that have these<br />

production structures. It should be noted that<br />

<strong>Minera</strong> <strong>Frisco</strong> has maintained since 2001 the UMA<br />

wildlife conservation management unit “Reserva<br />

San Francisco Oro,” which includes 150 hectares<br />

of wild flora and fauna. The reserve promotes<br />

ecological consciousness and tourism.<br />

At midyear, the water project of the San Felipe unit<br />

began, including the installation of a desalinization<br />

plant that uses inverse osmosis technology, representing<br />

an environmental benefit as a smaller area<br />

would be impacted and a greater water recovery<br />

would be achieved. At El Coronel, the implementation<br />

has begun of the Environmental and Social<br />

Management System, which takes into account the<br />

ISO 140001, ISO 26000 norms and the best practices<br />

of the International Code for Cyanide Handling.<br />

The objective is to reduce the health and environmental<br />

risks. Four units of the Group: <strong>Minera</strong><br />

María, Tayahua, El Coronel and San Francisco del<br />

Oro maintain the Certificado de Industria Limpia<br />

(Certification for clean industry) that is awarded by<br />

the Federal Environmental Protection Agency.

<strong>Minera</strong> <strong>Frisco</strong> has maintained since 2001 the UMA wildlife<br />

conservation management unit “Reserva San Francisco del<br />

Oro,” which includes 150 hectares of wild flora and fauna.<br />

41

Human Resources<br />

Due to the expansion projects and the construction of new<br />

units, 963 people were hired in the year, many of them<br />

local, benefitting neighboring communities with jobs.<br />

There were a total of 3,580 people in the operation, of<br />

which 6% were women and 94% men, without including<br />

outside contractors.<br />

Security of employees and neighboring communities is a<br />

priority for <strong>Minera</strong> <strong>Frisco</strong>. This is why the company offered<br />

training in industrial security and occupational health, the<br />

environment and operational processes. A total of 123,159<br />

hours of training was provided for union and non-union<br />

collaborators.<br />

The relationship between the company and the national<br />

and local union is healthy and cordial, maintaining<br />

positive and direct communication that permits dialog<br />

and agreements. With respect to the social benefits to<br />

collaborators, the company pays equitable and fair wages,<br />

above those established by the Federal Work Law and<br />

based on performance evaluations.<br />

42

Personnel installing irrigation pipes<br />

Security of employees is a priority for <strong>Minera</strong> <strong>Frisco</strong>. This is<br />

why the company offered training in industrial security and occupational<br />

health, the environment and operational processes.<br />

43

44<br />

San Felipe / Equipment<br />

Tayahua / Underground operation<br />

Asientos / Drilling

San Fco. del Oro / Underground operation<br />

El Coronel / Open-pit<br />

El Concheño / Panoramic view<br />

Tayahua / Metallurgical tests<br />

El Concheño / Construction<br />

Tayahua / Aerial view<br />

45

Board of Directors<br />

Board Members<br />

46<br />

Position* Years as Board Member** Type of Board Member*<br />

Carlos Slim Helú COB - Fundación Carlos Slim<br />

COB - Fundación Telmex<br />

COB - Impulsora del Desarrollo y el Empleo en América Latina<br />

COB - Carso Infraestructura y Construcción 1 Patrimonial Related<br />

José Humberto Gutiérrez COB - <strong>Minera</strong> <strong>Frisco</strong><br />

Olvera Zubizarreta CEO - Grupo Carso<br />

COB and CEO - Grupo Condumex 1 Related<br />

Sergio W. Covarrubias Vázquez CEO - Grupo IDESA<br />

CEO - Constructora y Fraccionadora Montebello 1 Independent<br />

Alejandro Gutiérrez Gutiérrez Business Consultant 1 Independent<br />

Guillermo Gutiérrez Saldívar COB - Grupo IDESA<br />

CEO - Equipos Mecánicos 1 Independent<br />

José Kuri Harfush COB - Janel 1 Related<br />

Gerardo Kuri Kaufmann CEO - Inmuebles Carso 1 Related<br />

Juan Rodríguez Torres Business Consultant 1 Independent<br />

José Shedid Mehry Business Consultant 1 Independent<br />

Patrick Slim Domit Vice Chairman - Grupo Carso<br />

COB - América Móvil<br />

Commercial Director of Mass Markets - Teléfonos de México<br />

COB - Sears Operadora México 1 Patrimonial Related<br />

Treasurer<br />

Quintín Humberto<br />

Botas Hernández Comptroller - Grupo Condumex 1<br />

Secretary<br />

Sergio F. Medina Noriega Director of the Legal Department - Teléfonos de México 1<br />

Pro-secretary<br />

Alejandro Archundia Becerra Manager of the Legal Department - Grupo Condumex 1<br />

* Based on information from the Board members.<br />

** The age as board members was considered from 2011, date on which the shares of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. were listed on the Mexican Stock Exchange.<br />

COB: Chairman of the Board CEO: Chief Executive Officer

Report of the Corporate and<br />

Auditing Practices Committee<br />

of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V.<br />

Juan Rodríguez Torres Chairman<br />

Guillermo Gutiérrez Saldivar<br />

José Shedid Mehry<br />

To the Board of Directors:<br />

As the chairman of the Corporate and Auditing Practices Committee of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (the “Committee”), I submit the<br />

following annual report of activities for the 2011 fiscal year.<br />

Corporate Practices, Evaluation and Compensation<br />

The CEO of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (the “Company”) and the executives of the corporate entities controlled by the Company,<br />

satisfactorily complied with the stated goals and with their responsibilities.<br />

The transactions with affiliates submitted to the consideration of the Committee were approved. Among them are the following<br />

significant transactions, each of which represents more than 1% of the consolidated assets of the Company, executed successively:<br />

Cobre de México, S.A. de C.V., for the sale of cathode cable; and Condumex, Inc. for the purchase of machinery, equipment and parts.<br />

All transactions with related parties were reviewed by Galaz, Yamazaki, Ruiz Urquiza, S.C., and a summary of them is contained in a<br />

note of the certified financial statements of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. and subsidiaries at December 31, 2011.<br />

The CEO of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. receives no remuneration for his activity. The Company does not have employees, and as<br />

to remuneration of the relevant executives of the companies controlled by the Company, we verified that they complied with the<br />

policies approved by the Board of Directors.<br />

The Board of Directors of the Company granted no exemption to any members of the Board, relevant executives or anyone in an<br />

executive position to take advantage of business opportunities, either for himself or for third parties, that correspond to the Company<br />

or to the corporate entities it controls or in which it has a significant influence. The Committee, on its part, granted no exemptions<br />

for the operations referred to in paragraph c), Section III, Article 28 of the Securities Market Law.<br />

Auditing Functions<br />

The internal control and internal auditing system of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. and of the corporate entities controlled by it are<br />

satisfactory and comply with the guidelines approved by the Board of Directors, as observed in the information provided to the Committee<br />

by management of the Company and in the external audit certification.<br />

The modifications of accounting policies of the Company were approved to elaborate its financial information based on International<br />

Financial Reporting Standards (IFRS) as of the 2012 fiscal year.<br />

We have no knowledge of any relevant default on the guidelines and operation and accounting registry policies of the Company or<br />

of the corporate entities controlled by it and, consequently, no preventive or corrective measures were implemented.<br />

The performance of the Galaz, Yamazaki, Ruiz Urquiza, S.C. and Camacho, Camacho y Asociados, S.C. accounting firms, the corporate<br />

entities that conducted the audit of the financial statements of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. and subsidiaries to December 31, 2011,<br />

and of the external auditor in charge of said audit, was satisfactory and the objectives agreed at the time they were retained were<br />

achieved. In addition, according to the information provided by said firms to the management of the Company, their fees for the<br />

external audit represented a percentage less than 20% of their total revenue.<br />

47

On the other hand, approval was given for Galaz, Yamazaki, Ruiz Urquiza, S.C. to provide to <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. and to some<br />

of its subsidiaries the following additional services: guidance to fulfill requirements of the Tax Administration System (SAT for initials<br />

in Spanish) for Compañía San Felipe, S.A. de C.V., Construcciones y Servicios <strong>Frisco</strong>, S.A. de C.V. and <strong>Minera</strong> Tayahua, S.A. de C.V.; various<br />

services provided to <strong>Minera</strong> CX, S.A. de C.V. and <strong>Minera</strong> Cra, S.A. de C.V.; preparation of financial statements, tax statement and<br />

annual report of the Company; revision of operations known as collars and the deferred employee profit sharing of some subsidiaries<br />

of the Company; and revision through the auditing of the initial balances for the IFRS.<br />

Pursuant to the information provided to us by the management of the Company and the meetings we held with the external and<br />

internal auditors without the presence of the Company’s officers, and to the best of our knowledge, there were no relevant comments<br />

from shareholders, members of the Board, relevant executives, employees or, in general, any third party, related to the accounting,<br />

internal control and matters related to the internal or external audit, nor claims by said persons regarding any irregularity in the<br />

management of the Company.<br />

During the period to which this report refers, we verified that the resolutions adopted by shareholders’ meetings and the Board of<br />

Directors of the Company were duly complied with. In addition, according to the information provided to us by the management<br />

of the Company, we verified that it has controls that allow for determining that it complies with provisions applicable to the stock<br />

market and that the legal department conducts a review at least once a year to verify said compliance, and there were no comments<br />

in this respect or any adverse change in the legal situation.<br />

With respect to financial information prepared by the Company and filed with the Bolsa Mexicana de Valores (Mexican Stock<br />

Exchange) and the Comisión Nacional Bancaria y de Valores (National Banking and Securities Commission), we verified that the<br />

information was prepared under the same principles, criteria and accounting practices with which the annual information is prepared.<br />

Finance and Planning Functions<br />

During the 2011 fiscal year, the Company and some of the entities under its control effected significant investments. In this regard, we<br />

verified that the financing was carried out in accordance with the strategic plan of the Company over the medium and long terms. In<br />

addition, we evaluated from time to time that the strategic position of the Company was conformed to said plan. We also reviewed<br />

and evaluated the budget for the 2011 fiscal year together with financial projects that were taken into account for its preparation,<br />

which include the principal investments and financial transactions of the Company, which we consider are viable and congruent with<br />

investment and financing policies and with the strategic vision of the Company.<br />

For the preparation of this report, the Committee for Corporate and Auditing Practices evaluated information provided by the director<br />

general of the Company, the relevant executives of the corporate persons controlled by the Company and by the external auditor.<br />

The Chairman<br />

Juan Rodríguez Torres<br />

48

Independent auditors’ report<br />

To the Board of Directors and Stockholders of <strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V.<br />

(formerly mining sector of Grupo Carso, S.A.B. de C.V.)<br />

We have audited the accompanying consolidated balance sheets and statements of changes in stockholders’ equity of <strong>Minera</strong> <strong>Frisco</strong>, S. A. B.<br />

de C. V. and Subsidiaries, formerly mining sector of Grupo Carso, S. A. B. de C. V. (the “Company”) as of December 31, 2011 and 2010, and<br />

the related consolidated and combined statements of income and cash flows for the years then ended. These financial statements are the<br />

responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.<br />

We conducted our audits in accordance with auditing standards generally accepted in Mexico. Those standards require that we plan and<br />

perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement and that they are<br />

prepared in accordance with Mexican Financial Reporting Standards. An audit includes examining, on a test basis, evidence supporting the<br />

amounts and disclosures in the financial statements. An audit also includes assessing the financial reporting standards used and significant<br />

estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a<br />

reasonable basis for our opinion.<br />

As mentioned in Note 2, on December 31, 2010 Grupo Carso, S. A. B. de C. V. split the mining sector and created a new public Company named<br />

<strong>Minera</strong> <strong>Frisco</strong>, S. A. B. de C. V. which is the direct and indirect owner, through its subsidiaries, of the assets of the mining sector of Grupo Carso,<br />

S. A. B. de C. V. and its subsidiaries.<br />

As mentioned in Note 3, beginning January 1, 2011, the Company adopted the following new provisions: Mexican Financial Reporting Standards<br />

(MFRSs/NIFs) C-4, Inventories; C-5, Prepaid Expenses; C-6, Property, Plant and Equipment; C-18, Obligations Associated with the Retirement of<br />

Property, Plant and Equipment; Improvements to Mexican Financial Reporting Standards 2011; Interpretation of Mexican Financial Reporting<br />

Standards 19, Changes Derived from the Adoption of International Financial Reporting Standards.<br />

The combined financial statements include the records and transactions of the mining sector companies as mentioned in Note 2. Such<br />

companies have common shareholders and administration. As such, the Company presents combined statements of income and cash flows for<br />

the year ended December 31, 2010.<br />

In our opinion, such consolidated and combined financial statements present fairly, in all material respects, the financial position of <strong>Minera</strong><br />

<strong>Frisco</strong>, S.A. B de C.V. and subsidiaries as of December 31, 2011 and 2010, and the results of their operations, changes in their stockholders’<br />

equity, and their cash flows for the years then ended, in conformity with Mexican Financial Reporting Standards.<br />

The accompanying consolidated and combined financial statements have been translated into English for the convenience of readers.<br />

Galaz, Yamazaki, Ruiz Urquiza, S. C.<br />

Member of Deloitte Touche Tohmatsu Limited<br />

C. P. C. Walter Fraschetto<br />

March 6, 2012<br />

49

Consolidated balance sheets<br />

<strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (formerly mining sector of Grupo Carso, S.A.B. de C.V.)<br />

As of December 31, 2011 and 2010 (In thousands of Mexican pesos)<br />

Assets<br />

50<br />

2011 2010<br />

Current assets:<br />

Cash and cash equivalents $ 4,861,356 $ 6,340,031<br />

Derivative financial instruments 726,179 47,097<br />

Accounts receivable – Net 1,645,861 1,377,643<br />

Due from related parties 612,004 266,058<br />

Inventories – Net 1,161,581 1,278,242<br />

Prepaid expenses 150,253 666,313<br />

Total current assets 9,157,234 9,975,384<br />

Property, plant and equipment – Net 12,436,162 5,079,228<br />

Deferred income taxes 751,314 2,572,931<br />

Deferred profit sharing – 370,724<br />

Other assets – Net 1,958,522 2,099,532<br />

Total $ 24,303,232 $ 20,097,799<br />

Liabilities and stockholders’ equity<br />

Current liabilities:<br />

Marketable notes $ 8,350,000 $ –<br />

Derivative financial instruments 410,699 297,398<br />

Accounts payables, taxes and accrued expenses 588,180 524,627<br />

Direct employee benefits 191,825 154,475<br />

Current portion of long term debt due to related parties – 116,715<br />

Due to related parties 170,390 545,913<br />

Income taxes – 523<br />

Total current liabilities 9,711,094 1,639,651<br />

Derivative financial instruments 2,244,207 3,977,221<br />

Employee benefits 17,869 15,210<br />

Provision for environment remediation 215,072 207,969<br />

Deferred profit sharing 112,182 –<br />

Long term debt due to related parties – 12,499,330<br />

Total liabilities 12,300,424 18,339,381<br />

Stockholders´ equity:<br />

Capital stock 74,362 67,274<br />

Additional paid-in capital 11,396,656 –<br />

Retained earnings 2,638,360 6,821,752<br />

Loss of valuation of derivative financial instruments (2,522,480) (6,498,987)<br />

Controlling interest 11,586,898 390,039<br />

Noncontrolling interest in consolidated subsidiaries 415,910 1,368,379<br />

Total stockholders ‘equity 12,002,808 1,758,418<br />

Total $ 24,303,232 $ 20,097,799<br />

See accompanying notes to consolidated and combined financial statements.

Consolidated and combined statements of income<br />

<strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (formerly mining sector of Grupo Carso, S.A.B. de C.V.)<br />

For the years ended December 31, 2011 and 2010 (In thousands of Mexican pesos)<br />

2011 2010<br />

Consolidated Combined<br />

Net sales $ 8,544,566 $ 7,141,703<br />

Costs and expenses:<br />

Cost of sales 3,936,544 3,147,380<br />

Project exploration expenses and mining concessions rights 425,636 304,856<br />

4,362,180 3,452,236<br />

Gross profit 4,182,386 3,689,467<br />

Operating expenses 512,674 451,855<br />

Income from operations 3,669,712 3,237,612<br />

Other expenses – Net (157,071) (194,157)<br />

Impairment of long-lived assets (37,727) (3,870)<br />

Comprehensive financing cost:<br />

Interest income 44,658 108,706<br />

Interest expense (606,061) (365,977)<br />

Loss of valuation of forwards– Net (2,332,968) (230,773)<br />

Exchange gain (loss) – Net 264,134 (129,299)<br />

(2,630,237) (617,343)<br />

Income before income taxes 844,677 2,422,242<br />

Income taxes 175,647 731,439<br />

Net income $ 669,030 $ 1,690,803<br />

Controlling interest $ 545,750 $ 1,397,208<br />

Noncontrolling interest 123,280 293,595<br />

$ 669,030 $ 1,690,803<br />

Basic earnings per common share $ 0.2229071 $ 0.6067564<br />

Average of shares in transit (‘000) 2,448,330 2,302,750<br />

See accompanying notes to consolidated and combined financial statements.<br />

51

Consolidated statements of changes<br />

in stockholders’ equity<br />

<strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (formerly mining sector of Grupo Carso, S.A.B. de C.V.)<br />

For the years ended December 31, 2011 and 2010 (In thousands of Mexican pesos)<br />

52<br />

Additional<br />

Capital paid-in<br />

stock capital<br />

Combined balances at the beginning of 2010 $ 3,732,802 $ 251,790<br />

Effect from adoption of NIF C-4 Inventorie – –<br />

Balances at the beginning of 2010, as adjusted 3,732,802 251,790<br />

Additional capital contribution in <strong>Minera</strong> San Francisco del Oro,<br />

<strong>Minera</strong> Real de Angeles and <strong>Minera</strong> Tayahua 2,500,001 196,796<br />

Decrease due to split of Inmuebles Riama (81,041) –<br />

Dividends paid for subsidiary – –<br />

Effect of split (6,084,488) (448,586)<br />

Balances before comprehensive loss 67,274 –<br />

Loss of valuation of derivative financial instrument – –<br />

Net income – –<br />

Comprehensive loss – –<br />

Consolidated balances as of December 31, 2010 67,274 –<br />

Decrease in noncontrolling interest of subsidiaries<br />

due to purchase of share – –<br />

Increase in capital stock 7,088 11,396,656<br />

Dividends paid for subsidiary – –<br />

Balances before comprehensive income 74,362 11,396,656<br />

Income (loss) of valuation of derivative financial instrument – –<br />

Net income – –<br />

Comprehensive income – –<br />

Consolidated balances as of December 31, 2011 $ 74,362 $ 11,396,656<br />

See accompanying notes to consolidated and combined financial statements.

Loss of<br />

valuation of Noncontrolling<br />

derivative interest Total<br />

Retained financial Controlling in consolidated stockholders´<br />

earnings (losses) instruments interest subsidiaries equity<br />

$ (1,056,369) $ (109,200) $ 2,819,023 $ 1,274,832 $ 4,093,855<br />

28,247 – 28,247 352 28,599<br />

(1,028,122) (109,200) 2,847,270 1,275,184 4,122,454<br />

– – 2,696,797 189,079 2,885,876<br />

25,889 – (55,152) – (55,152)<br />

(76,500) – (76,500) (73,500) (150,000)<br />

6,503,277 27,847 (1,950) 2,000 50<br />

5,424,544 (81,353) 5,410,465 1,392,763 6,803,228<br />

– (6,417,634) (6,417,634) (317,979) (6,735,613)<br />

1,397,208 – 1,397,208 293,595 1,690,803<br />

1,397,208 (6,417,634) (5,020,426) (24,384) (5,044,810)<br />

6,821,752 (6,498,987) 390,039 1,368,379 1,758,418<br />

(4,729,142) – (4,729,142) (898,779) (5,627,921)<br />

– – 11,403,744 – 11,403,744<br />

– – – (73,500) (73,500)<br />

2,092,610 (6,498,987) 7,064,641 396,100 7,460,741<br />

– 3,976,507 3,976,507 (103,470) 3,873,037<br />

545,750 – 545,750 123,280 669,030<br />

545,750 3,976,507 4,522,257 19,810 4,542,067<br />

$ 2,638,360 $ (2,522,480) $ 11,586,898 $ 415,910 $ 12,002,808<br />

53

Consolidated and combined<br />

statements of cash flows<br />

<strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (formerly mining sector of Grupo Carso, S.A.B. de C.V.)<br />

For the years ended December 31, 2011 and 2010 (In thousands of Mexican pesos)<br />

54<br />

2011 2010<br />

Consolidated Combined<br />

Operating activities:<br />

Income before income taxes $ 844,677 $ 2,422,242<br />

Items related to investing activities:<br />

Depreciation and amortization 639,822 419,442<br />

Loss in sale of property, plant and equipment 11,075 5,266<br />

Impairment of property, plant and equipment 37,727 3,870<br />

Interest income (44,658) (108,706)<br />

Adjustment in useful lives of property, plant and equipment (11,847) –<br />

Items related to financing activities:<br />

Interest expense 606,061 365,977<br />

2,082,857 3,108,091<br />

(Increase) decrease in:<br />

Accounts receivable – Net (353,690) (373,291)<br />

Due from related parties (345,946) 60,246<br />

Inventories – Net 93,794 (739,773)<br />

Prepaid expenses 516,060 –<br />

Deferred profit sharing 10,426 48,772<br />

Other assets (170,370) (111,460)<br />

Increase (decrease) in:<br />

Accounts payable, taxes and accrued expenses 63,030 216,227<br />

Employees benefits 40,009 21,812<br />

Provision for environment remediation 7,103 56,407<br />

Due to related parties (375,523) 524,372<br />

Income taxes (111,479) (662,479)<br />

Net cash flows from operating activities 1,456,271 2,148,924<br />

Investing activities:<br />

Purchase of subsidiaries shares (5,627,921) –<br />

Purchase of property, plant and equipment (7,984,478) (3,087,281)<br />

Purchase of mining concessions (22,535) (309,331)<br />

Proceeds from sale of property, plant and equipment 41,858 62,059<br />

Interest received 44,658 108,706<br />

Effect of split – 50<br />

Net cash flows from investing activities (13,548,418) (3,225,797)<br />

Cash to be obtained from financing activities (12,092,147) (1,076,873)<br />

Financing activities:<br />

Increase in capital stock and additional paid-in capital 11,403,744 2,885,876<br />

Interest paid (606,061) (365,977)<br />

Dividends paid (73,500) (150,000)<br />

Derivative financial instruments 4,155,334 (7,703,922)<br />

Marketable notes 8,350,000 –<br />

Net (decrease) increase of loans received from related parties (12,616,045) 9,746,273<br />

Net cash flows from financing activities 10,613,472 4,412,250<br />

Net (decrease) increase in cash and cash equivalents (1,478,675) 3,335,377<br />

Cash and cash equivalents at beginning of the year 6,340,031 3,004,654<br />

Cash and cash equivalents at end of year $ 4,861,356 $ 6,340,031<br />

See accompanying notes to consolidated and combined financial statements.

Notes to consolidated<br />

and combined financial statements<br />

<strong>Minera</strong> <strong>Frisco</strong>, S.A.B. de C.V. (formerly mining sector of Grupo Carso, S.A.B. de C.V.)<br />

For the years ended December 31, 2011 and 2010 (In thousands of Mexican pesos)<br />

1. Activity and important events<br />

a. Activity – The subsidiaries of <strong>Minera</strong> <strong>Frisco</strong>, S. A. B. de C. V. (“<strong>Minera</strong> <strong>Frisco</strong>” or the “Company”) are engaged in the exploration and<br />

exploitation of mining lands for the production and sale of concentrates of lead-silver, zinc, copper, “dore” (gold and silver) and copper<br />

cathodes. Such activity corresponds to the mining industry.<br />

b. Important events<br />

Since 2010, the Company has been in a process of accelerated growth. The Company has increased its exploration activity within the mining<br />

concessions owned by its subsidiaries.<br />

During 2011, the Company invested in the installation of new mining units and in the expansion of mining units that were already placed<br />

into operation. Company´s investment in 2011 was $7,170,119 (accumulated as of December 31, 2011 $9,707,892) and the expected<br />

investment for 2012 and 2013 is $10,000,000.<br />

The projects under construction or expansion are detailed as follows:<br />

1. <strong>Minera</strong> Real de Angeles, S. A. de C. V. (“Real de Angeles”)<br />

El Coronel unit. This mining unit is located in Zacatecas. It has a trituration capacity of 35,000 tons per day. El Coronel is a surfacing<br />

mining unit. The mineral is extracted through a leaching process in which the crushed mineral is placed in layers and it is irrigated with a<br />

chemical solution. Once the solution runs through the mineral layers it is processed in a plant to produce “dore” bars. Such bars contain<br />

gold and silver.<br />

As part of the unit´s expansion plans, at the end of 2011, the Company began to install a new trituration train which will have a capacity<br />

of 65,000 daily tons approximately. Once placed into service, the new train will double the current trituration capacity of the unit. The<br />

Company estimates the new installed capacity will be placed into service at the end of 2012.<br />

Concheño unit. It is located in Chihuahua. Currently, the Company is building a new mine and plant to produce gold and silver. This unit<br />

will be a new surface mine and will have a trituration capacity of 20,000 daily tons. It will produce “dore” bars with silver and gold<br />

content through a leaching process. Concheño will have a significant contribution to the future production of gold and silver of <strong>Minera</strong><br />

<strong>Frisco</strong>. The Company expects to initiate operation of the unit at the end of 2012.<br />

Asientos unit. It is located in Aguascalientes. Within this unit is the sub-surface mine called “Santa Francisca” with a capacity of 4,000<br />

daily tons. The mineral produced in this unit is lead, zinc and copper which are produced using a flotation process.<br />

Additionally, as part of the Asientos unit, the Company is installing a new project called “El Porvenir” that will have an independent<br />

operation. El Porvenir will be a surface mine and it will have a trituration daily capacity of 10,000 tons. El Porvenir will produce “dore”<br />

bars with silver and gold content through a leaching process. The Company expects to conclude this project at the end of 2012.<br />

San Felipe unit. This surface mining unit is located in Baja California. It has a daily trituration capacity of 7,500 tons. As part of the<br />

expansion plans for this unit, the Company is installing a new trituration train which will increase the total trituration capacity of the<br />

unit to 37,500 daily tons, approximately. This means that the current capacity will increase 5 times. The Company expects to conclude<br />

the new trituration train at the end of 2012.<br />

2. <strong>Minera</strong> San Francisco del Oro, S. A. de C. V. (“San Francisco del Oro”)<br />

It is a sub-surface mine located in Chihuahua. The mineral extracted in this mine is crushed in a plant with a capacity of 4,000 daily tons.<br />

After such process, the mineral is placed into a flotation process to produce concentrates of lead, zinc and copper.<br />

The Company is installing a new surface mine project that will operate independently to exploit mineral areas such as “<strong>Frisco</strong>”, “Sainas”<br />

and “Clarines”. After crashed in a train with a capacity above the 10,000 daily tons, the mineral will be processed in a new plant which<br />

is currently being installed. The mineral will be produced through leaching and flotation processes to obtain concentrates of lead, zinc,<br />

copper and “dore” with silver and gold contents. The Company expects to place this unit into service at the end of 2012.<br />

55

56<br />

3. <strong>Minera</strong> Tayahua, S. A. de C. V. (“Tayahua”)<br />

It is a sub-surface mine located in Zacatecas which produces mainly copper and zinc. The mineral is extracted and crashed in a plant with a<br />

capacity of 5,200 daily tons. The mineral is distributed in a lead-zinc and copper- zinc circuit and later goes to a flotation process to obtain<br />

concentrates of lead, zinc and copper with contents of gold, silver, lead, zinc and copper.<br />

The Company is developing a new project that considers an access ramp with a length of approximately 5,300 meters and the installation of<br />

a new trituration train with a daily capacity of 20,000 tons. The mineral will be crushed and later processed in a new flotation plant with a<br />

capacity of 20,000 daily tons. The Company expects to place into service this unit at the end of 2014.<br />

4. <strong>Minera</strong> María, S. A. de C. V. (“Maria”)<br />

It is a copper surface mine located in Sonora. It´s capacity is 27,000 daily tons. The crashed mineral is placed in layers to run the leaching<br />

process to obtain copper cathodes. During 2011, Maria contributed with 53.5% of the total copper production of <strong>Minera</strong> <strong>Frisco</strong>.<br />

2. Basis of presentation<br />

a. Explanation for translation into English - The accompanying consolidated and combined financial statements have been translated from<br />

Spanish into English for use outside of Mexico. These consolidated financial statements are presented on the basis of Mexican Financial<br />

Reporting Standards (“MFRS”, individually referred to as Normas de Información Financiera or “NIFs”). Certain accounting practices applied<br />

by the Company that conform with MFRS may not conform with accounting principles generally accepted in the country of use.<br />

b. Split from Grupo Carso, S. A. B. de C. V. - As of December 31, 2010, Grupo Carso, S. A. B. de C. V. (“Grupo Carso”), split its mining sector net<br />

assets, resulting in the constitution of <strong>Minera</strong> <strong>Frisco</strong>, which is the direct and indirect owner, through its subsidiaries, of the mining concessions<br />

that until that date, were owned by Grupo Carso and its subsidiaries. The main activity of the Company is the exploration and exploitation of<br />

mining lands to produce and sale concentrated lead-silver, zinc and copper, copper cathodes and “dore” (gold and silver) bars.<br />

c. Corporate restructuring - At the beginning of the restructuring process the entities that currently are subsidiaries of <strong>Minera</strong> <strong>Frisco</strong>, used to<br />

be subsidiaries of Grupo Condumex, S. A. de C. V. (“Grupo Condumex”) which was a subsidiary of Grupo Carso. The restructuring process is<br />

detailed as follows:<br />

1. As of October 22, 2010, the board of Directors and stockholders approved the split of Maria. In such split process Maria did not ceased<br />

to exist and the entity called Inmuebles Riama, S. A. de C. V. (“Inmuebles Riama”) was created. As a consequence of the split, Maria<br />

transferred to Inmuebles Riama the ownership of a property that does not belong to the economic group led by <strong>Minera</strong> <strong>Frisco</strong>.<br />

2. Once approved the split of Maria, on October 22, 2010, the Board of Directors and Stockholders also approved the split of Grupo Condumex,<br />

without ceasing its existence, to create a new entity called <strong>Minera</strong> CX, S. A. de C. V. (“<strong>Minera</strong> CX”).<br />

3. As a result of the above split, Grupo Condumex transferred the ownership of its shares to <strong>Minera</strong> CX as follows:<br />

(i) 51.00% of capital stock of Tayahua<br />

(ii) 68.00% of capital stock of Compañía Internacional <strong>Minera</strong>. S.A. de C.V. (“Internacional <strong>Minera</strong>”);<br />

(iii) 99.99% of capital stock of Compañía San Felipe, S.A. de C.V. (“San Felipe”);<br />

(iv) 99.99% of capital stock of San Francisco del Oro<br />

(v) 99.99% of capital stock of Real de Angeles<br />

(vi) 98.00% of capital stock of Construcciones y Servicios <strong>Frisco</strong>, S.A. de C.V. (“Construcciones y Servicios <strong>Frisco</strong>”);<br />

(vii) 99.90% of capital stock of Servicios <strong>Minera</strong> Real de Angeles, S. A. de C. V. (“Servicios <strong>Minera</strong> Real de Angeles”); and<br />

(viii) 99.99% of capital stock of Maria<br />

4. On October 26, 2010, the Board of Directors and Stockholders of Inmuebles Cantabria, S. A. de C. V. (“Inmuebles Cantabria”) approved the<br />

split of such entity, without ceasing its existence, to create a new entity called <strong>Minera</strong> CRA, S. A. de C. V. (“<strong>Minera</strong> CRA”).<br />

5. As a result of the above split, Inmuebles Cantabria transferred to <strong>Minera</strong> CRA the ownership of its shares of <strong>Minera</strong> CX.<br />

6. On November 4, 2010 the board of Directors and stockholders of Grupo Carso approved, with the previous accomplishment of certain<br />

conditions, the split of Grupo Carso, without ceasing its existence, to create a new entity called <strong>Minera</strong> <strong>Frisco</strong>.<br />

7. As a result of the above split and once the conditions were accomplished, Grupo Carso transferred its shares of <strong>Minera</strong> CRA and <strong>Minera</strong><br />

CX to <strong>Minera</strong> <strong>Frisco</strong>. Such shares represent the total capital stock of <strong>Minera</strong> CRA and <strong>Minera</strong> CX.

8. The Company is a pure holding with indirect subsidiaries that are controlled by <strong>Minera</strong> CX. Such subsidiaries are engaged in the exploration<br />

and exploitation of mining lands for the production and sale of concentrates of lead-silver, zinc, copper, “dore” (gold and silver) and copper<br />

cathodes.<br />

9. The Company´s direct and indirect subsidiaries and its respective ownership as of December 31, 2011 and 2010 are:<br />

Ownership percentage<br />

Subsidiary 2011 2010 Activity<br />

<strong>Minera</strong> CRA, S. A de C.V. 99.99 99.99 Holding.<br />

<strong>Minera</strong> CX, S.A. de C.V. 99.57 99.57 Holding.<br />

<strong>Minera</strong> Tayahua, S.A. de C.V. 89.98 50.78 Production and sale of concentrates of<br />

lead – silver, zinc and copper.<br />

Compañía <strong>Minera</strong> Tayahua, S.A. de C.V. 89.98 50.78 Services.<br />

Compañía San Felipe, S.A. de C .V. 99.57 99.57 Rent of equipment and machinery.<br />

<strong>Minera</strong> San Francisco del Oro, S.A. de C.V. 99.57 99.57 Production and sale of concentrates of<br />

lead – silver, zinc and copper.<br />

<strong>Minera</strong> Real de Angeles, S.A. de C.V. 99.57 99.57 Production and sale of concentrates of<br />

lead – silver, zinc and “dore” (gold and silver).<br />

<strong>Minera</strong> Maria, S.A. de C.V. 99.57 99.57 Production and sale of copper cathodes.<br />

Construcciones y Servicios <strong>Frisco</strong>, S.A. de C.V. 99.57 99.57 Services.<br />

Compañía Internacional <strong>Minera</strong>, S.A. de C.V. 67.71 67.71 In exploration stage.<br />

Servicios <strong>Minera</strong> Real de Angeles, S.A. de C.V. 99.57 99.57 Personnel services.<br />

Compañía <strong>Minera</strong> San Francisco del Oro, S.A. de C.V. 99.57 – Services.<br />

Empresa <strong>Minera</strong> de San Francisco del Oro, S.A. de C.V. 99.57 – Services.<br />

d. Monetary unit of the financial statements - The financial statements and notes as of December 31, 2011 and 2010 and for the years then ended<br />

include balances and transactions denominated in Mexican pesos of different purchasing power.<br />

e. Consolidation of financial statements - The consolidated financial statements include the financial statements of <strong>Minera</strong> <strong>Frisco</strong> and those of<br />

its subsidiaries where it holds control, as of December 31, 2011 and 2010 and for the years then ended. The Balance Sheet and the Statement<br />

of Changes in Stockholders ‘Equity as of December 31, 2010 include consolidated balances which represent the balances of the Company and<br />

its subsidiaries as an integrated economic entity. As such, during its elaboration the balances and operations between the Company and its<br />

subsidiaries were eliminated. The Income Statement and the Statement of Cash Flows as of December 31, 2010 represent combined balances<br />

which correspond to the addition of the balances of the entities that were part of the mining sector of Grupo Carso. As such, the balances and<br />

transactions between related parties were eliminated.<br />

e. Comprehensive income (loss) - Represents changes in stockholders’ equity during the year, for concepts other than capital contributions,<br />

reductions and distributions, and is comprised of the net income (loss) of the year, plus other comprehensive income (loss) items of the same<br />

period, which are presented directly in stockholders’ equity without affecting the statements of income (loss). Other comprehensive income<br />

(loss) is represented by the loss of valuation of derivative financial instruments net of the respective deferred taxes.<br />

f. Classification of costs and expenses - Costs and expenses presented in the consolidated and combined statements of income were classified<br />

according to their function because this is the practice of the sector to which the Company belongs.<br />

g. Income from operations - Income from operations is the result of subtracting the exploration expenses, mining concessions rights and general<br />

expenses from net sales. While NIF B-3, Statement of Income, does not require inclusion of this line item in the consolidated Statements of<br />

Income, it has been included for a better understanding of the Company’s economic and financial performance.<br />

57

3. Summary of significant accounting policies<br />

The accompanying consolidated financial statements have been prepared in conformity with Mexican Financial Reporting Standards (MFRSs/NIFs),<br />

which require that management make certain estimates and use certain assumptions that affect the amounts reported in the financial statements and<br />

their related disclosures; however, actual results may differ from such estimates. The Company’s management, upon applying professional judgment,<br />

considers that estimates made and assumptions used were adequate under the circumstances. The significant accounting policies of the Company<br />

are as follows:<br />

a. Accounting changes<br />

Beginning January 1, 2011, the Company adopted the following new NIFs and Interpretations to the Financial Reporting Standards (INIFs):<br />

58<br />

NIF C-4, Inventories, eliminates the direct cost and last-in, first-out valuation methods. It establishes that any change in the purchase cost of<br />

inventories based on the lower of cost or market, be made only based on net realizable value. It also requires additional disclosures of inventory<br />

reduction and impairment losses. The effect of the change represented an increase in the value of inventories of $28,599 and a decrease in the<br />