Chap 26

Chap 26

Chap 26

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

236 CHAPTER 10<br />

Answers to the Problems<br />

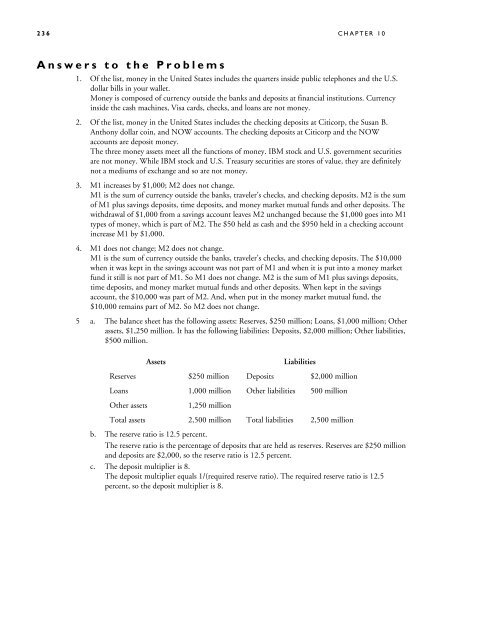

1. Of the list, money in the United States includes the quarters inside public telephones and the U.S.<br />

dollar bills in your wallet.<br />

Money is composed of currency outside the banks and deposits at financial institutions. Currency<br />

inside the cash machines, Visa cards, checks, and loans are not money.<br />

2. Of the list, money in the United States includes the checking deposits at Citicorp, the Susan B.<br />

Anthony dollar coin, and NOW accounts. The checking deposits at Citicorp and the NOW<br />

accounts are deposit money.<br />

The three money assets meet all the functions of money. IBM stock and U.S. government securities<br />

are not money. While IBM stock and U.S. Treasury securities are stores of value, they are definitely<br />

not a mediums of exchange and so are not money.<br />

3. M1 increases by $1,000; M2 does not change.<br />

M1 is the sum of currency outside the banks, traveler’s checks, and checking deposits. M2 is the sum<br />

of M1 plus savings deposits, time deposits, and money market mutual funds and other deposits. The<br />

withdrawal of $1,000 from a savings account leaves M2 unchanged because the $1,000 goes into M1<br />

types of money, which is part of M2. The $50 held as cash and the $950 held in a checking account<br />

increase M1 by $1,000.<br />

4. M1 does not change; M2 does not change.<br />

M1 is the sum of currency outside the banks, traveler’s checks, and checking deposits. The $10,000<br />

when it was kept in the savings account was not part of M1 and when it is put into a money market<br />

fund it still is not part of M1. So M1 does not change. M2 is the sum of M1 plus savings deposits,<br />

time deposits, and money market mutual funds and other deposits. When kept in the savings<br />

account, the $10,000 was part of M2. And, when put in the money market mutual fund, the<br />

$10,000 remains part of M2. So M2 does not change.<br />

5 a. The balance sheet has the following assets: Reserves, $250 million; Loans, $1,000 million; Other<br />

assets, $1,250 million. It has the following liabilities: Deposits, $2,000 million; Other liabilities,<br />

$500 million.<br />

Assets Liabilities<br />

Reserves $250 million Deposits $2,000 million<br />

Loans 1,000 million Other liabilities 500 million<br />

Other assets 1,250 million<br />

Total assets 2,500 million Total liabilities 2,500 million<br />

b. The reserve ratio is 12.5 percent.<br />

The reserve ratio is the percentage of deposits that are held as reserves. Reserves are $250 million<br />

and deposits are $2,000, so the reserve ratio is 12.5 percent.<br />

c. The deposit multiplier is 8.<br />

The deposit multiplier equals 1/(required reserve ratio). The required reserve ratio is 12.5<br />

percent, so the deposit multiplier is 8.