Offer to purchase CLEARNET.pdf - About TELUS

Offer to purchase CLEARNET.pdf - About TELUS

Offer to purchase CLEARNET.pdf - About TELUS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

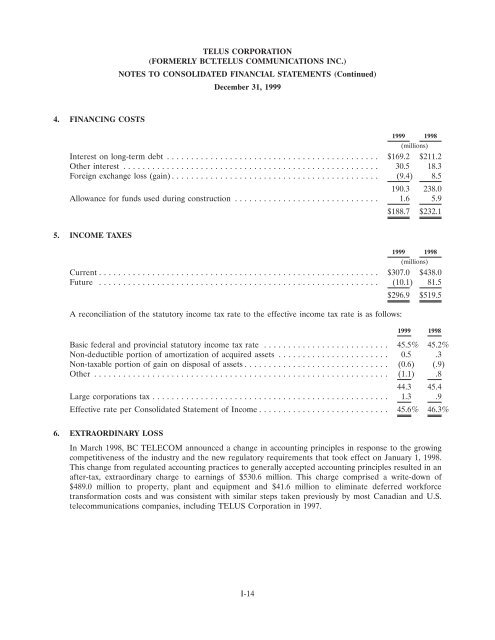

4. FINANCING COSTS<br />

<strong>TELUS</strong> CORPORATION<br />

(FORMERLY BCT.<strong>TELUS</strong> COMMUNICATIONS INC.)<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)<br />

December 31, 1999<br />

1999 1998<br />

(millions)<br />

Interest on long-term debt ............................................ $169.2 $211.2<br />

Other interest ..................................................... 30.5 18.3<br />

Foreign exchange loss (gain) ........................................... (9.4) 8.5<br />

190.3 238.0<br />

Allowance for funds used during construction .............................. 1.6 5.9<br />

$188.7 $232.1<br />

5. INCOME TAXES<br />

1999 1998<br />

(millions)<br />

Current .......................................................... $307.0 $438.0<br />

Future .......................................................... (10.1) 81.5<br />

$296.9 $519.5<br />

A reconciliation of the statu<strong>to</strong>ry income tax rate <strong>to</strong> the effective income tax rate is as follows:<br />

1999 1998<br />

Basic federal and provincial statu<strong>to</strong>ry income tax rate .......................... 45.5% 45.2%<br />

Non-deductible portion of amortization of acquired assets ....................... 0.5 .3<br />

Non-taxable portion of gain on disposal of assets .............................. (0.6) (.9)<br />

Other ............................................................. (1.1) .8<br />

44.3 45.4<br />

Large corporations tax ................................................. 1.3 .9<br />

Effective rate per Consolidated Statement of Income ........................... 45.6% 46.3%<br />

6. EXTRAORDINARY LOSS<br />

In March 1998, BC TELECOM announced a change in accounting principles in response <strong>to</strong> the growing<br />

competitiveness of the industry and the new regula<strong>to</strong>ry requirements that <strong>to</strong>ok effect on January 1, 1998.<br />

This change from regulated accounting practices <strong>to</strong> generally accepted accounting principles resulted in an<br />

after-tax, extraordinary charge <strong>to</strong> earnings of $530.6 million. This charge comprised a write-down of<br />

$489.0 million <strong>to</strong> property, plant and equipment and $41.6 million <strong>to</strong> eliminate deferred workforce<br />

transformation costs and was consistent with similar steps taken previously by most Canadian and U.S.<br />

telecommunications companies, including <strong>TELUS</strong> Corporation in 1997.<br />

I-14

![DISK004:[98CLG6.98CLG3726]BA3726A.;28 - About TELUS](https://img.yumpu.com/16786670/1/190x245/disk00498clg698clg3726ba3726a28-about-telus.jpg?quality=85)