Offer to purchase CLEARNET.pdf - About TELUS

Offer to purchase CLEARNET.pdf - About TELUS

Offer to purchase CLEARNET.pdf - About TELUS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>TELUS</strong> CORPORATION<br />

(FORMERLY BCT.<strong>TELUS</strong> COMMUNICATIONS INC.)<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)<br />

December 31, 1999<br />

21. DIFFERENCES BETWEEN CANADIAN AND UNITED STATES GENERALLY ACCEPTED<br />

ACCOUNTING PRINCIPLES (Continued)<br />

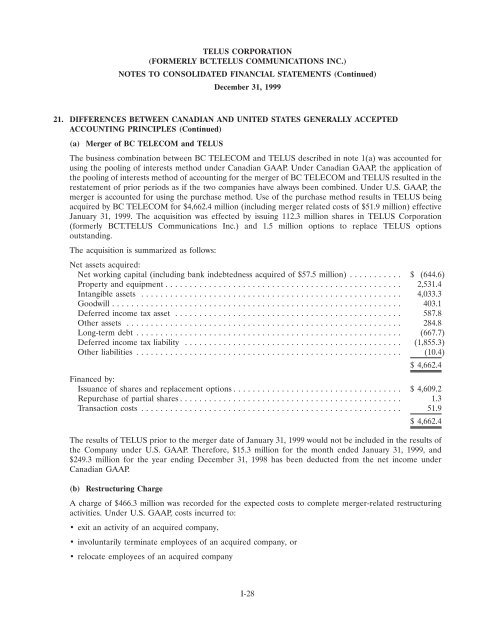

(a) Merger of BC TELECOM and <strong>TELUS</strong><br />

The business combination between BC TELECOM and <strong>TELUS</strong> described in note 1(a) was accounted for<br />

using the pooling of interests method under Canadian GAAP. Under Canadian GAAP, the application of<br />

the pooling of interests method of accounting for the merger of BC TELECOM and <strong>TELUS</strong> resulted in the<br />

restatement of prior periods as if the two companies have always been combined. Under U.S. GAAP, the<br />

merger is accounted for using the <strong>purchase</strong> method. Use of the <strong>purchase</strong> method results in <strong>TELUS</strong> being<br />

acquired by BC TELECOM for $4,662.4 million (including merger related costs of $51.9 million) effective<br />

January 31, 1999. The acquisition was effected by issuing 112.3 million shares in <strong>TELUS</strong> Corporation<br />

(formerly BCT.<strong>TELUS</strong> Communications Inc.) and 1.5 million options <strong>to</strong> replace <strong>TELUS</strong> options<br />

outstanding.<br />

The acquisition is summarized as follows:<br />

Net assets acquired:<br />

Net working capital (including bank indebtedness acquired of $57.5 million) ........... $ (644.6)<br />

Property and equipment ................................................. 2,531.4<br />

Intangible assets ...................................................... 4,033.3<br />

Goodwill ............................................................ 403.1<br />

Deferred income tax asset ............................................... 587.8<br />

Other assets ......................................................... 284.8<br />

Long-term debt ....................................................... (667.7)<br />

Deferred income tax liability ............................................. (1,855.3)<br />

Other liabilities ....................................................... (10.4)<br />

$ 4,662.4<br />

Financed by:<br />

Issuance of shares and replacement options ................................... $4,609.2<br />

Re<strong>purchase</strong> of partial shares .............................................. 1.3<br />

Transaction costs ...................................................... 51.9<br />

$ 4,662.4<br />

The results of <strong>TELUS</strong> prior <strong>to</strong> the merger date of January 31, 1999 would not be included in the results of<br />

the Company under U.S. GAAP. Therefore, $15.3 million for the month ended January 31, 1999, and<br />

$249.3 million for the year ending December 31, 1998 has been deducted from the net income under<br />

Canadian GAAP.<br />

(b) Restructuring Charge<br />

A charge of $466.3 million was recorded for the expected costs <strong>to</strong> complete merger-related restructuring<br />

activities. Under U.S. GAAP, costs incurred <strong>to</strong>:<br />

• exit an activity of an acquired company,<br />

• involuntarily terminate employees of an acquired company, or<br />

• relocate employees of an acquired company<br />

I-28

![DISK004:[98CLG6.98CLG3726]BA3726A.;28 - About TELUS](https://img.yumpu.com/16786670/1/190x245/disk00498clg698clg3726ba3726a28-about-telus.jpg?quality=85)