- Page 1 and 2:

CITY OF LAREDO CITY COUNCIL MEETING

- Page 3 and 4:

25-6 International Fuel Gas Code, t

- Page 5 and 6:

9. Public hearing and introductory

- Page 7 and 8:

All being situated in the Eastern D

- Page 9 and 10:

0922-33-109 (1.0 miles south of SH

- Page 11 and 12:

assurance for the Laredo Internatio

- Page 13 and 14:

XIII. STAFF REPORTS 4. Presentation

- Page 15 and 16:

COUNCIL COMMUNICATION DATE: I SUBJE

- Page 17 and 18:

ORDINANCE AUTHORIZING THE CITY MANA

- Page 19 and 20:

DATE: COUNCIL COMMUNICATION SUBJECT

- Page 21 and 22:

PASSED BY THE CITY COUNCIL AND APPR

- Page 23 and 24:

AN ORDINANCE ACCEPTING A GRANT FROM

- Page 25 and 26:

COUNCIL COMMUNICATION DATE: SUBJECT

- Page 27 and 28:

PASSED BY THE CITY COUNCIL AND APPR

- Page 29 and 30:

ORDINANCE NO. AMENDING CHAPTER 11 E

- Page 31 and 32:

Date: 10-15-2012 INITIATED BY: COUN

- Page 33 and 34:

Section 5. That this Ordinance and

- Page 35 and 36:

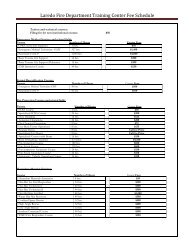

BACKGROUND: The Fire Chief with con

- Page 37 and 38:

WHEREAS, on January 4, 2010, by Ord

- Page 39 and 40:

DATE 10-15-12 INITIATED BY: Horacio

- Page 41 and 42:

Part 1: Section 7-1. Code-Adopted.

- Page 43 and 44:

Date: 10/15/12 Initiated by: Cornel

- Page 45 and 46:

CITY OF LAREDO ORDINANCE NO. 2012-0

- Page 47:

UNPLATTED

- Page 52 and 53:

1 t Warranty: Because the condition

- Page 54 and 55:

INGREDIENT: NONE SECTION 2 - HAZARD

- Page 56 and 57:

INHALATION: REMOVE TO FRESH AIR HOW

- Page 58 and 59:

, K+M:[C;N.. PR3i:XJI."I' and LTMI:

- Page 60 and 61:

d%ath. I ly c1vvnj.c exposure of an

- Page 62 and 63:

IR'T MMHF:R: 'W HIM, INT. R4I-E: 00

- Page 64 and 65:

ndar has adop.t~J the ACIXIH R.Ui r

- Page 66 and 67:

R'T MMER: 703 WPM (EA IK, NQI tK!14

- Page 68 and 69:

WPAK I.&> IK- PAGE: 011. MEPI~L ?E&

- Page 70 and 71:

1 DR1' MMFn:H : 7!)3 w)~-%u! IN::.

- Page 72 and 73:

PRODUCT NAME: CHEMICAL NAME: I - CH

- Page 74 and 75:

I PAGE 3 PRODUCT NAME: '[RIETHYLENE

- Page 76 and 77:

HP~~ARDous POLYMERI~ATI~N: wlil Not

- Page 78 and 79:

PRODUCT NAME: ITRIFTHYLENE GLYCOL i

- Page 80 and 81:

Material Safety Data Sheet ~ I 1 I

- Page 82 and 83:

Material ~afetd Data Sheet I Shell

- Page 84 and 85:

Material SafetylData Sheet Acute Or

- Page 86 and 87: Material Safety1 Data Sheet Shell H

- Page 88 and 89: Material Safety i)ata Sheet , Shell

- Page 90 and 91: Material Safety Qata Sheet I / Shel

- Page 92 and 93: Material Safety; Data Sheet Shell R

- Page 94 and 95: Material Safety Data Sheet Equipmen

- Page 96 and 97: I Material Safety,Data Sheet Shell

- Page 98 and 99: I Material Safely Data Sheet Shell

- Page 100 and 101: STAFF COMMENTS (CONTINUED) COUNCIL

- Page 102 and 103: hereof for all purposes. 4. All mer

- Page 104 and 105: 1020 Santa Maria Ave Council Distri

- Page 106: .. oi CO . d- oi CO 0 - Washington

- Page 111 and 112: STAFF COMMENTS (CONTINUED) COUNCIL

- Page 113 and 114: 3. The C.U.P. is restricted to the

- Page 115 and 116: UNPLATTED J*s=specia~ Use Permit (S

- Page 117: WATER ST. WATER ST. VBNTURA ST.

- Page 122 and 123: INTRODUCTORY ORDINANCE Ratifying th

- Page 124 and 125: CP 460-OWUG (CORPORATION) REV. 05/1

- Page 126 and 127: LAREDO, mxhS 1755 EXHIBIT "Av PAGE

- Page 128 and 129: DATE: 10/15/2012 INITIATED BY: Carl

- Page 130 and 131: delivery of Acceptance Certificates

- Page 132 and 133: EQUIPMENT LEASEIPURCHASE AGREEMENT

- Page 134 and 135: "Renewal Terms" means the renewal t

- Page 138 and 139: 103 of the Code. In furtherance of

- Page 140 and 141: (vi) All documents, including finan

- Page 142 and 143: een delivered and installed, Lessee

- Page 144 and 145: all utility and other charges incur

- Page 146 and 147: level of energy and/or operational

- Page 148 and 149: transfer or conveyance to a trustee

- Page 150 and 151: (f) An order, judgment or decree sh

- Page 152 and 153: IN WITNESS WHEREOF, Lessor and Less

- Page 154 and 155: Contract Rate. The Contract Rate is

- Page 156 and 157: Agreement (including such Exhibits)

- Page 158 and 159: FORM OF INCUMBENCY AND AUTHORIZATIO

- Page 160 and 161: 3. The Transaction Documents have b

- Page 162 and 163: Banc of America Public Capital Corp

- Page 165 and 166: FORM OF NOTICE AND ACKNOWLEDGEMENT

- Page 167 and 168: EXHIBIT I Form of Acquisition Fund

- Page 169 and 170: with any Event of Default under the

- Page 171 and 172: notice of any security interest in

- Page 173 and 174: In Witness Whereof, the parties hav

- Page 175 and 176: (iii) This requisition contains no

- Page 177 and 178: COUNCIL COMMUNICATION DATE: SUBJECT

- Page 179 and 180: BUDGET AMENDMENT OF NOISE ABATEMENT

- Page 181 and 182: ORDINANCE NO. 2012-0-174 AMENDING T

- Page 183 and 184: DATE: COUNCIL COMMUNICATION SUBJECT

- Page 185 and 186: ORDINANCE 2012-0-175 AUTHORIZING TH

- Page 187 and 188:

COUNCIL COMMUNICATION I DATE: / SUB

- Page 189 and 190:

ATTEST: Section 2: It hereby author

- Page 191 and 192:

RESOLUTION #2012-R-087 Amending res

- Page 193 and 194:

LAREDO POLICE DEPARTMENT Agreements

- Page 195 and 196:

GM200113 Fiscal Year 2013 Account n

- Page 197 and 198:

DATE: 10- 15- 12 SUBJECT: MOTION CO

- Page 199 and 200:

GM200113 CITY OF LAREDO Fiscal Year

- Page 201 and 202:

DATE: 10- 15- 12 COUNCIL COMMUNICAT

- Page 203:

DATE: 10/15/12 INITIATED BY: Carlos

- Page 207 and 208:

DATE: 10/15/2012 INITIATED BY: HORA

- Page 209 and 210:

PREPARED 9/28/12, 18:21:40 TAX ADJU

- Page 211 and 212:

PREPARED 9/28/12, 18:21:40 TAX ADJU

- Page 213 and 214:

PREPARED 9/28/12, 18:21:40 PROGRAM

- Page 215 and 216:

PREPARED 9/28/12, 17:33:06 TAX PERI

- Page 217 and 218:

DATE: 3ctober 15,2012 INITIATED BY:

- Page 219 and 220:

RESOLUTION NO. 2012-R-083 PASSED BY

- Page 221 and 222:

County WEBB District Laredo (22) RO

- Page 223 and 224:

County: Webb District: Laredo AGREE

- Page 225 and 226:

LOCATION "B" = 1-1 SCALE: 1 = 300'

- Page 227 and 228:

WESOLUTION NO. 20%-R4$9 PASSER BY T

- Page 229 and 230:

-&&q-, . -&:k%- Form ROW-W-EDC Xev.

- Page 232 and 233:

AU'PpQOMZING THE CITY MANAGER TO EX

- Page 234 and 235:

HIGHWAY PROJECT CUATRO VIENTOS ENTI

- Page 236 and 237:

RESOLUTION 201 2-R-086 Authorizing

- Page 238 and 239:

DATE: COUNCIL COMMUNICATION 1 SUBJE

- Page 240 and 241:

DATE: 10115/2012 INITIATED BY: Jesu

- Page 242 and 243:

This Agreement is entered into purs

- Page 244 and 245:

provided the non-performing party e

- Page 246 and 247:

Grantee shall maintain and retain s

- Page 248 and 249:

This Agreement contains the entire

- Page 250 and 251:

QUOTE# 001 CONTRACT PRICING WORKSHE

- Page 252 and 253:

DATE: 10/15/2012 INITIATED BY: Jesu

- Page 254 and 255:

F Non- Equipment Charges (Trade- In

- Page 257 and 258:

DATE: 10/15/12 INITIATED BY: Carlos

- Page 260 and 261:

To: The City of Laredo, Texas Honor

- Page 262 and 263:

Item No, 2 3 4 5 6 Eslimated Quanti

- Page 264 and 265:

Proposed Progress Schedules: +J, E

- Page 266 and 267:

Western Surety Company POWER OF ATT

- Page 268 and 269:

CDBG Sidewalks Project No.43 (25.5

- Page 270 and 271:

DATE: 10/15/12 INITIATED BY: Carlos

- Page 273 and 274:

LLC CDBG SIDEWALKS PROJECT #42 - 23

- Page 275 and 276:

Itiformation to Contractors Page 2

- Page 277 and 278:

STATEMENT OF !#iMTIEIIRI[&S AND OTm

- Page 279 and 280:

Proposal Page 2 of 9 AFFIDAVIT Form

- Page 281 and 282:

Proposal CITY OF LAREDO CDBG SIDEWA

- Page 283 and 284:

Proposal Page 6 of 9 Cumnt Worldoad

- Page 285 and 286:

BID BOND KNOW ALL MEN BY THESE PRES

- Page 287 and 288:

SureTec lnsurance Company THIS BOND

- Page 289 and 290:

SureTec Insurance Company LIMITED P

- Page 291 and 292:

2016 Mcdonell Laredo Tx. 78040 CURR

- Page 293 and 294:

San Luis Rio Colorado, Son. July 19

- Page 295 and 296:

Jacaman Road JUAN RAMIREZ INVESTMEN

- Page 297:

The bid and bid bonds for Leyendeck

- Page 300 and 301:

Affirmative Action Program: Project

- Page 302 and 303:

INFORMATION FROM BIDDERS MUST BE CO

- Page 305 and 306:

TELEPI-IONE (956)-722-053 1 FAX (95

- Page 307 and 308:

TOTAL BASE BID TOTAL BASE BID BID S

- Page 309 and 310:

1 RESTRICTIONS ON LOBBYING CERTIFIC

- Page 311 and 312:

POWER OF ATTORNEY Farnlington Casua

- Page 313:

DATE: 1011 5/12 COUNCIL COMMUNICATI

- Page 317:

DATE: 10/15/12 INITIATED BY: Carlos

- Page 321 and 322:

DATE: 10115112 INITIATED BY: Jesus

- Page 323 and 324:

Bid Tabulation FY 12-097 Contract L

- Page 325 and 326:

DATE: 10/15/12 COUNCIL COMMUNICATIO

- Page 327 and 328:

Requested by: Approved by: Approved

- Page 329 and 330:

September 20,201 2 DANNENBAUM ENGIN

- Page 331 and 332:

additional services and is based on

- Page 333 and 334:

EXHIBIT NO. 1-1 REPLACEMENT PAGE AN

- Page 335 and 336:

ATTACHMENT "A" Replacement Page (mo

- Page 337 and 338:

Date: May 3, 2012 Replacement Page

- Page 339 and 340:

ATTACHMENT "D" Replacement Page LIS

- Page 341 and 342:

Date: Mav , 3.2012 - ATTACHMENT "B"

- Page 343 and 344:

EXHIBIT NO. 2-1 Supplemental No. 1

- Page 345 and 346:

DATE: 1 1/05/2012 COUNCIL COMMUNICA

- Page 347 and 348:

To: Mr. Dan Migura Human Resources

- Page 349 and 350:

07/15/2011- Lt. Ramon had an MRI of

- Page 351 and 352:

Employee . . . . . . . . Authorized

- Page 353 and 354:

Date of Iniury: 10/14/2011 Iniuw: C

- Page 355 and 356:

CITY OF LAREDO Employee Status Info

- Page 357 and 358:

Date of Iniury: 0512 1/20 1 1 Injur

- Page 359:

Employee . . . . . . . . Authorized