rint fe e - Charity Blossom

rint fe e - Charity Blossom

rint fe e - Charity Blossom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

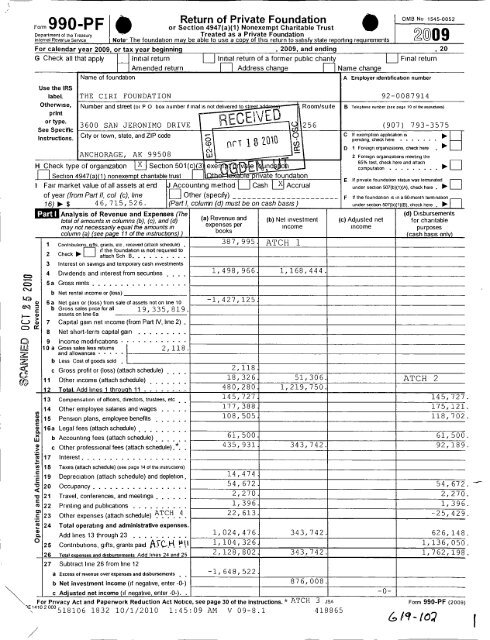

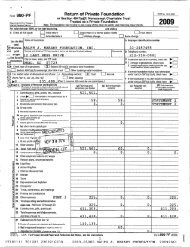

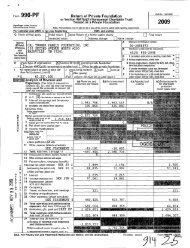

Form P F - or " Section Return 4947(a)(1) of Private Nonexempt Foundation Charitable OMB Trust N0 1555-0052<br />

Department of the Treasury " Tl"E8tEd BS 3 Pl"iVat9 FOUTldatl0l1<br />

internal Revenue service ) Note" The foundation may be able to use a copy of this return to satisfy state reporting requirements<br />

For calendar year 2009, or tax year beginning , 2009, and ending<br />

G Check all that apply H Amended Initial return return LI IrU&aUl Address return change of a former I I Name public change charity LI Final return<br />

Name of foundation A Employer identification number<br />

Use the IRS label. <strong>rint</strong> THE <strong>fe</strong> CIRI eFOUNDATION<br />

92-0087914<br />

omerwlsei Number and Street (or P O box number if mail is not delivered to stre - - - :<br />

t<br />

"type" 3600 SAN JERONIMO DRIVE P)<br />

5 ((35%-*Ep<br />

See Specific<br />

lnstructioni City or town, slate, and ZIP code<br />

ANCHORAGE, AK 99508<br />

nrt 18 201%<br />

I I<br />

,20<br />

ROOITT/SUlte B Telephone number (see page 10 ol the inst.rui:t.iors)<br />

256 (907) 793-3575<br />

C If<br />

pending,<br />

exemption<br />

check here<br />

application<br />

- - - - -- <br />

is ,<br />

D 1 Foreignorganizations,checkhere , ,tit<br />

2 Foreign organizations meeting the<br />

85% test check here and attach<br />

H Check type of organization tl(-I Section 501(c 3 exe UW* dm C,,,,,pu,,,",,,,,, U U U U U U U- U p tj<br />

Section 4947(g)(1) nonexempt chantable trust 0 I : -" - I- o - rivate foundation is If private foundation status was terminated<br />

I Fair market value of all assets at end J Accounting method t-/Jilash t-Xt Accrual unde, sechm 50,(,,)(,,(A)U check new U p tj<br />

of year (from Part //I CO/ (C): /,ne E other (Specify) - - - - - - - - - - - - - - - - - - - --- F If the foundation is ii-i360-mgnth termination<br />

15) p 5 4 6 , 7 15 , 52 6 . (Part I, co/urm (d) must be on cash basis ) unaefseetion sovib)i1)iB),eneeknere , P<br />

Analysis of Revenue and Expenses (77ie<br />

total of amounts in columns (b), (c), and (d)<br />

may not necessan/y equal the amounts in<br />

column @)-(see page 11 of the instmctions) )<br />

5a<br />

b<br />

6a b<br />

7<br />

10a<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16a<br />

17<br />

- 18<br />

-- 19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

b<br />

c<br />

a<br />

b<br />

Contributions ifts, grants, etc , received (attach schedule) ,<br />

Check , If) gtgiishfcgtggdgtion is notUreUquUired toU<br />

Interest on savings and temporary cash investments<br />

Dividends and interest from secunties , U , U<br />

Gross rents . . . . . . . . . . . . . . .. .<br />

Net rental income or (loss)<br />

Net gain or (loss) from sale of assets not on line 10<br />

Grosssalespnceforall assets online 6a 19U335U819<br />

Capital gain net income (from Part IV, line 2) .<br />

Net short-term capital gain . . . . . . .. .<br />

Income modifications - - - - - - - - - -- <br />

and Gross allowances sales - less - - - retums<br />

2 , 1 1 8<br />

Less Cost of goods sold ,<br />

Gross profit or (loss) (attach schedule) U U U<br />

Other income (attach schedule) U U U U UU U<br />

Total. Add lines 1 throuqh 11 . . . . . .. .<br />

Compensation of ofhcers, directors, trustees, etc U U<br />

Other employee salanes and wages . . . . .<br />

Pension plans, employee benefits U U U , ,<br />

Legal <strong>fe</strong>es (attach schedule) U U U U U UU U<br />

Accounting <strong>fe</strong>es (attach schedule) U U U UU U<br />

Other pro<strong>fe</strong>ssional <strong>fe</strong>es (attach schedule) ,*, ,<br />

Interest . . . . . . . . . . . . . . . . .. .<br />

Taxes (attach schedule) (see page 14 ot the instructions)<br />

Depreciation (attach schedule) and depletion,<br />

Occupancy . . . . . . . . . . . . . . .. .<br />

Travel, con<strong>fe</strong>rences, and meetings , , , ,, ,<br />

P<strong>rint</strong>ing and publications , , , , , , , ,, ,<br />

Other expenses (attach schedule) ,<br />

Total operating and administrative expenses.<br />

ta) Revenue and in) Nei investment ie) Adiusied net<br />

expenses per ll"1C0m9 IDCOITIB<br />

books<br />

387, 995. ATCH 1<br />

1,498,966. 1,168,444.<br />

-1, 427, 125.<br />

AddIines13through23 , , , . , , , ., , 110241476- 343/742<br />

Contributions, gifts, grants paid 1 I 1 O4 I 32 6 "<br />

Total expenses and disbursements Add lines 24 and 25<br />

2,128,802. 343,742.<br />

Subtract line 26 from line 12<br />

Excess of revenue over expenses and disbursements U U -1,648,522.<br />

Net investment income (if negative, enter -O-) 8 7 6 , 0 0 8 .<br />

(d) Disbursements<br />

for charitable<br />

purposes<br />

(cash basis only)<br />

2,118.<br />

18,326.<br />

480,280)<br />

145,727.<br />

177, 388.<br />

108, 505.<br />

51,306.<br />

1,219,750.<br />

ATCH 2<br />

145,727<br />

175, 121<br />

118,702<br />

61,500. 61, 500<br />

435, 931. 343, 742. 92, 189<br />

14,474.<br />

54,672. 54, 672<br />

2,270. 2,270<br />

1,396. 1, 396<br />

22,613. -25, 429<br />

X U c Adjusted net income (if negative, enter -0-). . -0"<br />

For Privacy Act and Paperwork Reduction Act Notice, see page 30 of the instructions. * ATCH 3 JSA<br />

X 518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

/<br />

X "E14102 O00<br />

626, 148<br />

1,136, 050<br />

1,762,198<br />

Form 990-PF (zoos)<br />

Z, /9 - /O2<br />

-.1

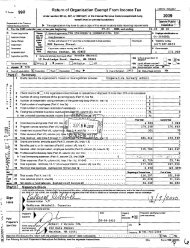

Form 990-PF (zoos) 92-0087 914 page 2<br />

ttached schedules and amounts in the<br />

Balance She escription column should befor end-of-year<br />

mounts only (See instructions )<br />

1 Cash - non-interest-bearing I I I I I I I I I I I I I I I II I<br />

2 Savings and temporary cash investments I I I I I I I I II I<br />

3 Accounts receivable P --------------- --gl-L<br />

Less allowance for doubtful accounts P ----------- -<br />

4 Pledges receivable P ---------------------- -<br />

Less allowance for doubtful accounts P ----------- -<br />

5 Grants receivable . . . . . . . . . . . . . . . . . . . .. .<br />

6 Receivables due from ofl"icers, directors, tmstees, and other<br />

disqualified perS0rtS (attach schedule) (see page 16 ofthe instmctions)<br />

7 Other notes and loans receivable (attach schedule) P - - - - <br />

Less allowance for doubtful accounts P ----------- -<br />

8 Inventories for sale or use I I I I I I I I I I I I I I I II I<br />

9 Prepaid expenses and de<strong>fe</strong>rred charges , , , , , , , I I II I<br />

1 0 8 Investments - U S and state govemment obligations (attach schedule) ,<br />

b Investments - corporate stock (attach schedule) IAITICIHI I5 I<br />

c Investments - corporate bonds (attach schedule),ATfQH I I<br />

1 1 Investments - land, buildings, ,<br />

and equipment basis . . . . . . . . . . . - - - . -.. <br />

Less accumulated depreciation p<br />

(attach schedule) ----------------- - <br />

1 2 Investments - mortgage loans I I , I , , I I I I I I I II I<br />

13 Investments - other (attach schedule) I I I I I II I<br />

" t22?5,2Zi?*%%Z.?"d F ......... 3291591-.<br />

(iiT3ci?Z2tL"d"J?$?"*deP<strong>fe</strong>"*"""* .......... -.2.QQr.fl5Q-.<br />

15 Other assets (descnbe b ------------------- -- )<br />

16 Total assets (to be completed by all filers - see the<br />

instructions Also, see page 1, item I) , , , , , , , , , , ,, ,<br />

17 Accounts payable and accrued expenses I I I I I I I I II I<br />

18 Grams payable . . . . . . . . . . . . . . . . . . . . .. .<br />

9, 19 De<strong>fe</strong>rred reverrue . . . . . . . . . . . . . . . . . . . .. .<br />

20 Loans from oft"icers, directors, trustees, and other disqualitied persons<br />

"Q N 21 Mortgages and other notes payable (attach schedule) I I I I I<br />

"I 22 Other liabilities (descnbe P ----------------- -- )<br />

23 Total liabilities (add lines 17 through 22) . . . . . . . . .. .<br />

Foundations that follow SFAS 117, check here PIL,<br />

and complete lines 24 through 26 and lines 30 and 31.<br />

24 Unrestricted . . . . . . . . . . . . . . . . . . . . . . .. .<br />

25 T@mP0f2fIlvf@Sl"Cl@d . . . . . . . . . . . . . . . . . .. .<br />

25 Pefmafteflllv<strong>fe</strong>sificied . . . . . . . . . . . . . . . . . .. .<br />

EIU<br />

1<br />

JSA<br />

9E142D 1 000<br />

Beginning of year d of year<br />

(a) Book Value (b) Book Van (c) Fair Market Value<br />

929,210 2,590,588 2,590,588<br />

103, 273 81, 380 81,380<br />

2,111 3,270 3, 270<br />

21, 381,300 28,152,262 28,152,262<br />

10,775,748 9,298, 955. 9,298, 955<br />

5,249,820 6,568, 476. 6,568,476<br />

35,069 20,595. 20, 595<br />

38, 476,531 46,715, 526. 46,715,526<br />

66, 619 151,162<br />

86,000 54,276.<br />

152, 619. 205, 438<br />

25,245,020 33, 138, 604<br />

13, 078,892 13,371, 484<br />

27<br />

Foundations that do not follow SFAS 117,<br />

check here and complete lines 27 through 31. P<br />

Capital stock, trust principal, or current funds I I I I II I<br />

28 Paid-in or capital surplus, or land, bldg , and equipment fund I I I<br />

29 Retained earnings, accumulated income, endowment, or other funds , ,<br />

30 Total net assets or fund balances (see page 17 of the<br />

instructions) I I I I II I<br />

38, 323, 912 46, 510, 088<br />

31 Total liabilities and net assetslfund balances (see page 17<br />

of the instructions) . . . . . . . . . . . . . . . . . . . .. . 38, 476, 531 46,715,526.<br />

Analysis of Changes in Net Assets or Fund Balances<br />

Total net assets or fund balances at beginning of year - Part Il, column (a), line 30 (must agree vinth<br />

end-of-yearfigure reported on prior yeafs retwn) I I I I I<br />

Enter amount from Part I, line 27a<br />

Other increases not included in line 2 (itemize) ------- -<br />

dd lines 1, 2, and 3<br />

Decreases not included inline 2 (itemize) p---------------------.----------- ------- -<br />

Total net assets or fund balances at end of year (line 4 minus line 5)- Part ll, column (QI), line 30 . . . . .<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

38, 323, 912<br />

-1, 648, 522<br />

9, 834, 698<br />

46, 510, 088<br />

46, 510, O88<br />

Form 990-PF (2009)

Form Part IV Capital 990-PF Ga nd Losses (zoos) for Tax on Investment Q 92-0037 Income 914 O Page 3<br />

(a) List and describe the kind(s) of property sold (e g , real estate, $253823 I(d) Dajte sold<br />

2-story brick warehouse, or common stock, 200 shs MLC Co) l-i%1,f,?"Zf5e (m0 . day. YY) mo " ay* yr)<br />

1a SEE PART IV SCHEDULE<br />

(1) Depreciation allowed (9) C051 0*" Other DBSIS<br />

(B) Gross sales price (or allowable) plus expense of sale<br />

Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69<br />

. (j) Adjusted basis (k) Excess of col (i)<br />

1*) F M V as of 12/31/59 as of 12/31/69 over col 0), ifany<br />

2 Capital gain net income or (net capital loss) . . . . . l<br />

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6)<br />

If gain, also enter in Part I, line 8, column (c) (see pages 13 and 17 ofthe instructions)<br />

If (loss), enter -0- in Part I, line 8.<br />

(h) Gain or (loss)<br />

(e) plus (f) minus (g)<br />

(I) Gains (Col (h) gain minus<br />

col (k), but not less than -0-) or<br />

Losses (from col (h))<br />

If gain, also enter in Part I, line 7<br />

lf (loss), enter-0- in Part I, line7 E 2 "1,3l7fl34<br />

1.<br />

Qualification Under Section 4940(g) for Reduced Tax on Net Investment Income<br />

(For optional use by domestic private foundations subject to the section 494O(a) tax on net investment income )<br />

If section 494O(d)(2) applies, leave this part blank<br />

(3) thi (ci *dl<br />

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? I I I I E Yes No<br />

lf "Yes," the foundation does not qualify under section 494O(e) Do not complete this part<br />

1 Enter the appropriate amount in each column for each year, see page 18 of the instructions before making any entries<br />

Base penod years Distribution ratio<br />

Cale,-ma, yea, (D, ,ax yea, be9,,,n,ng ,ny Adjusted qualifying distnbutions Net value of nonchantable-use assets (Col (b) dmded by col (CI)<br />

2008 2,553,538. 49,267,367 0.051830<br />

2007 2,508,483. 55,437,788 0.045249<br />

2006 2, 686,291 51, 596, 331 0.052064<br />

2005 347,233. 49, 175,259. 0.047732<br />

2004 230,472 46,243,830. 0.048233<br />

2 Total of line 1, column(d) I I<br />

3 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the<br />

number of years the foundation has been In existence if less than 5 years ,<br />

4 Enter the net value of noncharitable-use assets for 2009 from Part X, line 5<br />

5 Multiply line 4 byline 3 I I I<br />

6 Enter 1% of net investment income (1% of Part I, line 27b) I I I I I I I II I<br />

7 Add lines 5 and 6 I I I I II I<br />

8<br />

JSA<br />

Enter qualifying distributions<br />

Form<br />

from Part Xll, line 4 I I<br />

990-PF<br />

I I I I I I I I I I II I<br />

8<br />

(zoos)<br />

If line 8 is equal to or greater than line 7, check the box in Pait Vl, line 1b, and complete that part using a 1% tax rate See the<br />

Part Vl instructions on page 18<br />

9E14301000<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

2<br />

3<br />

0.245108<br />

0. 049022<br />

4 41,155,426.<br />

5 2,017,521.<br />

6 8,760.<br />

7 2,026,281.<br />

1,762,198.

l 6<br />

Form 990-PF (zoos) 92-0087 914 Page 4<br />

Part VI Excise Tax on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - s e 18 of the instructions)<br />

1a Exempt operating foundamscnbed in section 4940(d)(2). check here * I and enter "NIA" on line1 I I I I<br />

Date of ruling or determination letter ---------- - -(attach copy of ruling letter if necessary - see instructions)<br />

b Domestic foundations that meet the section 4940(e) requirements in Part V, check 1<br />

here v lj am-niefi%ofParii,i-ne21b . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

c All other domestic foundations enter 2% of line 27b Exempt foreign organizations enter 4%<br />

of Part I, line 12, col (b)<br />

Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-) I I I<br />

Add liiieS1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-) I I I<br />

Tax based on investment income. Subtract line 4 from line 3 If zero or less, enter -0- I , I I I I I I I I II I<br />

Credits/Payments<br />

a 2009 estimated tax payments and 2008 overpayment credited to 2O09I I I Sa 4 2 I 7 2 4 <br />

b Exempt foreign organizations-tax vinthheld at source I I I I I I I I I I II I m O <br />

c Tax paid with application for extension of time to file (Form 8868) I I I I II I B 0 <br />

d Backup withholding erroneously withheld I I I I I I I I I I I I I I I II I m<br />

7 Total credits and payments Add lines 6a through 6d . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 7<br />

3 Enter any penalty for underpayment of estimated tax Check here lj if Form 2220 is attached , , , , ,I , 8<br />

9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed I I I I I I I I I I I I I II I P 9<br />

1 0 Overpayment. lf line 7 is more than the total of lines 5 and 8, enter the amount overpaid I I I I I I I II I P 10<br />

11<br />

Enter the amount of line 10 to be Credited to 2010 estimated tax p 2 5 i 2 0 4 - Refunded p 11<br />

Part VII-A Statements Regarding Activities<br />

1a During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it<br />

Pamclpate 0*" mtewene In 30)/ P0mlC3t Campaign? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page 19<br />

of the instructions for defiriitidrii? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

lf the answer is "Yes" to 1a or 1b, attach a detailed descnption of the activities and copies of any matenals<br />

published or distributed by the foundation in connection with the activities<br />

c Did the foundation file Form 1120-POL for this year? I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I<br />

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year<br />

(1) On the foundation * $ 2-1--L " (2) On foundation managefs , $ O "<br />

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed<br />

on foundation managers P $ 0 "<br />

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? I I I I I I I I II I<br />

lf "Yes, " attach a detailed descnption ofthe activities<br />

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of<br />

incorporation, or bylaws, or other similar instruments? If "Yes,"attach a confonried copy of the changes I I I I I I I II I<br />

4a Did the foundation have unrelated business gross income of $1,000 or more dunng the year? , , , , , , , , , ,, ,<br />

b lf "Yes," has it filed a tax return on Form 990-T for this year? I I I I I I I I I I I I I I I I I I I I I I I I I II I<br />

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year? I I I I I I I I I I I I I I II I<br />

lf "Yes," attach the statement required by Genera/ Instruction T<br />

Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either<br />

0 By language in the governing instrument, or<br />

o By state legislation that ef<strong>fe</strong>ctively amends the governing instrument so that no mandatory directions that<br />

conflict with the state law remain in the goveming instrument? , , , , , , , , , , , , , , , , , , , I I I I I , I I II I<br />

7 Did the foundation have at least $5,000 in assets at any time dunng the year? lf"Yes,"complete Part ll, col (c), and PartXV<br />

Ba Enter the states to which the foundation reports or with which it is registered (see page 19 of the<br />

instructions) P -A-K-f ----------------------------------------------------------- -II<br />

b lf the answer is "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General<br />

(or designate) of each state as required by General Instruction G? lf "No, "attach explanation , , , , , , , , , , , , , ,, ,<br />

9 ls the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or<br />

4942(j)(5) for calendar year 2009 or the taxable year beginning in 2009 (see instructions for Part XIV on page<br />

27)? /f"YeS,"C0mP/H16 PartX/V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

10 Did any persons become substantial contributors during the tax year? If "Yes," attach a schedule listing their<br />

names and addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

JSA<br />

9E1440 1 000<br />

I 518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

17,520.<br />

17,520.<br />

0 .<br />

17,520.<br />

42,724.<br />

25, 204 .<br />

Yes No<br />

.LEX<br />

.-1b. X<br />

1c X<br />

12.1.. " X<br />

u 3 X<br />

4a X<br />

4b X<br />

- X<br />

51.*<br />

X<br />

7 X<br />

X N351*<br />

L-1X<br />

10 X<br />

Form 990-PF (zoos)

Form 990-PF (zoos) 92-0087914 Page 5<br />

arding Activities (continued) .<br />

1 1 At any time during the y- , did the foundation, directly or indirectly, own a controlled entity within the<br />

meaning of section 512(b)(13)? lf "Yes," attach schedule (see page 20 of the instmctions) . . . . . . . . . . .. . X<br />

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract before<br />

August 17, 2008? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application? . . . . .<br />

Website address , WWW . THECIRI FOUNDATION . ORG d<br />

14 The books are in care of ........ -- Telephone no P -----ggzizgg-Qgi?g----<br />

Located at v 3 6 0 0 S511. .J.E.R.O.N.I.M.O. .D.R.IXE.f. .S.LlI.T.E -23 E J3N9E*9.Rf*.G.E.f. 2315 - - - - zip + 4 P .9.9.5.0.8 ....... - <br />

15 Section 4947(a)(1) nonexempt charitable trusts tiling Form 990-PF in lieu of Form 1041 - Check here - - - - - - - - - - - - - - - -- - ,U<br />

and enter the amount of tax-exempt interest received or accrued during the year , , , , , , , , , , , , , , , ,, , P (1 5I /Q / Pi<br />

Part Vll-B Statements Regarding Activities for Which Form 4720 May Be Required<br />

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies. i-YiNl0<br />

1a During the year did the foundation (either directly or indirectly) ?<br />

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? , , , , , ,, , E, Yes L N0<br />

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a ,.disqualified<br />

person? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . - Yes i N0<br />

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? . . . . .. . Yes 1 N0<br />

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? , , , , , ,, , - Yes L N0<br />

(5) Trans<strong>fe</strong>r any income or assets to a disqualified person (or make any of either available for ,the<br />

benefit or use of a disqualified person)? . . . . . . . . . . . . . . . . . . . . . . . . .. . I3 Yes N0 T 7 T<br />

(6) Agree to pay money or property to a government official? (Exception. Check "No" if<br />

the foundation agreed to make a grant to or to employ the official for a period after ..termination<br />

of government service, if terminating within 90 days ) . . . . . . . . . . . . . .. . lj Yes L N0<br />

b lf any answer is "Yes" to 1a(1)-(6), did any of the acts fail to qualify under the exceptions descnbed in Regulations<br />

section 53 4941(d)-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)? - - - - L - - - - Q<br />

Organizations relying on a current notice regarding disaster assistance check here , , , , , , , , , , ,, , , 1<br />

c Did the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, that<br />

were not corrected before the first day of the tax year beginning in 2009? , , , , , , , , , , , , , , , , , , , , , , , , ,, , *Iii<br />

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private<br />

operating foundation defined in section 4942(i)(3) or 4942(i)(5))<br />

a At the end of tax year 2009, did the foundation have any undistributed income (lines Gd and<br />

6e, Part Xlll) for tax year(s) beginning before 2009? . . . . . . . . . . . . . . . . . . . . . . .. . lj Yes N0<br />

If "Yes," list the years 5 -------- -- , * * - - - - --- , * - - - - -- - , - - . - - *- <br />

b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)<br />

(relating to incorrect valuation of assets) to the year"s undistnbuted income? (lf applying section 4942(a)(2)<br />

to all years listed, answer "No" and attach statement - see page 20 of the instructions ) . . . . . . . . . . . . . . . . . .. . OM<br />

c lf the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here<br />

P ........ -- i . . . . . . .- - . . . . . . .- - i . . . . . .- <br />

3a Did the foundation hold more than a 2% direct or indirect interest in any business<br />

enterprise at any time during the veal? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . lj Yes "0<br />

b lf "Yes," did it have excess business holdings in 2009 as a result of (1) any purchase by the foundation or<br />

disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved by the<br />

Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequestg or (3) the lapse<br />

of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Fomi 4720, to determine if the<br />

foundation had excess business holdings in 2009 ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? , , , , , ,, , 41 X<br />

b Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its<br />

charitable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2009? . . . .. . 4b X<br />

Form 990-PF (zoos)<br />

JSA<br />

9514501000<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865

Form 990-PF (2009) 92-U08 /914 Page 6<br />

arding Activities for Which Form 4720 May Be Required (Conv)<br />

5a During the year did the . dation pay or incur any amount to ?<br />

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? I I I II I lj Yes L No<br />

(2) Influence the outcome of any specific public election (see section 4955), or to carry on, *<br />

(3) directly Provide a or grant indirectly, to an individual any voter for registration travel, study, drive? or other I I similar I I I I I purposes? I I I I I I I I I I I I I I I II I Yes 1 l No<br />

(4) Provide a grant to an organization other than a charitable, etc , organization descnbed in i<br />

section 509(a)(1), (2), or (3), or section 494O(d)(2)? (see page 22 of the instructions) I I I I II I C1 Yes L No<br />

(5) Provide for any purpose other than religious, charitable, scientific, literary, or educational ?<br />

purposes, or for the prevention of cruelty to children or animals? I I I I I I I I I I I I I I II I lj Yes L No<br />

b lf any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in<br />

Regulations section 53 4945 or in a current notice regarding disaster assistance (see page 22 of the instructions)? . . lb- X<br />

Organizations relying on a current notice regarding disaster assistance check here I I I I I I I I I I I I II I P 1<br />

c If the answer is "Yes" to question 5a(4), does the foundation claim exemption from the tax -*<br />

because it maintained expenditure responsibility for the grant? , I I I I I I I , I I I I I I I II I EI YGS 1 N0<br />

If "Yes, " attach the statement required by Regulations section 53 4945-5(d) /M) / A<br />

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums -.<br />

on a personal benefit contract? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . lj Yes i N0 .<br />

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? I I I II I I I I I I I Gln*-L<br />

If "Yes" to 6b, file Form 8870 *v<br />

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? I I lj Yes l No i "<br />

b If es, did the foundation receive any proceeds or have any net income attributable to the transaction? . . . . . . . . . . .. . 7b /J /A<br />

information and About Contractors Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,<br />

1 List all officers, directors, trustees, foundation managers and their compensation (seepage 22 of the instructions).<br />

(b) Title, and avera e c Compensation (d) Contributions to<br />

(3) Name and address hours per week g not paid, enter employee benefit plans (eZ,5,)$eglTf:ac,$gg$nt"<br />

devoted to position -0-) and de<strong>fe</strong>rred compensation<br />

-pIi%it-6H1T4Etxf1*"?9 """""""""""""""""""" " 145,727. 32,351. 1,080<br />

2 Compensation of five highest-paid employees (other than those included on line 1 - see page 23 of the instructions).<br />

If none, enter "NONE,"<br />

(b) Tme- and avemge (?e)rriC(l0n:elgut1le)r::fi1o (e) Expense account<br />

(a) Name and address of each employee paid more than $50,000 hours per week (c) Compensation planps aim de<strong>fe</strong>rred other allowances .<br />

devoted to position Compensahon<br />

RICARDO LOPEZ PROGRAM OFF11CER<br />

40.00 60,697. 11,273. O<br />

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .PI NONE<br />

Pom 990-PF (2009)<br />

JSA<br />

9514601000<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865

Form seo-PF(zoo9) 92-0087914 Page 7<br />

Part VIII Informatio.out Officers, Directors, Trustees, Foundation Managers, Highly Pgmployees,<br />

and Contractors (continued)<br />

3 Five highest-paid independent contractors for pro<strong>fe</strong>ssional services (see page 23 of the instructions). If none, enter "NONE."<br />

(a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation<br />

NONE<br />

/<br />

Total number of others receiving over $50,000 for pro<strong>fe</strong>ssional services . . . . . . . . . . . . . . . . . . . . . . . . .. . Pl NONE<br />

Part IX-A Summary of Direct Charitable Activities<br />

List the foundation*s four largest direct charitable activities dunng the tax year Include relevant statistical infomiation such as the number<br />

of organizations and other beneficianes served, con<strong>fe</strong>rences convened, research papers produced, etc<br />

1 N/A<br />

2 ------------------------------------------------------------------------- -<br />

3----1<br />

4--1$<br />

Expenses<br />

Part IX-B Summary of Program-Related Investments (see page 23 of the instructions)<br />

Describe the two largest program-related investments made by the foundation dunng the tax year on lines 1 and 2 Amount<br />

1 NOT APPLICABLE<br />

2-1111<br />

All other program-related investments See page 24 of the instructions<br />

3 NONE<br />

Total. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .P<br />

JSA<br />

9514651000<br />

518<br />

106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865<br />

Form 990-PF (2009)

Minimum Form Invest 990-Pr t Return (All domestic (2009) foundations 92 must -oo com plete 37 this part 91 Foreig 4 ndations, ,J Page 8<br />

see page 24 of the instructions )<br />

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc ,<br />

purposes<br />

a Average monthly fair market value of securities I I I I I I I I I I I I I I I I I I I I I I I I I II I<br />

b A)/@1399 of m0"th1Y C350 balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

c Fair market value of all other assets (see page 24 ofthe instructions) I I I I I I I I I I I I I II I<br />

d Total (add lines 12. b. and cl . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

e Reduction claimed for blockage or other factors reported on lines 1a and<br />

1c (attach detailed explanation) I I I I I I I I I I I I I I I I I I II I I 1e I<br />

1a<br />

1b<br />

1c<br />

1d<br />

41,393,149<br />

389, 009<br />

O<br />

41,782,158<br />

2 Acquisition indebtedness applicable to line 1 assets I I I I I I I I I I I I I I I I I I I II I<br />

3 Subtract line 2 from line 1d<br />

2<br />

3<br />

0<br />

41,782,158<br />

4 Cash deemed held for charitable activities Enter 1 1/2 % of line 3 (for greater amount, see page 25. I 7<br />

Of the l"S"UCfl0"S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

5 Net value of noncharitable-use assets. Subtract line 4 from line 3 Enter here and on Part V, line 4<br />

6 Minimum investment return. Enter 5% of line 5 , , , , , , , , , , I I , I I I I I I I I I I I II I<br />

4<br />

5<br />

6<br />

626, 732<br />

41, 155, 426<br />

2,057,771<br />

m Distributable Amount (see page 25 of the instructions) (Section 4942(j)(3) and (j)(5) private operatng<br />

foundations and certain foreign organizations check here P I-*I and do not complete this part)<br />

1 Minimum investment return from Part X, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 1 2 , 057 I 77 1<br />

2a Tax on investment income for 2009 from Part VI, line 5 I I I I I II I 2a 17 , 520b<br />

Income tax for 2009 (This does not include the tax from Part VI )I I I 360<br />

C u n l I u I u u u u - w a n n u n s n u I - - - u - . I - . n u c w Q u w w n n - w un w<br />

Distributable amount before adjustments Subtract line 2c from line 1 I I I I I I I I I I I I I I I II I<br />

Recoveries of amounts treated as qualifying distributions I I I I I I I I I I I I I I I I I I I I I I II I<br />

3 4 . . - n - r u u u n a u n u . I n n u s u u w u u n u - - u I I n - I - - n u u I n n nn 1<br />

2c 17, 880<br />

2, 039, 891<br />

18, 326<br />

2, 058,217<br />

Deduction from distributable amount (see page 25 of the instructions) I I I I I I I I I I I I I I I II I<br />

Distributable amount as adjusted Subtract line 6 from line 5 Enter here and on Part XIII,<br />

Ijne 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

Part XII Qualifying Distributions (see page 25 of the instructions)<br />

1 Amounts paid (including administrative expenses) to accomplish charitable, etc, purposes<br />

a Expenses, contributions, gifts, etc -total from Part I, column (d), line 26 I I I I I I I I I I I I I I II I<br />

b Program-related investments - total from Part IX-B I I I I I I I I I I I I I I I I I I I I I I I I I I II I<br />

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc ,<br />

Purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

3 Amounts set aside for speciic charitable projects that satisfy the<br />

a Suitability test (prior IRS approval required) I I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I<br />

b Cash distribution test (attach the required schedule) I I I I I I I I I I I I I I I I I I I I I I I I II I<br />

7 2,058,217<br />

1a 1,762,198<br />

1b 0<br />

2<br />

3a O<br />

3b 0<br />

4 Qualifying distributions. Add lines 1a through 3b Enter here and on Part V, line 8, and Part XIII, line 4 I I I II I 4 1 f 7 62 1 1 99<br />

5 Foundations that qualify under section 494O(e) for the reduced rate of tax on net investment income<br />

Enter 1% of Part l, line 27b (see page 26 ofthe instructions) I I I I I I I I I I I I I I I I I I I I II I 5 N/A<br />

6 Adjusted qualifying distributions. Subtract line 5 from line 4 I I I I I I I I I I I I I I I I I I I I II I 6 1 , 7 52 I 1 99<br />

Note: The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation<br />

qualifies for the section 4940(e) reduction of tax in those years<br />

JSA<br />

9E1470 1 O00<br />

l 518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

0<br />

Form 990-PF (zoos)

Form 990-PF(2oo9) U 92-0087 914 0 page 9<br />

Part XIII Undistributed Income (see page 26 of the instructions)<br />

1<br />

2<br />

a<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

b<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

a<br />

b<br />

C<br />

d<br />

e<br />

a<br />

b<br />

C<br />

d<br />

e<br />

f<br />

10<br />

a<br />

b<br />

c<br />

d<br />

e<br />

JSA<br />

(al lb) (Cl (dl<br />

Distributable amount for 2009 from Part XI, COFPUS Yeafs P001" 10 2003 2003 2009<br />

liner . . . . . . . . . . . . . . . . . . ... 2058/217<br />

Undistnbuted income, if any, as of the end of 2009<br />

Enter amount for 2008 only I I I I I I I II I<br />

Total for pnoryears 20 O7 ,20 O6 I20 05<br />

Excess distributions carryover, if any, to 2009<br />

From 2004 I I I II I 0<br />

From 2005 I I I II I <br />

From 2006 I I I II I <br />

From 2007 I I I II I<br />

From 2008 I I I II I<br />

Total of lines 3a through e I I I I I I I I II I<br />

Qualifying distributions for 2009 from Part XII,<br />

l,ne4 p 5 1,762,198.<br />

Applied to 2008, but not more than line 2a I I I<br />

Applied to undistnbuted income of prior years (Election<br />

required - see page 26 ofthe instructions) I I I II I<br />

Treated as distributions out of corpus (Election<br />

required - see page 26 of the instructions) I I I I<br />

Applied to 2009 distributable amount I I I I I<br />

Remaining amount distributed out of corpus I I<br />

Excess distributions carryover applied to 2009 I<br />

(lf an amount appears in column (d), the same<br />

amount must be shown in column (a) )<br />

Enter the net total of each column as<br />

indicated below:<br />

Corpus Add lines 3f, 4c, and 4e Subtract llne 5<br />

Prior years" undistributed income Subtract<br />

line 4b from line 2b I I I I I I I I I I I II I<br />

Enter the amount of prior years" undistributed<br />

income for which a notice of deficiency has been<br />

issued, or on which the section 4942(a) tax has<br />

been previously assessed . . . . . . . . . .. .<br />

Subtract line Sc from line 6b Taxable<br />

amount- see page 27 of the instructions I I I I<br />

Undistributed income for 2008 Subtract line<br />

4a from line 2a Taxable amount - see page<br />

27 ofthe instructions . . . . . . . . . . .. .<br />

Undistributed income for 2009 Subtract lines<br />

4d and 5 from line 1 This amount must be<br />

distributed in 2010 I I I I I I I I I I I I II I<br />

Amounts treated as distributions out of corpus<br />

to satisfy requirements imposed by section<br />

170(b)(1)(F) or 4942(g)(3) (see page 27 of the<br />

instructions) . . . . . . . . . . . . . . . .. .<br />

Excess distributions carryover from 2004 not<br />

applied on line 5 or line 7 (see page 27 of the<br />

instructions) . . . . . . . . . . . . . . . .. .<br />

Excess distributions carryover to 2010.<br />

Subtract lines 7 and 8 from line 6a I I I I II I<br />

Analysis of line 9<br />

Excess from 2005 <br />

Excess from 2006 I I I <br />

Excess from 2007 I I I<br />

Excess from 2008 I I I<br />

Excess from 2009<br />

9514801000<br />

518106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865<br />

35,545.<br />

O . 0<br />

35,545.<br />

1,726, 653.<br />

331, 564 .<br />

Form 990-PF (2009)

Form 990-PF (zoos) 92-0087 91 4 Page 10<br />

gg 1a If Foundations the foundation has (see ived page a ruling 27 or determination of the instructions letter that it is and a private Part operating Vll-A, u 9) NOT APPLICABLE<br />

foundation, and the ruling is ef<strong>fe</strong>ctive for 2009, enter the date of the ruling D . - . - U . - - - I- I P<br />

b Check box to indicate whether the foundation is a private operating foundation descnbed in section ( ( 4942(i)(3) or ( I 4942(j)(5)<br />

2a (usted Enter net the income lesser from of Part the (a) ad- 2009 Tax (b) 2008 year (c) Prior 2007 (d) 3 years 2006 (e) Total<br />

I or the minimum investment<br />

retum from Part X for each<br />

yearlisted - . - U .i U<br />

b 85%ofline2a , , , , ,<br />

C Qualifying distnbutions from Pait<br />

XII, line 4 for each year listed ,<br />

d Amounts included in line 2c not<br />

used directly for active conduct<br />

o<strong>fe</strong>xemptactivilies. . . . .<br />

6 Qualifying distributions made<br />

directly for active conduct of<br />

exempt activities Subtract line<br />

2d from Iine2c U , I I, ,<br />

3 Complete 3a, b, or c for the<br />

alternative test relied upon<br />

3 "Assets" allemative test - enter<br />

(1) Valueofall assets . . .<br />

(2) Value of assets qualifying<br />

under section<br />

4942(j)(3)(B)(l). . . . .<br />

b "Endowment" alternative testenter<br />

2/3 of minimum investment<br />

return shown in Part X,<br />

line6for each yearlisted f .<br />

C "Support" altemative test - enter<br />

(1) Total support other than<br />

gross investment income<br />

(interest, dividends, rents,<br />

payments on secunties<br />

loans (section 512(a)(5)),<br />

or royalties) I I D ID I<br />

(2) Support from general<br />

public and 5 or more<br />

exempt organizations as<br />

provided in section 4942<br />

GX3)(B)(I1I) . . . .. .<br />

(3) Largest amount of support<br />

lrom an exempt<br />

organization , , , , ,<br />

4 Gross investment income,<br />

Supplementary information (Complete this part only if the foundation had $5,000 or more in assets<br />

at any time during the year - see page 28 of the instructions.)<br />

1 Information Regarding Foundation Managers:<br />

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation<br />

before the close of any tax year (but only if they have contributed more than $5,000) (See section 507(d)(2) )<br />

N/A<br />

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the<br />

ownership of a partnership or other entity) of which the foundation has a 10% or greater interest<br />

N/A<br />

2 information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:<br />

Check hereb (jif the foundation only makes contributions to preselected charitable organizations and does not accept<br />

unsolicited requests for funds If the foundation makes gifts, grants, etc (see page 28 of the instructions) to individuals or<br />

organizations under other conditions, complete items 2a, b, c, and d<br />

a The name, address, and telephone number of the person to whom applications should be addressed<br />

ATTACHMENT 10<br />

b The form in which applications should be submitted and information and materials they should include<br />

SEE ATTACHMENT 10<br />

c Any submission deadlines<br />

SEE ATTACHMENT 1 O<br />

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other<br />

factors<br />

SEE ATTACHMENT 10<br />

9E,,,f,%A, 000 Form 990-PF (zoos)<br />

518106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865

Formseo Part XV Supplementnnformation PF(2oo9) (continued) 92-0097914 0 Pa9e11<br />

3 Grants and Contributions Paid During the Year or Approved for Future Payment<br />

lf recipient is an individual,<br />

fo dat status of<br />

Reclpiem show any relationship to Foundation Purpose of grant or<br />

Name and address (home or business) 2,"Zub2,2n,,"aT"w"Q?2S2,T,2 recipient C0""*b""0"<br />

a Pa/d dur/ng the year<br />

ATTACHMENT 1 1<br />

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . P 3a 1,136,050b<br />

Approved for future pa yment<br />

ATTACHMENT 12<br />

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . ...b ab 54,276.<br />

JSA<br />

9514911000<br />

518 106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

Amount<br />

Form 990-PF (2009)

Form Part XVI-A Analysis 990-PF(2009) come-Producing Activities*i<br />

92-0087914 0 Page 12<br />

(el<br />

(3) (b) (C) (d) unc ion i<br />

Enter gross amounts unless othen/vise indicated Unrelated business income Excluded by section 512, 513, or 514<br />

R<strong>fe</strong>lattted ornegcgnmept<br />

See e 28 of<br />

1 program sen/Ilce revenue Business code Amount Exdusion code Amount #he lnggqlcilons )<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

g Fees and contracts from govemment agencies<br />

2 Membership dues and assessments I I I I I<br />

3 Interest on savings and temporary cash investments<br />

4 Dividends and interest from securities I I I I 1 4 1 f 58 9 f 8 7 2 <br />

5 Net rental income or (loss) from real estate<br />

a Debt-financed property I I I I II I<br />

b Not debt-financed property I I I I I<br />

6 Net rental income or (loss) from personal property I<br />

7 Other investment income I I I I I I I II I 523000 -901 906<br />

8 Gain or (loss) from sales of assets other than inventory 1 8 I 1 I 4 2 7 I 1 2 5 <br />

9 Net income or (loss) from special events I I I<br />

10 Gross profit or (loss) from sales of inventory. . 2 I 1 1 8 "<br />

b SCHOLARSHIP REFUNDS 18,326.<br />

c<br />

11 Other revenue a<br />

d<br />

e<br />

12 subtotal Addcoiumns(b),(d),and(e) I I I, -90/905 162/747- 20,444<br />

13 wal./iddime12,coiumnsibi,tdi.andie) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 13 92f 285<br />

(See worksheet in line 13 instructions on page 28 to verify calculations )<br />

Relationship of Activities to the Accomplishment of Exempt Purposes<br />

Line N0, Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to<br />

v the accomplishment of the foundations exempt purposes (other than by providing funds for such purposes) (See<br />

page 29 of the instructions)<br />

10 AS PART OF ITS EDUCATIONAL MISSION THE FOUNDATION HAS<br />

COMPILED AND PUBLISHED BOOKS FOCUSING ON THE LIVES OF<br />

NATIVES BOTH YOUNG AND OLD. THE FOUNDATION SELLS A FEW<br />

OF THESE PUBLICATIONS TO RECOVER THE COST OF PUBLICATION.<br />

11B THIS IS INCOME FROM REFUNDS RECEIVED ON SCHOLARSHIPS PAID IN<br />

ACCORDANCE WITH THE ORGANIZATION"S EXEMPT PURPOSE.<br />

Jsp.<br />

9514921000<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

Form 990-PF (2009)

Form 990-PF (2009) 92-O08 /914 Page 13<br />

E . .<br />

Part XVII Informaq xempt anizations Regarding Trans<strong>fe</strong>rs To and Transactions and Relation* With Noncharitable<br />

1 Did the organization directly or indirectly engage in any of the following with any other organization described Yes No<br />

in section 501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political<br />

a Tirgagrsltzegiirtsofmriiliiw the reporting foundation to a nonchantable exempt organization of<br />

(1) Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . Quilt*<br />

(2) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . kglll<br />

b Other transactions<br />

(1) Sales of assets to a nonchantable exempt organization , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , ,, , 1b(1)<br />

(2) Purchases of assets from a nonchantable exempt organization , , , , , , , , , , , , , , , , , , , , , , , , , , , ,, , 1b(2)<br />

(3) Rental of facilities, equipment, or other assets , , , , , , , D - , . I - . - I . - . . I - I I , I I . I . . I I I . -I , 1b(3)<br />

(4) R@lmbUfS@mS"1arrangements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 1bI4)<br />

(5) LOBHS Of 10811 QUHYHHIGSS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . 1b(5t<br />

(6) Performance of services or membership or fundraising solicitations , , , , , , , , , , , , , , , , , , , , , , , , , ,, , 1b(6)<br />

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees , , , , , , , , , , , , , ,, , . . . . . . .N151<br />

d If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market<br />

value of the goods, other assets, or sen/ices given by the reporting foundation If the foundation received less than fair market<br />

value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or sen/ices received<br />

- N /A - N /A<br />

(a) Line no (b) Amount involved (c) Name of nonchantable exempt organization (d) Description of trans<strong>fe</strong>rs, transactions, and shanng anangements<br />

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in<br />

section 501(c) ofthe Code (other than section 501(c)(3)) or in section 5277 , , , , , , , , , , , , , , , , , , , , , , ,, , lj Yes No<br />

b lf "Yes," complete the followinq schedule<br />

(a) Name of organization (b) Type of organization (c) Description of relationship<br />

9 v 9. 1<br />

irm"sname(oryour KPMG L P EIN P 134-3565207<br />

Under lties of per , l clare that I have examined this retum, including accompanying schedules and statements, and to the best of my knowledge and<br />

belief is true, corr an mplete Dec ration of preparer (other than taxpayer or fiduciary) is based on all information of which preparer has any knowledge<br />

, U0. I2 ,M2 , (?&$g"dggQ6f0<br />

Signature of officer or tmstee Date Title<br />

Date Preparer"s identifying<br />

Check If number (See Signature on<br />

- repa,-eps , Self-employed E page 30 of the instnictions)<br />

-- ,, S. nature , IO-l 9 O POO146956<br />

self-employed), address, 701 WES TH AVENUE, SUITE 600<br />

Pmdzlpcode ANCHORAGE, AK 99501 Phgneng 907-265-1200<br />

Form 990-PF (zoos)<br />

JSA<br />

9E1d93 1 000<br />

518106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865

Schedule B . Schedule of Contributors 0 OMB "0 1545-0""<br />

(Form 990, 990-EZ,<br />

of Department seo-Pr) of the Treasury v Attach to Form 990, 990-Ez, or 990-PF.<br />

lntemal Revenue Service<br />

Name of the organization Employer identification number<br />

THE CIRI FOUNDATION<br />

Organization type (check one)<br />

Filers of: Section:<br />

Form 990 or 990-EZ 1 501(c)( ) (enter number) organzation<br />

1 til<br />

Special Rules<br />

: 4947(a)(1) nonexempt charitable trust not treated as a private foundation<br />

i 527 political organization<br />

Form 990-PF L 501(c)(3) exempt private foundation<br />

i 4947(a)(1) nonexempt charitable trust treated as a private foundation<br />

: 501(c)(3) taxable private foundation<br />

92-0087914<br />

Check if your organization is covered bythe General Rule or a Special Rule.<br />

Note. Only a section 501(c)(7), (8), or (10) organization can check boxes for both the General Rule and a Specal Rule See<br />

instructions<br />

General Rule<br />

1 For an organization filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more (in money or<br />

property) from any one contributor Complete Parts land ll<br />

lj<br />

lil<br />

For a section 501(c)(3) organization filing Form 990 or 990-EZ that met the 331/3% support test of the regulations under<br />

sections 509(a)(1) and 170(b)(1)(A)(vi), and received from any one contributor, during the year, a contribution ofthe greater<br />

of (1) $5,000 or (2) 2% of the amount on (i) Form 990, Part Vlll, Ilne 1h or (ii) Form 990-EZ, ine 1 Complete Parts land<br />

ll<br />

For a section 501(c)(7), (8), or (10) organization filing Form 990 or 990-EZ that received from any one contributor, dunng<br />

the year, aggregate contributions of more than $1,000 for use exc/us/ve/yfor religious, charitable, scientific, literary, or<br />

educational purposes, or the prevention of cruelty to children or animals Complete Parts l, ll, and lll<br />

For a section 501(c)(7), (8), or (10) organization filing Form 990 or 990-EZ that received from any one contributor, during<br />

the year, contributions for use exclusively for religious, charitable, etc , purposes, but these contributions did not<br />

aggregate to more than $1,000 lf this box is checked, enter here the total contributions that were received during the<br />

year for an exclusively religious, charitable, etc , purpose Do not complete any of the parts mless the General Rule<br />

applies to this organization because it received nonexclusively religious, charitable, etc , contributions of $5,000 or more<br />

dUflfl9 the Veal . . . . . . . . . . . . . . . . . . .. .<br />

Caution. An organization that is not covered by the General Rule and/or the Special Rules does not tile Schedule B (Form 990,<br />

990-EZ, or 990-PF), but it must answer "No" on Part lV, line 2 of its Form 990, or check the box on line H of its Form 990-EZ,<br />

or on line 2 of its Form 990-PF, to certify that it does not meet the tiling requirements of Schedule B (Form 990, 990-EZ, or<br />

990-PF)<br />

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions Schedule B (Form 990, 990-EZ, or 990-PF) (2009)<br />

for Form 990, 990-EZ, or 990-PF.<br />

JSA<br />

9E 1 251 2 000<br />

518106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865<br />

. . . . . . . . . . . . . . . . . . . . . ... *$-li?

Schedule Name of organization B T (Form I RI 990, FOUN 990-EZ,MF) DAT I ON Employer (2009) identification page of number of pa,-H<br />

92-0087914<br />

Contributors (see instructions)<br />

(2)<br />

No.<br />

(al<br />

No.<br />

(H)<br />

No.<br />

(2)<br />

No.<br />

la)<br />

No.<br />

(2)<br />

No.<br />

(bl<br />

Name, address, and ZlP+4<br />

1 SALAMATOF NATIVE ASSOCIATION<br />

(0)<br />

Aggregate contributions<br />

P.O. BOX 2682 $ 6,250.<br />

KENAI, AK 99611<br />

lb)<br />

Name, address, and ZlP+4<br />

2 AK VILLAGE INITIATIVES<br />

(C)<br />

Aggregate contributions<br />

1577 C STREET, STE 304 $ 10,000.<br />

ANCHORAGE, AK 99501<br />

3 TYONEK NATIVE CORP<br />

(bl<br />

Name, address, and ZlP+4<br />

(C)<br />

Aggregate contributions<br />

1689 C STREET, SUITE 219 $ 24,000.<br />

ANCHORAGE, AK 99501<br />

(bl<br />

Name, address, and ZlP+4<br />

(0)<br />

Aggregate contributions<br />

4 INTERNATIONAL TOWER HILL MINES, LTD.<br />

117 WEST HASTINGS ST SUITE 1901 $ 10,000.<br />

VANCOUVER BC<br />

CANADA<br />

5 KPMG LLP<br />

6 CIRI<br />

lb)<br />

Name, address, and ZIP+4<br />

(C)<br />

Aggregate contributions<br />

701 W 8TH AVENUE $ 10,000.<br />

ANCHORAGE, AK 99501<br />

(bl<br />

Name, address, and ZIP-+4<br />

(0)<br />

Aggregate contributions<br />

PO BOX 93330 $ 292,592.<br />

JSA Schedule B<br />

QE12531 000<br />

ANCHORAGE, AK 99509<br />

106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

(d)<br />

Type of contribution<br />

Person<br />

Payroll <br />

Noncash <br />

(Complete Part ll if there is<br />

a noncash contribution)<br />

ld)<br />

Type of contribution<br />

Person<br />

Payroll <br />

Noncash - <br />

(Complete Part ll if there is<br />

a noncash contribution)<br />

(dl<br />

Ty pe of contribution<br />

Person<br />

Payroll <br />

Noncash <br />

(Complete Part ll if there is<br />

a noncash contribution )<br />

(dl<br />

Type of contribution<br />

Person<br />

Payroll <br />

Noncash <br />

(Complete Part ll if there is<br />

a noncash contribution)<br />

ld)<br />

Type of contribution<br />

Person<br />

Payroll <br />

Noncash <br />

(Complete Part ll if there is<br />

a noncash contribution)<br />

(d)<br />

Type of contribution<br />

Person<br />

Payroll <br />

Noncash <br />

(Complete Part ll if there is<br />

a noncash contribution )<br />

(Form 990, 990-EZ, Or 990-PF) (2009)

Schedule B (Form 990, 990-EZ,MPF) T (2009)<br />

Page of of Part I<br />

Name of organization IRI FOUNDATION Employer identification number<br />

92-0087914<br />

Contributors (see instructions)<br />

(2)<br />

No.<br />

(2)<br />

No.<br />

(2)<br />

No.<br />

(2)<br />

No.<br />

(al<br />

No.<br />

(al<br />

No.<br />

(bl<br />

Name, address, and ZIP + 4<br />

7 COOK INLET TRIBAL COUNCIL, INC.<br />

(C)<br />

Aggregate contributions<br />

3600 SAN JERONIMO DRIVE STE 410 $ 20,355.<br />

ANCHORAGE, AK 99508<br />

lb)<br />

Name, address, and ZIP + 4<br />

lb)<br />

Name, address, and ZIP + 4<br />

lb)<br />

Name, address, and ZIP + 4<br />

lb)<br />

Name, address, and ZIP + 4<br />

lb)<br />

Name, address, and ZIP + 4<br />

(C)<br />

Aggregate contributions<br />

$<br />

lc)<br />

Aggregate contributions<br />

$<br />

(0)<br />

Aggregate contributions<br />

$<br />

(C)<br />

Aggregate contributions<br />

$<br />

(C)<br />

Aggregate contributions<br />

$<br />

JSA Schedule B<br />

9521253 1 000<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

(dl<br />

Type of contribution<br />

Person<br />

Payroll <br />

Noncash <br />

(Complete Part Il if there is<br />

a noncash contribution )<br />

(fi)<br />

Ty pe of contribution<br />

Person<br />

Payroll<br />

Noncash<br />

(Complete Part ll if there is<br />

a noncash contribution)<br />

ld)<br />

Ty pe of contribution<br />

Person<br />

Payroll<br />

Noncash<br />

(Complete Part Il if there is<br />

a noncash contribution)<br />

(dl<br />

Type of contribution<br />

Person<br />

Payroll<br />

Noncash<br />

(Complete Part ll if there is<br />

a noncash contribution )<br />

(dl<br />

Type of contribution<br />

Person<br />

Payroll<br />

Noncash<br />

(Complete Part ll if there is<br />

a noncash contribution )<br />

(dl<br />

Type of contribution<br />

Person<br />

Payroll<br />

Noncash<br />

(Complete Part II if there is<br />

a noncash contribution )<br />

(Form 990, 990-EZ, or 990-PF) (2009)

JSA<br />

Perm 4 7 9 7 (Also 0 Sales Involuntary of Business Conversions Property and 0 OMB Recapture N0 1515-0184 Amounts<br />

Department of Under the Sections Treasury 179 and 280F(b)(2)) , . Attachm nt<br />

imemei Revenue sen/tee (99) P Attach to your tax retum. P See separate instructions. Sequencf, No 27<br />

Name(s) shown on retum Identifying number<br />

THE CIRI FOUNDATION 92-0087914<br />

1 Enter the gross proceeds from sales or exchanges reported to you for 2009 on Form(s) 1099-B or 1099-S (or<br />

substitute statement) that you are including on line 2, 10, or 20 (see instructions) , . I I I . . . I I , I , I I I, , V 1<br />

Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other<br />

2<br />

8<br />

Than Casualty or Theft - Most Property Held More Than 1 Year (see instructions)<br />

(a) Description (b) Date acquired (c) Date sold (d) Gross allowed<br />

(e) Depreciation<br />

or basis, plus<br />

(f) Cost<br />

(9) Gam<br />

or other<br />

or(<br />

lo<br />

55)<br />

acquisition expense of sale<br />

S bt t fr th<br />

sum ( (e)<br />

of property *, (mo , day, yr) (mo , day, yr) sales pnce allowable since improvements and U ras, ag? e<br />

Gam- *f a"Y- from Form 4584- "ne 43 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

Section 1231 gain from installment sales from Form 6252, line 26 or 37 I . - I . I I I I I I I - I I I I I D Di I<br />

Section 1231 gain or (loss) from like-kind exchanges from Form 8824 . . I I I I I I I I I - U I I U I D . , .. D<br />

Gain, if any, from line 32, from other than casualty or theft . I I I I - . . D . I I I I I F I . I I I U I I . D Ii u<br />

Combine lines 2 through 6 Enter the gain or (loss) here and on the appropnate line as follows . I . . I I . I .i I<br />

Partnerships (except electing large partnerships) and S corporations. Report the gain or (loss) following the<br />

instructions for Form 1065, Schedule K, line 10, or Fomi 11208, Schedule K, line 9 Skip lines 8,9, 11, and 12 below<br />

Individuals, partners, S corporation shareholders, and all others. lf line 7 is zero or a loss, enter the amount from<br />

line 7 on line 11 below and skip lines 8 and 9 If line 7 is a gain and you did not have any prior year section 1231<br />

losses, or they were recaptured in an earlier year, enter the gain from line 7 as a long-term capital gain on the<br />

Schedule D filed with your return and skip lines 8, 9, 11, and 12 below<br />

Nonrecaptured net section 1231 losses from prior years (see instructions) . . . I I . . . I I I I D I D I . I .i i<br />

.L-1-l<br />

9 Subtract line 8 from line 7 lf zero or less, enter -0- lf line 9 is zero, enter the gain from line 7 on line 12 below lf line<br />

9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from line 9 as a long-term<br />

capital gain on the Schedule D filed with your return (see instructions) . I D I . I I I I I . I - I I I I D I . -I v 9<br />

Ordinary Gains and Losses (see instructions)<br />

10 Ordinary gains and losses not included on lines 11 through 16 (include property held 1 year or less)<br />

ATTACHMENT 1 3 105,524.<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

Loss. if any. from ine 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

Gain, if any, from line 7 or amount from line 8, if applicable I I - I U - I D U I I I I I I - I - - I I . - . . .I .<br />

Gam. -f env. from fine 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

Net gain or (loss) from Form 4684, lines 35 and 42a I I I D . . - I I I I , . - I D U U - D I D I I , . I - . II l<br />

Ordinary gain from installment sales from Form 6252, line 25 or 36 I I I D I D . - I I I U I U I - D - - D I .- i<br />

Ordinary gain or (loss) from Iikekind exchanges from Form 8824 I . . U . I I D I . . D - I I I . U . I I D I DD I<br />

Combine 1-nes 101hwuQh16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

For all except individual returns, enter the amount from line 17 on the appropriate line of your return and skip lines a<br />

and b below For individual returns, complete lines a and b below<br />

If the loss on line 11 includes a loss from Form 4684, line 39, column (b)(ii), enter that part of the loss here Enter the<br />

part ot the loss from income-producing property on Schedule A (Form 1040), line 28, arid the part ot the loss from<br />

property used as an employee on Schedule A (Form 1040), line 23 Identify as from "Form 4797, line 18a "<br />

599 lflSlfUCU0f1S . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

b Redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a Enter here and on Form 1040,<br />

line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .<br />

For Paperwork Reduction Act Notice, see separate instructions.<br />

9X261O 1 000<br />

518106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865<br />

.lutiil<br />

.il<br />

Eli.. .$.11<br />

.,212 Eli<br />

17 105,524.<br />

18a<br />

18b<br />

Form 4797 (zoos)

JSA<br />

Form mv (2009, .I 92-0087 9, page<br />

m Gain From osition of Property Under Sections 1245, 1250, 1252, 1254, an 255<br />

Y (see instructions)<br />

-19 (a) Description of section 1245, 1250, 1252, 1254, or 1255 property (b?rEgtIedg$?L#"):d 8rcrl)0D.iitSy?cc?)<br />

P rt P C<br />

i These columns relate to the properties on lines 19A through 19D P rope y A rope,-ty B Property Property D<br />

20 Gross sales price (Note:See I/ne 1 before completing) 20<br />

21 Cost or other basis plus expense of sale I I I I II I 21<br />

22 Depreciation (or depletion) allowed or allowable I I I 22<br />

23 Adjusted basis Subtract line 22 from line 21 I I I 23<br />

Q1 Total gain Subtract line 23 from line 20 . . . .. . 24<br />

25 lf section 1245 property.<br />

a Depreciation allowed or allowable from line 22 I I I 25a<br />

b Enter the smallerof line 24 or 25a . . . . . . .. . 25b<br />

26 If section 1250 property lf straight line depreciation was<br />

used, enter -0- on line 269, except for a corporation subject I<br />

to section 291<br />

a Additional depreciation after 1975 (see instn.rctions)I 26a<br />

b Applicable percentage multiplied by the smaller of<br />

line 24 or lrne 26a (see instructions) I I I I , , ,I I 2Sb<br />

C Subtract line 26a from line 24 If residential rental property<br />

or line 24 is not more than line 26a, skip lines 26d and 26e I 26c<br />

d Additional depreciation after 1969 and before 1976 I 26d<br />

e Enter the smaller of line 26c or 26d I I I I I I II I 26e<br />

f Section 291 amount (corporations only) I I I I ,, , 26f<br />

i g Add lines 26b, 26e, and 261 I , I I I I I I I II I 253<br />

27 If section 1252 property Skip this section ifyou did not<br />

dispose of farmland or it this form is being completed for a<br />

partnership (other than an electing large partnership)<br />

a Soil, water, and land clearing expenses I I I I II I 27a<br />

b Line 27a multiplied by applicable percentage (see instructions) I I I 27b<br />

i c Enter the smaller of line 24 or 27b , , , , , , ,, , 271:<br />

28 If section 1254 property:<br />

a Intangible drilling and development costs, expenditures for<br />

development of mines and other natural deposits, mining<br />

exploration costs, and depletion (see instructions) I I I I I 28a<br />

i b Enter the smaller of line 24 or 28a . . . . . . .. . 28b<br />

29 lf section 1255 property:<br />

a Applicable percentage of payments excluded from<br />

income under section 126 (see instructions)I I I I I 29a<br />

i b Enter the smaller of line 24 or 29a (see instructions), 29h<br />

Summary of Part III Gains. Complete property colum ns A through D through line 29b before going to line 30<br />

30 Total gains for all properties Add property columns A through D, line 24 I I I I I I I I I I I I I I I I I I I I I II I 30<br />

31 Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b Enter here and online 13 I I I I I I I I I II I 31<br />

32 Subtract line 31 from line 30 Enter the portion from casualty or theft on Fomi 4684, line 37 Enter the portion from<br />

other than casualty or theft on Form 4797, line 6 I I I I I I I I I I I I I I I I I I I I I I I I I I I I I I I I II I 32<br />

Part IV Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to 50% or Less<br />

(see instructlons)<br />

33 Section 179 expense deduction or depreciation allowable in pnor years I I I I I I I I I I II I 33<br />

34 Recomputed depreciation (see instnictions) I I I I I I I I I I I I I I I I I I I I I I I I II I 34<br />

35 Recapture amount Subtract line 34 from line 33 See the instructions for where to report . . . . . 35<br />

sxzezorooo 518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865<br />

1 ,<br />

(a) Section (b) Section<br />

79 280F(b)(2)<br />

2<br />

Form 4797 (2009)

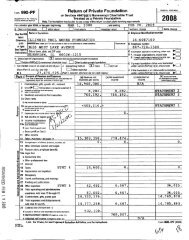

THE CIRI FOUNDATION 92-0087914<br />

cAPiT . GA FORM Ns ANO 990-PF Losses FOR - TAX PART ON iNvEsTivi iv E* iNcOiviE<br />

P<br />

Kind Of Property Description Or Date Date sold<br />

D acquired<br />

Gross sale Depreciation Cost or FMV Adi basis Excess of Gain<br />

price less allo wed/ other , as of as of FMV Over Or<br />

expenses of sale all-(Ma-bje (13315 1231-L5.9 *L2L3j-L59 adi basis - (loss)<br />

SECURITIES P VARIOUS VARIOUS<br />

PROPERTY TYPE: SECURITIES<br />

19335819. 20868468. -1532649.<br />

NET PASS THROUGH LOSSES FROM ALTERNATIVE P VARIOUS VARIOUS<br />

PROPERTY TYPE: SECURITIES<br />

-284,485.<br />

TOTAL GAIN(LOSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... -1817134.<br />

JSA<br />

9E 1 730 1 000<br />

518106 1832 10/1/2010 1:45:09 AM V 09-8.1 418865

THE CIRI FOUNDATION 92-0087914<br />

0 ATTAQHEZNT 8<br />

FORM 99OPF, PART III - OTHER INCREASES IN NET WORTH OR FUND BALANCES<br />

DESCRIPTION AMOUNT<br />

UNREALIZED GAINS ON INVESTMENTS 9,834,698.<br />

TOTAL 9,834l698.<br />

518106 1832 10/1/2010 1:45:09 AM V O9-8.1 418865<br />

ATTACHMENT 8

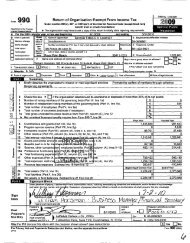

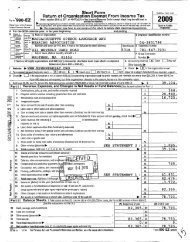

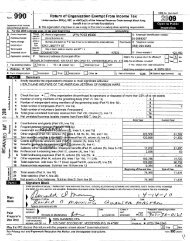

THE CIRI FOUNDATI$ 92-0087914<br />

X / 2009 THE CIRI FOUNDATION<br />

02 05 09 Name: -Zig-1<br />

*ffQfx/ SCHOLARSHIP AND GRANT APPLICATION<br />

The CIRI Foundation<br />

The mission of The CIRI Foundation (TCF) is to promote individual self-development and economic selfsufficiency<br />

through education and to maintain pride in culture and heritage among Alaska Natives. The<br />

Foundation supports the education and career development of eligible original enrollees of Cook Inlet<br />

Region and their direct lineal descendants through post-secondary scholarships and grants.<br />

Application Package, The materials listed below must be received by The CIRI Foundation on or before the<br />

appropriate deadline for full consideration. All scholarships and grants are awarded subiect to availability of funds.<br />

. Completed four-page application - signed and dated<br />

. Proof of eligibility for first-time applicant (Birth certificates and/or name change documents)<br />

. Letter of re<strong>fe</strong>rence - signed, dated, and with contact information (valid for three years)<br />

Copy of most recent official grade transcripts or certificates of completion<br />

Statement of purpose<br />

Proof of acceptance/enrollment/registration confirmation from school<br />

Updated class schedule<br />

8. Photograph of yourself (optiona/-P/ease note that your photograph becomes the property of TCF and may be<br />

used in TCF pub//cations)<br />

lj 9 Release of information consent form (optional, available on our website)<br />

** DO NOT LEAVE ANY BLANKS ON YOUR APPLICATION FORM **<br />

*PLEASE PRINT LEGIBLY*<br />

A. ELIGIBILITY- CHECK ALL THAT APPLY<br />

1 I certify that I am: i EI an Original Enrollee D Erggliig Lmeai Descendant of an Original i III a Tribal Member<br />

lj Cook Inlet Region, Inc, (CIRI) lj Ninilchik Native Association, Inc. El Salamatof Native Association (SNA1)<br />

56<br />

descendant of this Reiauonshlp * *<br />

3 Original Enrollee:<br />

ciii 9 a<br />

Cl Parent El Grandparent lj Great-Grandparent<br />

Cir<br />

B. PERSONAL DATA<br />

Name (Last, First, M1 )<br />

4<br />

Mailing Address (correspondence will be mailed fwfr) E-mail address (correspondence will be emailed here)<br />

CIW I Sta<strong>fe</strong> ZIP C032 Date of Birth Gender<br />

a lj Tyonek Native Corporation EI Native Village of Tyonek lj Salamatof Native Association Spouse<br />

Name (I-353 Flfsfi M 1 ) Other Last Names Used<br />

2 I am a direct lineal<br />

7 Tel No ( ) , Fax No ( ) <br />

8<br />

Are you related to a current Board member of The CIRI Foundation?<br />

lj No lj Yes (specify who and your relationship to them)<br />

Slibiiiit yri.ir #ppl-rawor to<br />

The CIRI Foundation<br />

3600 San Jeioiiimo Drive, Ste 256, Aiicliortii-ge, AK 99508<br />

Tel (Q07) 793-3575 // Toll-Free (800) 764 3382 // Fax (907) 793 358%<br />

Wet-si:e i-.iw-.-. tiiecirifot-ndation org // E."-rail: tcf@thecirifoundation org Page 1<br />

ATTACHMENT I0

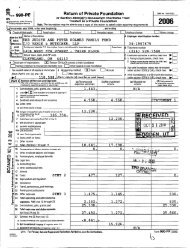

THE CIRI FOUNDATION 92-0087914<br />

l, / 2009 THE CIRI FOUNDATION<br />

-*-lffg3Y/ SCHOLARSHIP AND GRANT APPLICATION<br />

The C IRI Foundation<br />

02.06.09 Name: -*-iii<br />

C. APPLICATION CATEGORY AND DEADLINE (see flow chart on page 11)<br />

Please indicate the deadline you are applying for: CHOOSE QNE<br />

Scholarship Award Deadlines (TCF & Village) Grant Award Deadlines (TCF & Village)<br />

I D June 1 lj December 1<br />

9 General Semester and General Semester El Mal"Cl"l 31 U June 30 D September" 30 EI D@CBlTlbSl* 1<br />

Annual Awards only<br />

lo Have you applied before? lj No lj Yes, during the year (specify).<br />

Other names used (if any). I<br />

D. EDUCATION & RELATED ACTIVITIES<br />

Education Level/Date of completion: Check all that aggly<br />

lj Currently in High School III Have 2-year Associates degree<br />

11 A<br />

12<br />

lj High School Graduate lj Have 4-year Degree<br />

lj General Education Diploma (GED) EI Have Masters Degree or Ph.D<br />

El Have VOCBUODBI training/C@FlIflCBIB lj Have not been enrolled in the past five years<br />