Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FACT BOOK<br />

2007

2006 TSE STATISTICAL HIGHLIGHTS<br />

Stock Market<br />

Listed Companies [Domestic] .......................................................................................... 2,391<br />

[Foreign] .................................................................................................. 25<br />

Newly Listed Companies [Domestic] ............................................................................................. 113<br />

[Foreign] .................................................................................................... 1<br />

Market Value (¥ mils.) [Domestic] ............................................................................... 549,789,371<br />

Trading Value (¥ mils.) [Domestic] ............................................................................... 673,762,460<br />

[Foreign] ......................................................................................... 153,788<br />

Trading Volume [Domestic] ............................................................................... 502,463,349<br />

(thous. shs.) [Foreign] ........................................................................................... 14,667<br />

Bond Market<br />

Listed Issues [Domestic] ............................................................................................. 373<br />

[Foreign] .................................................................................................... 0<br />

Market Value (¥ mils.) ................................................................................................. 562,273,335<br />

Trading Value (¥ mils.) ........................................................................................................ 594,112<br />

Trading Volume (¥ mils.) ........................................................................................................ 525,920<br />

(Par Value)<br />

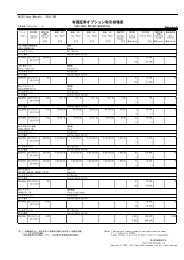

Derivative Markets<br />

Trading Volume (¥ 100 mils.) [5-Year Japanese Government Bond Futures]......................................... —<br />

[10-Year Japanese Government Bond Futures] ........................ 11,950,101<br />

(¥ mils.) [TOPIX Futures] ......................................................................... 14,907,723<br />

[TOPIX Sector Index Futures] .................................................................. —<br />

(contracts) [Options on Japanese Government Bond Futures] ..................... 2,060,624<br />

[TOPIX Options]................................................................................ 18,354<br />

[Equity Options].............................................................................. 190,876<br />

Open Interest (¥ 100 mils.) [5-Year Japanese Government Bond Futures]......................................... —<br />

[10-Year Japanese Government Bond Futures] ............................. 131,772<br />

(¥ mils.) [TOPIX Futures] .............................................................................. 369,690<br />

[TOPIX Sector Index Futures] .................................................................. —<br />

(contracts) [Options on Japanese Government Bond Futures] .......................... 16,987<br />

[TOPIX Options].................................................................................. 2,176<br />

[Equity Options]................................................................................ 39,428<br />

High 1,783.72 April 7<br />

TOPIX (Tokyo Stock Price Index) Low 1,458.30 June 13<br />

Year-end 1,681.07 (+31.31)<br />

Liability<br />

While every effort has been taken to ensure that the data contained in this FACT BOOK 2007 is free from error, TSE does<br />

not accept any responsibility for any damages or losses suffered as a result of using any of the data in any way.

STOCK<br />

MARKET<br />

STOCK PRICE<br />

INDEX<br />

LISTING<br />

DERIVATIVE<br />

MARKETS<br />

BOND<br />

MARKETS<br />

INVESTORS<br />

SECURITIES<br />

COMPANIES<br />

SECURITIES<br />

TAXATION<br />

CROSS BORDER<br />

CAPITAL FLOW<br />

HISTORICAL<br />

DATA<br />

GLOBAL AND<br />

REGIONEL<br />

ORGANIZATIONS<br />

ORGANIZATIONAL<br />

STRUCTURE<br />

TRADING<br />

PARTICIPANT<br />

LIST<br />

TABLE OF CONTENTS<br />

THE YEAR 2006 IN REVIEW ............................................................................................................1<br />

STOCK MARKET<br />

Stock Trading Activities ...........................................................................................................................2<br />

Trading Volume & Value / 50 Most Active Stocks / Stock Transactions by Types of Investors /<br />

Trading Value of Listed Stocks on All Stock Exchanges / TSE Listed Foreign Stocks<br />

Trading Mechanism ..................................................................................................................................7<br />

Order-Driven Market / Trading Units / Tick Size / Daily Price Limits / Special Quote Parameters /<br />

System Diagram / Margin Transactions / Proportion of Margin Transactions to Regular Transactions /<br />

Off-Auction Trading<br />

Clearing & Settlement............................................................................................................................14<br />

Clearing & Settlement / Clearing, Settlement & Custody of Foreign Stocks<br />

STOCK PRICE INDEX<br />

TOPIX (Tokyo Stock Price Index)...........................................................................................................17<br />

TOPIX Daily Closing Value, 2006 ...........................................................................................................18<br />

TOPIX Sub-indices ..................................................................................................................................19<br />

TOPIX New Index Series ........................................................................................................................21<br />

Other Key Indices....................................................................................................................................22<br />

Average Price Earnings & Price Book Value Ratios / Dividend Yields<br />

LISTING<br />

Listing Regulations .................................................................................................................................23<br />

Listing Criteria / Numerical Criteria / Listing Fees<br />

Mothers....................................................................................................................................................27<br />

Listing Criteria / Delisting Criteria / Listing Fees<br />

Foreign Stocks.........................................................................................................................................29<br />

Listing Criteria / Listing Fees<br />

Investment Trusts ...................................................................................................................................31<br />

ETF / REIT<br />

Listed Companies....................................................................................................................................33<br />

Overview / Newly Listed, Delisted, First Section Assigned & Second Section Reassigned Companies /<br />

Foreign Companies Listed on TSE<br />

Timely Disclosure Network System (TDnet) ........................................................................................38<br />

Listed Company Awards ........................................................................................................................39<br />

Financing..................................................................................................................................................40<br />

DERIVATIVE MARKETS<br />

Derivative Markets in TSE......................................................................................................................42<br />

Trading Activities & Contract Specifications .......................................................................................43<br />

Index Futures / TOPIX Sector Index Futures / TOPIX Options / Equity Options / Japanese Government<br />

Bond Futures / Options on Japanese Government Bond Futures<br />

Coordination between Cash & Derivative Markets .............................................................................53<br />

Temporary Trading Halts / Temporary Restriction on Index Arbitrage Trading / Index Arbitrage &<br />

Program Trading<br />

BOND MARKETS<br />

Bond Trading Activities ..........................................................................................................................56<br />

Trading Specifications ............................................................................................................................58<br />

Listing Regulations .................................................................................................................................59<br />

Listing & Delisting Criteria / Listing Fees

INVESTORS<br />

Shareownership......................................................................................................................................61<br />

Shareownership by Market Value / Number of Shareholders<br />

Investment Plans.....................................................................................................................................63<br />

Employee Stock Ownership Plans<br />

Financial Assets of Individuals...............................................................................................................64<br />

SECURITIES COMPANIES<br />

Overview of Securities Companies .......................................................................................................65<br />

Income Statements of TSE Trading Participants.................................................................................66<br />

SECURITIES TAXATION<br />

Tax on Capital Gain from Listed Stocks, etc. .......................................................................................67<br />

Tax on Dividends, Interest .....................................................................................................................68<br />

CROSS BORDER CAPITAL FLOW<br />

Securities Investment.............................................................................................................................69<br />

Inward and Outward Investments in Securities<br />

HISTORICAL DATA<br />

Historical Highlights ...............................................................................................................................70<br />

Stock Trading Volume (Domestic Stocks)............................................................................................71<br />

Stock Trading Value (Domestic Stocks) ...............................................................................................72<br />

Stock Trading Value on All Stock Exchanges ......................................................................................73<br />

Number of Listed Companies and Shares, Market Value ...................................................................74<br />

Equity Financing (All Listed Companies) ..............................................................................................75<br />

TSE Listed Foreign Stocks .....................................................................................................................76<br />

TOPIX .......................................................................................................................................................77<br />

10 Largest Day-to-Day Fluctuations in TOPIX ......................................................................................78<br />

Nikkei 225 ................................................................................................................................................79<br />

GLOBAL AND REGIONAL ORGANIZATIONS<br />

WFE ..........................................................................................................................................................80<br />

AOSEF ......................................................................................................................................................81<br />

ORGANIZATIONAL STRUCTURE ..............................................................................................82<br />

TRADING PARTICIPANT LIST.......................................................................................................83<br />

Remarks<br />

1. The specific symbols in the statistical tables are as follows;<br />

"0" Fractional or less than the unit.<br />

"–" Nil, no figures or N/A<br />

2. Figures less than the unit are omitted, except in cases in which a fraction of 0.5 or more is counted<br />

as a whole number and a fraction less than that is omitted.<br />

3. Figures for stocks are those for common stocks unless otherwise noted.<br />

4. Figures are those for TSE unless otherwise noted.<br />

STOCK<br />

MARKET<br />

STOCK PRICE<br />

INDEX<br />

LISTING<br />

DERIVATIVE<br />

MARKETS<br />

BOND<br />

MARKETS<br />

INVESTORS<br />

SECURITIES<br />

COMPANIES<br />

SECURITIES<br />

TAXATION<br />

CROSS BORDER<br />

CAPITAL FLOW<br />

HISTORICAL<br />

DATA<br />

GLOBAL AND<br />

REGIONEL<br />

ORGANIZATIONS<br />

ORGANIZATIONAL<br />

STRUCTURE<br />

TRADING<br />

PARTICIPANT<br />

LIST

THE YEAR 2006 IN REVIEW<br />

System Augmentations and Development<br />

of the Next-Generation System<br />

Increases to Capacity of the Current Trading System<br />

In response to the unfortunate series of system-related<br />

problems that occurred at the end of<br />

2005 and the beginning of 2006, the TSE has<br />

pledged to exert our utmost efforts in regaining<br />

the trust of investors in our trading systems, and<br />

improving confidence in the market as a whole.<br />

As a part of these efforts, the TSE promptly<br />

augmented the order-taking capacity of the current<br />

stock/CB trading system. The first augmentation<br />

made in May increased the maximum number<br />

of orders accepted from 9 million to 12 million,<br />

and a second augmentation was made in<br />

November to increase the limit another 2 million<br />

orders to 14 million. In addition, the TSE augmented<br />

the clearing system in May in tandem<br />

with the stock/CB system enhancement, increasing<br />

the maximum number of executions from 5<br />

million to 8.4 million.<br />

Development of Next-Generation System<br />

In addition to these augmentations, the TSE<br />

also began the process for development of the<br />

next-generation trading system. We drew up the<br />

basic concept for the new system, placing a priority<br />

on four aspects: reliability and stability, scalability,<br />

speed, and robustness. The TSE plans to<br />

begin operation of the system, which is expected<br />

to set the highest standard in the world, in 2009.<br />

Improving Convenience for Investors<br />

Introduction of TOPIX 1000 CSR (Corporate Social<br />

Responsibility) Index<br />

The TSE has begun calculating the TOPIX<br />

1000 CSR customized index in order to meet the<br />

needs of investors wanting to invest in companies<br />

who proactively contribute to society. In determining<br />

the component stocks for this index, previously<br />

known as the TOPIX 1000 FLOAT index, the<br />

TSE applies a screening process that incorporates<br />

the element of CSR to the 1,000 domestic issues<br />

listed on the TSE First Section that have the highest<br />

market capitalization and liquidity.<br />

1<br />

Introduction of Equity Options Supporters System<br />

The TSE introduced the Equity Options<br />

Supporters system in June in response to the difficulty<br />

that some individual investors had experienced<br />

in finding securities companies who deal in<br />

equity options. The goal of the system is to<br />

enable easier access for individual investors to the<br />

TSE equity options market by designating trading<br />

participants active in equity options as "TSE Equity<br />

Options Supporters," and enlisting these<br />

Supporters' cooperation in trouble-free completion<br />

and promotion of equity transactions in the<br />

TSE market.<br />

International Cooperation<br />

Conclusion of Memorandums of Understanding<br />

(MOUs) with Exchanges Abroad<br />

As globalization continues to gain momentum<br />

in the financial industry, the TSE is keenly aware<br />

of the need to develop and strengthen connections<br />

with other exchanges and financial institutions<br />

abroad, and amplify its presence on the<br />

international stage. In achieving this, the TSE has<br />

been diligently signing Memorandums of<br />

Understanding with exchanges all around the<br />

world, with the aim of sharing useful information<br />

in areas such as listed products, regulation, and<br />

technology. This year alone, the TSE has concluded<br />

MOUs with exchanges in Shenzhen, Shanghai,<br />

Taiwan, Korea, and India, and in addition to these<br />

leading Asian exchanges, the TSE has also begun<br />

negotiations on specific business alliances with<br />

the foremost exchanges in America and Europe.<br />

Expanded use of TOPIX-based Exchange Traded<br />

Funds (ETFs) in Europe<br />

Following the introduction of the first TOPIX<br />

ETF on the Euronext market in 2005, additional<br />

TOPIX-based ETFs were introduced on other<br />

European markets such as Deutsche Borse and<br />

Borsa Italiana in 2006. These funds enable<br />

European investors to easily access the Japanese<br />

equity market from their home exchange, thereby<br />

encouraging the cross-border flow of capital<br />

between Japan and Europe.

STOCK MARKET<br />

Stock Trading Activities<br />

Stock Trading Volume & Value<br />

There are three kinds of stock trading methods<br />

on TSE — (1) "regular" transactions settled on<br />

the third business day following the day of the<br />

contract, (2) "cash" transactions settled on the day<br />

of the contract or on the next business day, and<br />

(3) "when issued" transactions settled in new<br />

shares after their issuance. In practice, "regular"<br />

transactions account for the majority of trading.<br />

2<br />

The total trading volume in 2006 increased to<br />

502.4 billion shares, with a daily average of 2,026<br />

million shares. The total trading value and daily<br />

average trading value increased to 673.7 trillion<br />

yen and 2,717 billion yen, respectively.<br />

The turnover ratio on a volume basis increased<br />

to 146.8%, and the turnover ratio on a value basis<br />

rose to 123.7%.<br />

Stock Trading Volume & Value (Domestic Stocks)<br />

No. of<br />

Trading<br />

Days<br />

Volume (mils. of shares)<br />

Total Daily<br />

Average<br />

Turnover<br />

Ratio (%)<br />

(based on<br />

volume)<br />

Value (¥ 100 mils.)<br />

Total<br />

Daily<br />

Average<br />

Turnover<br />

Ratio (%)<br />

(based on<br />

value)<br />

1st section (Daily Average)<br />

Trading<br />

Volume<br />

(mils. of<br />

shares)<br />

Trading<br />

Value<br />

(¥ 100mils.)<br />

2002 246 213,173 867 64.7 1,933,545 7,860 71.0 843 7,759<br />

2003 245 316,124 1,290 97.0 2,423,712 9,893 85.9 1,254 9,710<br />

2004 246 378,755 1,540 113.6 3,431,211 13,948 100.8 1,451 13,167<br />

2005 245 558,901 2,281 166.0 4,917,723 20,072 108.8 2,075 18,740<br />

2006 248 502,463 2,026 146.8 6,737,624 27,168 123.7 1,927 25,980<br />

Jan. 19 51,854 2,729 15.4 670,899 35,311 12.2 2,495 32,726<br />

Feb. 20 50,161 2,508 14.9 661,237 33,062 12.0 2,334 31,171<br />

Mar. 22 44,497 2,023 13.1 587,187 26,690 10.6 1,904 25,331<br />

Apr. 20 40,472 2,024 11.9 594,082 29,704 10.6 1,911 28,464<br />

May 20 41,300 2,065 12.1 585,429 29,271 10.9 1,994 28,483<br />

June 22 45,171 2,053 13.2 582,645 26,484 11.3 1,960 25,508<br />

July 20 36,216 1,811 10.6 471,908 23,595 9.2 1,734 22,780<br />

Aug. 23 40,813 1,774 11.9 515,778 22,425 9.9 1,678 21,360<br />

Sept. 20 35,501 1,775 10.3 471,126 23,556 9.0 1,720 22,697<br />

Oct. 21 39,484 1,880 11.5 563,742 26,845 10.7 1,823 26,005<br />

Nov. 20 37,247 1,862 10.7 514,492 25,725 9.8 1,810 24,977<br />

Dec. 21 39,742 1,892 11.4 519,092 24,719 9.7 1,836 23,525<br />

Note:<br />

1. Turnover ratio (based on volume) = (trading volume / average no. of listed shares) × 100.<br />

Average no. of listed shares = (previous year (month) end no. of listed shares + present year (month) end no. of<br />

listed shares) ÷ 2.<br />

2. Turnover ratio (based on value) = (trading value / average market capitalization) × 100.<br />

Average market capitalization = (previous year (month) end market capitalization + present year (month) end market<br />

capitalization) ÷ 2.<br />

STOCK<br />

MARKET

STOCK<br />

MARKET<br />

50 Most Active Stocks of 2006 (Value)<br />

Rank Code Stocks<br />

Value<br />

(¥ bils.)<br />

Rank Code Stocks<br />

Value<br />

(¥ bils.)<br />

1 9984 SOFTBANK 24,486 26 9433 KDDI 3,624<br />

2 8411 Mizuho Financial Group 18,446 27 8830 Sumitomo Realty & Development 3,465<br />

3 8306 Mitsubishi UFJ Financial Group 15,877 28 8031 MITSUI 3,459<br />

4 7203 TOYOTA MOTOR 13,954 29 8601 Daiwa Securities Group 3,440<br />

5 8316 Sumitomo Mitsui Financial Group10,948 30 8801 Mitsui Fudosan 3,427<br />

6 6758 SONY 9,205 31 8591 ORIX 3,362<br />

7 5401 NIPPON STEEL 8,574 32 4063 Shin-Etsu Chemical 3,344<br />

8 7751 CANON 7,952 33 4503 Astellas Pharma 3,316<br />

9 5405 Sumitomo Metal Industries 6,629 34 6701 NEC 3,242<br />

10 7267 HONDA MOTOR 6,539 35 5713 Sumitomo Metal Mining 3,135<br />

11 9437 NTT DoCoMo 6,196 36 8473 SBI Holdings 3,115<br />

12 8604 Nomura Holdings 5,917 37 2914 JAPAN TOBACCO 3,058<br />

13 8308 Resona Holdings 5,851 38 9020 East Japan Railway 2,944<br />

14 4502 Takeda Pharmaceutical 5,840 39 6954 FANUC 2,849<br />

15 8058 Mitsubishi 5,503 40 6753 Sharp 2,826<br />

16 7201 NISSAN MOTOR 5,260 41 6902 DENSO 2,792<br />

17 6502 TOSHIBA 4,798 42 6971 KYOCERA 2,779<br />

18 8802 Mitsubishi Estate 4,711 43 8603 Nikko Cordial 2,754<br />

19 6752 Matsushita Electric Industrial 4,400 44 4689 Yahoo Japan 2,728<br />

20 5411 JFE Holdings 4,250 45 9501 The Tokyo Electric Power 2,644<br />

21 9432 NIPPON TELEGRAPH AND TELEPHONE 4,190 46 6501 Hitachi 2,558<br />

22 8035 Tokyo Electron 4,174 47 6702 FUJITSU 2,531<br />

23 3382 Seven & I Holdings 4,173 48 8766 Millea Holdings 2,479<br />

24 6301 KOMATSU 3,983 49 4901 FUJIFILM Holdings 2,463<br />

25 6857 ADVANTEST 3,707 50 6988 NITTO DENKO 2,385<br />

Total trading value of 50 most active stocks (A) 270,306<br />

Total trading value of all listed domestic stocks (B) 673,762<br />

Ratio (A/B) 40.1%<br />

Note: Total trading value includes all stocks listed on the 1st Section, 2nd Section, and Mothers (excluding listed foreign<br />

stocks).<br />

3

Stock Transactions by Types of Investors (Tokyo, Osaka & Nagoya)<br />

2003 Buy<br />

Trading Participants' own accounts<br />

Individuals<br />

Foreigners<br />

Insurance Companies<br />

Banks<br />

Investment Trusts<br />

Business Corporations<br />

Others<br />

Total<br />

69,783<br />

39,757<br />

72,380<br />

1,016<br />

20,652<br />

3,025<br />

4,370<br />

6,584<br />

217,570<br />

2004 Buy<br />

Trading Participants' own accounts<br />

Individuals<br />

Foreigners<br />

Insurance Companies<br />

Banks<br />

Investment Trusts<br />

Business Corporations<br />

Others<br />

Total<br />

90,482<br />

66,056<br />

106,226<br />

682<br />

22,066<br />

5,123<br />

5,510<br />

7,551<br />

303,701<br />

2005 Buy<br />

Trading Participants' own accounts<br />

Individuals<br />

Foreigners<br />

Insurance Companies<br />

Banks<br />

Investment Trusts<br />

Business Corporations<br />

Others<br />

Total<br />

117,825<br />

123,252<br />

153,762<br />

717<br />

28,251<br />

8,915<br />

8,413<br />

7,317<br />

448,456<br />

2006 Buy<br />

Trading Participants' own accounts<br />

Individuals<br />

Foreigners<br />

Insurance Companies<br />

Banks<br />

Investment Trusts<br />

Business Corporations<br />

Others<br />

Total<br />

164,396<br />

149,255<br />

243,105<br />

1,027<br />

35,206<br />

9,530<br />

8,118<br />

7,293<br />

617,933<br />

4<br />

Sell<br />

68,976<br />

41,409<br />

64,166<br />

2,123<br />

26,456<br />

3,166<br />

4,594<br />

6,469<br />

217,363<br />

Sell<br />

88,947<br />

69,729<br />

98,573<br />

1,199<br />

26,462<br />

4,660<br />

5,685<br />

8,088<br />

303,347<br />

Sell<br />

119,573<br />

127,248<br />

143,440<br />

1,277<br />

33,150<br />

8,160<br />

7,061<br />

8,152<br />

448,064<br />

Sell<br />

164,104<br />

144,874<br />

248,634<br />

877<br />

32,046<br />

11,237<br />

10,137<br />

6,016<br />

617,927<br />

Note:<br />

1. Figures are based on domestic stock transactions at Tokyo, Osaka, and Nagoya Stock Exchanges.<br />

2. Figures are derived from regular Trading Participants with capital of 3 billion yen or more.<br />

3. Foreigners are individual foreigners and foreign corporations.<br />

(¥ bils.)<br />

Net<br />

806<br />

–1,652<br />

8,213<br />

–1,107<br />

–5,803<br />

–141<br />

–224<br />

115<br />

206<br />

Net<br />

1,535<br />

–3,672<br />

7,652<br />

–517<br />

–4,395<br />

463<br />

–175<br />

–536<br />

354<br />

Net<br />

–1,748<br />

–3,995<br />

10,321<br />

–560<br />

–4,897<br />

755<br />

1,352<br />

–834<br />

392<br />

Net<br />

–292<br />

–4,381<br />

5,528<br />

–149<br />

–3,160<br />

1,707<br />

2,019<br />

–1,277<br />

–5<br />

STOCK<br />

MARKET

STOCK<br />

MARKET<br />

Trading Value of Listed Stocks on All Stock Exchanges<br />

Nagoya<br />

0.1%<br />

Other<br />

0.008%<br />

Share of Stock Trading Value (2006)<br />

Osaka<br />

3.7%<br />

Tokyo 87.9%<br />

5<br />

Jasdaq<br />

3.0%<br />

Trading outside<br />

of Exchanges<br />

5.2%<br />

Total Tokyo Osaka Nagoya<br />

2002 2,252,012 1,933,545 147,276 10,654<br />

2003 2,712,810 2,423,712 123,560 5,352<br />

2004 3,784,220 3,431,211 134,717 6,591<br />

2005 5,620,763 4,917,723 226,568 7,355<br />

2006 7,661,229 6,737,624 284,372 8,850<br />

(¥ 100 mils.)<br />

Fukuoka Sapporo Jasdaq<br />

Trading outside<br />

of Exchanges<br />

2002 554 263 — 159,718<br />

2003 671 124 — 159,388<br />

2004 305 34 — 211,359<br />

2005 546 153 195,391 273,024<br />

2006 279 365 232,877 396,857<br />

Note: Trading value of foreign stocks are not included.

STOCK<br />

MARKET<br />

6<br />

TSE Listed Foreign Stocks<br />

Daily<br />

Average<br />

Total<br />

Value (¥ mils.)<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

Jan.<br />

Feb.<br />

Mar.<br />

Apr.<br />

May<br />

June<br />

July<br />

Aug.<br />

Sept.<br />

Oct.<br />

Nov.<br />

Dec.<br />

13,364<br />

6,419<br />

8,016<br />

13,082<br />

14,667<br />

4,971<br />

2,181<br />

1,344<br />

1,254<br />

590<br />

498<br />

414<br />

1,017<br />

484<br />

450<br />

664<br />

794<br />

54<br />

26<br />

33<br />

53<br />

59<br />

262<br />

109<br />

61<br />

63<br />

30<br />

23<br />

21<br />

44<br />

24<br />

21<br />

33<br />

38<br />

53,593<br />

24,386<br />

62,931<br />

312,796<br />

153,788<br />

40,299<br />

20,277<br />

11,507<br />

24,757<br />

7,844<br />

5,327<br />

5,273<br />

8,830<br />

5,000<br />

4,455<br />

5,804<br />

14,410<br />

217<br />

99<br />

256<br />

1,277<br />

620<br />

2,121<br />

1,014<br />

523<br />

1,238<br />

392<br />

242<br />

264<br />

384<br />

250<br />

212<br />

290<br />

686<br />

246<br />

245<br />

246<br />

245<br />

248<br />

19<br />

20<br />

22<br />

20<br />

20<br />

22<br />

20<br />

23<br />

20<br />

21<br />

20<br />

21<br />

34<br />

32<br />

30<br />

28<br />

25<br />

28<br />

28<br />

27<br />

27<br />

27<br />

27<br />

26<br />

26<br />

24<br />

24<br />

24<br />

25<br />

Daily<br />

Average<br />

Total<br />

Volume (thousand shares)<br />

No. of<br />

Trading<br />

Days<br />

No. of<br />

Listed<br />

Companies

STOCK<br />

MARKET<br />

Trading Mechanism<br />

An Entirely Order-Driven Market<br />

The TSE market operates as a continuous auction,<br />

where buy and sell orders interact directly<br />

with one another.<br />

All orders, whether limit or market orders, are<br />

placed by broker/dealer trading participants (see<br />

table on next page for tick size) and matched in<br />

accordance with price priority and time priority<br />

rules. Under the price priority rule, a sell (buy)<br />

order with the lowest (highest) price takes precedence.<br />

Under the time priority rule, an earlier order<br />

takes precedence over others at the same price.<br />

Thus, when the lowest sell and highest buy orders<br />

match in price, the transaction is executed at the<br />

price. In short, the TSE market is a pure order-driven<br />

market with no market-makers.<br />

There are two transaction methods: itayose<br />

and zaraba. The itayose method is used mainly to<br />

decide opening and closing prices. Under this<br />

method, the time priority rule is not applied and<br />

numerous orders placed before price setting are<br />

matched in aggregate. In other words, if a sell<br />

(buy) order with a lower (higher) price than the<br />

opening price is placed before the market opens,<br />

it will be executed at the opening price regardless<br />

of size. In contrast, under the zaraba method,<br />

both the price priority and time priority rules are<br />

applied, and pairs of buy and sell orders are<br />

matched continuously.<br />

In addition, the TSE adopts the following<br />

unique measures to prevent wild short-term fluctuations<br />

in prices. These measures not only help<br />

ensure price continuity, but also in effect work as<br />

"circuit breakers" in an emergency.<br />

(1) Special Bid & Asked Quotes<br />

When there is a major imbalance in orders,<br />

Trading units of listed companies<br />

7<br />

special bid or asked quotes are indicated. Special<br />

quotes are disseminated publicly through the TSE<br />

market information system. If counter orders<br />

come into the market and the orders are matched<br />

at that price, the quote is withdrawn.<br />

Conversely, if the imbalance continues, the<br />

special quotes are revised up or down within certain<br />

parameters (see table on next page), at intervals<br />

of at least five minutes until the imbalance is<br />

resolved.<br />

(2) Daily Price Limits<br />

In addition to special quotes, the TSE sets<br />

daily price limits for individual stocks to prevent<br />

wild day-to-day swings in stock prices and provide<br />

for a "time-out" in the event of a sharp rise or<br />

decline in price and the resulting reaction from the<br />

investing public. Daily price limits are set in terms<br />

of absolute yen values according, for the sake of<br />

simplicity, to the price range of each stock (see<br />

table on next page). As the price limits prohibit<br />

bids and offers at prices beyond the set limits, the<br />

market for a stock is open for trading within these<br />

limits, even though the stock may have hit a limit.<br />

Daily price limits also apply to special quotes.<br />

Consequently, special quotes cannot be indicated<br />

outside the daily price limit.<br />

(3) Trading Units<br />

Trading units are the minimum amount of<br />

each individual stock that may be traded. With an<br />

amendment made to the Commercial Code in<br />

October 2001 the number of shares which constitute<br />

one unit may now be determined under the<br />

constitution of each listed company.<br />

Trading Unit<br />

First section<br />

Number of companies<br />

Second section Mothers Total<br />

1 share 88 27 172 287<br />

10 shares 19 — 1 20<br />

50 shares 12 1 — 13<br />

100 shares 734 168 9 911<br />

500 shares 39 13 — 52<br />

1,000 shares 822 282 3 1,107<br />

3,000 shares 1 — — 1<br />

Total 1,715 491 185 2,391<br />

* Figures do not include foreign listed companies.<br />

(As of end of 2006)

Daily Price Limits<br />

Previous Day's Closing Price or Daily Price<br />

Special Quote Limits (±)<br />

Less than ¥100 ¥30<br />

Equal to or more than ¥100 ¥200 ¥50<br />

¥200 ¥500 ¥80<br />

¥500 ¥1,000 ¥100<br />

¥1,000 ¥1,500 ¥200<br />

¥1,500 ¥2,000 ¥300<br />

¥2,000 ¥3,000 ¥400<br />

¥3,000 ¥5,000 ¥500<br />

¥5,000 ¥10,000 ¥1,000<br />

¥10,000 ¥20,000 ¥2,000<br />

¥20,000 ¥30,000 ¥3,000<br />

¥30,000 ¥50,000 ¥4,000<br />

¥50,000 ¥70,000 ¥5,000<br />

¥70,000 ¥100,000 ¥10,000<br />

¥100,000 ¥150,000 ¥20,000<br />

¥150,000 ¥200,000 ¥30,000<br />

¥200,000 ¥300,000 ¥40,000<br />

¥300,000 ¥500,000 ¥50,000<br />

¥500,000 ¥1,000,000 ¥100,000<br />

¥1,000,000 ¥1,500,000 ¥200,000<br />

¥1,500,000 ¥2,000,000 ¥300,000<br />

¥2,000,000 ¥3,000,000 ¥400,000<br />

¥3,000,000 ¥5,000,000 ¥500,000<br />

¥5,000,000 ¥10,000,000 ¥1,000,000<br />

¥10,000,000 ¥15,000,000 ¥2,000,000<br />

¥15,000,000 ¥20,000,000 ¥3,000,000<br />

¥20,000,000 ¥30,000,000 ¥4,000,000<br />

¥30,000,000 ¥50,000,000 ¥5,000,000<br />

¥50,00,000 or more ¥10,000,000<br />

Tick Size<br />

Stock Price per Share Tick Size<br />

Up to ¥2,000 ¥1<br />

More than ¥2,000 Up to ¥3,000 ¥5<br />

More than ¥3,000 Up to ¥30,000 ¥10<br />

More than ¥30,000 Up to ¥50,000 ¥50<br />

More than ¥50,000 Up to ¥100,000 ¥100<br />

More than ¥100,000 Up to ¥1,000,000 ¥1,000<br />

More than ¥1,000,000 Up to ¥20,000,000 ¥10,000<br />

More than ¥20,000,000 Up to ¥30,000,000 ¥50,000<br />

More than ¥30,000,000 ¥100,000<br />

8<br />

Special Quote Parameters<br />

Current price<br />

Parameters<br />

(±)<br />

Less than ¥500 ¥5<br />

Equal to or more than ¥500 ¥1,000 ¥10<br />

¥1,000 ¥1,500 ¥20<br />

¥1,500 ¥2,000 ¥30<br />

¥2,000 ¥3,000 ¥40<br />

¥3,000 ¥5,000 ¥50<br />

¥5,000 ¥10,000 ¥100<br />

¥10,000 ¥20,000 ¥200<br />

¥20,000 ¥30,000 ¥300<br />

¥30,000 ¥50,000 ¥400<br />

¥50,000 ¥70,000 ¥500<br />

¥70,000 ¥100,000 ¥1,000<br />

¥100,000 ¥150,000 ¥2,000<br />

¥150,000 ¥200,000 ¥3,000<br />

¥200,000 ¥300,000 ¥4,000<br />

¥300,000 ¥500,000 ¥5,000<br />

¥500,000 ¥1,000,000 ¥10,000<br />

¥1,000,000 ¥1,500,000 ¥20,000<br />

¥1,500,000 ¥2,000,000 ¥30,000<br />

¥2,000,000 ¥3,000,000 ¥40,000<br />

¥3,000,000 ¥5,000,000 ¥50,000<br />

¥5,000,000 ¥10,000,000 ¥100,000<br />

¥10,000,000 ¥15,000,000 ¥200,000<br />

¥15,000,000 ¥20,000,000 ¥300,000<br />

¥20,000,000 ¥30,000,000 ¥400,000<br />

¥30,000,000 ¥50,000,000 ¥500,000<br />

¥50,000,000 or more ¥1,000,000<br />

STOCK<br />

MARKET

STOCK<br />

MARKET<br />

TOKYO STOCK EXCHANGE SYSTEM DIAGRAM<br />

Trading Systems<br />

Stock·CB<br />

Trading<br />

System<br />

[Trading System]<br />

Participants<br />

Futures & Options<br />

Trading System<br />

Name<br />

Stock Trading System<br />

Futures & Options Trading System<br />

CB Trading System<br />

ToSTNeT<br />

Integrated Network<br />

Information System Information Dissemination System<br />

All TSE products, major products of five<br />

Clearing System Clearing System<br />

All TSE products<br />

(*) "Five other exchanges" includes Osaka, Nagoya, Fukuoka, Sapporo, and Jasdaq.<br />

9<br />

ToSTNeT<br />

Integrated<br />

Japan Securities Clearing Corporation<br />

Products<br />

All stocks, preferred shares, real estate<br />

TOPIX Futures, TOPIX Sector Indexes<br />

Convertible bonds, bonds with warrants,<br />

Stocks and domestic convertible bonds

Network<br />

Listed Companies Information Vendors<br />

Investors, etc.<br />

Information<br />

Dissemination<br />

System<br />

/ Clearing System<br />

Index<br />

Calculation<br />

Integrated Network<br />

TDnet<br />

investment trust, etc.<br />

Futures, TOPIX Options, Equity Options, JGB (Japanese Government Bonds) Futures, Options on JGB Futures<br />

warrants, exchangeable bonds, foreign convertible bonds<br />

on off-auction trading<br />

other exchanges (*)<br />

10<br />

Target<br />

Integrated<br />

Platform<br />

Information System<br />

(Public Website etc.)<br />

External<br />

Settlement<br />

System<br />

(JSSC,<br />

JASDEC,<br />

etc.)<br />

STOCK<br />

MARKET

STOCK<br />

MARKET<br />

Margin Transactions<br />

Margin transactions are purchases, sales, or other securities transactions effected on credit extended to<br />

the customer by a securities company.<br />

(1) Margin<br />

Customers buying or selling stocks on margin must make a warranty deposit ("Initial Margin") equivalent<br />

to at least 30% of the transaction value or 300,000 yen (whichever is greater) with the securities company<br />

by noon of the trading day. When the rate of deposited margin to trading value drops below 20% due to<br />

price fluctuation, the customer must deposit additional margin to increase the rate to at least 20%.<br />

(2) There are two types of margin transactions: Standardized Margin Transactions and Negotiable Margin<br />

Transactions<br />

Standardized Negotiable<br />

Lending fee (*1)Regulated All conditions are negotiable<br />

Period of settlement 6 months<br />

Margin issues Selected by TSE All listed issues<br />

(*2)Loan transactions May be used May not be used<br />

(*1) The lending fee is determined in the securities finance company's auction.<br />

(*2) Loan transactions are lending transactions between securities finance companies, which specialize in securities<br />

financing, and securities companies.<br />

(3) Margin issues for standardized margin transactions<br />

The TSE selects as margin issues for standardized margin transactions those issues which meet specific<br />

criteria in the following categories: (1) number of outstanding shares (2) ratio of shares owned by the<br />

"special few" (includes the ten largest shareholders, persons having special interests in the issuer, and the<br />

issuer itself if it holds its own shares) (3) number of shareholders (4) trading volume (5) ratio of trading execution<br />

(6) business results.<br />

Customers<br />

Margin Transactions<br />

Deposit of Margin<br />

Lend<br />

Money/<br />

Securities<br />

Execute "regular"<br />

transactions<br />

Tokyo Stock Exchange, Inc.<br />

Securites<br />

Companies<br />

11<br />

Deposit of Margin<br />

Lend<br />

Money/<br />

Securities<br />

Loan Transactions<br />

Securities<br />

Finance<br />

Companies

Year<br />

Proportion of Margin Transactions to Regular Transactions<br />

Regular Transactions<br />

Trading Trading<br />

Volume (A) Value (B)<br />

(100 mil. shares) (¥ bils.)<br />

Margin Transactions<br />

Trading<br />

Volume (C)<br />

(100 mil. shares)<br />

Trading<br />

Value (D)<br />

(¥ bils.)<br />

12<br />

C/A<br />

%<br />

D/B<br />

%<br />

Rate of<br />

utilization by<br />

individual<br />

Investors<br />

%<br />

1997 2,132 214,237 314 25,882 14.7 12.1 38.8<br />

1998 2,202 165,037 418 24,003 19.0 14.5 36.8<br />

1999 2,870 338,377 576 62,531 20.1 18.5 41.0<br />

2000 3,170 438,515 553 69,635 17.4 15.9 36.9<br />

2001 3,729 363,621 731 58,183 19.6 16.0 34.6<br />

2002 3,778 333,471 764 54,818 20.2 16.4 36.5<br />

2003 5,743 435,431 1,190 68,537 20.7 15.7 46.8<br />

2004 7,011 627,636 1,457 102,405 20.8 16.3 47.1<br />

2005 10,479 901,020 2,341 153,776 22.3 17.1 47.5<br />

2006 9,376 1,252,521 1,777 183,360 19.0 14.6 51.3<br />

Jan. 984 126,299 210 22,017 21.3 17.4 46.9<br />

Feb. 941 122,732 184 19,640 19.6 16.0 49.0<br />

Mar. 829 108,151 160 16,403 19.3 15.2 48.9<br />

Apr. 753 109,348 155 17,340 20.6 15.9 49.8<br />

May 763 108,007 128 13,897 16.8 12.9 51.0<br />

June 842 108,695 155 14,317 18.4 13.2 53.6<br />

July 674 88,150 127 12,634 18.8 14.3 56.1<br />

Aug. 765 96,687 150 14,575 19.6 15.1 53.9<br />

Sept. 666 88,448 121 11,972 18.2 13.5 54.3<br />

Oct. 734 104,488 135 14,636 18.4 14.0 53.2<br />

Nov. 690 95,619 115 12,146 16.7 12.7 55.4<br />

Dec. 735 95,897 137 13,783 18.6 14.4 51.8<br />

Note: 1. Trading volume and value is the combined total of all sales and purchases made in the 1st section, 2nd section, and<br />

Mother's, and includes execution of rights for equity options.<br />

2. Rate of utilization by individual investors is the percentage of the total amount of margin transactions made by<br />

individual investors. (Based on general trading participants with capital of 3 billion yen or more).<br />

STOCK<br />

MARKET

STOCK<br />

MARKET<br />

Off-Auction Trading<br />

The off-auction trading system was implemented<br />

on November 14, 1997 to accommodate<br />

large block order and basket order transactions,<br />

the trading of which is difficult under the competitive<br />

trading principals of auction trading.<br />

In the beginning, processing and such for order<br />

placement and execution was not systemized, and<br />

the conduct structure was limited to parallel transactions<br />

in which securities companies placed a buy<br />

order and a sell order at the same time with the<br />

same conditions. Complete systemization of these<br />

transactions was achieved, however, when the<br />

ToSTNeT electronic transaction system began operation<br />

on June 29, 1998. Negotiation transactions<br />

between securities companies for large block orders<br />

Product<br />

Trading unit<br />

Trading hours<br />

Price range<br />

Tick Size<br />

Transaction<br />

method<br />

Settlement date<br />

13<br />

also became possible with the implementation of<br />

this system. Also, in an effort to improve userfriendliness<br />

for a wide base of individual and other<br />

investors, the ToSTNeT-2 system began operation<br />

on August 7 of the same year for transactions<br />

based on the closing price of auction trading. The<br />

restriction on transaction units was removed in<br />

October of 1999 when the designation "large<br />

block orders" was revised to "single issue orders."<br />

Through this system, the TSE is able to make<br />

trades made by auction, which has a price determining<br />

function, the focus of exchange transactions,<br />

while at the same time maintaining a trading<br />

system that is able to respond to a wide range<br />

of investors' needs.<br />

(As of end of March 2007)<br />

Single Issue Trading and Basket Trading Trading on Closing Price (ToSTNeT-2)<br />

(ToSTNeT-1)<br />

Domestic listed stocks and domestic listed convertible bonds<br />

(1)Single Issue Trading<br />

One auction trading unit or more<br />

(2)Basket Cross Trading<br />

Transaction including 15 issues or more<br />

with trading value of 100 million yen or<br />

more<br />

8:20 ~ 9:00<br />

11:00 ~ 12:30<br />

15:00 ~ 16:30<br />

(For half-trading days, 8:20 ~ 9:00,<br />

11:00 ~ 12:30)<br />

(1)Single Issue Trading<br />

7% above or below the last price<br />

formed in the auction market<br />

8:20 ~ 9:00 VWAP of the day before<br />

adjusted by (net commission) amount<br />

11:00 ~ 12:30 VWAP of the morning<br />

session adjusted by (net commission)<br />

amount<br />

15:00 ~ 16:30 VWAP of the day &<br />

VWAP of the afternoon session adjusted<br />

by (net commission) amount<br />

(2)Basket Cross Trading<br />

5% above or below the trading value of<br />

the components with the caluculation<br />

based on the last prices from the auction<br />

market<br />

0.0001 —<br />

(1)Single Issue Trading<br />

Cross trading or negotiation between<br />

buyer and seller<br />

(2)Basket Cross Trading<br />

Cross trading<br />

T+0 or T+3 T+3<br />

One auction trading unit or more<br />

8:45<br />

12:15<br />

16:00<br />

Orders are accepted from 8:20 to 16:00<br />

(For half-trading days, 8:45 / 12:15, orders<br />

are accepted from 8:20 to 12:15)<br />

8:45:<br />

Closing price or VWAP on the previous<br />

day<br />

12:15:<br />

Closing price or VWAP of the morning<br />

session on the trading day<br />

16:00:<br />

Closing price on the trading day, or<br />

VWAP of the afternoon session or of<br />

the trading day<br />

Closing Price Trading<br />

Individual auction (cross trading is<br />

matched prior to other orders)<br />

VWAP Trading<br />

Cross trading<br />

Note: 1. The trading system for ETFs and REITs is the same as that for equities<br />

2. Order-taking and notification of execution for basket orders of convertible bonds is made by FAX.<br />

3. A review of part of the off-auction trading methodology is scheduled to be made in October, 2007

Clearing & Settlement<br />

Previously in the Japanese securities market, the<br />

responsibility to clear and settle trades on any<br />

exchange had been left to the specific exchange the<br />

trade was made on. This system, however, created<br />

inefficiencies within the wider Japanese domestic<br />

market. Seeking to eliminate these inefficiencies, in<br />

July 2002 all domestic stock exchanges in Japan as<br />

well as the Japan Securities Dealers Association<br />

established a unified clearing organization to handle all<br />

cash products traded on Japanese securities markets.<br />

This new organization is called Japan Securities<br />

Clearing Corporation (JSCC).<br />

JSCC began operations for trade clearing of cash<br />

products for all domestic exchanges on January 14,<br />

2003. With this, consolidated clearing operations,<br />

standardized clearing procedures, creation of a unified<br />

access point for users, and the introduction of a settlement<br />

guarantee system in accordance with global<br />

standards was realized.<br />

No. of<br />

Settlement<br />

Days<br />

Cleared<br />

volume<br />

(A)<br />

(thous.<br />

Shares)<br />

Domestic Stocks<br />

No. of<br />

settled<br />

stocks<br />

(B)<br />

(thous.<br />

Shares)<br />

(B)/(A)<br />

%<br />

14<br />

In addition, to further increase convenience and<br />

efficiency for market users, JSCC broadened its role<br />

as a clearing organization to also include trades conducted<br />

on the TSE derivatives market on February 2,<br />

2004.<br />

The TSE utilizes the central counter-party (CCP)<br />

system and the clearing participant system for the<br />

settlement of trading on its exchange. In the CCP system<br />

a clearing organization (JSCC) acts as the settlement<br />

counter-party to clearing participants for all<br />

trades effected on the TSE market, thereby guaranteeing<br />

settlement. This system eliminates the risk of<br />

trade counterparty default.<br />

Under the clearing participants system, four types<br />

of clearing qualifications are available at JSCC based<br />

on asset class: Cash Products, Government Bond<br />

Futures and Futures Options, Stock Index Futures and<br />

Options, and Equity Options. Participants who hold<br />

these qualifications are called clearing participants,<br />

Settlement through JSCC (Average Daily Volume)<br />

Cleared<br />

volume<br />

(C)<br />

(thous.<br />

Shares)<br />

Foreign Stocks<br />

No. of<br />

settled<br />

stocks<br />

(D)<br />

(thous.<br />

Shares)<br />

(D)/(C)<br />

%<br />

Cleared<br />

volume<br />

(E)<br />

(¥ mils.)<br />

Domestic CBs Overall settled value<br />

Settled<br />

volume<br />

(F)<br />

(¥ mils.)<br />

(F)/(E)<br />

%<br />

Overall Overall<br />

settled settled<br />

volume of volume of<br />

cash derivative<br />

transactions transactions<br />

(¥100 mils.) (¥100 mils.)<br />

2004 246 1,983,862 669,253 33.7 32 22 69.4 3,563 2,162 60.7 1,263 171<br />

2005 245 2,913,319 839,640 28.8 377 173 46.0 2,753 1,719 62.5 1,597 152<br />

2006 248 2,509,206 759,453 30.3 237 128 54.2 2,160 1,467 67.9 2,081 259<br />

Jan. 19 3,203,841 919,314 28.7 813 277 34.1 1,361 920 67.6 2,326 333<br />

Feb. 20 3,132,814 901,555 28.8 345 172 49.8 2,563 1,588 62.0 2,376 288<br />

Mar. 22 2,444,126 742,239 30.4 225 132 59.0 2,544 1,949 76.6 2,229 282<br />

Apr. 20 2,684,972 793,801 29.6 540 301 55.8 1,456 1,012 69.5 2,517 314<br />

May 20 2,499,515 757,082 30.3 138 96 70.0 857 605 70.6 2,212 369<br />

June 22 2,524,481 756,303 30.0 134 89 66.2 772 454 58.9 2,194 327<br />

July 20 2,258,223 697,269 30.9 133 82 62.1 3,446 2,265 65.7 1,677 270<br />

Aug. 23 2,273,960 714,811 31.4 139 100 71.8 2,513 1,738 69.2 1,892 213<br />

Sept. 20 2,146,559 664,355 30.9 123 93 75.4 1,619 1,037 64.1 1,896 193<br />

Oct. 21 2,326,924 726,578 31.2 187 125 67.2 2,903 1,817 62.6 1,899 174<br />

Nov. 20 2,300,790 718,561 31.2 51 36 70.6 2,398 1,397 58.3 1,681 187<br />

Dec. 21 2,403,659 740,863 30.8 83 55 66.7 3,396 2,723 80.2 2,101 167<br />

Note: 1. Cleared volume is the total amount of transactions on each market (excluding "cash" transactions and "when<br />

issued" transactions) and loan transactions.<br />

2. The number of settled stocks for domestic stocks includes "when issued" transactions, off-auction transactions,<br />

and loan transactions.<br />

3. Overall settled volume of derivative transactions excludes volume of delivered settlement of JGB Futures.<br />

4. Figures of derivative transactions for year 2004 are for the period starting February 2, 2004 (starting date of<br />

JSCC's operations for derivatives).<br />

Source: Japan Securities Clearing Corporation<br />

STOCK<br />

MARKET

STOCK<br />

MARKET<br />

and act as an actual party to a trade when conducting<br />

settlement with the clearing organization.<br />

Non-clearing participants conduct settlement for<br />

trades they have effected on TSE's market with a designated<br />

clearing participant, and that clearing participant<br />

then effects final settlement of the trade with<br />

the clearing organization.<br />

Settlement for normal domestic equity transactions<br />

in the exchange market is made on the fourth<br />

business day starting from the transaction date (T+3).<br />

Delivery and receipt of domestic equities and<br />

domestic convertible bonds (CBs) during settlement is<br />

made by an account transfer between JSCC's account<br />

and the clearing participant's account at JASDEC.<br />

The cabinet order concerning book entry transfer of<br />

securities stipulates that all share certificates of<br />

domestic listed companies shall be dematerialized by<br />

June 9, 2009. The concerned parties and practitioners<br />

have agreed to target the beginning of January 2009 as<br />

an implementation date. When this system is adopted,<br />

shareholder's rights will be assured by electronic<br />

means in shareholders accounts at securities companies<br />

and other financial institutions. The paperless<br />

share system is expected to eliminate the risks associ-<br />

TSE<br />

Transactions<br />

(Cash &<br />

Derivatives)<br />

Matching<br />

Clearing<br />

Participant<br />

A/C<br />

15<br />

ated with loss, theft or forgery of stock certificates. It<br />

will also reduce the costs for printing and issuing new<br />

stocks and simplify the procedures thereof.<br />

Until December 2006, settlement for foreign equities<br />

had been performed through account transfer at<br />

Japan Securities Settlement and Custody, Inc. (JSSC),<br />

however, JASDEC has taken over the settlement<br />

function for listed foreign equities and carries out<br />

book entry and account transfer of those securities.<br />

Transfer of funds in a settlement is carried out<br />

between the clearing participant's bank account and<br />

JSCC's bank account at either the Bank of Japan or a<br />

bank JSCC designates as a fund settlement bank.<br />

Delivery versus payment (DVP) settlement is utilized<br />

via a netting basis in JSCC for all regular traded<br />

domestic stocks and CBs. In netting, only the net<br />

amount of securities bought and sold and net funds<br />

arising from these transactions are transferred<br />

between accounts. This system allows for efficient<br />

use of both securities and funds as well as simplified<br />

settlement management.<br />

DVP Settlement is also utilized for Japanese government<br />

bond transactions through the Bank of<br />

Japan's financial network system (BOJ-NET).<br />

Cross-market Clearing Organization (JSCC)<br />

Osaka SE<br />

Transactions<br />

(Cash)<br />

Matching<br />

•CCP Function<br />

•Settlement<br />

Guarantee<br />

Scheme<br />

Central Securities Depository<br />

JSCC's A/C<br />

Nagoya SE<br />

Transactions<br />

(Cash)<br />

Matching<br />

JSCC<br />

Undertaking<br />

Netting<br />

Fukuoka SE<br />

Transactions<br />

(Cash)<br />

Matching<br />

Settlement matching<br />

Account transfer instructions<br />

DVP Settlement<br />

(Link between settlement of securities and that of funds)<br />

Clearing<br />

Participant<br />

A/C<br />

Clearing<br />

Participant<br />

Bank A/C<br />

Sapporo SE<br />

Transactions<br />

(Cash)<br />

Matching<br />

Agency Clearing<br />

Participants<br />

Principal Clearing<br />

Participants<br />

Principal Clearing<br />

Participants<br />

BOJ/ Fund Settlement Bank<br />

JSCC's A/C<br />

Jasdaq SE<br />

Transactions<br />

(Cash)<br />

Matching<br />

Market<br />

participants<br />

other than<br />

clearing<br />

participants<br />

(non-clearing<br />

participants)<br />

Clearing<br />

Participant<br />

Bank A/C

Clearing, Settlement & Custody of Foreign Stocks<br />

1.Clearing & Settlement<br />

The Japan Securities Clearing Corporation<br />

(JSCC) acts as the cross-market clearing organization<br />

for cash transactions in Japan, including foreign<br />

stocks and convertible bonds on all of the<br />

stock exchanges.<br />

For the settlement of foreign stocks listed on<br />

the TSE, Japan Securities Depository Center, Inc.<br />

(JASDEC) plays a key role as a central depository<br />

and conducts settlement through the book-entry<br />

transfer system. (Previously Japan Securities<br />

Settlement and Custody, Inc. (JSSC) had been the<br />

depository and carried out book-entry transfer for<br />

foreign stocks.)<br />

Under this system, share certificates of the<br />

beneficial shareholders are deposited by the custodian<br />

under JASDEC's name in the home country<br />

of the listed company, and the trading of foreign<br />

listed shares on the TSE is settled by debiting<br />

or crediting the accounts of JASDEC participants.<br />

2. Custody Services<br />

The shareholder service agents (banks) and the<br />

16<br />

dividend paying banks are designated by foreign<br />

listed companies at the time of TSE listing.<br />

When a foreign listed company announces the<br />

payment of dividends or allotment of new shares to<br />

its shareholders, JASDEC receives these on behalf<br />

of the beneficial shareholders in Japan. The dividends<br />

are remitted by the dividend paying banks<br />

and the shareholder service agents. The new<br />

shares are allotted by JASDEC to its participants'<br />

accounts. These transactions are conducted based<br />

on the beneficial shareholders' list which is compiled<br />

by the shareholder service agents in cooperation<br />

with JASDEC.<br />

In the case of voting rights, the beneficial shareholders<br />

give the voting instructions to the shareholder<br />

service agent. Then JASDEC exercises the<br />

instructions through the custodian or standing proxy<br />

agent in the listed companies' home country.<br />

Moreover, if the payment or allotment is subject<br />

to Japanese Income Tax Law, JASDEC is<br />

responsible for managing and collecting withholding<br />

taxes related to its holdings of listed foreign<br />

shares.<br />

Shareholder Service and Dividend Paying Systems<br />

Home Market Corporate Action Processing<br />

Shareholder<br />

Service<br />

Agent<br />

Notices<br />

a<br />

Listed Foreign Company<br />

Exercise<br />

Custodian<br />

JASDEC<br />

JASDEC Participants<br />

e<br />

Dividends<br />

Beneficial Shareholders<br />

Instruction to voting rights<br />

Tokyo Market<br />

a. Service Agreement<br />

b. Paying Agreement<br />

c. Custody Agreement<br />

d. Regulations of JASDEC<br />

e. Agreement concerning the opening of a foreign stock trading account<br />

Note: JASDEC participants include securities firms, banks and other financial institutions.<br />

c<br />

d<br />

b<br />

Dividend<br />

Paying<br />

Bank<br />

STOCK<br />

MARKET

STOCK PRICE<br />

INDEX<br />

STOCK PRICE INDEX<br />

TOPIX (Tokyo Stock Price Index)<br />

On July 1, 1969, Tokyo Stock Exchange introduced<br />

TOPIX (Tokyo Stock Price Index), a composite<br />

index of all the domestic common stocks listed<br />

on the TSE First Section, to provide a comprehensive<br />

measure of market trends for investors interested<br />

in general market price movements.<br />

This composite index is supplemented by subindices<br />

for each of the 33 industry sectors as well<br />

as three indices for large, medium, and small-size<br />

stocks, in which companies listed on the TSE First<br />

Section are selected based on free-float adjusted<br />

market capitalization and liquidity.<br />

In addition, TSE has computed a composite<br />

index called "Tokyo Stock Exchange Second<br />

Section Stock Price Index" covering all the domestic<br />

common stocks listed on the TSE Second<br />

Section since August 18, 1969.<br />

On February 1, 1999, TSE also began publishing<br />

a total return index for TOPIX and its subindices.<br />

Computation Method for Indices<br />

The indices are basically a measure of the<br />

changes in aggregate market value of domestic<br />

common stocks. The base for each of the indices<br />

is the aggregate market value of its component<br />

stocks as at the close on January 4, 1968, the first<br />

trading day of that year. The aggregate market<br />

value is calculated by multiplying the number of<br />

listed shares of each component stock by its<br />

respective price and totaling the products derived<br />

therefrom.<br />

In calculating the indices, the base market value<br />

is used as the denominator of a fraction whose<br />

numerator represents the current aggregate market<br />

value. The fraction so obtained is multiplied by<br />

100 (the index value on the base date) and<br />

reduced to a decimal figure to the nearest onehundredth<br />

for each of the indices computed.<br />

The formula is as follows:<br />

Current index = Current Market Value (CMV) X 100<br />

Base Market Value (BMV)<br />

17<br />

For the purpose of maintaining continuity of<br />

the indices, the base market value is adjusted<br />

from time to time to reflect only price movements<br />

resulting from auction market activity and eliminate<br />

the effects of other factors, such as new listings,<br />

delistings and new share issues, either<br />

through public offering or through rights offerings<br />

to shareholders.<br />

No adjustment is made, however, in case of<br />

stock splits, stock consolidation (decrease in capital<br />

without compensation), since such corporate<br />

actions do not affect the current market value.<br />

The formula for adjusting the base market<br />

value is as follows:<br />

New Market Value (New Basis)<br />

New BMV = Old BMV X<br />

Old Market Value (Old Basis)<br />

Frequency of Index Computation<br />

TOPIX and its sub-indices have been calculated<br />

and published every 15 seconds since April 18,<br />

2005.<br />

Historically, TOPIX has been available on a<br />

daily closing basis from May 16, 1949, while the<br />

sub-indices have been available since January 4,<br />

1968, the base date. The Tokyo Stock Exchange<br />

Second Section Stock Price Index has been available<br />

on a daily closing basis from October 2,<br />

1961, when the Second Section of TSE commenced.<br />

Introduction of Free-Float<br />

Free-float adjustment methodology was introduced<br />

into the calculation of TOPIX and its<br />

subindices in three phases. The first and second<br />

phases began after the close of trading one business<br />

day before the last business day of October<br />

2005 and February 2006 respectively, and introduction<br />

was completed after the close of trading<br />

one business day on the last business day of June<br />

2006.

January 4, 1968=100<br />

TOPIX Daily Closing Value, 2006<br />

Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec.<br />

1 1,694.24 1,635.60 1,717.17 1,584.56 1,567.01 1,633.35 1,622.51 1,604.90<br />

2 1,711.02 1,632.24 1,737.18 1,606.11 1,569.65 1,625.12 1,619.02<br />

3 1,707.96 1,612.96 1,754.64 1,593.22 1,569.53 1,617.84<br />

4 1,673.07 1,749.65 1,602.43 1,571.70 1,649.32 1,601.99 1,607.74<br />

5 1,685.15 1,746.05 1,594.92 1,589.97 1,651.35 1,633.20 1,598.89<br />

6 1,684.90 1,712.30 1,626.46 1,775.67 1,567.30 1,572.29 1,642.82 1,634.21 1,616.71 1,615.17<br />

7 1,713.47 1,617.87 1,783.72 1,533.54 1,573.15 1,540.12 1,613.46 1,616.68 1,622.77<br />

8 1,671.39 1,605.58 1,755.03 1,482.22 1,562.73 1,619.92 1,597.50 1,616.34<br />

9 1,682.26 1,641.01 1,747.50 1,498.68 1,578.43 1,589.06<br />

10 1,659.03 1,660.22 1,647.27 1,777.34 1,725.06 1,594.07 1,582.88 1,634.83 1,581.37<br />

11 1,672.44 1,770.18 1,711.31 1,585.85 1,577.92 1,596.50 1,622.07 1,627.97<br />

12 1,684.34 1,742.89 1,688.18 1,510.89 1,563.69 1,585.98 1,613.64 1,636.72<br />

13 1,681.69 1,618.01 1,674.66 1,743.77 1,458.30 1,551.03 1,583.55 1,628.00 1,568.76 1,639.19<br />

14 1,635.24 1,665.79 1,744.07 1,466.14 1,521.71 1,601.02 1,598.13 1,596.42 1,651.85<br />

15 1,624.28 1,666.78 1,681.81 1,485.98 1,605.12 1,593.43 1,592.00 1,657.40<br />

16 1,670.15 1,631.39 1,645.06 1,644.97 1,534.71 1,629.73 1,646.05 1,582.04<br />

17 1,631.61 1,605.33 1,663.98 1,719.05 1,657.07 1,631.46 1,637.95 1,573.54<br />

18 1,574.67 1,741.75 1,632.08 1,475.28 1,641.45 1,638.74 1,665.32<br />

19 1,620.29 1,747.32 1,638.57 1,527.66 1,475.42 1,591.98 1,635.77 1,645.40<br />

20 1,624.39 1,572.11 1,688.22 1,747.86 1,510.32 1,528.59 1,570.18 1,644.15 1,533.94 1,667.01<br />

21 1,612.56 1,756.40 1,505.51 1,515.53 1,624.21 1,580.08 1,532.95 1,671.30<br />

22 1,609.46 1,686.35 1,615.86 1,549.12 1,641.77 1,563.60 1,552.87 1,672.10<br />

23 1,587.90 1,640.47 1,680.09 1,579.26 1,545.57 1,640.28 1,659.39<br />

24 1,612.43 1,647.74 1,689.34 1,710.76 1,606.01 1,514.22 1,623.03 1,662.53 1,538.04<br />

25 1,618.46 1,719.73 1,584.71 1,534.82 1,619.81 1,559.78 1,653.38 1,664.87<br />

26 1,643.29 1,723.29 1,613.78 1,548.97 1,520.44 1,549.41 1,664.59 1,672.45<br />

27 1,690.32 1,656.82 1,693.84 1,729.37 1,549.37 1,541.81 1,591.04 1,650.73 1,553.01 1,676.95<br />

28 1,660.42 1,692.69 1,716.43 1,527.51 1,559.41 1,600.25 1,602.57 1,555.11 1,678.91<br />

29 1,711.54 1,616.17 1,547.75 1,615.99 1,610.73 1,580.10 1,681.07<br />

30 1,704.28 1,726.68 1,612.76 1,586.96 1,612.66 1,620.65 1,603.03<br />

31 1,710.77 1,728.16 1,579.94 1,572.01 1,634.46 1,617.42<br />

High 1,710.77 1,713.47 1,728.16 1,783.72 1,755.03 1,606.11 1,602.43 1,641.77 1,651.35 1,664.59 1,622.51 1,681.07<br />

Low 1,574.67 1,572.11 1,605.58 1,710.76 1,579.26 1,458.30 1,475.28 1,540.12 1,549.41 1,601.99 1,532.95 1,598.89<br />

Ave. 1,654.17 1,653.33 1,665.10 1,745.00 1,657.22 1,532.82 1,549.25 1,601.79 1,599.36 1,635.35 1,580.23 1,646.40<br />

Note: Highest in year Lowest in year<br />

18<br />

STOCK PRICE<br />

INDEX

STOCK PRICE<br />

INDEX<br />

TOPIX Sub-indices<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

End of<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

Jan.<br />

Feb.<br />

Mar.<br />

Apr.<br />

May<br />

June<br />

July<br />

Aug.<br />

Sept.<br />

Oct.<br />

Nov.<br />

Dec.<br />

Jan. 4, 1968 = 100<br />

Size-based TOPIX Sub-Indices<br />

19<br />

TOPIX<br />

Large<br />

Medium<br />

Small<br />

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006<br />

TOPIX<br />

843.29<br />

1,043.69<br />

1,149.63<br />

1,649.76<br />

1,681.07<br />

1,710.77<br />

1,660.42<br />

1,728.16<br />

1,716.43<br />

1,579.94<br />

1,586.96<br />

1,572.01<br />

1,634.46<br />

1,610.73<br />

1,617.42<br />

1,603.03<br />

1,681.07<br />

Size-based TOPIX Sub-Indices<br />

Large<br />

866.33<br />

1,063.33<br />

1,160.61<br />

1,647.91<br />

1,761.76<br />

1,708.92<br />

1,680.66<br />

1,737.95<br />

1,741.54<br />

1,604.63<br />

1,624.66<br />

1,630.21<br />

1,690.75<br />

1,658.47<br />

1,679.19<br />

1,669.73<br />

1,761.76<br />

Note: Large-Sized Stocks: Component stocks in TOPIX 100<br />

Medium-Sized Stocks: Component stocks in TOPIX Mid 400<br />

Small-Sized Stocks: Component stocks in TOPIX Small<br />

Medium<br />

694.78<br />

929.71<br />

1,106.24<br />

1,729.10<br />

1,691.42<br />

1,795.30<br />

1,727.31<br />

1,813.83<br />

1,774.37<br />

1,636.16<br />

1,633.09<br />

1,595.18<br />

1,665.10<br />

1,658.42<br />

1,647.20<br />

1,625.70<br />

1,691.42<br />

Small<br />

934.61<br />

1,247.88<br />

1,578.20<br />

2,600.90<br />

2,283.11<br />

2,688.75<br />

2,511.43<br />

2,637.80<br />

2,608.36<br />

2,379.96<br />

2,329.55<br />

2,221.87<br />

2,319.67<br />

2,281.77<br />

2,247.73<br />

2,209.66<br />

2,283.11

Changes in TOPIX Sector Indices (First Section, 2006)<br />

Industry<br />

Iron & Steel<br />

Electric Power & Gas<br />

Foods<br />

Pharmaceutical<br />

Transportation Equipment<br />

Other Products<br />

Precision Instruments<br />

Real Estate<br />

Marine Transportation<br />

Electric Appliances<br />

Metal Products<br />

Machinery<br />

Fishery, Agriculture & Forestry<br />

Rubber Products<br />

Chemicals<br />

Industry<br />

Glass & Ceramics Products<br />

Insurance<br />

Land Transportation<br />

Information & Communication<br />

Nonferrous Metals<br />

Pulp & Paper<br />

Mining<br />

Oil & Coal Products<br />

Warehousing & Harbor Transportation Services<br />

Banks<br />

Services<br />

Securities & Commodity Futures<br />

Wholesale Trade<br />

Textiles & Apparels<br />

Construction<br />

Air Transportation<br />

Retail Trade<br />

Other Financing Business<br />

End of 2005<br />

(A)<br />

1,038.32<br />

830.05<br />

953.57<br />

1,855.25<br />

2,545.71<br />

1,840.50<br />

3,938.62<br />

1,712.42<br />

1,031.84<br />

2,085.05<br />

1,190.64<br />

1,349.94<br />

411.66<br />

2,031.89<br />

1,298.32<br />

End of 2005<br />

(A)<br />

1,388.71<br />

1,254.95<br />

1,626.64<br />

2,093.43<br />

1,457.85<br />

680.92<br />

774.21<br />

1,666.78<br />

2,033.09<br />

462.12<br />

1,291.63<br />

1,041.37<br />

1,343.02<br />

918.01<br />

906.31<br />

699.81<br />

1,120.99<br />

1,452.67<br />

Up<br />

Stock Price Indices<br />

Down<br />

Stock Price Indices<br />

20<br />

End of 2006<br />

(B)<br />

1,356.21<br />

1,044.34<br />

1,188.24<br />

2,307.06<br />

3,156.60<br />

2,260.52<br />

4,516.67<br />

1,942.21<br />

1,167.40<br />

2,274.60<br />

1,280.02<br />

1,426.97<br />

435.03<br />

2,126.68<br />

1,342.31<br />

End of 2006<br />

(B)<br />

1,381.70<br />

1,227.43<br />

1,563.21<br />

1,990.52<br />

1,379.97<br />

632.68<br />

715.61<br />

1,503.12<br />

1,817.33<br />

413.01<br />

1,151.48<br />

918.22<br />

1,183.98<br />

806.34<br />

768.96<br />

558.04<br />

888.41<br />

1,010.94<br />

% Change<br />

from End of 2005<br />

((B–A)/A)<br />

30.62%<br />

25.82%<br />

24.61%<br />

24.35%<br />

24.00%<br />

22.82%<br />

14.68%<br />

13.42%<br />

13.14%<br />

9.09%<br />

7.51%<br />

5.71%<br />

5.68%<br />

4.67%<br />

3.39%<br />

% Change<br />

from End of 2005<br />

((B–A)/A)<br />

–0.50%<br />

–2.19%<br />

–3.90%<br />

–4.92%<br />

–5.34%<br />

–7.08%<br />

–7.57%<br />

–9.82%<br />

–10.61%<br />

–10.63%<br />

–10.85%<br />

–11.83%<br />

–11.84%<br />

–12.16%<br />

–15.15%<br />

–20.26%<br />

–20.75%<br />

–30.41%<br />

Point Change<br />

from End of 2005<br />

(B–A)<br />

317.89<br />

214.29<br />

234.67<br />

451.81<br />

610.89<br />

420.02<br />

578.05<br />

229.79<br />

135.56<br />

189.55<br />

89.38<br />

77.03<br />

23.37<br />

94.79<br />

43.99<br />

Point Change<br />

from End of 2005<br />

(B–A)<br />

–7.01<br />

–27.52<br />

–63.43<br />

–102.91<br />

–77.88<br />

–48.24<br />

–58.60<br />

–163.66<br />

–215.76<br />

–49.11<br />

–140.15<br />

–123.15<br />

–159.04<br />

–111.67<br />

–137.35<br />

–141.77<br />

–232.58<br />

–441.73<br />

STOCK PRICE<br />