2013-06-KCB%20(Final)

2013-06-KCB%20(Final) 2013-06-KCB%20(Final)

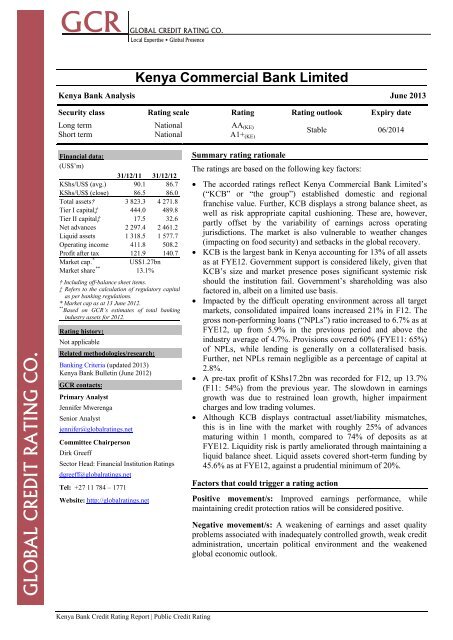

Kenya Bank Credit Rating Report | Public Credit Rating Kenya Commercial Bank Limited Kenya Bank Analysis June 2013 Security class Rating scale Rating Rating outlook Expiry date Long term National AA(KE) Short term National A1+(KE) Financial data: (US$’m) 31/12/11 31/12/12 KShs/US$ (avg.) 90.1 86.7 KShs/US$ (close) 86.5 86.0 Total assets† 3 823.3 4 271.8 Tier I capital‡ 444.0 489.8 Tier II capital‡ 17.5 32.6 Net advances 2 297.4 2 461.2 Liquid assets 1 318.5 1 577.7 Operating income 411.8 508.2 Profit after tax 121.9 140.7 Market cap. * US$1.27bn Market share ** 13.1% † Including off-balance sheet items. ‡ Refers to the calculation of regulatory capital as per banking regulations. * Market cap as at 13 June 2012. ** Based on GCR’s estimates of total banking industry assets for 2012. Rating history: Not applicable Related methodologies/research: Banking Criteria (updated 2013) Kenya Bank Bulletin (June 2012) GCR contacts: Primary Analyst Jennifer Mwerenga Senior Analyst jennifer@globalratings.net Committee Chairperson Dirk Greeff Sector Head: Financial Institution Ratings dgreeff@globalratings.net Tel: +27 11 784 – 1771 Website: http://globalratings.net Summary rating rationale The ratings are based on the following key factors: The accorded ratings reflect Kenya Commercial Bank Limited’s (“KCB” or “the group”) established domestic and regional franchise value. Further, KCB displays a strong balance sheet, as well as risk appropriate capital cushioning. These are, however, partly offset by the variability of earnings across operating jurisdictions. The market is also vulnerable to weather changes (impacting on food security) and setbacks in the global recovery. KCB is the largest bank in Kenya accounting for 13% of all assets as at FYE12. Government support is considered likely, given that KCB’s size and market presence poses significant systemic risk should the institution fail. Government’s shareholding was also factored in, albeit on a limited use basis. Impacted by the difficult operating environment across all target markets, consolidated impaired loans increased 21% in F12. The gross non-performing loans (“NPLs”) ratio increased to 6.7% as at FYE12, up from 5.9% in the previous period and above the industry average of 4.7%. Provisions covered 60% (FYE11: 65%) of NPLs, while lending is generally on a collateralised basis. Further, net NPLs remain negligible as a percentage of capital at 2.8%. A pre-tax profit of KShs17.2bn was recorded for F12, up 13.7% (F11: 54%) from the previous year. The slowdown in earnings growth was due to restrained loan growth, higher impairment charges and low trading volumes. Although KCB displays contractual asset/liability mismatches, this is in line with the market with roughly 25% of advances maturing within 1 month, compared to 74% of deposits as at FYE12. Liquidity risk is partly ameliorated through maintaining a liquid balance sheet. Liquid assets covered short-term funding by 45.6% as at FYE12, against a prudential minimum of 20%. Factors that could trigger a rating action Stable 06/2014 Positive movement/s: Improved earnings performance, while maintaining credit protection ratios will be considered positive. Negative movement/s: A weakening of earnings and asset quality problems associated with inadequately controlled growth, weak credit administration, uncertain political environment and the weakened global economic outlook.

- Page 2 and 3: Corporate profile Business summary

- Page 4 and 5: Table 6: Contribution to F11 F12 de

- Page 6 and 7: Year end: 31 December 2008 2009 201

Kenya Bank Credit Rating Report | Public Credit Rating<br />

Kenya Commercial Bank Limited<br />

Kenya Bank Analysis June <strong>2013</strong><br />

Security class Rating scale Rating Rating outlook Expiry date<br />

Long term National AA(KE)<br />

Short term National A1+(KE)<br />

Financial data:<br />

(US$’m)<br />

31/12/11 31/12/12<br />

KShs/US$ (avg.) 90.1 86.7<br />

KShs/US$ (close) 86.5 86.0<br />

Total assets† 3 823.3 4 271.8<br />

Tier I capital‡ 444.0 489.8<br />

Tier II capital‡ 17.5 32.6<br />

Net advances 2 297.4 2 461.2<br />

Liquid assets 1 318.5 1 577.7<br />

Operating income 411.8 508.2<br />

Profit after tax 121.9 140.7<br />

Market cap. *<br />

US$1.27bn<br />

Market share **<br />

13.1%<br />

† Including off-balance sheet items.<br />

‡ Refers to the calculation of regulatory capital<br />

as per banking regulations.<br />

* Market cap as at 13 June 2012.<br />

** Based on GCR’s estimates of total banking<br />

industry assets for 2012.<br />

Rating history:<br />

Not applicable<br />

Related methodologies/research:<br />

Banking Criteria (updated <strong>2013</strong>)<br />

Kenya Bank Bulletin (June 2012)<br />

GCR contacts:<br />

Primary Analyst<br />

Jennifer Mwerenga<br />

Senior Analyst<br />

jennifer@globalratings.net<br />

Committee Chairperson<br />

Dirk Greeff<br />

Sector Head: Financial Institution Ratings<br />

dgreeff@globalratings.net<br />

Tel: +27 11 784 – 1771<br />

Website: http://globalratings.net<br />

Summary rating rationale<br />

The ratings are based on the following key factors:<br />

The accorded ratings reflect Kenya Commercial Bank Limited’s<br />

(“KCB” or “the group”) established domestic and regional<br />

franchise value. Further, KCB displays a strong balance sheet, as<br />

well as risk appropriate capital cushioning. These are, however,<br />

partly offset by the variability of earnings across operating<br />

jurisdictions. The market is also vulnerable to weather changes<br />

(impacting on food security) and setbacks in the global recovery.<br />

KCB is the largest bank in Kenya accounting for 13% of all assets<br />

as at FYE12. Government support is considered likely, given that<br />

KCB’s size and market presence poses significant systemic risk<br />

should the institution fail. Government’s shareholding was also<br />

factored in, albeit on a limited use basis.<br />

Impacted by the difficult operating environment across all target<br />

markets, consolidated impaired loans increased 21% in F12. The<br />

gross non-performing loans (“NPLs”) ratio increased to 6.7% as at<br />

FYE12, up from 5.9% in the previous period and above the<br />

industry average of 4.7%. Provisions covered 60% (FYE11: 65%)<br />

of NPLs, while lending is generally on a collateralised basis.<br />

Further, net NPLs remain negligible as a percentage of capital at<br />

2.8%.<br />

A pre-tax profit of KShs17.2bn was recorded for F12, up 13.7%<br />

(F11: 54%) from the previous year. The slowdown in earnings<br />

growth was due to restrained loan growth, higher impairment<br />

charges and low trading volumes.<br />

Although KCB displays contractual asset/liability mismatches,<br />

this is in line with the market with roughly 25% of advances<br />

maturing within 1 month, compared to 74% of deposits as at<br />

FYE12. Liquidity risk is partly ameliorated through maintaining a<br />

liquid balance sheet. Liquid assets covered short-term funding by<br />

45.6% as at FYE12, against a prudential minimum of 20%.<br />

Factors that could trigger a rating action<br />

Stable <strong>06</strong>/2014<br />

Positive movement/s: Improved earnings performance, while<br />

maintaining credit protection ratios will be considered positive.<br />

Negative movement/s: A weakening of earnings and asset quality<br />

problems associated with inadequately controlled growth, weak credit<br />

administration, uncertain political environment and the weakened<br />

global economic outlook.

Corporate profile<br />

Business summary<br />

KCB’s roots can be traced back to 1896 when it<br />

established its first outlet in Mombasa as the National<br />

Bank of India (“NBI”). In 1904, NBI extended its<br />

operations to Nairobi, which had become the<br />

headquarters of the expanding railway line to<br />

Uganda. In 1958, NBI merged with Grindlays Bank<br />

(“Grindlays”) to form the National and Grindlays<br />

Bank (“NGB”). Upon Kenya’s independence in 1963,<br />

the Government of Kenya acquired a 60% stake in<br />

NGB. The Government acquired full control in 1970<br />

and renamed the bank, Kenya Commercial Bank<br />

Limited. Over the years the Government has<br />

gradually reduced its stake in KCB to 35% and more<br />

recently to 26.2% on the back of a rights issue in<br />

2004 (which raised KShs2.5bn). A second rights<br />

issue in 2008 reduced Governments shareholding to<br />

23.1% (raising Kshs5.5bn additional capital). A third<br />

rights issue in 2010 raised Kshs12.5bn and further<br />

reduced the Government’s stake to 17.7%. KCB is<br />

listed on the Nairobi Securities Exchange, Uganda<br />

Securities Exchange, Dar-es-Salaam Stock Exchange<br />

and Rwanda Stock Exchange.<br />

Ownership structure<br />

The table below provides a breakdown of KCB’s<br />

main shareholders as at end-December 2012.<br />

Table 1: Shareholding composition %<br />

The Government of Kenya 17.6<br />

National Social Security Fund 7.7<br />

Standard Chartered Nominees 12.8<br />

CFC Stanbic Nominees 1.8<br />

Other (less than 1.5%) 60.1<br />

Shareholding profile %<br />

Kenyan Individual Investors 27.0<br />

Kenyan Institutional Investors 50.7<br />

East African Individual Investors 0.1<br />

East African Institutional Investors 0.2<br />

Foreign Individual Investors 0.3<br />

Foreign Institutional Investors 21.8<br />

Source: KCB.<br />

Strategy and operations<br />

KCB’s operations are divided into four main business<br />

units, namely, Corporate Banking, Retail Banking,<br />

Treasury and Mortgage Finance. As at FYE12, the<br />

Group had a total of 230 branches across its regional<br />

footprint, up from 222 as at FYE11, as tabled below:<br />

Table 2: Subsidiary Branches Subsidiary No. of branches<br />

Kenya 173 Uganda 14<br />

Tanzania 11 Rwanda 11<br />

South Sudan 20 Burundi 1<br />

Source: KCB.<br />

The expansive branch network is complemented by<br />

over 940 ATMs across the region. KCB also has a<br />

well developed internet and mobile banking service<br />

and over 2,600 agents.<br />

Subsidiaries<br />

KCB serves as the holding company of the Group’s<br />

subsidiaries and associates, having established a<br />

presence in five East African countries i.e. Kenya,<br />

Tanzania, Uganda, Rwanda, South Sudan and<br />

Burundi. KCB has 100% ownership in Kenya<br />

Commercial Finance Company Ltd, Kenya<br />

Commercial Bank Nominees Ltd, Kencom House<br />

Ltd, KCB Tanzania Ltd, KCB Sudan Ltd, KCB<br />

Rwanda, KCB Uganda Ltd, KCB Burundi Ltd and<br />

45% ownership in United Finance Ltd.<br />

To promote cross border trading, KCB Tanzania was<br />

established in Dar-es-Salaam in 1997. In May 20<strong>06</strong>,<br />

KCB Southern Sudan was established to provide<br />

conventional banking services. KCB Uganda and<br />

KCB Rwanda commenced operations in 2007 and<br />

2008 respectively. In 2012, KCB opened a subsidiary<br />

in Burundi. KCB Kenya is the flagship of the group,<br />

contributing roughly 83% (FYE11: 85%) of total<br />

group assets and 92% (FYE11: 93%) of the group net<br />

profit before tax (“NPBT”) as at FYE12.<br />

Governance structure<br />

KCB (along with its subsidiaries) abides by the rules<br />

on good corporate governance as set out by the<br />

Capital Markets Authority in Kenya, the Central<br />

Bank of Kenya (“CBK”), as well as the principal<br />

bodies in each country of operation. A<br />

comprehensive “Corporate Governance Policy” is in<br />

place.<br />

The Group’s directorate, as at 31 December 2012,<br />

consisted of nine independent non-executive directors<br />

(including the chairman) and two executive directors.<br />

All banking subsidiaries are registered as legal<br />

entities in their respective countries of operation,<br />

each with its own board of directors. To ensure<br />

uniformity, each country board has the same working<br />

committees as its parent. The group chairman also<br />

serves as a non-executive on the KCB Kenya, KCB<br />

Sudan, KCB Uganda and KCB Rwanda Boards.<br />

Financial Reporting<br />

KCB’s financial statements are prepared in<br />

accordance with International Financial Reporting<br />

Standards (“IFRS”) and the Kenyan Companies Act.<br />

Following a rotation of auditors, KPMG took over<br />

from Ernst & Young during 2011, and have issued<br />

unqualified reports for FYE11 and FYE12.<br />

Operating environment<br />

Economic overview<br />

The East African economies remained resilient,<br />

despite challenging macroeconomic conditions<br />

characterised by high inflation rates, volatile<br />

exchange rates and high interest rates. A real GDP<br />

growth of 4.7% was recorded in Kenya, up from<br />

4.4% in 2011, supported by improved weather<br />

conditions and macroeconomic stability. The CBK<br />

continued to enforce a tight monetary policy<br />

Kenya Bank Credit Rating Report | Public Credit Rating Page 2

following heightened inflationary conditions which<br />

were prevalent from the last quarter of 2011. Inflation<br />

came down from a high of 19.7% y-o-y in November<br />

2011 to 7.7% in July 2012 and 3% in December<br />

2012 in line with the CBKs target range (5 ± 2.5%).<br />

Monetary policy tightening succeeded in curbing<br />

credit growth and reducing volatility in the interbank<br />

market. Following its success against inflation, the<br />

CBK reduced its policy rate from 18% in December<br />

2011 to 13% in September 2012,11% in December<br />

2012 and 9.5% in March <strong>2013</strong>. The IMF estimated a<br />

real GDP growth of 4.7% for 2012 (2011: 4.4%). The<br />

Kenya Shilling has stabilised which had witnessed<br />

significant volatility in 2011 depreciating by up to<br />

30%, ranging between 83 - 87 to the US$ in 2012.<br />

Macroeconomic indicators* 2010 2011 2012 <strong>2013</strong>f<br />

Real GDP growth (annual% change) 5.8 4.4 4.7 5.9<br />

Inflation (annual average % change) 4.1 14.0 9.4 5.2<br />

Current account balance (% of GDP) (6.5) (9.7) (9.1) (7.4)<br />

Total public debt, net (% of GDP) 44.7 43.6 43.2 42.9<br />

*Refers to Kenya. f – forecast.<br />

Source: IMF World Economic April <strong>2013</strong>.<br />

Estimated real GDP growth for <strong>2013</strong> is as follows:<br />

Kenya - 5.9%, Rwanda - 7.6%, Tanzania - 7.0%,<br />

Uganda - 4.8% and Burundi - 4.5%. The economic<br />

outlook remains subject to risks arising from an<br />

uncertain external environment, unpredictable donor<br />

inflows and political stability.<br />

Banking sector overview<br />

As at 31 December 2012, there were 44 banks<br />

operating in Kenya. The banking sector recorded<br />

improved performance during the period ended<br />

December 2012.<br />

Table 3: Key industry indicators 2011 2012<br />

Capital adequacy (%)<br />

Capital adequacy ratio 20.0 23.0<br />

Core capital/total deposits 16.0 17.0<br />

Asset quality (%)<br />

Gross NPLs/Gross loans 4.4 4.7<br />

Net NPLs/Gross loans 1.2 1.7<br />

Gross loans/net loans 58.9 57.1<br />

Profitability (%)<br />

ROaA 4.4 4.7<br />

ROaE 30.9 30.0<br />

Net Interest Margin 8.2 11.6<br />

Yield on advances 12.2 16.6<br />

Cost/income 47.4 40.1<br />

Cost of deposits 2.8 5.9<br />

Liquidity (%)<br />

Liquid assets/total deposits 42.0 46.0<br />

Source: CBK.<br />

The sector registered a pre-tax profit of KShs107bn,<br />

up 20.6% from the previous year (2011: 20.5%).<br />

Total assets grew by 15.3% (2011: 20.3%) to<br />

KShs2.3tn, while total deposits grew by 14.8%<br />

(2011: 20.4%) to KShs1.7tn. Net loans grew by<br />

12.5% to KShs1.3tn, compared to a growth of 31.4%<br />

in 2011. The sector also registered strong<br />

capitalisation levels on the back of retained earnings<br />

and additional capital injection. However, asset<br />

quality declined with the gross NPLs ratio increasing<br />

to 4.7% due to the high interest rates. The table below<br />

provides the key performance metrics.<br />

Competitive position<br />

KCB is the largest bank in Kenya with market shares<br />

of 13.1% (F11: 14%) and 16.6% (F11: 14%) of total<br />

industry assets and deposits respectively, as at 31<br />

December 2012. Selected market share indicators for<br />

the top 4 banks are shown below.<br />

Table 4: Peer<br />

analysis (KShs'm)<br />

KCB* Equity Coop S/Chart<br />

Total assets 304 112 215 829 199 663 195 493<br />

Market share 13.1% 9.3% 8.6% 8.4%<br />

Net customer loans 187 023 122 410 119 088 112 695<br />

Market share 16.6% 10.9% 10.6% 10.0%<br />

Customer deposits 223 493 140 286 162 267 140 525<br />

Market share 13.1% 8.2% 9.5% 8.2%<br />

*Refers to KCB Kenya. Source: CBK/Company financials.<br />

Financial profile<br />

Likelihood of support<br />

Given government’s shareholding in the group<br />

support is implied, however, to what extent this can<br />

be relied on by the Group is somewhat speculative.<br />

Funding composition<br />

The group is predominantly funded through customer<br />

deposits, shareholders equity and to a lesser extent<br />

borrowings. Being a listed entity, the group can raise<br />

additional capital through the equity market. Total<br />

funding (excluding equity ) grew by 8.6% to<br />

KShs3<strong>06</strong>bn as at FYE12, compared to growth of 36%<br />

in the previous period. The funding mix remained<br />

largely unchanged, with customer deposits making up<br />

a slightly higher 94% of the overall total.<br />

Table 5: Funding base<br />

F11<br />

KShs'm %<br />

F12<br />

KShs'm %<br />

Customer deposits 259 309 92.0 288 037 94.0<br />

Government & parastatals 66 027 23.4 66 669 21.8<br />

Private sector & individuals 193 282 68.6 221 368 72.3<br />

Interbank borrowings 14 105 5.0 9 334 3.0<br />

Long term debt 8 525 3.0 8 923 2.9<br />

Total<br />

By maturity<br />

281 939 100.0 3<strong>06</strong> 294 100.0<br />

> 1 month 202 197 71.7 216 288 70.6<br />

1-3 months 32 923 11.7 22 341 7.3<br />

1-12 months 30 973 11.0 40 493 13.2<br />

< 12 months 15 845 5.6 27 173 8.9<br />

Total<br />

Customer deposits<br />

281 939 100.0 3<strong>06</strong> 294 100.0<br />

Demand 188 092 66.7 210 336 68.7<br />

Term 71 217 25.3 77 701 25.4<br />

Total<br />

Source: KCB.<br />

259 309 100.0 288 037 100.0<br />

Customer deposits grew by 11% in F12,<br />

comparatively lower than the average industry<br />

growth of 14.8%. The deposit base is fairly<br />

diversified, with the single largest and 20 largest<br />

depositors constituting 2.5% and 22.7% of total<br />

deposits respectively as at FYE12. Borrowings<br />

mainly comprise a 7-year loan facility of US$100m<br />

from the International Finance Corporation, at an<br />

effective interest rate of 2.25%. A breakdown of<br />

customer deposits by subsidiary is tabled below.<br />

Kenya Bank Credit Rating Report | Public Credit Rating Page 3

Table 6: Contribution to F11 F12<br />

depositor funding † KShs’m % KShs’m %<br />

Kenya 210 174 81.1 223 493 77.6<br />

Tanzania 8 427 3.2 9 802 3.4<br />

South Sudan 27 434 10.6 38 583 13.4<br />

Uganda 7 385 2.8 8 041 2.8<br />

Rwanda 6 713 2.6 7 850 2.7<br />

Burundi - - 580 0.2<br />

Group elimination (824) (0.3) (312) (0.1)<br />

Total 259 309 100.0 288 037 100.0<br />

†Excluding borrowings. Source: KCB.<br />

Capital structure<br />

Total capital & reserves grew by 20% to KShs53.3bn<br />

in F12 (FYE11: 13.4%), supported by retained<br />

earnings.<br />

Table 7: Capitalisation<br />

F11 F12<br />

KShs'm KShs'm<br />

Tier I capital 38 403 42 125<br />

Tier II capital 1 517 2 800<br />

Total regulatory capital 39 920 44 925<br />

Total risk weighted assets (“RWA”) 197 734 192 939<br />

Key capitalisation ratios<br />

Core capital: RWA (%) 20.7 22.7<br />

Statutory requirement @ 8%<br />

Total regulatory capital: RWA (%) 19.9 21.3<br />

Statutory requirement @ 12%<br />

Source: KCB.<br />

The capital/assets ratio increased to 14.5% (FYE11:<br />

13.4%). The total risk weighted capital adequacy<br />

ratio followed a similar trend, rising to 21.3% on the<br />

back of a decline in risk weighted assets.<br />

Credit risk<br />

Risk management<br />

The Group’s board is responsible for the<br />

establishment and oversight of the risk management<br />

framework. Risk management is pursued through<br />

board approved committees, namely: the Audit<br />

Committee, Credit Committee and Risk Management<br />

Committee.<br />

Strategic overview<br />

Total assets ( including contingencies) grew by 11%<br />

to KShs498bn in F12 (F11: 31.6%), compared to an<br />

average industry growth of 15%. The asset mix was<br />

relatively constant for the year, although reflecting a<br />

notable increase in funds allocated to Government<br />

Paper.<br />

Table 8: Asset mix<br />

F11<br />

KShs'm %<br />

F12<br />

KShs'm %<br />

Cash & liquid assets 114 050 25.1 135 683 27.3<br />

Cash 15 697 3.5 14 942 3.0<br />

Balances with CBK 27 011 5.9 21 478 4.3<br />

Balances with other banks 25 812 5.7 10 422 2.1<br />

Government securities 45 530 10.0 88 842 17.8<br />

Customer advances 198 725 43.7 211 664 42.5<br />

Other investments 474 0.1 449 0.1<br />

Fixed assets 8 018 1.8 8 896 1.8<br />

Other assets 9 449 2.1 10 687 2.1<br />

Contingencies 123 871 27.2 130 368 26.2<br />

Total<br />

Source: KCB.<br />

454 587 100.0 497 747 100.0<br />

Loan portfolio<br />

The total gross loan book grew by a modest 6.5%<br />

(F11: 20.1%) to KShs220.6bn, as the group focused<br />

on bad debt recovery. The sectorial distribution of<br />

loans remained largely unchanged with lending<br />

activities targeted at corporates (39%) , followed by<br />

microcredit (26%) and the construction sector (17%).<br />

Table 9: Gross loan book<br />

characteristics<br />

F11 F12<br />

KShs'm % KShs'm %<br />

By sector<br />

Construction 33 722 16.3 38 249 17.3<br />

Micro credit 60 271 29.2 58 019 26.3<br />

Agriculture 10 677 5.2 9 650 4.4<br />

SME 22 5<strong>06</strong> 10.9 27 909 12.7<br />

Corporate 79 540 38.5 86 722 39.3<br />

Total 2<strong>06</strong> 717 100.0 220 550 100.0<br />

Private sector/individuals 200 793 97.1 210 923 95.6<br />

Government/parastatals 5 924 2.9 9 627 4.4<br />

Total 2<strong>06</strong> 717 100.0 220 550 100.0<br />

By maturity<br />

> 1 month 24 315 11.8 53 771 24.4<br />

1-3 months 10 743 5.2 4 850 2.2<br />

3-12 months 17 160 8.3 12 707 5.8<br />

1-5 years 73 618 35.6 63 164 28.6<br />

< 5 years 80 881 39.1 86 057 39.0<br />

Total 2<strong>06</strong> 717 100.0 220 550 100.0<br />

Source: KCB.<br />

A breakdown of gross loans & advances (by<br />

subsidiary) is tabled below. Although decreasing<br />

somewhat, the bulk of the lending activities takes<br />

place in Kenya, accounting for 85% of gross loans as<br />

at FYE12. The gross loan book in South Sudan<br />

almost doubled in F12 to contribute a higher 2.5% of<br />

the total loan portfolio, albeit from a very low base.<br />

Table 10: Contribution to F11 F12<br />

gross loans & advances KShs'm % KShs'm %<br />

Kenya 179 844 87.0 187 023 84.8<br />

Tanzania 6 702 3.2 7 803 3.5<br />

South Sudan 2 850 1.4 5 575 2.5<br />

Uganda 4 302 2.1 5 204 2.4<br />

Rwanda 5 027 2.4 5 791 2.6<br />

Burundi - - 268 0.1<br />

Total 2<strong>06</strong> 717 100.0 220 550 100.0<br />

Source: KCB.<br />

Asset quality<br />

Arrears grew by 20.6% to KSh14.8bn as at FYE12,<br />

as repayment pressure continued to drag on portfolio<br />

performance. Consequently, the gross NPLs ratio<br />

increased to 6.7%. Total provisions covered 60% of<br />

the capital value in arrears, down from 65% in F11.<br />

Cognisance is taken of the large amount of collateral<br />

held against NPLs. However, the reality of long time<br />

delays and the costs involved with converting<br />

collateral into cash actually makes the bank less<br />

protected against the fallout from defaulting clients.<br />

Kenya Bank Credit Rating Report | Public Credit Rating Page 4

Table 11: Asset quality<br />

F11<br />

KShs'm<br />

F12<br />

KShs'm<br />

Gross advances 2<strong>06</strong> 717 220 550<br />

Performing 194 488 205 799<br />

Neither past due nor impaired 182 260 185 504<br />

Past due but not impaired 12 228 20 295<br />

Non-performing 12 228 14 750<br />

Impaired 12 228 14 750<br />

Less : Provisions (7 992) (8 885)<br />

Individually assessed (6 466) (6 836)<br />

Collectively assessed (1 526) (2 049)<br />

Net NPL's 4 237 5 865<br />

Fair value of collateral on NPLs 5 762 8 605<br />

Loan write-offs 2 8<strong>06</strong> 1 204<br />

Loan recoveries 2 349 1 659<br />

Gross NPL ratio 5.9% 6.7%<br />

Net NPL ratio 2.1% 2.8%<br />

Net NPL/Total Capital 10.8% 13.2%<br />

Source: KCB.<br />

Liquidity risk<br />

From a systemic point of view, most emerging<br />

market banks tend to have a particularly pronounced<br />

negative (contractual) short term liquidity gap due to<br />

the short term nature of deposits, largely as a result of<br />

volatile interest rates, the lack of an extended savings<br />

culture and low financial intermediation. However,<br />

the trend of the mismatch over time, as well as the<br />

size thereof, is important, since an increase in the<br />

mismatch could indicate a potential funding problem.<br />

KCB displayed a short term maturity mismatch equal<br />

to 2.2x capital at FYE12, with 25% of advances<br />

maturing within 30-days, compared to 74% of<br />

deposits. In terms of behavioral maturity, however,<br />

the bulk of deposits is rolled over and is relatively<br />

stable. Given the scarcity of long-dated term deposits<br />

in the region, the group’s ability to build a stable pool<br />

of fixed rate funding is limited. Notwithstanding this,<br />

the group is making efforts to diversify the funding<br />

base through longer dated lines of credit. Liquid &<br />

trading assets/total short term funding increased to<br />

45.6% up from 41.7% previously, as the Group<br />

slowed its lending activities. The ratio was well<br />

above the prudential minimum of 20%.<br />

Advances/deposits increased to 77% in F12 (F11:<br />

74%), though remaining within the acceptable market<br />

average of 80%.<br />

Financial performance<br />

A 5-year financial synopsis is reflected at the back of<br />

this report, supplemented by the commentary below.<br />

The Group’s net profit before tax (“NPBT”) grew by<br />

13.7% to KShs17.2bn in F12, compared to growth of<br />

54.4% in the previous period. The performance was<br />

37% below budget. Net interest income grew by 28%<br />

(F11: 22%) to KShs30.6bn, supported by higher<br />

margins. The weighted average effective interest rate<br />

on loans and advances increased from 12.7% in F11<br />

to 18.5%, driven by the tightening of monetary policy<br />

during the review period. In turn, non-interest income<br />

grew by a marginal 1.5% (F11: 36.5%).<br />

Consequently, net interest income contributed 70% of<br />

total operating income, up from 64% in F11. Overall,<br />

total operating income amounted to KShs44.1bn,<br />

representing an 18.7% (F11: 26.5%) increase over the<br />

previous period; operating expenses increased by a<br />

comparatively lower 13.4% (F11: 18.6%) to<br />

KShs24.8bn. Consequently, the cost/income ratio<br />

improved to 56% from 59% previously. The bad debt<br />

charge (income stateme nt/total operating income)<br />

climbed to 4.8% from 0.4%, due to the significant<br />

rise in loan impairments.<br />

In terms of subsidiary performance, there was an<br />

increase in the contribution from Kenya, Tanzania,<br />

Uganda and South Sudan. Rwanda however,<br />

recorded a loss in F12. Burundi, which commenced<br />

operations in June 2012, also recorded a loss of<br />

KShs59m in the same period.<br />

Table 12: Contribution F11 F12<br />

to after tax earnings KShs'm % KShs'm %<br />

Kenya 14 074 93.0 15 772 91.7<br />

Tanzania 47 0.3 139 0.8<br />

South Sudan 864 5.7 1 352 7.9<br />

Uganda 27 0.2 54 0.3<br />

Rwanda 118 0.8 (50) (0.3)<br />

Burundi - - (59) (0.3)<br />

Total 15 129 100.0 17 208 100.0<br />

Source: KCB.<br />

Kenya Bank Credit Rating Report | Public Credit Rating Page 5

Year end: 31 December 2008 2009 2010 2011 2012<br />

Income Statement Analysis<br />

Inte re s t incom e 14 746 17 968 23 110 28 501 43 082<br />

Inte re s t e xpe ns e (2 970) (3 500) (3 464) (4 616) (12 446)<br />

Net interest income 11 775 14 469 19 645 23 885 30 636<br />

Fe e a nd com m is s ion incom e 5 549 5 540 6 482 8 729 9 074<br />

Tra ding incom e 1 629 1 648 2 775 3 608 3 688<br />

Othe r incom e 475 937 426 881 661<br />

Total operating income 19 428 22 594 29 329 37 103 44 059<br />

Im pa irm e nt cha rge (1 409) (718) (1 118) (146) (2 098)<br />

Ope ra ting e xpe nditure (12 0<strong>06</strong>) (15 575) (18 413) (21 829) (24 754)<br />

Net profit before tax 6 013 6 300 9 798 15 129 17 207<br />

Ta x (1 822) (2 216) (2 620) (4 148) (5 005)<br />

Net profit after tax 4 191 4 084 7 178 10 980 12 203<br />

Balance Sheet Analysis<br />

Subs cribe d ca pita l 9 516 9 516 21 516 21 860 21 892<br />

Re s e rve s (incl. ne t incom e for the yea r) 11 571 13 054 17 614 22 505 31 448<br />

Total capital and reserves 21 087 22 570 39 130 44 365 53 340<br />

Ba nk borrowings (incl. de pos its , pla cements & REPOs) 38 5<strong>06</strong> 6 668 11 057 14 105 9 334<br />

Cus tom e r de pos its 126 684 159 732 191 016 259 309 288 037<br />

Short-term funding (< 1 year) 165 190 166 401 202 073 273 414 297 371<br />

Cus tom e r de pos its 7 3 297 5 959 - -<br />

Other funding (> 1 year) 7 3 297 5 959 8 525 8 923<br />

Pa ya ble s /De fe rre d lia bilitie s 4 928 2 510 4 195 4 412 7 745<br />

Other liabilities 4 928 2 510 4 195 4 412 7 745<br />

Total capital and liabilities 191 212 194 778 251 356 330 716 367 379<br />

Ca s h in ha nd 4 909 7 <strong>06</strong>7 10 010 15 697 14 942<br />

Ba la nce s with ce ntra l ba nk 12 330 12 804 16 988 27 011 21 478<br />

Fixe d a s s e ts 5 788 7 747 8 272 8 018 8 896<br />

Re ce iva ble s /De fe rre d a s s e ts 7 324 8 952 7 654 9 449 10 687<br />

Non-earnings assets 30 351 36 569 42 923 60 175 56 002<br />

Loa ns & a dva nce s (ne t of provis ions) 93 522 122 659 148 113 198 725 211 664<br />

Ba nk pla ce m e nts 42 175 9 <strong>06</strong>8 10 211 25 812 10 422<br />

Ma rke ta ble /Tra ding s e curities 24 7<strong>06</strong> 26 120 49 811 45 530 88 842<br />

Othe r inve s tm e nts 457 362 297 475 449<br />

Total earning assets 160 861 158 209 208 433 270 542 311 377<br />

Total assets 191 212 194 778 251 356 330 716 367 379<br />

Contingencies 28 681 32 909 72 429 123 871 130 368<br />

Ratio Analysis (%)<br />

Capitalisation<br />

Inte rna l ca pita l ge ne ra tion 19.9 18.1 18.3 24.7 22.9<br />

Tota l ca pita l / Ne t a dva nce s + net equity invest. + gua ra ntees 17.2 14.5 17.7 13.7 15.6<br />

Tota l ca pita l / Tota l a s s e ts 11.0 11.6 15.6 13.4 14.5<br />

Liquidity<br />

Ne t a dva nce s / Cus tom er de pos its 73.8 75.2 75.2 76.6 73.5<br />

Ne t a dva nce s / Cus tom er de pos its + other s hort-term funding 56.6 72.3 71.2 72.7 71.2<br />

Liquid & tra ding a s s e ts / Tota l a s s ets 44.0 28.3 34.6 34.5 36.9<br />

Liquid & tra ding a s s e ts / Tota l s hort-term funding 50.9 33.1 43.1 41.7 45.6<br />

Asset quality<br />

Im pa ire d loa ns / Gros s a dva nces 0.0 88.9 9.2 5.9 6.7<br />

Tota l loa n los s re s e rve s / Gros s a dva nces 8.9 7.4 6.7 3.9 4.0<br />

Ba d debt cha rge (incom e s ta tement) / Gros s a dva nces (a vg.) 1.7 0.6 0.8 0.1 1.0<br />

Ba d debt cha rge (incom e s ta tement) / Tota l opera ting incom e 7.3 3.2 3.8 0.4 4.8<br />

Profitability<br />

Ne t incom e / Tota l ca pita l (a vg.) 24.4 18.7 23.3 26.3 25.0<br />

Ne t inte re s t m a rgin 8.7 8.6 10.2 9.9 10.6<br />

Non-inte re s t incom e / Tota l opera ting incom e 39.4 36.0 33.0 35.6 30.5<br />

Non-inte re s t incom e / Tota l opera ting expens es (or burden ra tio) 63.7 52.2 52.6 60.6 54.2<br />

Cos t ra tio 61.8 68.9 62.8 58.8 56.2<br />

ROa E 24.4 18.7 23.3 26.3 25.0<br />

ROa A 2.7 2.1 3.2 3.8 3.5<br />

Nom inal growth indicators<br />

Kenya Com m ercial Bank Lim ited<br />

(Kenya Shillings in millions except as noted)<br />

Tota l a s s e ts 58.7 1.9 29.0 31.6 11.1<br />

Ne t a dva nce s 45.5 31.2 20.8 34.2 6.5<br />

Tota l ca pita l a nd re s e rve s 59.7 7.0 73.4 13.4 20.2<br />

Cus tom e r de pos its 34.2 28.7 20.8 31.6 11.1<br />

Tota l funding (e xcl. e quity portion) 64.7 2.7 22.6 35.5 8.6<br />

Ne t incom e 40.9 (2.5) 75.8 53.0 11.1<br />

Kenya Bank Credit Rating Report | Public Credit Rating Page 6

SALEINT POINTS OF ACCORDED RATINGS<br />

GCR affirms that a.) no part of the rating was influenced by any other business activities of the credit rating agency; b.) the rating was<br />

based solely on the merits of the rated entity, security or financial instrument being rated; c.) such rating was an independent evaluation of<br />

the risks and merits of the rated entity, security or financial instrument; and d.) the validity of the rating is for a maximum of 12 months, or<br />

earlier as indicated by the applicable credit rating document.<br />

The ratings above were solicited by, or on behalf of, the rated client, and therefore, GCR has been compensated for the provision of the<br />

ratings.<br />

Kenya Commercial Bank Limited participated in the rating process via face-to-face management meetings, teleconferences and other<br />

written correspondence. Furthermore, the quality of info received was considered adequate and has been independently verified where<br />

possible.<br />

The credit rating/s has been disclosed to Kenya Commercial Bank Limited with no contestation of the rating.<br />

The information received from Kenya Commercial Bank Limited and other reliable third parties to accord the credit rating included the<br />

latest audited annual financial statements (plus four years of comparative numbers), latest internal and/or external report to management,<br />

full year detailed budgeted financial statements, most recent year-to-date management accounts, reserving methodologies and capital<br />

management policies. In addition, information specific to the rated entity and/or industry was also received.<br />

ALL GCR CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS, TERMS OF USE OF SUCH RATINGS AND<br />

DISCLAIMERS. PLEASE READ THESE LIMITATIONS, TERMS OF USE AND DISCLAIMERS BY FOLLOWING THIS LINK:<br />

HTTP://GLOBALRATINGS.NET/UNDERSTANDINGRATINGS. IN ADDITION, RATING SCALES AND DEFINITIONS ARE<br />

AVAILABLE ON GCR’S PUBLIC WEB SITE AT HTTP://GLOBALRATINGS.NET/RATINGSINFORMATION. PUBLISHED<br />

RATINGS, CRITERIA, AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. GCR'S CODE OF<br />

CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, COMPLIANCE, AND OTHER RELEVANT POLICIES AND<br />

PROCEDURES ARE ALSO AVAILABLE FROM THE UNDERSTANDING RATINGS SECTION OF THIS SITE.<br />

CREDIT RATINGS ISSUED AND RESEARCH PUBLICATIONS PUBLISHED BY GCR, ARE GCR’S OPINIONS, AS AT THE<br />

DATE OF ISSUE OR PUBLICATION THEREOF, OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT<br />

COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. GCR DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY<br />

MAY NOT MEET ITS CONTRACTUAL AND/OR FINANCIAL OBLIGATIONS AS THEY BECOME DUE. CREDIT RATINGS<br />

DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: FRAUD, MARKET LIQUIDITY RISK, MARKET<br />

VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND GCR’S OPINIONS INCLUDED IN GCR’S PUBLICATIONS<br />

ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. CREDIT RATINGS AND GCR’S PUBLICATIONS DO NOT<br />

CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND GCR’S PUBLICATIONS<br />

ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL OR HOLD PARTICULAR SECURITIES.<br />

NEITHER GCR’S CREDIT RATINGS, NOR ITS PUBLICATIONS, COMMENT ON THE SUITABILITY OF AN INVESTMENT<br />

FOR ANY PARTICULAR INVESTOR. GCR ISSUES ITS CREDIT RATINGS AND PUBLISHES GCR’S PUBLICATIONS WITH<br />

THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL MAKE ITS OWN STUDY AND EVALUATION<br />

OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING OR SALE.<br />

Copyright © <strong>2013</strong> Global Credit Rating Co (Pty) Ltd. THE INFORMATION CONTAINED HEREIN MAY NOT BE COPIED<br />

OR OTHERWISE REPRODUCED OR DISCLOSED , IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY<br />

MEANS WHATSOEVER, BY ANY PERSON WITHOUT GCR’S PRIOR WRITTEN CONSENT. The ratings were solicited<br />

by, or on behalf of, the issuer of the instrument in respect of which the rating is issued, and GCR has been<br />

compensated for the provision of the ratings. Information sources used to prepare the ratings are set out in each<br />

credit rating report and/or rating notification and include the following: parties involved in the ratings and public<br />

information. All information used to prepare the ratings is obtained by GCR from sources reasonably believed by<br />

it to be accurate and reliable. Although GCR will at all times use its best efforts and practices to ensure that the<br />

information it relies on is accurate at the time, GCR does not provide any warranty in respect of, nor is it<br />

otherwise responsible for, the accurateness of such information. GCR adopts all reasonable measures to ensure<br />

that the information it uses in assigning a credit rating is of sufficient quality and that such information is<br />

obtained from sources that GCR, acting reasonably, considers to be reliable, including, when appropriate,<br />

independent third-party sources. However, GCR cannot in every instance independently verify or validate<br />

information received in the rating process. Under no circumstances shall GCR have any liability to any person or<br />

entity for (a) any loss or damage suffered by such person or entity caused by, resulting from, or relating to, any<br />

error made by GCR, whether negligently (including gross negligence) or otherwise, or other circumstance or<br />

contingency outside the control of GCR or any of its directors, officers, employees or agents in connection with<br />

the procurement, collection, compilation, analysis, interpretation, communication, publication or delivery of any<br />

such information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages<br />

whatsoever (including without limitation, lost profits) suffered by such person or entity, as a result of the use of<br />

or inability to use any such information. The ratings, financial reporting analysis, projections, and other<br />

observations, if any, constituting part of the information contained herein are, and must be construed solely as,<br />

statements of opinion and not statements of fact or recommendations to purchase, sell or hold any securities.<br />

Each user of the information contained herein must make its own study and evaluation of each security it may<br />

consider purchasing, holding or selling. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY,<br />

TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH<br />

RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY GCR IN ANY FORM OR MANNER<br />

WHATSOEVER.<br />

Kenya Bank Credit Rating Report | Public Credit Rating Page 7