File417

File417

File417

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

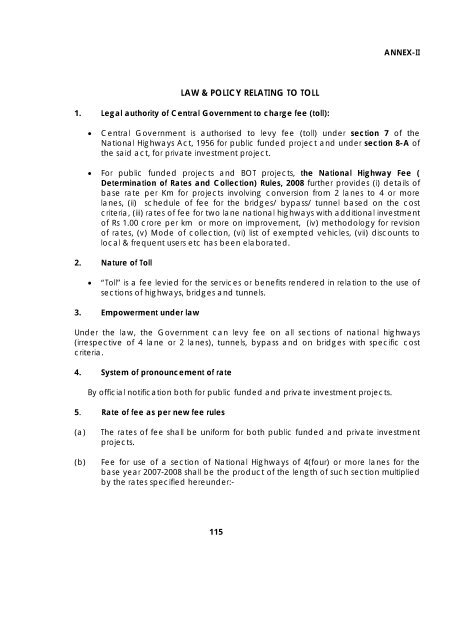

LAW & POLICY RELATING TO TOLL<br />

1. Legal authority of Central Government to charge fee (toll):<br />

ANNEX-II<br />

• Central Government is authorised to levy fee (toll) under section 7 of the<br />

National Highways Act, 1956 for public funded project and under section 8-A of<br />

the said act, for private investment project.<br />

• For public funded projects and BOT projects, the National Highway Fee (<br />

Determination of Rates and Collection) Rules, 2008 further provides (i) details of<br />

base rate per Km for projects involving conversion from 2 lanes to 4 or more<br />

lanes, (ii) schedule of fee for the bridges/ bypass/ tunnel based on the cost<br />

criteria, (iii) rates of fee for two lane national highways with additional investment<br />

of Rs 1.00 crore per km or more on improvement, (iv) methodology for revision<br />

of rates, (v) Mode of collection, (vi) list of exempted vehicles, (vii) discounts to<br />

local & frequent users etc has been elaborated.<br />

2. Nature of Toll<br />

• “Toll” is a fee levied for the services or benefits rendered in relation to the use of<br />

sections of highways, bridges and tunnels.<br />

3. Empowerment under law<br />

Under the law, the Government can levy fee on all sections of national highways<br />

(irrespective of 4 lane or 2 lanes), tunnels, bypass and on bridges with specific cost<br />

criteria.<br />

4. System of pronouncement of rate<br />

By official notification both for public funded and private investment projects.<br />

5. Rate of fee as per new fee rules<br />

(a) The rates of fee shall be uniform for both public funded and private investment<br />

projects.<br />

(b) Fee for use of a section of National Highways of 4(four) or more lanes for the<br />

base year 2007-2008 shall be the product of the length of such section multiplied<br />

by the rates specified hereunder:-<br />

115