Together good things happen - Airtel

Together good things happen - Airtel Together good things happen - Airtel

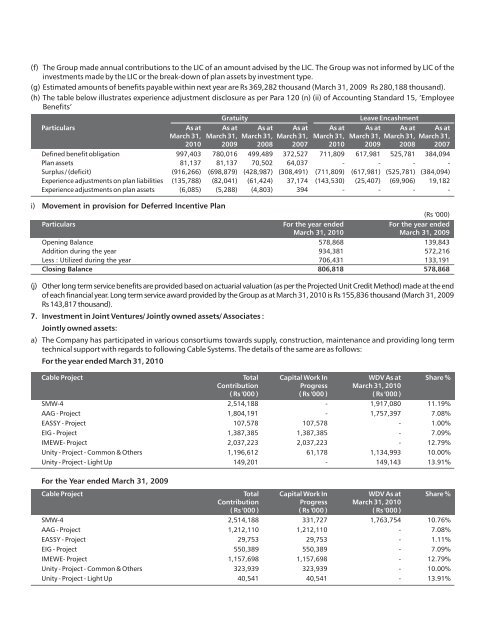

(f) The Group made annual contributions to the LIC of an amount advised by the LIC. The Group was not informed by LIC of the investments made by the LIC or the break-down of plan assets by investment type. (g) Estimated amounts of benefits payable within next year are Rs 369,282 thousand (March 31, 2009 Rs 280,188 thousand). (h) The table below illustrates experience adjustment disclosure as per Para 120 (n) (ii) of Accounting Standard 15, ‘Employee Benefits’ Gratuity Leave Encashment Particulars As at As at As at As at As at As at As at As at March 31, March 31, March 31, March 31, March 31, March 31, March 31, March 31, 2010 2009 2008 2007 2010 2009 2008 2007 Defined benefit obligation 997,403 780,016 499,489 372,527 711,809 617,981 525,781 384,094 Plan assets 81,137 81,137 70,502 64,037 - - - - Surplus / (deficit) (916,266) (698,879) (428,987) (308,491) (711,809) (617,981) (525,781) (384,094) Experience adjustments on plan liabilities (135,788) (82,041) (61,424) 37,174 (143,530) (25,407) (69,906) 19,182 Experience adjustments on plan assets (6,085) (5,288) (4,803) 394 - - - - i) Movement in provision for Deferred Incentive Plan Particulars For the year ended (Rs '000) For the year ended March 31, 2010 March 31, 2009 Opening Balance 578,868 139,843 Addition during the year 934,381 572,216 Less : Utilized during the year 706,431 133,191 Closing Balance 806,818 578,868 (j) Other long term service benefits are provided based on actuarial valuation (as per the Projected Unit Credit Method) made at the end of each financial year. Long term service award provided by the Group as at March 31, 2010 is Rs 155,836 thousand (March 31, 2009 Rs 143,817 thousand). 7. Investment in Joint Ventures/ Jointly owned assets/ Associates : Jointly owned assets: a) The Company has participated in various consortiums towards supply, construction, maintenance and providing long term technical support with regards to following Cable Systems. The details of the same are as follows: For the year ended March 31, 2010 Cable Project Total Capital Work In WDV As at Share % Contribution Progress March 31, 2010 ( Rs '000 ) ( Rs '000 ) ( Rs '000 ) SMW-4 2,514,188 - 1,917,080 11.19% AAG - Project 1,804,191 - 1,757,397 7.08% EASSY - Project 107,578 107,578 - 1.00% EIG - Project 1,387,385 1,387,385 - 7.09% IMEWE- Project 2,037,223 2,037,223 - 12.79% Unity - Project - Common & Others 1,196,612 61,178 1,134,993 10.00% Unity - Project - Light Up 149,201 - 149,143 13.91% For the Year ended March 31, 2009 Cable Project Total Capital Work In WDV As at Share % Contribution Progress March 31, 2010 ( Rs '000 ) ( Rs '000 ) ( Rs '000 ) SMW-4 2,514,188 331,727 1,763,754 10.76% AAG - Project 1,212,110 1,212,110 - 7.08% EASSY - Project 29,753 29,753 - 1.11% EIG - Project 550,389 550,389 - 7.09% IMEWE- Project 1,157,698 1,157,698 - 12.79% Unity - Project - Common & Others 323,939 323,939 - 10.00% Unity - Project - Light Up 40,541 40,541 - 13.91%

Joint Venture Entities: b) The Company entered into a Joint Venture with 9 other overseas mobile operators to form a regional alliance called the Bridge Mobile Alliance incorporated in Singapore as Bridge Mobile Pte Limited. The principal activity of the venture is creating and developing regional mobile services and managing the Bridge Mobile Alliance Programme. The Group has invested USD 2,200 thousand, amounting to Rs 92,237 thousand, in 2,200 thousand ordinary shares of USD 1 each which is equivalent to an ownership of 10.00% as at March 31, 2010 (March 31, 2009: USD 2,200 thousands Rs 92,237 thousand, ownership interest 10.00%) c) Bharti Infratel Limited has entered into a joint venture agreement on December 8, 2007 with Vodafone Essar Limited and Idea Cellular Limited to form an independent tower company (“Indus Towers Limited”) to provide passive infrastructure services in 16 circles of India. The Company and Vodafone Essar Limited holds 42% each in the Indus Tower Limited and the balance 16% is being held by Aditya Birla Telecom Limited. For this purpose Bharti Infratel Ventures Limited has been incorporated as a wholly owned subsidiary of Bharti Infratel Limited wherein relevant assets are to be transferred for ultimate merger in the Indus Towers Limited. Pursuant to the aforesaid agreement, Bharti Infratel Limited has acquired 50,000 equity shares of Rs 10 each in Indus Towers Limited on December 17, 2007 for an aggregate value of Rs. 500 thousand. d) Bharti Airtel Services Limited ('BASL') entered into a Joint Venture with 6 other parties to form an aircraft chartering company called the Forum I Aviation Limited incorporated in India. The principal activity of the venture is operating aircrafts on charter basis. BASL has invested in 4,550 thousand ordinary shares of Rs 10 each amounting to Rs 45,500 thousand along with other partners, which is equivalent to an ownership interest of 14.28% as at March 31, 2010. (March 31, 2009: Rs 45,500 thousand, ownership interest 14.28%) e) The following represent the Group’s share of assets and liabilities, and income and results of the joint ventures before elimination of transactions between joint ventures and the Company to the extent of its proportionate share Balance Sheet (Rs '000) Reserve and surplus (439,214) (764,174) Fixed assets, (net) 41,548,641 28,252,977 Investments 322,876 2,824 Deferred Tax Assets 212,274 376,982 Current assets Sundry debtors 10,704,112 4,569,743 Cash and bank 279,109 2,041,987 Loans and advances 3,970,114 5,604,738 Current liabilities and provisions 16,567,472 18,117,789 Unsecured Loans 5,783,090 15,562,449 Secured Loans 34,918,083 7,770,000 Profit and Loss Account (Rs '000) Service revenue 36,858,081 8,946,430 Other income 39,218 41,263 Expenses Operating expenses 28,296,551 7,894,247 Selling, general and Bharti Airtel Annual Report 2009-10 which are included in the Balance Sheet and Profit and Loss Account respectively. Particulars As at As at March 31, 2010 March31, 2009 Particulars For the year For the year ended March ended March 31, 2010 31, 2009 administration expenses 552,049 210,135 Finance expenses/(income) 3,468,256 1,051,728 Depreciation 4,095,061 925,915 Charity and Donation 1 221 Deferred Tax expense/(income) 164,708 (376,982) Fringe Benefit Tax - 6,198 Profit/(Loss) 320,673 (723,769) Contingent Liability 86,204 165 Capital Commitment 2,604,389 10,160,782 The above includes Total Assets of Rs 192,273 thousand, Revenue of Rs 57,647 thousand and Profit of Rs 2,387 thousand with respect to certain Joint ventures based on unaudited financial statements of these Companies. f) Loss of Associate Companies of Rs 48,283 thousand is based on unaudited financial statement of these companies. 141

- Page 91 and 92: 6. Employee benefits a) During the

- Page 93 and 94: e) The estimates of future salary i

- Page 95 and 96: epayable on disconnection, net of o

- Page 97 and 98: 2008-09 Particulars Year ended Purc

- Page 99 and 100: ) Details of trade investments purc

- Page 101 and 102: Bharti Airtel Annual Report 2009-10

- Page 103 and 104: Related Party Transaction for 2009-

- Page 105 and 106: Related Party Transaction for 2009-

- Page 107 and 108: Related Party Transaction for 2008-

- Page 109 and 110: Related Party Transaction for 2008-

- Page 111 and 112: 24.Operating lease - As a Lessee Th

- Page 113 and 114: (v) The Information concerning stoc

- Page 115 and 116: Particulars As at As at March 31, 2

- Page 117 and 118: Auditors' Report to The Board of Di

- Page 119 and 120: Bharti Airtel Annual Report 2009-10

- Page 121 and 122: Particulars C. Cash flow from finan

- Page 123 and 124: Particulars SCHEDULE : 2 (Cont.) Pr

- Page 125 and 126: Particulars SCHEDULE : 6 INVESTMENT

- Page 127 and 128: Particulars SCHEDULE : 12 CURRENT L

- Page 129 and 130: Bharti Airtel Annual Report 2009-10

- Page 131 and 132: Bharti Airtel Annual Report 2009-10

- Page 133 and 134: ecognised over the period of servic

- Page 135 and 136: Standard 15 (revised), “Employee

- Page 137 and 138: SCHEDULE: 22 NOTES TO THE FINANCIAL

- Page 139 and 140: obligations fully due to certain no

- Page 141: c) Reconciliation of opening and cl

- Page 145 and 146: 13. Particulars of securities charg

- Page 147 and 148: Bharti Airtel Annual Report 2009-10

- Page 149 and 150: Related Party Transaction for 2009-

- Page 151 and 152: (Rs '000) Related Party Transaction

- Page 153 and 154: 17. Leases a) Operating Lease - As

- Page 155 and 156: d) 2006 Plan under the Old Scheme T

- Page 157 and 158: Bharti Airtel Annual Report 2009-10

- Page 159 and 160: 24. As at March 31, 2010 the accumu

- Page 161 and 162: Notice is hereby given that the fif

- Page 163 and 164: EXPLANATORY STATEMENT (Under sectio

- Page 165: Mr. Rakesh Bharti Mittal Date of bi

- Page 169: To Karvy Computershare Private Limi

- Page 172: Bharti Airtel Limited, Bharti Cresc

(f) The Group made annual contributions to the LIC of an amount advised by the LIC. The Group was not informed by LIC of the<br />

investments made by the LIC or the break-down of plan assets by investment type.<br />

(g) Estimated amounts of benefits payable within next year are Rs 369,282 thousand (March 31, 2009 Rs 280,188 thousand).<br />

(h) The table below illustrates experience adjustment disclosure as per Para 120 (n) (ii) of Accounting Standard 15, ‘Employee<br />

Benefits’<br />

Gratuity Leave Encashment<br />

Particulars As at As at As at As at As at As at As at As at<br />

March 31, March 31, March 31, March 31, March 31, March 31, March 31, March 31,<br />

2010 2009 2008 2007 2010 2009 2008 2007<br />

Defined benefit obligation 997,403 780,016 499,489 372,527 711,809 617,981 525,781 384,094<br />

Plan assets 81,137 81,137 70,502 64,037 - - - -<br />

Surplus / (deficit) (916,266) (698,879) (428,987) (308,491) (711,809) (617,981) (525,781) (384,094)<br />

Experience adjustments on plan liabilities (135,788) (82,041) (61,424) 37,174 (143,530) (25,407) (69,906) 19,182<br />

Experience adjustments on plan assets (6,085) (5,288) (4,803) 394 - - - -<br />

i) Movement in provision for Deferred Incentive Plan<br />

Particulars For the year ended<br />

(Rs '000)<br />

For the year ended<br />

March 31, 2010 March 31, 2009<br />

Opening Balance 578,868 139,843<br />

Addition during the year 934,381 572,216<br />

Less : Utilized during the year 706,431 133,191<br />

Closing Balance 806,818 578,868<br />

(j) Other long term service benefits are provided based on actuarial valuation (as per the Projected Unit Credit Method) made at the end<br />

of each financial year. Long term service award provided by the Group as at March 31, 2010 is Rs 155,836 thousand (March 31, 2009<br />

Rs 143,817 thousand).<br />

7. Investment in Joint Ventures/ Jointly owned assets/ Associates :<br />

Jointly owned assets:<br />

a) The Company has participated in various consortiums towards supply, construction, maintenance and providing long term<br />

technical support with regards to following Cable Systems. The details of the same are as follows:<br />

For the year ended March 31, 2010<br />

Cable Project Total Capital Work In WDV As at Share %<br />

Contribution Progress March 31, 2010<br />

( Rs '000 ) ( Rs '000 ) ( Rs '000 )<br />

SMW-4 2,514,188 - 1,917,080 11.19%<br />

AAG - Project 1,804,191 - 1,757,397 7.08%<br />

EASSY - Project 107,578 107,578 - 1.00%<br />

EIG - Project 1,387,385 1,387,385 - 7.09%<br />

IMEWE- Project 2,037,223 2,037,223 - 12.79%<br />

Unity - Project - Common & Others 1,196,612 61,178 1,134,993 10.00%<br />

Unity - Project - Light Up 149,201 - 149,143 13.91%<br />

For the Year ended March 31, 2009<br />

Cable Project Total Capital Work In WDV As at Share %<br />

Contribution Progress March 31, 2010<br />

( Rs '000 ) ( Rs '000 ) ( Rs '000 )<br />

SMW-4 2,514,188 331,727 1,763,754 10.76%<br />

AAG - Project 1,212,110 1,212,110 - 7.08%<br />

EASSY - Project 29,753 29,753 - 1.11%<br />

EIG - Project 550,389 550,389 - 7.09%<br />

IMEWE- Project 1,157,698 1,157,698 - 12.79%<br />

Unity - Project - Common & Others 323,939 323,939 - 10.00%<br />

Unity - Project - Light Up 40,541 40,541 - 13.91%