Together good things happen - Airtel

Together good things happen - Airtel Together good things happen - Airtel

(Shares in Thousands) As of March 31, 2010 (vi) The fair value of the options granted was estimated on the date of grant using the Black-Scholes / Lattice valuation model with the following assumptions Particulars For the For the year ended year ended March 31,2010 March 31, 2009 Risk free interest rates 6.44% to 7.86% 4.45% to 9.70% Expected life 48 to 66 months 48 to 60 months Volatility 36.13% to 37.47% 36.23% to 41.39% Dividend yield 0.31% 0 Weighted average share price on the date of grant 307.42 to 412.13 308.40 to 416.27 The volatility of the options is based on the historical volatility of the share price since the Company’s equity shares became publicly traded, which may be shorter than the term of the options. As of March 31, 2009 Number of Weighted Weighted Number of Weighted Weighted stock options average average stock average average exercise remaining options exercise remaining price (Rs.) contractual price (Rs.) contractual life (in Years) life (in Years) Scheme 2005 Number of shares under option: Outstanding at beginning of year 5,998 237.30 7,682 237.30 Granted 1,323 5.00 - - Exercised 920 128.37 478 134.08 Cancelled or expired 604 - 1,206 - Outstanding at the year end 5,797 192.53 2.44 to 6.34 5,998 237.30 3.44 to 5.92 Exercisable at end of year 2,576 192.53 1,876 237.30 Weighted average grant date fair value/exercise price per option for options granted during the year/ period at less than market value 1,323 401.40 - - Scheme 2008 & Annual Grant Plan Number of shares under option: Outstanding at beginning of period 5,794 331.22 - - Granted 2,566 402.50 6,216 330.36 Exercised 1 - - - Cancelled or expired 1,328 - 422 - Outstanding at period end 7,031 352.05 5.25 to 6.25 5,794 331.22 6.25 to 6.76 Exercisable at end of period 1,282 352.05 - - Weighted average grant date fair value/exercise price per option for options granted during the year/ period at less than market value 2,566 169.45 6,216 154.44 *Options have been exercised out of the shares issued to the trust The weighted average share price during the year was Rs 365.48. (vii) The balance of deferred stock compensation as on March 31, 2010 is Rs 977,748 thousand (March 31, 2009 Rs 824,092 thousand) and total employee compensation cost recognized for the year then ended is Rs 934,185 thousand (March 31, 2009 Rs 646,967 thousand). (viii)The Company has granted stock options to the employees of the subsidiaries i.e. Bharti Hexacom Limited and Bharti Infratel Limited and the corresponding compensation cost is borne by the Company. 28.Earnings per share (Basic and Diluted): The board of directors in its meeting held on April 29, 2009 have approved sub-division (share split) of existing equity shares of Rs 10 each into 2 equity shares of Rs 5 each, which was duly approved by postal ballot by the shareholders of the Company on July 11, 2009. Accordingly, EPS for the year ended March 31, 2010 and previous year has been restated, as applicable, below:

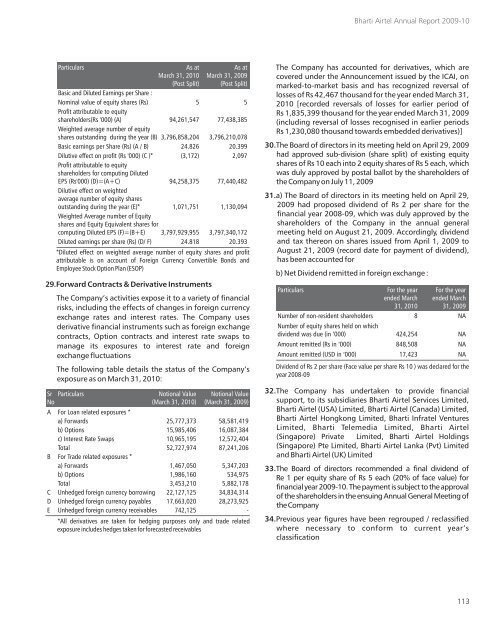

Particulars As at As at March 31, 2010 March 31, 2009 Basic and Diluted Earnings per Share : (Post Split) (Post Split) Nominal value of equity shares (Rs) Profit attributable to equity 5 5 shareholders(Rs '000) (A) Weighted average number of equity 94,261,547 77,438,385 shares outstanding during the year (B) 3,796,858,204 3,796,210,078 Basic earnings per Share (Rs) (A / B) 24.826 20.399 Dilutive effect on profit (Rs '000) (C )* Profit attributable to equity shareholders for computing Diluted (3,172) 2,097 EPS (Rs'000) (D)=(A+C) Dilutive effect on weighted average number of equity shares 94,258,375 77,440,482 outstanding during the year (E)* Weighted Average number of Equity shares and Equity Equivalent shares for 1,071,751 1,130,094 computing Diluted EPS (F)=(B+E) 3,797,929,955 3,797,340,172 Diluted earnings per share (Rs) (D/ F) 24.818 20.393 *Diluted effect on weighted average number of equity shares and profit attributable is on account of Foreign Currency Convertible Bonds and Employee Stock Option Plan (ESOP) 29.Forward Contracts & Derivative Instruments The Company’s activities expose it to a variety of financial risks, including the effects of changes in foreign currency exchange rates and interest rates. The Company uses derivative financial instruments such as foreign exchange contracts, Option contracts and interest rate swaps to manage its exposures to interest rate and foreign exchange fluctuations The following table details the status of the Company’s exposure as on March 31, 2010: Sr Particulars Notional Value Notional Value No (March 31, 2010) (March 31, 2009) A For Loan related exposures * a) Forwards 25,777,373 58,581,419 b) Options 15,985,406 16,087,384 c) Interest Rate Swaps 10,965,195 12,572,404 Total 52,727,974 87,241,206 B For Trade related exposures * a) Forwards 1,467,050 5,347,203 b) Options 1,986,160 534,975 Total 3,453,210 5,882,178 C Unhedged foreign currency borrowing 22,127,125 34,834,314 D Unhedged foreign currency payables 17,663,020 28,273,925 E Unhedged foreign currency receivables 742,125 - *All derivatives are taken for hedging purposes only and trade related exposure includes hedges taken for forecasted receivables Bharti Airtel Annual Report 2009-10 The Company has accounted for derivatives, which are covered under the Announcement issued by the ICAI, on marked-to-market basis and has recognized reversal of losses of Rs 42,467 thousand for the year ended March 31, 2010 [recorded reversals of losses for earlier period of Rs 1,835,399 thousand for the year ended March 31, 2009 (including reversal of losses recognised in earlier periods Rs 1,230,080 thousand towards embedded derivatives)] 30.The Board of directors in its meeting held on April 29, 2009 had approved sub-division (share split) of existing equity shares of Rs 10 each into 2 equity shares of Rs 5 each, which was duly approved by postal ballot by the shareholders of the Company on July 11, 2009 31.a) The Board of directors in its meeting held on April 29, 2009 had proposed dividend of Rs 2 per share for the financial year 2008-09, which was duly approved by the shareholders of the Company in the annual general meeting held on August 21, 2009. Accordingly, dividend and tax thereon on shares issued from April 1, 2009 to August 21, 2009 (record date for payment of dividend), has been accounted for b) Net Dividend remitted in foreign exchange : Particulars For the year For the year ended March ended March 31, 2010 31, 2009 Number of non-resident shareholders 8 NA Number of equity shares held on which dividend was due (in ‘000) 424,254 NA Amount remitted (Rs in ‘000) 848,508 NA Amount remitted (USD in ‘000) 17,423 NA Dividend of Rs 2 per share (Face value per share Rs 10 ) was declared for the year 2008-09 32.The Company has undertaken to provide financial support, to its subsidiaries Bharti Airtel Services Limited, Bharti Airtel (USA) Limited, Bharti Airtel (Canada) Limited, Bharti Airtel Hongkong Limited, Bharti Infratel Ventures Limited, Bharti Telemedia Limited, Bharti Airtel (Singapore) Private Limited, Bharti Airtel Holdings (Singapore) Pte Limited, Bharti Airtel Lanka (Pvt) Limited and Bharti Airtel (UK) Limited 33.The Board of directors recommended a final dividend of Re 1 per equity share of Rs 5 each (20% of face value) for financial year 2009-10. The payment is subject to the approval of the shareholders in the ensuing Annual General Meeting of the Company 34.Previous year figures have been regrouped / reclassified where necessary to conform to current year’s classification 113

- Page 63 and 64: Distribution of shareholding By num

- Page 65 and 66: The Board of directors, Bharti Airt

- Page 67 and 68: Annexure referred to in paragraph 4

- Page 69 and 70: (x) The Company has no accumulated

- Page 71 and 72: Bharti Airtel Annual Report 2009-10

- Page 73 and 74: Particulars C. Cash flow from finan

- Page 75 and 76: Particulars SCHEDULE : 3 SECURED LO

- Page 77 and 78: Particulars SCHEDULE : 6 INVESTMENT

- Page 79 and 80: Particulars SCHEDULE : 9 CASH AND B

- Page 81 and 82: Bharti Airtel Annual Report 2009-10

- Page 83 and 84: SCHEDULE: 21 STATEMENT OF SIGNIFICA

- Page 85 and 86: Forward Exchange Contracts covered

- Page 87 and 88: Minimum Alternative Tax (MAT) credi

- Page 89 and 90: Unless otherwise stated below, the

- Page 91 and 92: 6. Employee benefits a) During the

- Page 93 and 94: e) The estimates of future salary i

- Page 95 and 96: epayable on disconnection, net of o

- Page 97 and 98: 2008-09 Particulars Year ended Purc

- Page 99 and 100: ) Details of trade investments purc

- Page 101 and 102: Bharti Airtel Annual Report 2009-10

- Page 103 and 104: Related Party Transaction for 2009-

- Page 105 and 106: Related Party Transaction for 2009-

- Page 107 and 108: Related Party Transaction for 2008-

- Page 109 and 110: Related Party Transaction for 2008-

- Page 111 and 112: 24.Operating lease - As a Lessee Th

- Page 113: (v) The Information concerning stoc

- Page 117 and 118: Auditors' Report to The Board of Di

- Page 119 and 120: Bharti Airtel Annual Report 2009-10

- Page 121 and 122: Particulars C. Cash flow from finan

- Page 123 and 124: Particulars SCHEDULE : 2 (Cont.) Pr

- Page 125 and 126: Particulars SCHEDULE : 6 INVESTMENT

- Page 127 and 128: Particulars SCHEDULE : 12 CURRENT L

- Page 129 and 130: Bharti Airtel Annual Report 2009-10

- Page 131 and 132: Bharti Airtel Annual Report 2009-10

- Page 133 and 134: ecognised over the period of servic

- Page 135 and 136: Standard 15 (revised), “Employee

- Page 137 and 138: SCHEDULE: 22 NOTES TO THE FINANCIAL

- Page 139 and 140: obligations fully due to certain no

- Page 141 and 142: c) Reconciliation of opening and cl

- Page 143 and 144: Joint Venture Entities: b) The Comp

- Page 145 and 146: 13. Particulars of securities charg

- Page 147 and 148: Bharti Airtel Annual Report 2009-10

- Page 149 and 150: Related Party Transaction for 2009-

- Page 151 and 152: (Rs '000) Related Party Transaction

- Page 153 and 154: 17. Leases a) Operating Lease - As

- Page 155 and 156: d) 2006 Plan under the Old Scheme T

- Page 157 and 158: Bharti Airtel Annual Report 2009-10

- Page 159 and 160: 24. As at March 31, 2010 the accumu

- Page 161 and 162: Notice is hereby given that the fif

- Page 163 and 164: EXPLANATORY STATEMENT (Under sectio

Particulars<br />

As at As at<br />

March 31, 2010 March 31, 2009<br />

Basic and Diluted Earnings per Share :<br />

(Post Split) (Post Split)<br />

Nominal value of equity shares (Rs)<br />

Profit attributable to equity<br />

5 5<br />

shareholders(Rs '000) (A)<br />

Weighted average number of equity<br />

94,261,547 77,438,385<br />

shares outstanding during the year (B) 3,796,858,204 3,796,210,078<br />

Basic earnings per Share (Rs) (A / B) 24.826 20.399<br />

Dilutive effect on profit (Rs '000) (C )*<br />

Profit attributable to equity<br />

shareholders for computing Diluted<br />

(3,172) 2,097<br />

EPS (Rs'000) (D)=(A+C)<br />

Dilutive effect on weighted<br />

average number of equity shares<br />

94,258,375 77,440,482<br />

outstanding during the year (E)*<br />

Weighted Average number of Equity<br />

shares and Equity Equivalent shares for<br />

1,071,751 1,130,094<br />

computing Diluted EPS (F)=(B+E) 3,797,929,955 3,797,340,172<br />

Diluted earnings per share (Rs) (D/ F) 24.818 20.393<br />

*Diluted effect on weighted average number of equity shares and profit<br />

attributable is on account of Foreign Currency Convertible Bonds and<br />

Employee Stock Option Plan (ESOP)<br />

29.Forward Contracts & Derivative Instruments<br />

The Company’s activities expose it to a variety of financial<br />

risks, including the effects of changes in foreign currency<br />

exchange rates and interest rates. The Company uses<br />

derivative financial instruments such as foreign exchange<br />

contracts, Option contracts and interest rate swaps to<br />

manage its exposures to interest rate and foreign<br />

exchange fluctuations<br />

The following table details the status of the Company’s<br />

exposure as on March 31, 2010:<br />

Sr Particulars Notional Value Notional Value<br />

No (March 31, 2010) (March 31, 2009)<br />

A For Loan related exposures *<br />

a) Forwards 25,777,373 58,581,419<br />

b) Options 15,985,406 16,087,384<br />

c) Interest Rate Swaps 10,965,195 12,572,404<br />

Total 52,727,974 87,241,206<br />

B For Trade related exposures *<br />

a) Forwards 1,467,050 5,347,203<br />

b) Options 1,986,160 534,975<br />

Total 3,453,210 5,882,178<br />

C Unhedged foreign currency borrowing 22,127,125 34,834,314<br />

D Unhedged foreign currency payables 17,663,020 28,273,925<br />

E Unhedged foreign currency receivables 742,125 -<br />

*All derivatives are taken for hedging purposes only and trade related<br />

exposure includes hedges taken for forecasted receivables<br />

Bharti <strong>Airtel</strong> Annual Report 2009-10<br />

The Company has accounted for derivatives, which are<br />

covered under the Announcement issued by the ICAI, on<br />

marked-to-market basis and has recognized reversal of<br />

losses of Rs 42,467 thousand for the year ended March 31,<br />

2010 [recorded reversals of losses for earlier period of<br />

Rs 1,835,399 thousand for the year ended March 31, 2009<br />

(including reversal of losses recognised in earlier periods<br />

Rs 1,230,080 thousand towards embedded derivatives)]<br />

30.The Board of directors in its meeting held on April 29, 2009<br />

had approved sub-division (share split) of existing equity<br />

shares of Rs 10 each into 2 equity shares of Rs 5 each, which<br />

was duly approved by postal ballot by the shareholders of<br />

the Company on July 11, 2009<br />

31.a) The Board of directors in its meeting held on April 29,<br />

2009 had proposed dividend of Rs 2 per share for the<br />

financial year 2008-09, which was duly approved by the<br />

shareholders of the Company in the annual general<br />

meeting held on August 21, 2009. Accordingly, dividend<br />

and tax thereon on shares issued from April 1, 2009 to<br />

August 21, 2009 (record date for payment of dividend),<br />

has been accounted for<br />

b) Net Dividend remitted in foreign exchange :<br />

Particulars For the year For the year<br />

ended March ended March<br />

31, 2010 31, 2009<br />

Number of non-resident shareholders 8 NA<br />

Number of equity shares held on which<br />

dividend was due (in ‘000) 424,254 NA<br />

Amount remitted (Rs in ‘000) 848,508 NA<br />

Amount remitted (USD in ‘000) 17,423 NA<br />

Dividend of Rs 2 per share (Face value per share Rs 10 ) was declared for the<br />

year 2008-09<br />

32.The Company has undertaken to provide financial<br />

support, to its subsidiaries Bharti <strong>Airtel</strong> Services Limited,<br />

Bharti <strong>Airtel</strong> (USA) Limited, Bharti <strong>Airtel</strong> (Canada) Limited,<br />

Bharti <strong>Airtel</strong> Hongkong Limited, Bharti Infratel Ventures<br />

Limited, Bharti Telemedia Limited, Bharti <strong>Airtel</strong><br />

(Singapore) Private Limited, Bharti <strong>Airtel</strong> Holdings<br />

(Singapore) Pte Limited, Bharti <strong>Airtel</strong> Lanka (Pvt) Limited<br />

and Bharti <strong>Airtel</strong> (UK) Limited<br />

33.The Board of directors recommended a final dividend of<br />

Re 1 per equity share of Rs 5 each (20% of face value) for<br />

financial year 2009-10. The payment is subject to the approval<br />

of the shareholders in the ensuing Annual General Meeting of<br />

the Company<br />

34.Previous year figures have been regrouped / reclassified<br />

where necessary to conform to current year’s<br />

classification<br />

113