Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

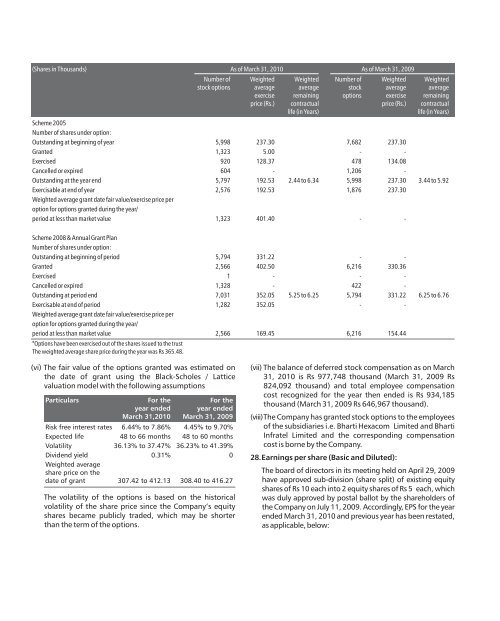

(Shares in Thousands) As of March 31, 2010<br />

(vi) The fair value of the options granted was estimated on<br />

the date of grant using the Black-Scholes / Lattice<br />

valuation model with the following assumptions<br />

Particulars For the<br />

For the<br />

year ended year ended<br />

March 31,2010 March 31, 2009<br />

Risk free interest rates 6.44% to 7.86% 4.45% to 9.70%<br />

Expected life 48 to 66 months 48 to 60 months<br />

Volatility 36.13% to 37.47% 36.23% to 41.39%<br />

Dividend yield 0.31% 0<br />

Weighted average<br />

share price on the<br />

date of grant 307.42 to 412.13 308.40 to 416.27<br />

The volatility of the options is based on the historical<br />

volatility of the share price since the Company’s equity<br />

shares became publicly traded, which may be shorter<br />

than the term of the options.<br />

As of March 31, 2009<br />

Number of Weighted Weighted Number of Weighted Weighted<br />

stock options average average stock average average<br />

exercise remaining options exercise remaining<br />

price (Rs.) contractual price (Rs.) contractual<br />

life (in Years) life (in Years)<br />

Scheme 2005<br />

Number of shares under option:<br />

Outstanding at beginning of year 5,998 237.30 7,682 237.30<br />

Granted 1,323 5.00 - -<br />

Exercised 920 128.37 478 134.08<br />

Cancelled or expired 604 - 1,206 -<br />

Outstanding at the year end 5,797 192.53 2.44 to 6.34 5,998 237.30 3.44 to 5.92<br />

Exercisable at end of year 2,576 192.53 1,876 237.30<br />

Weighted average grant date fair value/exercise price per<br />

option for options granted during the year/<br />

period at less than market value 1,323 401.40 - -<br />

Scheme 2008 & Annual Grant Plan<br />

Number of shares under option:<br />

Outstanding at beginning of period 5,794 331.22 - -<br />

Granted 2,566 402.50 6,216 330.36<br />

Exercised 1 - - -<br />

Cancelled or expired 1,328 - 422 -<br />

Outstanding at period end 7,031 352.05 5.25 to 6.25 5,794 331.22 6.25 to 6.76<br />

Exercisable at end of period 1,282 352.05 - -<br />

Weighted average grant date fair value/exercise price per<br />

option for options granted during the year/<br />

period at less than market value 2,566 169.45 6,216 154.44<br />

*Options have been exercised out of the shares issued to the trust<br />

The weighted average share price during the year was Rs 365.48.<br />

(vii) The balance of deferred stock compensation as on March<br />

31, 2010 is Rs 977,748 thousand (March 31, 2009 Rs<br />

824,092 thousand) and total employee compensation<br />

cost recognized for the year then ended is Rs 934,185<br />

thousand (March 31, 2009 Rs 646,967 thousand).<br />

(viii)The Company has granted stock options to the employees<br />

of the subsidiaries i.e. Bharti Hexacom Limited and Bharti<br />

Infratel Limited and the corresponding compensation<br />

cost is borne by the Company.<br />

28.Earnings per share (Basic and Diluted):<br />

The board of directors in its meeting held on April 29, 2009<br />

have approved sub-division (share split) of existing equity<br />

shares of Rs 10 each into 2 equity shares of Rs 5 each, which<br />

was duly approved by postal ballot by the shareholders of<br />

the Company on July 11, 2009. Accordingly, EPS for the year<br />

ended March 31, 2010 and previous year has been restated,<br />

as applicable, below: