schedule of investments fiscal year 2011 - State of Wisconsin ...

schedule of investments fiscal year 2011 - State of Wisconsin ... schedule of investments fiscal year 2011 - State of Wisconsin ...

FIXED INCOME CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, 2011 NAME COUPON RATE MATURITY RATING COST FAIR VALUE BTC LONG CORP BD INDEX FUND A2.............. N/A N/A NR 498,674,102 570,892,941 BTC LONG GOVT BD INDEX A2......................... N/A N/A NR 645,723,990 634,471,440 BUCCANEER MERGER SUB INC........................ 9.125 1/15/2019 B- 2,954,995 2,990,000 BUNDESOBLIGATION.......................................... 2.250 4/11/2014 NR 7,597,880 7,746,944 BUNDESOBLIGATION.......................................... 2.250 4/10/2015 NR 58,993,238 65,768,426 BUNDESOBLIGATION.......................................... 2.500 2/27/2015 NR 9,627,711 10,326,046 BUNDESOBLIGATION.......................................... 3.500 4/12/2013 NR 28,257,108 29,982,260 BUNDESREPUBLIK DEUTSCHLAND................. 3.000 7/4/2020 NR 600,784 656,921 BUNDESREPUBLIK DEUTSCHLAND................. 3.250 1/4/2020 NR 13,701,277 14,927,432 BUNDESREPUBLIK DEUTSCHLAND................. 3.500 1/4/2016 NR 5,245,774 5,353,123 BUNDESREPUBLIK DEUTSCHLAND................. 4.250 7/4/2039 NR 537,197 544,965 BUNDESREPUBLIK DEUTSCHLAND................. 4.750 7/4/2028 NR 920,801 972,548 BUNDESREPUBLIK DEUTSCHLAND................. 4.750 7/4/2034 NR 2,777,482 3,049,883 BUNDESREPUBLIK DEUTSCHLAND................. 4.750 7/4/2040 NR 8,514,157 8,477,876 BUNDESREPUBLIK DEUTSCHLAND................. 6.500 7/4/2027 NR 669,505 705,345 BUONI DEL TESORO POLENNALI...................... 4.250 2/1/2019 NR 3,180,330 3,145,653 BUONI POLIENNALI DEL TES............................. 3.000 11/1/2015 NR 9,126,761 9,764,616 BUONI POLIENNALI DEL TES............................. 3.000 4/15/2015 NR 10,990,563 11,274,237 BUONI POLIENNALI DEL TES............................. 3.750 8/1/2021 NR 2,441,784 2,422,821 BUONI POLIENNALI DEL TES............................. 4.500 3/1/2026 NR 3,394,596 3,415,674 BUONI POLIENNALI DEL TES............................. 5.000 9/1/2040 NR 3,437,071 3,415,794 BURLINGTON NORTHERN SANTA FE L............ 4.700 10/1/2019 BBB+ 6,057,776 6,365,880 BURLINGTON NORTHERN SANTA FE L............ 5.650 5/1/2017 BBB+ 428,357 451,147 BURLINGTON NORTHERN SANTA FE L............ 5.750 3/15/2018 BBB+ 980,425 1,013,855 BURLINGTON NORTHERN SANTA FE L............ 6.150 5/1/2037 BBB+ 5,121,830 5,338,507 BURLINGTON NORTHERN SANTA FE L............ 6.200 8/15/2036 BBB+ 1,333,412 1,293,312 BURLINGTON NORTHERN SANTA FE L............ 7.000 2/1/2014 BBB+ 4,999,150 5,689,882 BURLINGTON NORTHERN SANTA FE L............ 7.950 8/15/2030 BBB+ 2,119,728 2,205,379 BWAY HOLDING CO............................................. 10.000 6/15/2018 CCC+ 1,421,333 1,527,750 CABLEVISION SYSTEMS CORP.......................... 7.750 4/15/2018 B+ 1,675,000 1,785,969 CABLEVISION SYSTEMS CORP.......................... 8.000 4/15/2020 B+ 500,000 536,250 CABLEVISION SYSTEMS CORP.......................... 8.625 9/15/2017 B+ 1,218,811 1,327,594 CADMUS COMMUNICATIONS CORP SR........... 8.375 6/15/2014 CCC+ 736,925 637,000 CAESARS ENTERTAINMENT OPERATIN.......... 5.375 12/15/2013 CCC 663,375 685,125 CAESARS ENTERTAINMENT OPERATIN.......... 10.000 12/15/2018 CCC 5,565,513 5,672,213 CAESARS ENTERTAINMENT OPERATIN.......... 12.750 4/15/2018 CCC 789,956 773,063 CAJA AHORROS GUIPUZCOA............................. 4.375 11/5/2014 AAA 3,875,219 3,990,717 CAJA MADRID....................................................... 3.500 3/14/2013 AAA 4,639,877 5,213,981 CALCIPAR SA......................................................... 6.875 5/1/2018 BB- 1,654,375 1,654,125 CALIFORNIA ST..................................................... 6.200 10/1/2019 A- 11,943,793 13,060,369 CALIFORNIA ST..................................................... 7.300 10/1/2039 A- 3,366,210 3,714,279 CALIFORNIA ST..................................................... 7.500 4/1/2034 A- 1,373,925 1,413,750 CALIFORNIA ST..................................................... 7.600 11/1/2040 A- 2,952,758 3,370,682 CALIFORNIA ST..................................................... 7.625 3/1/2040 A- 5,085,050 5,756,050 CALIFORNIA ST..................................................... VARIABLE RATE 4/1/2039 A- 2,396,485 2,446,119 CALPINE CORP...................................................... 7.250 10/15/2017 B+ 2,650,313 2,791,250 CALPINE CORP...................................................... 7.500 2/15/2021 B+ 2,805,000 2,856,000 CALPINE CORP...................................................... 7.875 7/31/2020 B+ 525,041 548,625 CALUMET SPECIALTY PRODUCTS PAR........... 9.375 5/1/2019 B 1,470,000 1,514,100 CANADA HOUSING TRUST NO 1........................ 3.600 6/15/2013 AAA 4,977,763 5,372,670 CANADA HOUSING TRUST NO 1........................ 4.550 12/15/2012 AAA 9,930,608 10,813,411 CANADIAN NATIONAL RAILWAY CO............... 5.550 3/1/2019 A- 5,432,136 5,408,064 CANADIAN NATIONAL RAILWAY CO............... 5.850 11/15/2017 A- 1,495,245 1,717,386 CANADIAN NATIONAL RAILWAY CO............... 6.375 10/15/2011 A- 5,070,384 4,877,856 CAP CANA S A....................................................... 10.000 4/30/2016 NR 380,077 329,821 CAP CANA S A....................................................... 10.000 4/30/2016 NR 408,570 373,800 CAP GUARD GLOBAL HIGH YIELD.................... N/A N/A NR 203,781,491 463,722,795 CAPELLA HEALTHCARE INC.............................. 9.250 7/1/2017 B 1,481,100 1,582,500 CAPEX SA............................................................... 10.000 3/10/2018 B- 358,630 352,718 CAPITAL ONE FINANCIAL CORP........................ 6.750 9/15/2017 BBB 9,941,736 10,636,396 - 63 - STATE OF WISCONSIN INVESTMENT BOARD

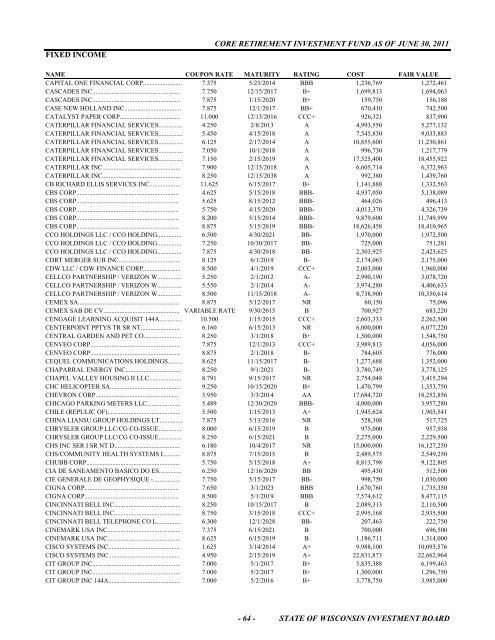

FIXED INCOME CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, 2011 NAME COUPON RATE MATURITY RATING COST FAIR VALUE CAPITAL ONE FINANCIAL CORP........................ 7.375 5/23/2014 BBB 1,236,769 1,272,461 CASCADES INC...................................................... 7.750 12/15/2017 B+ 1,699,813 1,694,063 CASCADES INC...................................................... 7.875 1/15/2020 B+ 159,750 156,188 CASE NEW HOLLAND INC................................... 7.875 12/1/2017 BB+ 670,410 742,500 CATALYST PAPER CORP..................................... 11.000 12/15/2016 CCC+ 926,321 837,900 CATERPILLAR FINANCIAL SERVICES............... 4.250 2/8/2013 A 4,993,550 5,277,132 CATERPILLAR FINANCIAL SERVICES............... 5.450 4/15/2018 A 7,545,830 9,033,883 CATERPILLAR FINANCIAL SERVICES............... 6.125 2/17/2014 A 10,855,600 11,230,861 CATERPILLAR FINANCIAL SERVICES............... 7.050 10/1/2018 A 996,730 1,217,779 CATERPILLAR FINANCIAL SERVICES............... 7.150 2/15/2019 A 17,525,400 18,455,922 CATERPILLAR INC................................................ 7.900 12/15/2018 A 6,605,714 6,372,963 CATERPILLAR INC................................................ 8.250 12/15/2038 A 992,380 1,439,760 CB RICHARD ELLIS SERVICES INC................... 11.625 6/15/2017 B+ 1,141,888 1,332,563 CBS CORP............................................................... 4.625 5/15/2018 BBB- 4,937,050 5,138,089 CBS CORP............................................................... 5.625 8/15/2012 BBB- 464,026 496,413 CBS CORP............................................................... 5.750 4/15/2020 BBB- 4,013,370 4,326,739 CBS CORP............................................................... 8.200 5/15/2014 BBB- 9,879,600 11,749,999 CBS CORP............................................................... 8.875 5/15/2019 BBB- 18,626,458 18,410,965 CCO HOLDINGS LLC / CCO HOLDING............... 6.500 4/30/2021 BB- 1,970,000 1,972,500 CCO HOLDINGS LLC / CCO HOLDING............... 7.250 10/30/2017 BB- 725,000 751,281 CCO HOLDINGS LLC / CCO HOLDING............... 7.875 4/30/2018 BB- 2,303,925 2,423,625 CDRT MERGER SUB INC...................................... 8.125 6/1/2019 B- 2,174,063 2,175,000 CDW LLC / CDW FINANCE CORP....................... 8.500 4/1/2019 CCC+ 2,003,000 1,960,000 CELLCO PARTNERSHIP / VERIZON W............... 5.250 2/1/2012 A- 2,990,190 3,078,720 CELLCO PARTNERSHIP / VERIZON W............... 5.550 2/1/2014 A- 3,974,280 4,406,633 CELLCO PARTNERSHIP / VERIZON W............... 8.500 11/15/2018 A- 8,738,900 10,350,614 CEMEX SA.............................................................. 8.875 5/12/2017 NR 60,150 75,096 CEMEX SAB DE CV............................................... VARIABLE RATE 9/30/2015 B 700,927 683,220 CENGAGE LEARNING ACQUISIT 144A.............. 10.500 1/15/2015 CCC+ 2,603,333 2,262,500 CENTERPOINT PPTYS TR SR NT........................ 6.160 6/15/2013 NR 6,000,000 6,077,220 CENTRAL GARDEN AND PET CO....................... 8.250 3/1/2018 B+ 1,500,000 1,548,750 CENVEO CORP....................................................... 7.875 12/1/2013 CCC+ 3,989,813 4,056,000 CENVEO CORP....................................................... 8.875 2/1/2018 B- 784,605 776,000 CEQUEL COMMUNICATIONS HOLDINGS......... 8.625 11/15/2017 B- 1,277,688 1,352,000 CHAPARRAL ENERGY INC.................................. 8.250 9/1/2021 B- 3,780,749 3,778,125 CHAPEL VALLEY HOUSING II LLC.................... 8.791 9/15/2017 NR 2,754,048 3,415,294 CHC HELICOPTER SA........................................... 9.250 10/15/2020 B+ 1,470,799 1,353,750 CHEVRON CORP................................................... 3.950 3/3/2014 AA 17,684,720 18,252,856 CHICAGO PARKING METERS LLC..................... 5.489 12/30/2020 BBB- 4,000,000 3,957,280 CHILE (REPULIC OF)............................................. 5.500 1/15/2013 A+ 1,945,624 1,903,541 CHINA LIANSU GROUP HOLDINGS LT.............. 7.875 5/13/2016 NR 528,308 517,725 CHRYSLER GROUP LLC/CG CO-ISSUE.............. 8.000 6/15/2019 B 975,000 957,938 CHRYSLER GROUP LLC/CG CO-ISSUE.............. 8.250 6/15/2021 B 2,275,000 2,229,500 CHS INC SER I SR NT D........................................ 6.180 10/4/2017 NR 15,000,000 16,127,250 CHS/COMMUNITY HEALTH SYSTEMS I........... 8.875 7/15/2015 B 2,489,575 2,549,250 CHUBB CORP......................................................... 5.750 5/15/2018 A+ 8,813,798 9,122,805 CIA DE SANEAMENTO BASICO DO ES.............. 6.250 12/16/2020 BB 495,430 512,500 CIE GENERALE DE GEOPHYSIQUE -................. 7.750 5/15/2017 BB- 998,750 1,030,000 CIGNA CORP.......................................................... 7.650 3/1/2023 BBB 1,670,760 1,735,350 CIGNA CORP.......................................................... 8.500 5/1/2019 BBB 7,574,612 8,477,115 CINCINNATI BELL INC......................................... 8.250 10/15/2017 B 2,089,313 2,110,500 CINCINNATI BELL INC......................................... 8.750 3/15/2018 CCC+ 2,995,168 2,935,500 CINCINNATI BELL TELEPHONE CO L............... 6.300 12/1/2028 BB- 207,463 222,750 CINEMARK USA INC............................................. 7.375 6/15/2021 B 700,000 696,500 CINEMARK USA INC............................................. 8.625 6/15/2019 B 1,186,711 1,314,000 CISCO SYSTEMS INC............................................ 1.625 3/14/2014 A+ 9,988,100 10,093,576 CISCO SYSTEMS INC............................................ 4.950 2/15/2019 A+ 22,831,873 22,662,964 CIT GROUP INC...................................................... 7.000 5/1/2017 B+ 5,835,388 6,199,463 CIT GROUP INC...................................................... 7.000 5/2/2017 B+ 1,300,000 1,296,750 CIT GROUP INC 144A............................................ 7.000 5/2/2016 B+ 3,778,750 3,985,000 - 64 - STATE OF WISCONSIN INVESTMENT BOARD

- Page 15 and 16: STOCKS CORE RETIREMENT INVESTMENT F

- Page 17 and 18: STOCKS CORE RETIREMENT INVESTMENT F

- Page 19 and 20: STOCKS CORE RETIREMENT INVESTMENT F

- Page 21 and 22: STOCKS CORE RETIREMENT INVESTMENT F

- Page 23 and 24: STOCKS CORE RETIREMENT INVESTMENT F

- Page 25 and 26: STOCKS CORE RETIREMENT INVESTMENT F

- Page 27 and 28: STOCKS CORE RETIREMENT INVESTMENT F

- Page 29 and 30: STOCKS CORE RETIREMENT INVESTMENT F

- Page 31 and 32: STOCKS CORE RETIREMENT INVESTMENT F

- Page 33 and 34: STOCKS CORE RETIREMENT INVESTMENT F

- Page 35 and 36: STOCKS CORE RETIREMENT INVESTMENT F

- Page 37 and 38: STOCKS CORE RETIREMENT INVESTMENT F

- Page 39 and 40: STOCKS CORE RETIREMENT INVESTMENT F

- Page 41 and 42: STOCKS CORE RETIREMENT INVESTMENT F

- Page 43 and 44: STOCKS CORE RETIREMENT INVESTMENT F

- Page 45 and 46: STOCKS CORE RETIREMENT INVESTMENT F

- Page 47 and 48: STOCKS CORE RETIREMENT INVESTMENT F

- Page 49 and 50: STOCKS CORE RETIREMENT INVESTMENT F

- Page 51 and 52: STOCKS CORE RETIREMENT INVESTMENT F

- Page 53 and 54: STOCKS CORE RETIREMENT INVESTMENT F

- Page 55 and 56: STOCKS CORE RETIREMENT INVESTMENT F

- Page 57 and 58: STOCKS CORE RETIREMENT INVESTMENT F

- Page 59 and 60: STOCKS CORE RETIREMENT INVESTMENT F

- Page 61 and 62: STOCKS CORE RETIREMENT INVESTMENT F

- Page 63 and 64: FIXED INCOME CORE RETIREMENT INVEST

- Page 65: FIXED INCOME CORE RETIREMENT INVEST

- Page 69 and 70: FIXED INCOME CORE RETIREMENT INVEST

- Page 71 and 72: FIXED INCOME CORE RETIREMENT INVEST

- Page 73 and 74: FIXED INCOME CORE RETIREMENT INVEST

- Page 75 and 76: FIXED INCOME CORE RETIREMENT INVEST

- Page 77 and 78: FIXED INCOME CORE RETIREMENT INVEST

- Page 79 and 80: FIXED INCOME CORE RETIREMENT INVEST

- Page 81 and 82: FIXED INCOME CORE RETIREMENT INVEST

- Page 83 and 84: FIXED INCOME CORE RETIREMENT INVEST

- Page 85 and 86: FIXED INCOME CORE RETIREMENT INVEST

- Page 87 and 88: FIXED INCOME CORE RETIREMENT INVEST

- Page 89 and 90: FIXED INCOME CORE RETIREMENT INVEST

- Page 91 and 92: FIXED INCOME CORE RETIREMENT INVEST

- Page 93 and 94: LIMITED PARTNERSHIPS CORE RETIREMEN

- Page 95 and 96: LIMITED PARTNERSHIPS CORE RETIREMEN

- Page 97 and 98: LIMITED PARTNERSHIPS CORE RETIREMEN

- Page 99 and 100: PREFERRED SECURITIES CORE RETIREMEN

- Page 101 and 102: CONVERTIBLE SECURITIES CORE RETIREM

- Page 103 and 104: FINANCIAL FUTURES CONTRACTS CORE RE

- Page 105 and 106: STOCKS VARIABLE RETIREMENT INVESTME

- Page 107 and 108: STOCKS VARIABLE RETIREMENT INVESTME

- Page 109 and 110: STOCKS VARIABLE RETIREMENT INVESTME

- Page 111 and 112: STOCKS VARIABLE RETIREMENT INVESTME

- Page 113 and 114: STOCKS VARIABLE RETIREMENT INVESTME

- Page 115 and 116: STOCKS VARIABLE RETIREMENT INVESTME

FIXED INCOME<br />

CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, <strong>2011</strong><br />

NAME COUPON RATE MATURITY RATING COST FAIR VALUE<br />

CAPITAL ONE FINANCIAL CORP........................ 7.375 5/23/2014 BBB 1,236,769 1,272,461<br />

CASCADES INC...................................................... 7.750 12/15/2017 B+ 1,699,813 1,694,063<br />

CASCADES INC...................................................... 7.875 1/15/2020 B+ 159,750 156,188<br />

CASE NEW HOLLAND INC................................... 7.875 12/1/2017 BB+ 670,410 742,500<br />

CATALYST PAPER CORP..................................... 11.000 12/15/2016 CCC+ 926,321 837,900<br />

CATERPILLAR FINANCIAL SERVICES............... 4.250 2/8/2013 A 4,993,550 5,277,132<br />

CATERPILLAR FINANCIAL SERVICES............... 5.450 4/15/2018 A 7,545,830 9,033,883<br />

CATERPILLAR FINANCIAL SERVICES............... 6.125 2/17/2014 A 10,855,600 11,230,861<br />

CATERPILLAR FINANCIAL SERVICES............... 7.050 10/1/2018 A 996,730 1,217,779<br />

CATERPILLAR FINANCIAL SERVICES............... 7.150 2/15/2019 A 17,525,400 18,455,922<br />

CATERPILLAR INC................................................ 7.900 12/15/2018 A 6,605,714 6,372,963<br />

CATERPILLAR INC................................................ 8.250 12/15/2038 A 992,380 1,439,760<br />

CB RICHARD ELLIS SERVICES INC................... 11.625 6/15/2017 B+ 1,141,888 1,332,563<br />

CBS CORP............................................................... 4.625 5/15/2018 BBB- 4,937,050 5,138,089<br />

CBS CORP............................................................... 5.625 8/15/2012 BBB- 464,026 496,413<br />

CBS CORP............................................................... 5.750 4/15/2020 BBB- 4,013,370 4,326,739<br />

CBS CORP............................................................... 8.200 5/15/2014 BBB- 9,879,600 11,749,999<br />

CBS CORP............................................................... 8.875 5/15/2019 BBB- 18,626,458 18,410,965<br />

CCO HOLDINGS LLC / CCO HOLDING............... 6.500 4/30/2021 BB- 1,970,000 1,972,500<br />

CCO HOLDINGS LLC / CCO HOLDING............... 7.250 10/30/2017 BB- 725,000 751,281<br />

CCO HOLDINGS LLC / CCO HOLDING............... 7.875 4/30/2018 BB- 2,303,925 2,423,625<br />

CDRT MERGER SUB INC...................................... 8.125 6/1/2019 B- 2,174,063 2,175,000<br />

CDW LLC / CDW FINANCE CORP....................... 8.500 4/1/2019 CCC+ 2,003,000 1,960,000<br />

CELLCO PARTNERSHIP / VERIZON W............... 5.250 2/1/2012 A- 2,990,190 3,078,720<br />

CELLCO PARTNERSHIP / VERIZON W............... 5.550 2/1/2014 A- 3,974,280 4,406,633<br />

CELLCO PARTNERSHIP / VERIZON W............... 8.500 11/15/2018 A- 8,738,900 10,350,614<br />

CEMEX SA.............................................................. 8.875 5/12/2017 NR 60,150 75,096<br />

CEMEX SAB DE CV............................................... VARIABLE RATE 9/30/2015 B 700,927 683,220<br />

CENGAGE LEARNING ACQUISIT 144A.............. 10.500 1/15/2015 CCC+ 2,603,333 2,262,500<br />

CENTERPOINT PPTYS TR SR NT........................ 6.160 6/15/2013 NR 6,000,000 6,077,220<br />

CENTRAL GARDEN AND PET CO....................... 8.250 3/1/2018 B+ 1,500,000 1,548,750<br />

CENVEO CORP....................................................... 7.875 12/1/2013 CCC+ 3,989,813 4,056,000<br />

CENVEO CORP....................................................... 8.875 2/1/2018 B- 784,605 776,000<br />

CEQUEL COMMUNICATIONS HOLDINGS......... 8.625 11/15/2017 B- 1,277,688 1,352,000<br />

CHAPARRAL ENERGY INC.................................. 8.250 9/1/2021 B- 3,780,749 3,778,125<br />

CHAPEL VALLEY HOUSING II LLC.................... 8.791 9/15/2017 NR 2,754,048 3,415,294<br />

CHC HELICOPTER SA........................................... 9.250 10/15/2020 B+ 1,470,799 1,353,750<br />

CHEVRON CORP................................................... 3.950 3/3/2014 AA 17,684,720 18,252,856<br />

CHICAGO PARKING METERS LLC..................... 5.489 12/30/2020 BBB- 4,000,000 3,957,280<br />

CHILE (REPULIC OF)............................................. 5.500 1/15/2013 A+ 1,945,624 1,903,541<br />

CHINA LIANSU GROUP HOLDINGS LT.............. 7.875 5/13/2016 NR 528,308 517,725<br />

CHRYSLER GROUP LLC/CG CO-ISSUE.............. 8.000 6/15/2019 B 975,000 957,938<br />

CHRYSLER GROUP LLC/CG CO-ISSUE.............. 8.250 6/15/2021 B 2,275,000 2,229,500<br />

CHS INC SER I SR NT D........................................ 6.180 10/4/2017 NR 15,000,000 16,127,250<br />

CHS/COMMUNITY HEALTH SYSTEMS I........... 8.875 7/15/2015 B 2,489,575 2,549,250<br />

CHUBB CORP......................................................... 5.750 5/15/2018 A+ 8,813,798 9,122,805<br />

CIA DE SANEAMENTO BASICO DO ES.............. 6.250 12/16/2020 BB 495,430 512,500<br />

CIE GENERALE DE GEOPHYSIQUE -................. 7.750 5/15/2017 BB- 998,750 1,030,000<br />

CIGNA CORP.......................................................... 7.650 3/1/2023 BBB 1,670,760 1,735,350<br />

CIGNA CORP.......................................................... 8.500 5/1/2019 BBB 7,574,612 8,477,115<br />

CINCINNATI BELL INC......................................... 8.250 10/15/2017 B 2,089,313 2,110,500<br />

CINCINNATI BELL INC......................................... 8.750 3/15/2018 CCC+ 2,995,168 2,935,500<br />

CINCINNATI BELL TELEPHONE CO L............... 6.300 12/1/2028 BB- 207,463 222,750<br />

CINEMARK USA INC............................................. 7.375 6/15/2021 B 700,000 696,500<br />

CINEMARK USA INC............................................. 8.625 6/15/2019 B 1,186,711 1,314,000<br />

CISCO SYSTEMS INC............................................ 1.625 3/14/2014 A+ 9,988,100 10,093,576<br />

CISCO SYSTEMS INC............................................ 4.950 2/15/2019 A+ 22,831,873 22,662,964<br />

CIT GROUP INC...................................................... 7.000 5/1/2017 B+ 5,835,388 6,199,463<br />

CIT GROUP INC...................................................... 7.000 5/2/2017 B+ 1,300,000 1,296,750<br />

CIT GROUP INC 144A............................................ 7.000 5/2/2016 B+ 3,778,750 3,985,000<br />

- 64 - STATE OF WISCONSIN INVESTMENT BOARD