schedule of investments fiscal year 2011 - State of Wisconsin ...

schedule of investments fiscal year 2011 - State of Wisconsin ... schedule of investments fiscal year 2011 - State of Wisconsin ...

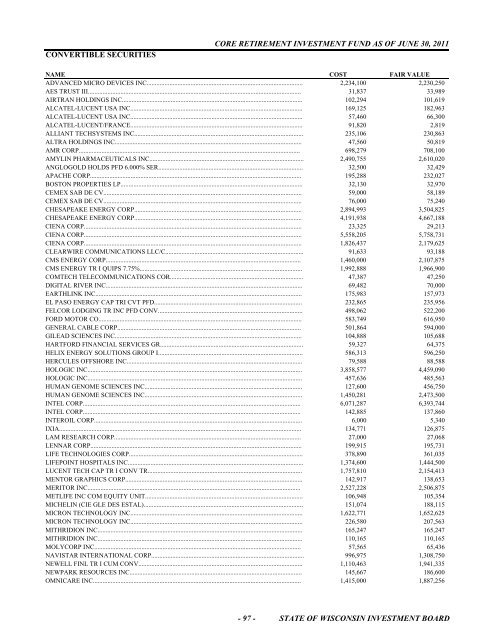

CONVERTIBLE SECURITIES CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, 2011 NAME COST FAIR VALUE ADVANCED MICRO DEVICES INC................................................................................................ 2,234,100 2,230,250 AES TRUST III................................................................................................................................... 31,837 33,989 AIRTRAN HOLDINGS INC............................................................................................................... 102,294 101,619 ALCATEL-LUCENT USA INC.......................................................................................................... 169,125 182,963 ALCATEL-LUCENT USA INC.......................................................................................................... 57,460 66,300 ALCATEL-LUCENT/FRANCE.......................................................................................................... 91,820 2,819 ALLIANT TECHSYSTEMS INC........................................................................................................ 235,106 230,863 ALTRA HOLDINGS INC................................................................................................................... 47,560 50,819 AMR CORP........................................................................................................................................ 698,279 708,100 AMYLIN PHARMACEUTICALS INC............................................................................................... 2,490,755 2,610,020 ANGLOGOLD HOLDS PFD 6.000% SER......................................................................................... 32,500 32,429 APACHE CORP.................................................................................................................................. 195,288 232,027 BOSTON PROPERTIES LP................................................................................................................ 32,130 32,970 CEMEX SAB DE CV.......................................................................................................................... 59,000 58,189 CEMEX SAB DE CV.......................................................................................................................... 76,000 75,240 CHESAPEAKE ENERGY CORP....................................................................................................... 2,894,993 3,504,825 CHESAPEAKE ENERGY CORP....................................................................................................... 4,191,938 4,667,188 CIENA CORP...................................................................................................................................... 23,325 29,213 CIENA CORP...................................................................................................................................... 5,558,205 5,758,731 CIENA CORP...................................................................................................................................... 1,826,437 2,179,625 CLEARWIRE COMMUNICATIONS LLC/C..................................................................................... 91,633 93,188 CMS ENERGY CORP........................................................................................................................ 1,460,000 2,107,875 CMS ENERGY TR I QUIPS 7.75%.................................................................................................... 1,992,888 1,966,900 COMTECH TELECOMMUNICATIONS COR.................................................................................. 47,387 47,250 DIGITAL RIVER INC......................................................................................................................... 69,482 70,000 EARTHLINK INC............................................................................................................................... 175,983 157,973 EL PASO ENERGY CAP TRI CVT PFD........................................................................................... 232,865 235,956 FELCOR LODGING TR INC PFD CONV......................................................................................... 498,062 522,200 FORD MOTOR CO............................................................................................................................. 583,749 616,950 GENERAL CABLE CORP................................................................................................................. 501,864 594,000 GILEAD SCIENCES INC................................................................................................................... 104,888 105,688 HARTFORD FINANCIAL SERVICES GR........................................................................................ 59,327 64,375 HELIX ENERGY SOLUTIONS GROUP I......................................................................................... 586,313 596,250 HERCULES OFFSHORE INC............................................................................................................ 79,588 88,588 HOLOGIC INC.................................................................................................................................... 3,858,577 4,459,090 HOLOGIC INC.................................................................................................................................... 457,636 485,563 HUMAN GENOME SCIENCES INC................................................................................................. 127,600 456,750 HUMAN GENOME SCIENCES INC................................................................................................. 1,450,281 2,473,500 INTEL CORP...................................................................................................................................... 6,071,287 6,393,744 INTEL CORP...................................................................................................................................... 142,885 137,860 INTEROIL CORP................................................................................................................................ 6,000 5,340 IXIA..................................................................................................................................................... 134,771 126,875 LAM RESEARCH CORP................................................................................................................... 27,000 27,068 LENNAR CORP.................................................................................................................................. 199,915 195,731 LIFE TECHNOLOGIES CORP........................................................................................................... 378,890 361,035 LIFEPOINT HOSPITALS INC............................................................................................................ 1,374,600 1,444,500 LUCENT TECH CAP TR I CONV TR............................................................................................... 1,757,810 2,154,413 MENTOR GRAPHICS CORP............................................................................................................. 142,917 138,653 MERITOR INC................................................................................................................................... 2,527,228 2,506,875 METLIFE INC COM EQUITY UNIT................................................................................................. 106,948 105,354 MICHELIN (CIE GLE DES ESTAL).................................................................................................. 151,074 188,115 MICRON TECHNOLOGY INC.......................................................................................................... 1,622,771 1,652,625 MICRON TECHNOLOGY INC.......................................................................................................... 226,580 207,563 MITHRIDION INC.............................................................................................................................. 165,247 165,247 MITHRIDION INC.............................................................................................................................. 110,165 110,165 MOLYCORP INC............................................................................................................................... 57,565 65,436 NAVISTAR INTERNATIONAL CORP.............................................................................................. 996,975 1,308,750 NEWELL FINL TR I CUM CONV..................................................................................................... 1,110,463 1,941,335 NEWPARK RESOURCES INC.......................................................................................................... 145,667 186,600 OMNICARE INC................................................................................................................................ 1,415,000 1,887,256 - 97 - STATE OF WISCONSIN INVESTMENT BOARD

CONVERTIBLE SECURITIES CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, 2011 NAME COST FAIR VALUE ON SEMICONDUCTOR CORP......................................................................................................... 268,883 305,081 ON SEMICONDUCTOR CORP......................................................................................................... 169,660 188,955 OWENS-BROCKWAY GLASS CONTAINER.................................................................................. 2,388,177 2,378,775 PATRIOT COAL CORP CONV 144A................................................................................................ 839,563 927,438 PDL BIOPHARMA INC..................................................................................................................... 50,000 48,438 PEABODY ENERGY CORP.............................................................................................................. 1,758,331 2,231,063 QUICKSILVER RESOURCES INC................................................................................................... 103,692 104,074 RADIAN GROUP INC........................................................................................................................ 45,944 34,380 RTI INTERNATIONAL METALS INC.............................................................................................. 72,370 89,950 SANDISK CORP................................................................................................................................. 188,854 191,408 SESI LLC............................................................................................................................................ 145,691 146,160 SHIRE................................................................................................................................................. 311,991 373,120 SLM CORP SR NT............................................................................................................................. 69,838 83,541 SMITHFIELD FOODS INC................................................................................................................ 148,986 167,028 SOVEREIGN CAP TR IV CONTINGENT......................................................................................... 1,116,148 1,909,017 STEWART ENTERPRISES CONV.................................................................................................... 186,000 203,500 SUBSEA 7 S.A.................................................................................................................................... 243,800 244,100 SUZUKI MOTOR CORP CVT BDS................................................................................................... 122,564 123,762 TERA MEDICA SER A CONV PFD STK.......................................................................................... 500,000 500,000 TERAMEDICA IN SER A-1 PFD STK.............................................................................................. 571,430 571,430 TERAMEDICA SERIES A-2 PFD STK.............................................................................................. 820,000 820,000 TEVA PHARMACEUTICAL FINANCE CO..................................................................................... 153,291 139,531 TRINITY INDUSTRIES INC.............................................................................................................. 4,685,278 5,704,094 TYSON FOODS INC.......................................................................................................................... 230,956 254,130 UNISYS CORP................................................................................................................................... 5,300 4,155 UNITED CONTINENTAL HOLDINGS IN........................................................................................ 1,210,885 1,231,599 UNITED RENTALS TRUST I............................................................................................................ 101,690 101,349 WEBMD HEALTH CORP.................................................................................................................. 80,250 77,300 WEBMD HEALTH CORP.................................................................................................................. 26,663 25,853 WELLS FARGO & CO NEW PERP PFD........................................................................................... 378,511 414,460 WINTRUST FINANCIAL CORP........................................................................................................ 133,732 139,720 XILINX INC........................................................................................................................................ 155,166 196,463 TOTAL CONVERTIBLE SECURITIES........................................................................................ 69,581,673 79,170,678 - 98 - STATE OF WISCONSIN INVESTMENT BOARD

- Page 49 and 50: STOCKS CORE RETIREMENT INVESTMENT F

- Page 51 and 52: STOCKS CORE RETIREMENT INVESTMENT F

- Page 53 and 54: STOCKS CORE RETIREMENT INVESTMENT F

- Page 55 and 56: STOCKS CORE RETIREMENT INVESTMENT F

- Page 57 and 58: STOCKS CORE RETIREMENT INVESTMENT F

- Page 59 and 60: STOCKS CORE RETIREMENT INVESTMENT F

- Page 61 and 62: STOCKS CORE RETIREMENT INVESTMENT F

- Page 63 and 64: FIXED INCOME CORE RETIREMENT INVEST

- Page 65 and 66: FIXED INCOME CORE RETIREMENT INVEST

- Page 67 and 68: FIXED INCOME CORE RETIREMENT INVEST

- Page 69 and 70: FIXED INCOME CORE RETIREMENT INVEST

- Page 71 and 72: FIXED INCOME CORE RETIREMENT INVEST

- Page 73 and 74: FIXED INCOME CORE RETIREMENT INVEST

- Page 75 and 76: FIXED INCOME CORE RETIREMENT INVEST

- Page 77 and 78: FIXED INCOME CORE RETIREMENT INVEST

- Page 79 and 80: FIXED INCOME CORE RETIREMENT INVEST

- Page 81 and 82: FIXED INCOME CORE RETIREMENT INVEST

- Page 83 and 84: FIXED INCOME CORE RETIREMENT INVEST

- Page 85 and 86: FIXED INCOME CORE RETIREMENT INVEST

- Page 87 and 88: FIXED INCOME CORE RETIREMENT INVEST

- Page 89 and 90: FIXED INCOME CORE RETIREMENT INVEST

- Page 91 and 92: FIXED INCOME CORE RETIREMENT INVEST

- Page 93 and 94: LIMITED PARTNERSHIPS CORE RETIREMEN

- Page 95 and 96: LIMITED PARTNERSHIPS CORE RETIREMEN

- Page 97 and 98: LIMITED PARTNERSHIPS CORE RETIREMEN

- Page 99: PREFERRED SECURITIES CORE RETIREMEN

- Page 103 and 104: FINANCIAL FUTURES CONTRACTS CORE RE

- Page 105 and 106: STOCKS VARIABLE RETIREMENT INVESTME

- Page 107 and 108: STOCKS VARIABLE RETIREMENT INVESTME

- Page 109 and 110: STOCKS VARIABLE RETIREMENT INVESTME

- Page 111 and 112: STOCKS VARIABLE RETIREMENT INVESTME

- Page 113 and 114: STOCKS VARIABLE RETIREMENT INVESTME

- Page 115 and 116: STOCKS VARIABLE RETIREMENT INVESTME

- Page 117 and 118: STOCKS VARIABLE RETIREMENT INVESTME

- Page 119 and 120: STOCKS VARIABLE RETIREMENT INVESTME

- Page 121 and 122: STOCKS VARIABLE RETIREMENT INVESTME

- Page 123 and 124: STOCKS VARIABLE RETIREMENT INVESTME

- Page 125 and 126: STOCKS VARIABLE RETIREMENT INVESTME

- Page 127 and 128: STOCKS VARIABLE RETIREMENT INVESTME

- Page 129 and 130: STOCKS VARIABLE RETIREMENT INVESTME

- Page 131 and 132: STOCKS VARIABLE RETIREMENT INVESTME

- Page 133 and 134: STOCKS VARIABLE RETIREMENT INVESTME

- Page 135 and 136: STOCKS VARIABLE RETIREMENT INVESTME

- Page 137 and 138: STOCKS VARIABLE RETIREMENT INVESTME

- Page 139 and 140: STOCKS VARIABLE RETIREMENT INVESTME

- Page 141 and 142: STOCKS VARIABLE RETIREMENT INVESTME

- Page 143 and 144: STOCKS VARIABLE RETIREMENT INVESTME

- Page 145 and 146: STOCKS VARIABLE RETIREMENT INVESTME

- Page 147 and 148: STOCKS VARIABLE RETIREMENT INVESTME

- Page 149 and 150: STOCKS VARIABLE RETIREMENT INVESTME

CONVERTIBLE SECURITIES<br />

CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, <strong>2011</strong><br />

NAME COST FAIR VALUE<br />

ADVANCED MICRO DEVICES INC................................................................................................ 2,234,100 2,230,250<br />

AES TRUST III................................................................................................................................... 31,837 33,989<br />

AIRTRAN HOLDINGS INC............................................................................................................... 102,294 101,619<br />

ALCATEL-LUCENT USA INC.......................................................................................................... 169,125 182,963<br />

ALCATEL-LUCENT USA INC.......................................................................................................... 57,460 66,300<br />

ALCATEL-LUCENT/FRANCE.......................................................................................................... 91,820 2,819<br />

ALLIANT TECHSYSTEMS INC........................................................................................................ 235,106 230,863<br />

ALTRA HOLDINGS INC................................................................................................................... 47,560 50,819<br />

AMR CORP........................................................................................................................................ 698,279 708,100<br />

AMYLIN PHARMACEUTICALS INC............................................................................................... 2,490,755 2,610,020<br />

ANGLOGOLD HOLDS PFD 6.000% SER......................................................................................... 32,500 32,429<br />

APACHE CORP.................................................................................................................................. 195,288 232,027<br />

BOSTON PROPERTIES LP................................................................................................................ 32,130 32,970<br />

CEMEX SAB DE CV.......................................................................................................................... 59,000 58,189<br />

CEMEX SAB DE CV.......................................................................................................................... 76,000 75,240<br />

CHESAPEAKE ENERGY CORP....................................................................................................... 2,894,993 3,504,825<br />

CHESAPEAKE ENERGY CORP....................................................................................................... 4,191,938 4,667,188<br />

CIENA CORP...................................................................................................................................... 23,325 29,213<br />

CIENA CORP...................................................................................................................................... 5,558,205 5,758,731<br />

CIENA CORP...................................................................................................................................... 1,826,437 2,179,625<br />

CLEARWIRE COMMUNICATIONS LLC/C..................................................................................... 91,633 93,188<br />

CMS ENERGY CORP........................................................................................................................ 1,460,000 2,107,875<br />

CMS ENERGY TR I QUIPS 7.75%.................................................................................................... 1,992,888 1,966,900<br />

COMTECH TELECOMMUNICATIONS COR.................................................................................. 47,387 47,250<br />

DIGITAL RIVER INC......................................................................................................................... 69,482 70,000<br />

EARTHLINK INC............................................................................................................................... 175,983 157,973<br />

EL PASO ENERGY CAP TRI CVT PFD........................................................................................... 232,865 235,956<br />

FELCOR LODGING TR INC PFD CONV......................................................................................... 498,062 522,200<br />

FORD MOTOR CO............................................................................................................................. 583,749 616,950<br />

GENERAL CABLE CORP................................................................................................................. 501,864 594,000<br />

GILEAD SCIENCES INC................................................................................................................... 104,888 105,688<br />

HARTFORD FINANCIAL SERVICES GR........................................................................................ 59,327 64,375<br />

HELIX ENERGY SOLUTIONS GROUP I......................................................................................... 586,313 596,250<br />

HERCULES OFFSHORE INC............................................................................................................ 79,588 88,588<br />

HOLOGIC INC.................................................................................................................................... 3,858,577 4,459,090<br />

HOLOGIC INC.................................................................................................................................... 457,636 485,563<br />

HUMAN GENOME SCIENCES INC................................................................................................. 127,600 456,750<br />

HUMAN GENOME SCIENCES INC................................................................................................. 1,450,281 2,473,500<br />

INTEL CORP...................................................................................................................................... 6,071,287 6,393,744<br />

INTEL CORP...................................................................................................................................... 142,885 137,860<br />

INTEROIL CORP................................................................................................................................ 6,000 5,340<br />

IXIA..................................................................................................................................................... 134,771 126,875<br />

LAM RESEARCH CORP................................................................................................................... 27,000 27,068<br />

LENNAR CORP.................................................................................................................................. 199,915 195,731<br />

LIFE TECHNOLOGIES CORP........................................................................................................... 378,890 361,035<br />

LIFEPOINT HOSPITALS INC............................................................................................................ 1,374,600 1,444,500<br />

LUCENT TECH CAP TR I CONV TR............................................................................................... 1,757,810 2,154,413<br />

MENTOR GRAPHICS CORP............................................................................................................. 142,917 138,653<br />

MERITOR INC................................................................................................................................... 2,527,228 2,506,875<br />

METLIFE INC COM EQUITY UNIT................................................................................................. 106,948 105,354<br />

MICHELIN (CIE GLE DES ESTAL).................................................................................................. 151,074 188,115<br />

MICRON TECHNOLOGY INC.......................................................................................................... 1,622,771 1,652,625<br />

MICRON TECHNOLOGY INC.......................................................................................................... 226,580 207,563<br />

MITHRIDION INC.............................................................................................................................. 165,247 165,247<br />

MITHRIDION INC.............................................................................................................................. 110,165 110,165<br />

MOLYCORP INC............................................................................................................................... 57,565 65,436<br />

NAVISTAR INTERNATIONAL CORP.............................................................................................. 996,975 1,308,750<br />

NEWELL FINL TR I CUM CONV..................................................................................................... 1,110,463 1,941,335<br />

NEWPARK RESOURCES INC.......................................................................................................... 145,667 186,600<br />

OMNICARE INC................................................................................................................................ 1,415,000 1,887,256<br />

- 97 - STATE OF WISCONSIN INVESTMENT BOARD