EUROPOS BENDRIJA / ATLEIDIMO NUO PVM IR AKCIZŲ ...

EUROPOS BENDRIJA / ATLEIDIMO NUO PVM IR AKCIZŲ ...

EUROPOS BENDRIJA / ATLEIDIMO NUO PVM IR AKCIZŲ ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Pridėtinės vertės mokesčio ir akcizų grąžinimo Lietuvos Respublikoje įsikūrusioms diplomatinėms atstovybėms,<br />

konsulinėms įstaigoms ir tarptautinėms organizacijoms ar jų atstovybėms, taip pat šių atstovybių, įstaigų ir<br />

organizacijų nariams ir jų šeimų nariams taisyklių priedas<br />

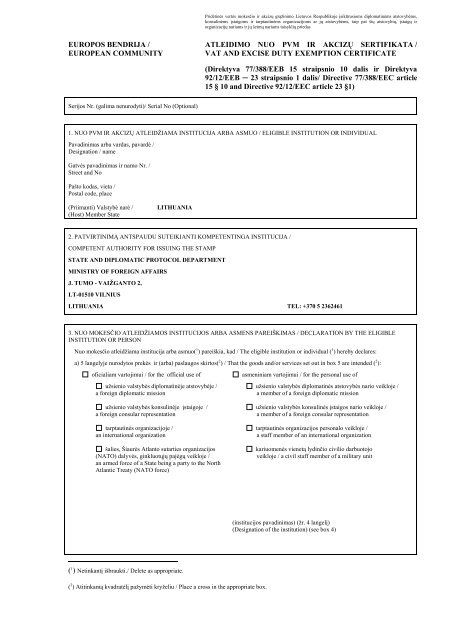

<strong>EUROPOS</strong> <strong>BENDRIJA</strong> / <strong>ATLEIDIMO</strong> <strong>NUO</strong> <strong>PVM</strong> <strong>IR</strong> <strong>AKCIZŲ</strong> SERTIFIKATA /<br />

EUROPEAN COMMUNITY VAT AND EXCISE DUTY EXEMPTION CERTIFICATE<br />

Serijos Nr. (galima nenurodyti)/ Serial No (Optional)<br />

(Direktyva 77/388/EEB 15 straipsnio 10 dalis ir Direktyva<br />

92/12/EEB ─ 23 straipsnio 1 dalis/ Directive 77/388/EEC article<br />

15 § 10 and Directive 92/12/EEC article 23 §1)<br />

1. <strong>NUO</strong> <strong>PVM</strong> <strong>IR</strong> <strong>AKCIZŲ</strong> ATLEIDŽIAMA INSTITUCIJA ARBA ASMUO / ELIGIBLE INSTITUTION OR INDIVIDUAL<br />

Pavadinimas arba vardas, pavardė /<br />

Designation / name<br />

Gatvės pavadinimas ir namo Nr. /<br />

Street and No<br />

Pašto kodas, vieta /<br />

Postal code, place<br />

(Priimanti) Valstybė narė / LITHUANIA<br />

(Host) Member State<br />

2. PATV<strong>IR</strong>TINIMĄ ANTSPAUDU SUTEIKIANTI KOMPETENTINGA INSTITUCIJA /<br />

COMPETENT AUTHORITY FOR ISSUING THE STAMP<br />

STATE AND DIPLOMATIC PROTOCOL DEPARTMENT<br />

MINISTRY OF FOREIGN AFFA<strong>IR</strong>S<br />

J. TUMO - VAIŽGANTO 2,<br />

LT-01510 VILNIUS<br />

LITHUANIA TEL: +370 5 2362461<br />

3. <strong>NUO</strong> MOKESČIO ATLEIDŽIAMOS INSTITUCIJOS ARBA ASMENS PAREIŠKIMAS / DECLARATION BY THE ELIGIBLE<br />

INSTITUTION OR PERSON<br />

Nuo mokesčio atleidžiama institucija arba asmuo( 1 ) pareiškia, kad / The eligible institution or individual ( 1 ) hereby declares:<br />

a) 5 langelyje nurodytos prekės ir (arba) paslaugos skirtos( 2 ) / That the goods and/or services set out in box 5 are intended ( 2 ):<br />

oficialiam vartojimui / for the official use of asmeniniam vartojimui / for the personal use of<br />

užsienio valstybės diplomatinėje atstovybėje / užsienio valstybės diplomatinės atstovybės nario veikloje /<br />

a foreign diplomatic mission a member of a foreign diplomatic mission<br />

užsienio valstybės konsulinėje įstaigoje / užsienio valstybės konsulinės įstaigos nario veikloje /<br />

a foreign consular representation a member of a foreign consular representation<br />

tarptautinės organizacijoje / tarptautinės organizacijos personalo veikloje /<br />

an international organization a staff member of an international organization<br />

šalies, Šiaurės Atlanto sutarties organizacijos kariuomenės vienetą lydinčio civilio darbuotojo<br />

(NATO) dalyvės, ginkluotųjų pajėgų veikloje / veikloje / a civil staff member of a military unit<br />

an armed force of a State being a party to the North<br />

Atlantic Treaty (NATO force)<br />

( 1 ) Netinkantį išbraukti./ Delete as appropriate.<br />

( 2 ) Atitinkamą kvadratėlį pažymėti kryželiu / Place a cross in the appropriate box.<br />

(institucijos pavadinimas) (žr. 4 langelį)<br />

(Designation of the institution) (see box 4)

) 5 langelyje apibūdintos prekės ir (ar) paslaugos atitinka atleidimo nuo <strong>PVM</strong> ir/ar akcizų sąlygas ir apribojimus, taikomus 1 langelyje<br />

paminėtoje priimančioje valstybėje narėje, ir /<br />

that the goods and/or services described at box 5 comply with the conditions and limitations applicable to VAT and Excise duty<br />

exemption in the host Member State mentioned in box 1, and<br />

c) čia pateikti duomenys nurodyti sąžiningai. Nuo mokesčio atleidžiama institucija arba asmuo įsipareigoja sumokėti valstybei narei, iš<br />

kurios išsiųstos prekės ir (ar) paslaugos, <strong>PVM</strong> ir/ar akcizo mokestį, kurį reikėtų sumokėti, jei šios prekės ir (ar) paslaugos netenkintų<br />

atleidimo nuo mokesčių sąlygų arba jei šios prekės ir (ar) paslaugos būtų vartojamos ne pagal paskirtį /<br />

that the information above is furnished in good faith. The eligible institution or individual hereby undertakes to pay the Member<br />

State from which the goods were dispatched, the VAT and/or excise duty which would be due if goods and/or services did not<br />

comply with the conditions of exemption, or if goods and/or services were not used in the matter intended.<br />

VILNIUS, May 2, 2007<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas)<br />

ir pareigos / Name and status of signatory<br />

………………………………………………<br />

Parašas / Signature<br />

4. PATV<strong>IR</strong>TINIMAS INSTITUCIJOS ANTSPAUDU (kai nuo mokesčio atleidžiamos prekės ir (ar) paslaugos skirtos asmeniniam<br />

vartojimui) / STAMP OF THE INSTITUTION (in case of exemption for personal use)<br />

VILNIUS / May 2, 2007<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas) ir pareigos /<br />

Name and status of signatory<br />

Antspaudas /<br />

Stamp<br />

….………………………………………………………..<br />

Parašas / Signature<br />

5. SIUNČIAMŲ PREKIŲ <strong>IR</strong> (AR) PASLAUGŲ, KURIAS PRAŠOMA ATLEISTI <strong>NUO</strong> <strong>PVM</strong> <strong>IR</strong>/AR <strong>AKCIZŲ</strong>, APRAŠYMAS /<br />

DESCRIPTION OF THE DISPATCHED GOODS AND/OR SERVICES, FOR WHICH THE EXEMPTION FROM VAT AND/OR<br />

EXCISE DUTY IS REQUESTED<br />

A. Duomenys apie įgaliotąjį akcizais apmokestinamų prekių sandėlio savininką/prekių ir/ar paslaugų tiekėją / Information about the<br />

authorized warehousekeeper / supplier of goods and/or services:<br />

1. Vardas, pavardė (pavadinimas) ir adresas /<br />

Name and address<br />

2. Valstybė narė /<br />

Member State<br />

3. Akcizo Nr. / <strong>PVM</strong> mokėtojo kodas<br />

VAT / excise payer number<br />

B. Duomenys apie prekes ir (ar) paslaugas / Information concerning the goods and / or services<br />

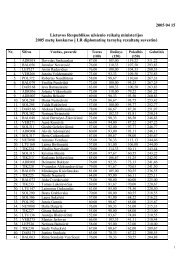

Nr.<br />

Išsamus prekių ir (ar) paslaugų<br />

apibūdinimas ( 3 ) (arba nuoroda į<br />

pridedamą užsakymo formą) / Detailed<br />

description of goods and/or services ( 3 )<br />

(or reference to the attached order form)<br />

Kiekis arba<br />

skaičius /<br />

Quantity or<br />

Vertė be <strong>PVM</strong> ir / ar akcizo<br />

mokesčio / Value excluding VAT<br />

and/or excise duty<br />

number vieneto vertė /<br />

Value per Unit<br />

bendra vertė /<br />

Total value<br />

Valiuta / Currency<br />

( 3 ) Neužpildytą langelio plotą išbraukti. Šis reikalavimas taip pat taikomas užsakymų formoms, jei jos pridedamos / Delete space not used.<br />

This obligation also applies if order forms are attached.

Bendra suma /<br />

Total value<br />

6. PRIIMANČIOS VALSTYBĖS NARĖS KOMPETENTINGOS INSTITUCIJOS PATV<strong>IR</strong>TINIMAS / CERTIFICATION BY THE<br />

COMPETENT AUTHORITY OF THE HOST MEMBER STATE<br />

5 langelyje aprašytos prekės ir (ar) paslaugos / the consigment of goods and/or services described in box 5<br />

visiškai / totally<br />

iki tam tikro kiekio ………………………………………………. (skaičius) ( 4 ) / up to a quantity of ….(number) ( 4 )<br />

atitinka atleidimo nuo <strong>PVM</strong> ir/ar akcizų sąlygas / meets the conditions for exemption from VAT and/or excise duty.<br />

VILNIUS, ……………………….… …………………………………………….………..<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas)<br />

ir pareigos / Name and status of signatory<br />

………….…………………………………………..<br />

Parašas / Signatory<br />

7. LEIDIMAS APSIEITI BE ANTSPAUDO / PERMISSION TO DISPENSE WITH STAMP (tik tuo atveju, kai nuo mokesčio atleidžiamos<br />

prekės skirtos oficialiam vartojimui / only in case of exemption for official use)<br />

Raštu Nr. / By letter No .………………………………………………………, pažymėtu / of …….………….………………….. data / date,<br />

(nurodyti rašto Nr./ reference to file) (nurodyti datą / date)<br />

…………………………………………………………....……………………. buvo suteiktas leidimas, kurį išdavė / has been permitted by<br />

(nurodyti nuo mokesčio atleidžiamos institucijos, kuriai suteiktas<br />

leidimas, pavadinimą) / (designation of eligible institution)<br />

………………………….………………………………, apsieiti be antspaudo 6 langelio apačioje / to dispense with the stamp under box 6.<br />

(priimančios valstybės kompetentingos institucijos pavadinimas)<br />

(designation of the competent authority in the host Member State)<br />

..………………………………………… ……….……………..……………………………………….………..<br />

Vieta, data / Place, date Pasirašančiojo vardas, pavardė (pavadinimas)<br />

ir pareigos / Name and status of signatory<br />

Antspaudas<br />

Stamp<br />

……………………………….<br />

Parašas / Signature<br />

( 4 ) Prekės ir (ar) paslaugos, kurioms netaikomas atleidimas nuo mokesčių, turėtų būti iš 5 langelio išbrauktos / Goods and/or services not<br />

eligible should be deleted in box 5.

Explanatory notes<br />

1. For the authorized warehousekeeper, this certificate serves as a supporting document for the<br />

tax exemption of the consignments of goods to eligible institutions/individuals referred to in<br />

Article 23 (1), of Directive 92/12/EEC. Accordingly, one certificate shall be drawn up for each<br />

warehousekeeper. Moreover, the warehousekeeper is required to keep this certificate as part of<br />

his records in accordance with the legal provisions applicable in his Member State.<br />

2. (a) The general specification of the paper to be used is as laid down in the Official Journal<br />

of the European Communities No C 164 of 1. 7. 1989.<br />

The paper is to be white for all copies and should be 210 millimetres by 297 millimetres with a<br />

maximum tolerance of 5 millimetres less or 8 millimetres more with regard to their length.<br />

The exemption certificate shall be drawn up in duplicate:<br />

- one copy to be kept by the consignor,<br />

- one copy to accompany the administrative accompanying document.<br />

(b) Any unused space in box 5.B is to be crossed out so that nothing can be added.<br />

(c) The document must be completed legibly and in a manner that makes entries indelible. No<br />

erasures or overwriting are permitted. It shall be completed in a language recognized by the<br />

host Member State.<br />

(d) If the description of the goods (box 5.B of the certificate) refers to a purchase order form<br />

drawn up in a language other than a language recognized by the host Member State, a<br />

translation must be attached by the eligible institution/individual.<br />

(e) On the other hand, if the certificate is drawn up in a language other than a language<br />

recognized by the Member State of the warehousekeeper, a translation of the information<br />

concerning the goods in box 5.B must be attached by the eligible institution/individual.<br />

(f) A recognized language means one of the languages officially in use in the Member State or<br />

any other official language of the Community which the Member State declares can be used<br />

for this purpose.<br />

3. By its declaration in box 3 of the certificate, the eligible institution/individual provides the<br />

information necessary for the evaluation of the request for exemption in the host Member<br />

State.<br />

4. By its declaration in box 4 of the certificate, the institution confirms the details in boxes 1<br />

and 3 (a) of the document and certifies that the eligible individual is a staff member of the<br />

institution.<br />

5. (a) The reference to the purchase order form (box 5.B of the certificate) must contain at least<br />

the date and order number. The order form should contain all the elements that figure at box 5<br />

of the certificate. If the certificate has to be stamped by the competent authority of the host<br />

Member State, the order form shall also be stamped.<br />

(b) The indication of the excise No as defined in Article 15 (a), paragraph 2 (a), of Directive<br />

92/12/EEC of the authorized warehousekeeper is optional.<br />

(c) The currencies should be indicated by means of a three-letter code in conformity with the

international ISOIDIS 4127 standard established by the International Standards Organization<br />

(1).<br />

6. The abovementioned declaration by the eligible institution/individual shall be authenticated<br />

at box 6 by the stamp of the competent authority of the host Member State. That authority can<br />

make its approval dependent on the agreement of another authority in its Member State. It is<br />

up to the competent tax authority to obtain such agreement.<br />

7. To simplify the procedure, the competent authority can dispense with the obligation on the<br />

eligible institution to ask for the stamp in the case of exemption for official use. The eligible<br />

institution should mention this dispensation at box 7 of the certificate.<br />

(1) As an indication, some codes relating to currencies currently used: BEF (Belgian franc),<br />

DEM (German mark), DKK (Danish kroner), ESP (Spanish peseta), FRF (French franc), GBP<br />

(Pound sterling), GRD (Greek drachma), IEP (Irish pound), ITL (Italian lire), LUF<br />

(Luxembourg franc), NLG (Dutch guilder), PTE (Portuguese escudo), ATS (Austrian<br />

schilling), FIM (Finnish mark), SEK (Swedish kroner), USD (United States dollar).