- Page 1 and 2: Registration Document 2006

- Page 3: Registration Document 2006 This is

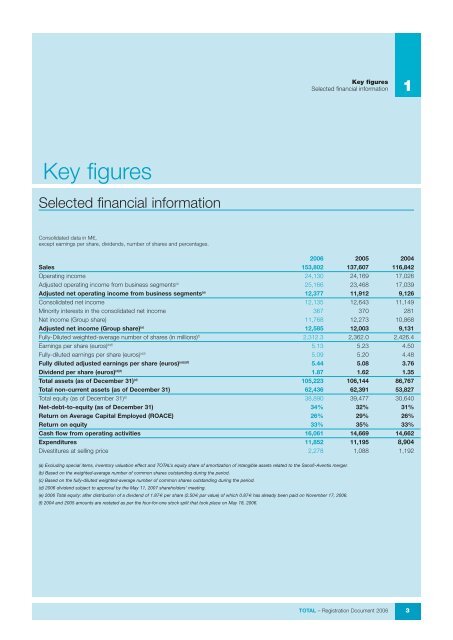

- Page 7 and 8: 116,842 Key figures Operating and m

- Page 9 and 10: Refined product sales including Tra

- Page 11 and 12: Business overview History and strat

- Page 13 and 14: Upstream TOTAL’s Upstream segment

- Page 15 and 16: Exploration & Production Exploratio

- Page 17 and 18: Production For the full year 2006,

- Page 19 and 20: Presentation of production activiti

- Page 21 and 22: Europe Business overview Exploratio

- Page 23 and 24: Africa TOTAL has been present in Af

- Page 25 and 26: this zone through its subsidiaries

- Page 27 and 28: North America Since 2004, TOTAL has

- Page 29 and 30: Trinidad & Tobago TOTAL holds a 30%

- Page 31 and 32: TOTAL also has a 50% interest in th

- Page 33 and 34: Europe TOTAL’s production in Euro

- Page 35 and 36: K6-GT platform, in anticipation of

- Page 37 and 38: The Group also holds a 20% interest

- Page 39 and 40: Gas & Power The Gas & Power divisio

- Page 41 and 42: Asia Pacific The Hazira re-gasifica

- Page 43 and 44: In Morocco, Temasol, in which TOTAL

- Page 45 and 46: Refining & Marketing As of December

- Page 47 and 48: Refined products The table below se

- Page 49 and 50: capacity oil recycling plant in Fra

- Page 51 and 52: In 2006, the principal market bench

- Page 53 and 54: Base Chemicals TOTAL’s Base Chemi

- Page 55 and 56:

Specialties TOTAL’s Specialties s

- Page 57 and 58:

Investments Main investments made o

- Page 59 and 60:

Property, Plant and Equipment TOTAL

- Page 61 and 62:

Board of Directors Executive Commit

- Page 63 and 64:

Management Report of the Board of D

- Page 65 and 66:

Market environment 2006 2005 2004 E

- Page 67 and 68:

Upstream results Liquids and gas pr

- Page 69 and 70:

Downstream results For the full yea

- Page 71 and 72:

Liquidity and capital resources Lon

- Page 73 and 74:

Research and development Research a

- Page 75 and 76:

Trends and outlook Outlook Since th

- Page 77 and 78:

Risk Factors Market risks p. 76 •

- Page 79 and 80:

The Group has implemented strict po

- Page 81 and 82:

The non-current debt in dollars des

- Page 83 and 84:

Grande Paroisse An explosion occurr

- Page 85 and 86:

Myanmar Under the Belgian “univer

- Page 87 and 88:

Risk management Risk evaluations le

- Page 89 and 90:

TOTAL, like other major internation

- Page 91 and 92:

Insurance and risk management Organ

- Page 93 and 94:

Corporate Governance Board of Direc

- Page 95 and 96:

Daniel Bouton 56 years old. Inspect

- Page 97 and 98:

Bertrand Jacquillat 62 years old. A

- Page 99 and 100:

Michel Pébereau 64 years old. Hono

- Page 101 and 102:

Management General Management On Ma

- Page 103 and 104:

Corporate Governance Compensation o

- Page 105 and 106:

Pensions and other commitments (Art

- Page 107 and 108:

Within this framework, the Board’

- Page 109 and 110:

Members of the Audit Committee may

- Page 111 and 112:

Messrs. Bouton, Collomb, Desmarais,

- Page 113 and 114:

establishes and maintains procedure

- Page 115 and 116:

Employees, Share Ownership, Stock O

- Page 117 and 118:

Corporate Governance Employees, Sha

- Page 119 and 120:

TOTAL stock options Corporate Gover

- Page 121 and 122:

Corporate Governance Employees, Sha

- Page 123 and 124:

Corporate Governance Employees, Sha

- Page 125 and 126:

Restricted share plans as of Decemb

- Page 127 and 128:

TOTAL and its shareholders Listing

- Page 129 and 130:

Four-for-one stock split The Genera

- Page 131 and 132:

Information Summary TOTAL and its s

- Page 133 and 134:

Dividends Dividend policy In accord

- Page 135 and 136:

Share buybacks The General Meeting

- Page 137 and 138:

Summary table of transactions compl

- Page 139 and 140:

cancels and replaces the unused por

- Page 141 and 142:

which was approved by the French Co

- Page 143 and 144:

Shareholder structure Distribution

- Page 145 and 146:

Non-resident individual taxpayers e

- Page 147 and 148:

The Committee also worked on the co

- Page 149 and 150:

2007 Calendar February 14 Results f

- Page 151 and 152:

Financial information Historical fi

- Page 153 and 154:

Additional information Financial in

- Page 155 and 156:

General information Share capital p

- Page 157 and 158:

Pursuant to this authorization, the

- Page 159 and 160:

Potential capital as of December 31

- Page 161 and 162:

General information Share capital J

- Page 163 and 164:

Directors’ Charter and Committees

- Page 165 and 166:

Other matters Employee incentives a

- Page 167 and 168:

Information on holdings General inf

- Page 169 and 170:

Statutory auditors’ report on the

- Page 171 and 172:

Consolidated statement of income TO

- Page 173 and 174:

Consolidated statement of cash flow

- Page 175 and 176:

On February 13, 2007, the Board of

- Page 177 and 178:

G. Earnings per share Earnings per

- Page 179 and 180:

equal to the market price. For unli

- Page 181 and 182:

The net periodic pension cost is re

- Page 183 and 184:

(iii) Portion of intangible assets

- Page 185 and 186:

A. Information by business segment

- Page 187 and 188:

Appendix 1 - Consolidated financial

- Page 189 and 190:

Appendix 1 - Consolidated financial

- Page 191 and 192:

Appendix 1 - Consolidated financial

- Page 193 and 194:

Appendix 1 - Consolidated financial

- Page 195 and 196:

ADJUSTMENTS TO OPERATING INCOME 200

- Page 197 and 198:

In 2006, gains and losses on sales

- Page 199 and 200:

Appendix 1 - Consolidated financial

- Page 201 and 202:

Property, plant and equipment prese

- Page 203 and 204:

14) Other non-current assets As of

- Page 205 and 206:

The variation of the weighted-avera

- Page 207 and 208:

18) Employee benefits obligations P

- Page 209 and 210:

The components of the net periodic

- Page 211 and 212:

20) Financial debt and related fina

- Page 213 and 214:

Appendix 1 - Consolidated financial

- Page 215 and 216:

Impact on net income The amount of

- Page 217 and 218:

23) Commitments and contingencies A

- Page 219 and 220:

Other guarantees given Non-consolid

- Page 221 and 222:

Appendix 1 - Consolidated financial

- Page 223 and 224:

25) Payroll and staff For the year

- Page 225 and 226:

The classification by strategy and

- Page 227 and 228:

B) Financial instruments related to

- Page 229 and 230:

29) Market risks Oil and gas market

- Page 231 and 232:

As a result of its policy for manag

- Page 233 and 234:

3) The Group has recorded provision

- Page 235 and 236:

Appendix 1 - Consolidated financial

- Page 237 and 238:

53.2% 95.7% Elf Aquitaine 99.5% 100

- Page 239 and 240:

Oil and gas reserves p. 238 • Cha

- Page 241 and 242:

Changes in liquids reserves Appendi

- Page 243 and 244:

Changes in liquids and gas reserves

- Page 245 and 246:

Costs incurred in oil and gas prope

- Page 247 and 248:

Appendix 2 - Supplemental oil and g

- Page 249 and 250:

Other information Accounting for ex

- Page 251 and 252:

Appendix 3 - TOTAL S.A. Special aud

- Page 253 and 254:

(Free translation of a French langu

- Page 255 and 256:

Balance Sheet (TOTAL S.A.) Appendix

- Page 257 and 258:

Statement of changes in Shareholder

- Page 259 and 260:

2) Property, plant and equipment As

- Page 261 and 262:

6) Shareholders’ equity A) Common

- Page 263 and 264:

7) Contingency reserves As of Decem

- Page 265 and 266:

11) Translation adjustment The appl

- Page 267 and 268:

20) Commitments As of December 31 (

- Page 269 and 270:

TOTAL share purchase options plans

- Page 271 and 272:

Appendix 3 - TOTAL S.A. Parent comp

- Page 273 and 274:

List of marketable securities held

- Page 275 and 276:

Distribution of earnings 2006 Net d

- Page 277 and 278:

Social and environmental informatio

- Page 279 and 280:

AVERAGE COMPENSATION PER MONTH - TO

- Page 281 and 282:

Environment Pursuant to French law

- Page 283 and 284:

Consolidated financial information

- Page 285 and 286:

European Cross Reference List 10. C

- Page 288:

TOTAL S.A. Registered Office: 2, pl