Registration document 2007 - Total.com

Registration document 2007 - Total.com

Registration document 2007 - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

9<br />

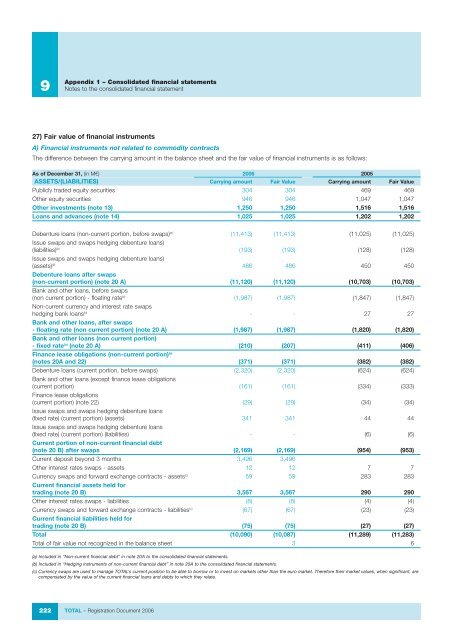

27) Fair value of financial instruments<br />

A) Financial instruments not related to <strong>com</strong>modity contracts<br />

The difference between the carrying amount in the balance sheet and the fair value of financial instruments is as follows:<br />

As of December 31, (in M€) 2006 2005<br />

ASSETS/(LIABILITIES) Carrying amount Fair Value Carrying amount Fair Value<br />

Publicly traded equity securities 304 304 469 469<br />

Other equity securities 946 946 1,047 1,047<br />

Other investments (note 13) 1,250 1,250 1,516 1,516<br />

Loans and advances (note 14) 1,025 1,025 1,202 1,202<br />

Debenture loans (non-current portion, before swaps) (a) (11,413) (11,413) (11,025) (11,025)<br />

Issue swaps and swaps hedging debenture loans)<br />

(liabilities) (b) (193) (193) (128) (128)<br />

Issue swaps and swaps hedging debenture loans)<br />

(assets) (b) 486 486 450 450<br />

Debenture loans after swaps<br />

(non-current portion) (note 20 A) (11,120) (11,120) (10,703) (10,703)<br />

Bank and other loans, before swaps<br />

(non current portion) - floating rate (a) (1,987) (1,987) (1,847) (1,847)<br />

Non-current currency and interest rate swaps<br />

hedging bank loans (b) - - 27 27<br />

Bank and other loans, after swaps<br />

- floating rate (non current portion) (note 20 A) (1,987) (1,987) (1,820) (1,820)<br />

Bank and other loans (non current portion)<br />

- fixed rate (a) (note 20 A) (210) (207) (411) (406)<br />

Finance lease obligations (non-current portion) (a)<br />

(notes 20A and 22) (371) (371) (382) (382)<br />

Debenture loans (current portion, before swaps) (2,320) (2,320) (624) (624)<br />

Bank and other loans (except finance lease obligations<br />

(current portion) (161) (161) (334) (333)<br />

Finance lease obligations<br />

(current portion) (note 22) (29) (29) (34) (34)<br />

Issue swaps and swaps hedging debenture loans<br />

(fixed rate) (current portion) (assets) 341 341 44 44<br />

Issue swaps and swaps hedging debenture loans<br />

(fixed rate) (current portion) (liabilities) - - (6) (6)<br />

Current portion of non-current financial debt<br />

(note 20 B) after swaps (2,169) (2,169) (954) (953)<br />

Current deposit beyond 3 months 3,496 3,496<br />

Other interest rates swaps - assets 12 12 7 7<br />

Currency swaps and forward exchange contracts - assets (c) 59 59 283 283<br />

Current financial assets held for<br />

trading (note 20 B) 3,567 3,567 290 290<br />

Other interest rates swaps - liabilities (8) (8) (4) (4)<br />

Currency swaps and forward exchange contracts - liabilities (c) (67) (67) (23) (23)<br />

Current financial liabilities held for<br />

trading (note 20 B) (75) (75) (27) (27)<br />

<strong>Total</strong> (10,090) (10,087) (11,289) (11,283)<br />

<strong>Total</strong> of fair value not recognized in the balance sheet 3 6<br />

(a) Included in “Non-current financial debt” in note 20A to the consolidated financial statements.<br />

(b) Included in “Hedging instruments of non-current financial debt” in note 20A to the consolidated financial statements.<br />

(c) Currency swaps are used to manage TOTAL’s current position to be able to borrow or to invest on markets other than the euro market. Therefore their market values, when significant, are<br />

<strong>com</strong>pensated by the value of the current financial loans and debts to which they relate.<br />

222<br />

Appendix 1 – Consolidated financial statements<br />

Notes to the consolidated financial statement<br />

TOTAL – <strong>Registration</strong> Document 2006