Registration document 2007 - Total.com

Registration document 2007 - Total.com

Registration document 2007 - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

which was approved by the French Conseil des marchés<br />

financiers on May 31, 2000, and which ran from June 15, 2000,<br />

to September 1, 2000, <strong>Total</strong>FinaElf acquired 10,828,326 shares<br />

of Elf Aquitaine in exchange for 14,437,768 new <strong>Total</strong>FinaElf<br />

shares.<br />

In a notice dated October 20, 2000, as a result of the offer,<br />

PARISBOURSE SBF S.A. (now Euronext Paris S.A.) announced<br />

its decision to delist Elf Aquitaine from the Premier Marché of the<br />

Paris Stock Exchange. The delisting took effect on November 3,<br />

2000. Since November 6, 2000, the Elf Aquitaine shares have<br />

been traded in the delisted shares section of the regulated<br />

markets (<strong>com</strong>partiment des valeurs radiées des marchés<br />

réglementés) and may be traded at a price fixed daily at<br />

3:00 p.m. In the United States, the trading of Elf Aquitaine<br />

American Depositary Shares (ADSs) was discontinued by the<br />

New York Stock Exchange (NYSE) on September 5, 2000. Elf<br />

Principal Shareholders<br />

Changes in the holdings of principal shareholders<br />

TOTAL and its shareholders<br />

Shareholders<br />

Aquitaine’s ADS program ended on September 18, 2000.<br />

6<br />

The delisting of Elf Aquitaine ADS was effective at market<br />

opening on October 18, 2000, after approval by the U.S.<br />

Securities and Exchange Commission (SEC). On March 23,<br />

2001, Elf Aquitaine requested the termination of the registration<br />

of its <strong>com</strong>mon shares and ADS.<br />

As of December 31, 2006, TOTAL S.A. held, directly and<br />

indirectly, 279,704,596 shares of Elf Aquitaine, taking into<br />

account the 10,635,767 treasury shares held by Elf Aquitaine.<br />

This represented 99.48% of Elf Aquitaine’s share capital<br />

(281,177,570 shares) and 535,770,140 voting rights, or 99.72%<br />

of the 537,280,837 total voting rights.<br />

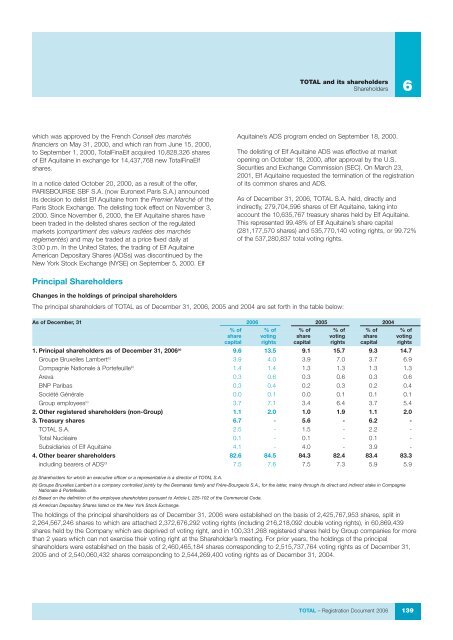

The principal shareholders of TOTAL as of December 31, 2006, 2005 and 2004 are set forth in the table below:<br />

As of December, 31 2006 2005 2004<br />

% of % of % of % of % of % of<br />

share voting share voting share voting<br />

capital rights capital rights capital rights<br />

1. Principal shareholders as of December 31, 2006 (a) 9.6 13.5 9.1 15.7 9.3 14.7<br />

Groupe Bruxelles Lambert (b) 3.9 4.0 3.9 7.0 3.7 6.9<br />

Compagnie Nationale à Portefeuille (b) 1.4 1.4 1.3 1.3 1.3 1.3<br />

Areva 0.3 0.6 0.3 0.6 0.3 0.6<br />

BNP Paribas 0.3 0.4 0.2 0.3 0.2 0.4<br />

Société Générale 0.0 0.1 0.0 0.1 0.1 0.1<br />

Group employees (c) 3.7 7.1 3.4 6.4 3.7 5.4<br />

2. Other registered shareholders (non-Group) 1.1 2.0 1.0 1.9 1.1 2.0<br />

3. Treasury shares 6.7 - 5.6 - 6.2 -<br />

TOTAL S.A. 2.5 - 1.5 - 2.2 -<br />

<strong>Total</strong> Nucléaire 0.1 - 0.1 - 0.1 -<br />

Subsidiaries of Elf Aquitaine 4.1 - 4.0 - 3.9 -<br />

4. Other bearer shareholders 82.6 84.5 84.3 82.4 83.4 83.3<br />

including bearers of ADS (d) 7.5 7.6 7.5 7.3 5.9 5.9<br />

(a) Shareholders for which an executive officer or a representative is a director of TOTAL S.A.<br />

(b) Groupe Bruxelles Lambert is a <strong>com</strong>pany controlled jointly by the Desmarais family and Frère-Bourgeois S.A., for the latter, mainly through its direct and indirect stake in Compagnie<br />

Nationale à Portefeuille.<br />

(c) Based on the definition of the employee shareholders pursuant to Article L 225-102 of the Commercial Code.<br />

(d) American Depositary Shares listed on the New York Stock Exchange.<br />

The holdings of the principal shareholders as of December 31, 2006 were established on the basis of 2,425,767,953 shares, split in<br />

2,264,567,246 shares to which are attached 2,372,676,292 voting rights (including 216,218,092 double voting rights), in 60,869,439<br />

shares held by the Company which are deprived of voting right, and in 100,331,268 registered shares held by Group <strong>com</strong>panies for more<br />

than 2 years which can not exercise their voting right at the Shareholder’s meeting. For prior years, the holdings of the principal<br />

shareholders were established on the basis of 2,460,465,184 shares corresponding to 2,515,737,764 voting rights as of December 31,<br />

2005 and of 2,540,060,432 shares corresponding to 2,544,269,400 voting rights as of December 31, 2004.<br />

TOTAL – <strong>Registration</strong> Document 2006 139