Registration document 2007 - Total.com

Registration document 2007 - Total.com

Registration document 2007 - Total.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

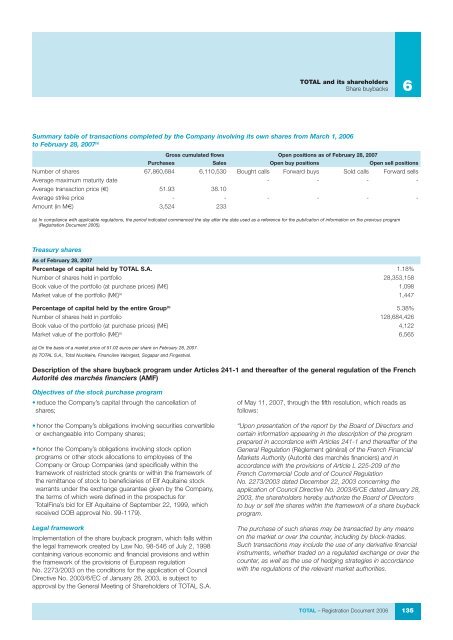

Summary table of transactions <strong>com</strong>pleted by the Company involving its own shares from March 1, 2006<br />

to February 28, <strong>2007</strong> (a)<br />

Gross cumulated flows Open positions as of February 28, <strong>2007</strong><br />

Purchases Sales Open buy positions Open sell positions<br />

Number of shares 67,860,684 6,110,530 Bought calls Forward buys Sold calls Forward sells<br />

Average maximum maturity date - - - -<br />

Average transaction price (€) 51.93 38.10<br />

Average strike price - - - - - -<br />

Amount (in M€) 3,524 233<br />

(a) In <strong>com</strong>pliance with applicable regulations, the period indicated <strong>com</strong>menced the day after the date used as a reference for the publication of information on the previous program<br />

(<strong>Registration</strong> Document 2005).<br />

Treasury shares<br />

As of February 28, <strong>2007</strong><br />

Percentage of capital held by TOTAL S.A. 1.18%<br />

Number of shares held in portfolio 28,353,158<br />

Book value of the portfolio (at purchase prices) (M€) 1,098<br />

Market value of the portfolio (M€) (a) 1,447<br />

Percentage of capital held by the entire Group (b) 5.38%<br />

Number of shares held in portfolio 128,684,426<br />

Book value of the portfolio (at purchase prices) (M€) 4,122<br />

Market value of the portfolio (M€) (a) 6,565<br />

(a) On the basis of a market price of 51.02 euros per share on February 28, <strong>2007</strong>.<br />

(b) TOTAL S.A., <strong>Total</strong> Nucléaire, Financière Valorgest, Sogapar and Fingestval.<br />

TOTAL and its shareholders<br />

Share buybacks<br />

Description of the share buyback program under Articles 241-1 and thereafter of the general regulation of the French<br />

Autorité des marchés financiers (AMF)<br />

Objectives of the stock purchase program<br />

• reduce the Company’s capital through the cancellation of<br />

shares;<br />

• honor the Company’s obligations involving securities convertible<br />

or exchangeable into Company shares;<br />

• honor the Company’s obligations involving stock option<br />

programs or other stock allocations to employees of the<br />

Company or Group Companies (and specifically within the<br />

framework of restricted stock grants or within the framework of<br />

the remittance of stock to beneficiaries of Elf Aquitaine stock<br />

warrants under the exchange guarantee given by the Company,<br />

the terms of which were defined in the prospectus for<br />

<strong>Total</strong>Fina’s bid for Elf Aquitaine of September 22, 1999, which<br />

received COB approval No. 99-1179).<br />

Legal framework<br />

Implementation of the share buyback program, which falls within<br />

the legal framework created by Law No. 98-546 of July 2, 1998<br />

containing various economic and financial provisions and within<br />

the framework of the provisions of European regulation<br />

No. 2273/2003 on the conditions for the application of Council<br />

Directive No. 2003/6/EC of January 28, 2003, is subject to<br />

approval by the General Meeting of Shareholders of TOTAL S.A.<br />

of May 11, <strong>2007</strong>, through the fifth resolution, which reads as<br />

follows:<br />

6<br />

“Upon presentation of the report by the Board of Directors and<br />

certain information appearing in the description of the program<br />

prepared in accordance with Articles 241-1 and thereafter of the<br />

General Regulation (Règlement général) of the French Financial<br />

Markets Authority (Autorité des marchés financiers) and in<br />

accordance with the provisions of Article L 225-209 of the<br />

French Commercial Code and of Council Regulation<br />

No. 2273/2003 dated December 22, 2003 concerning the<br />

application of Council Directive No. 2003/6/CE dated January 28,<br />

2003, the shareholders hereby authorize the Board of Directors<br />

to buy or sell the shares within the framework of a share buyback<br />

program.<br />

The purchase of such shares may be transacted by any means<br />

on the market or over the counter, including by block-trades.<br />

Such transactions may include the use of any derivative financial<br />

instruments, whether traded on a regulated exchange or over the<br />

counter, as well as the use of hedging strategies in accordance<br />

with the regulations of the relevant market authorities.<br />

TOTAL – <strong>Registration</strong> Document 2006 135