ANDHRA PRADESH REVISED PENSION RULES, 1980 (As ... - APHB

ANDHRA PRADESH REVISED PENSION RULES, 1980 (As ... - APHB ANDHRA PRADESH REVISED PENSION RULES, 1980 (As ... - APHB

R - 19 Executive Instructions Admissibility of Family Pension in respect of the military pensioner re-employed in Civil Service:- (a) If, on regular appointment in a civil service or a civil post, a military pensioner has, in the course of his re-employment, opted to retain military pension for the past military service in terms of Rule 19 (1)(a) of A.P. Revised Pension Rules, 1980, he shall exercise another option to receive family pension admissible under the relevant provisions governing family pension in Revised Pension Rules, 1980 or the family pension already authorised under relevant instructions of Army/Navy/Air Force, as the case may be. The option shall be exercised within a period of six months of the date of issue of the orders of regular appointment to a civil service or post on re-employment or within a period of three months of his return from leave, whichever is later, if he is on leave. If no option is exercised within the period aforesaid, he shall be deemed to have opted for family pension authorised under the relevant instructions of Army/Navy/Air Force as the case may be. (b) If, on his regular appointment in a civil service or civil post, in the course of re-employment, he has opted to surrender military pension and count in lieu thereof, the military service also for civil pension, he shall be governed by the family pension admissible under the pension rules applicable to him in respect of his civil service or civil post. (c) If a military pensioner is employed in civil service and dies while holding the civil post before the expiry of the period for exercising option as envisaged in (a) above, his family may be allowed to opt for the family pension admissible under the relevant provisions of the pension rules applicable to him in the civil post or the family pension authorised at the time of his retirement or discharge from the military service under relevant instructions of Army/Navy/Air force as the case may be. For this purpose, an option shall be given. If the option is not given within 6 months as envisaged in (a) above, the State Civil Pension Rules will be made applicable, which shall be final. (G.O.Ms.No.195, Fin. & Plg. (FW: Pen.I) Dept., dt.12-5-1985 w.e.f 21-5-85) 36

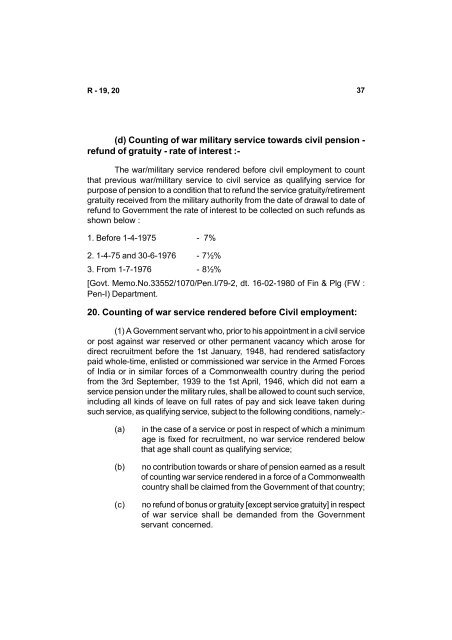

R - 19, 20 (d) Counting of war military service towards civil pension - refund of gratuity - rate of interest :- The war/military service rendered before civil employment to count that previous war/military service to civil service as qualifying service for purpose of pension to a condition that to refund the service gratuity/retirement gratuity received from the military authority from the date of drawal to date of refund to Government the rate of interest to be collected on such refunds as shown below : 1. Before 1-4-1975 - 7% 2. 1-4-75 and 30-6-1976 - 7½% 3. From 1-7-1976 - 8½% [Govt. Memo.No.33552/1070/Pen.I/79-2, dt. 16-02-1980 of Fin & Plg (FW : Pen-I) Department. 20. Counting of war service rendered before Civil employment: (1) A Government servant who, prior to his appointment in a civil service or post against war reserved or other permanent vacancy which arose for direct recruitment before the 1st January, 1948, had rendered satisfactory paid whole-time, enlisted or commissioned war service in the Armed Forces of India or in similar forces of a Commonwealth country during the period from the 3rd September, 1939 to the 1st April, 1946, which did not earn a service pension under the military rules, shall be allowed to count such service, including all kinds of leave on full rates of pay and sick leave taken during such service, as qualifying service, subject to the following conditions, namely:- (a) in the case of a service or post in respect of which a minimum age is fixed for recruitment, no war service rendered below that age shall count as qualifying service; (b) no contribution towards or share of pension earned as a result of counting war service rendered in a force of a Commonwealth country shall be claimed from the Government of that country; (c) no refund of bonus or gratuity [except service gratuity] in respect of war service shall be demanded from the Government servant concerned. 37

- Page 1 and 2: ANDHRA PRADESH REVISED PENSION RULE

- Page 3 and 4: R - 3 the Consolidated Fund of the

- Page 5 and 6: R - 5, 6 retires or is retired or i

- Page 7 and 8: R - 8 8. Pension subject to future

- Page 9 and 10: R - 9 Provided that the Andhra Prad

- Page 11 and 12: R - 9 11 (i) in the case of crimina

- Page 13 and 14: R - 9 (a) shall be with the sanctio

- Page 15 and 16: R - 9 3. Sri .......is directed to

- Page 17 and 18: R - 9 iii) Effect of deletion of Ru

- Page 19 and 20: R - 9 of superannuation while under

- Page 21 and 22: R - 9,10 pension was allowed either

- Page 23 and 24: R - 11 Explanation:- (a) For the pu

- Page 25 and 26: R - 12,13 (2)(a) If a pensioner, to

- Page 27 and 28: R - 14 (c) (i) No separate orders n

- Page 29 and 30: R - 15, 16, 17 an option in terms o

- Page 31 and 32: R - 18, 19 for clause (a) of sub-ru

- Page 33 and 34: R - 19 Verification of previous Mil

- Page 35: R - 19 Station: Dated: Station: cre

- Page 39 and 40: R - 20 (v) The break if any between

- Page 41 and 42: R - 20 Note (4):- The question whet

- Page 43 and 44: R - 20, 21 Note(9):- The service re

- Page 45 and 46: R - 22, 23, 24, 25, 26 22. Counting

- Page 47 and 48: R - 27, 28 (a) authorised leave of

- Page 49 and 50: R - 29, 30, 31 servcie as per rule

- Page 51 and 52: R - 31 The rate of deputation (loca

- Page 53 and 54: R - 31 (iii) Counting of notional p

- Page 55 and 56: R - 32 allowance admissible at the

- Page 57 and 58: R - 32 period of average emoluments

- Page 59 and 60: R - 35, 36 35. Pension on absorptio

- Page 61 and 62: R - 36 (4) The officer will exercis

- Page 63 and 64: R - 36 of the central autonomous bo

- Page 65 and 66: R - 36 new Provident Fund Account u

- Page 67 and 68: R - 36 (v) For the period of servic

- Page 69 and 70: R - 36 sanction for the absorption

- Page 71 and 72: R - 36 absorption in the service of

- Page 73 and 74: R - 36 16. Procedure for drawal of

- Page 75 and 76: R - 36 contribution, which the univ

- Page 77 and 78: R - 36 out specifically and clearly

- Page 79 and 80: R - 36 establishment, on absorption

- Page 81 and 82: R - 36 The provisions contained in

- Page 83 and 84: R - 37 Vidhana Parishad does not ha

- Page 85 and 86: R - 38 38. Compensation pension :-

R - 19, 20<br />

(d) Counting of war military service towards civil pension -<br />

refund of gratuity - rate of interest :-<br />

The war/military service rendered before civil employment to count<br />

that previous war/military service to civil service as qualifying service for<br />

purpose of pension to a condition that to refund the service gratuity/retirement<br />

gratuity received from the military authority from the date of drawal to date of<br />

refund to Government the rate of interest to be collected on such refunds as<br />

shown below :<br />

1. Before 1-4-1975 - 7%<br />

2. 1-4-75 and 30-6-1976 - 7½%<br />

3. From 1-7-1976 - 8½%<br />

[Govt. Memo.No.33552/1070/Pen.I/79-2, dt. 16-02-<strong>1980</strong> of Fin & Plg (FW :<br />

Pen-I) Department.<br />

20. Counting of war service rendered before Civil employment:<br />

(1) A Government servant who, prior to his appointment in a civil service<br />

or post against war reserved or other permanent vacancy which arose for<br />

direct recruitment before the 1st January, 1948, had rendered satisfactory<br />

paid whole-time, enlisted or commissioned war service in the Armed Forces<br />

of India or in similar forces of a Commonwealth country during the period<br />

from the 3rd September, 1939 to the 1st April, 1946, which did not earn a<br />

service pension under the military rules, shall be allowed to count such service,<br />

including all kinds of leave on full rates of pay and sick leave taken during<br />

such service, as qualifying service, subject to the following conditions, namely:-<br />

(a) in the case of a service or post in respect of which a minimum<br />

age is fixed for recruitment, no war service rendered below<br />

that age shall count as qualifying service;<br />

(b) no contribution towards or share of pension earned as a result<br />

of counting war service rendered in a force of a Commonwealth<br />

country shall be claimed from the Government of that country;<br />

(c) no refund of bonus or gratuity [except service gratuity] in respect<br />

of war service shall be demanded from the Government<br />

servant concerned.<br />

37