Etude des marchés d'assurance non-vie à l'aide d'équilibres de ...

Etude des marchés d'assurance non-vie à l'aide d'équilibres de ...

Etude des marchés d'assurance non-vie à l'aide d'équilibres de ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

tel-00703797, version 2 - 7 Jun 2012<br />

BIBLIOGRAPHY<br />

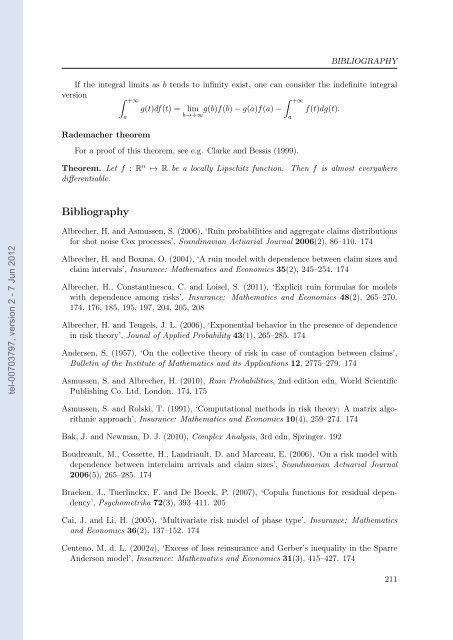

If the integral limits as b tends to infinity exist, one can consi<strong>de</strong>r the in<strong>de</strong>finite integral<br />

version +∞<br />

+∞<br />

g(t)df(t) = lim g(b)f(b) − g(a)f(a) −<br />

b→+∞<br />

f(t)dg(t).<br />

Ra<strong>de</strong>macher theorem<br />

a<br />

For a proof of this theorem, see e.g. Clarke and Bessis (1999).<br />

Theorem. Let f : R n ↦→ R be a locally Lipschitz function. Then f is almost everywhere<br />

differentiable.<br />

Bibliography<br />

Albrecher, H. and Asmussen, S. (2006), ‘Ruin probabilities and aggregate claims distributions<br />

for shot noise Cox processes’, Scandinavian Actuarial Journal 2006(2), 86–110. 174<br />

Albrecher, H. and Boxma, O. (2004), ‘A ruin mo<strong>de</strong>l with <strong>de</strong>pen<strong>de</strong>nce between claim sizes and<br />

claim intervals’, Insurance: Mathematics and Economics 35(2), 245–254. 174<br />

Albrecher, H., Constantinescu, C. and Loisel, S. (2011), ‘Explicit ruin formulas for mo<strong>de</strong>ls<br />

with <strong>de</strong>pen<strong>de</strong>nce among risks’, Insurance: Mathematics and Economics 48(2), 265–270.<br />

174, 176, 185, 195, 197, 204, 205, 208<br />

Albrecher, H. and Teugels, J. L. (2006), ‘Exponential behavior in the presence of <strong>de</strong>pen<strong>de</strong>nce<br />

in risk theory’, Jounal of Applied Probability 43(1), 265–285. 174<br />

An<strong>de</strong>rsen, S. (1957), ‘On the collective theory of risk in case of contagion between claims’,<br />

Bulletin of the Institute of Mathematics and its Applications 12, 2775–279. 174<br />

Asmussen, S. and Albrecher, H. (2010), Ruin Probabilities, 2nd edition edn, World Scientific<br />

Publishing Co. Ltd. London. 174, 175<br />

Asmussen, S. and Rolski, T. (1991), ‘Computational methods in risk theory: A matrix algorithmic<br />

approach’, Insurance: Mathematics and Economics 10(4), 259–274. 174<br />

Bak, J. and Newman, D. J. (2010), Complex Analysis, 3rd edn, Springer. 192<br />

Boudreault, M., Cossette, H., Landriault, D. and Marceau, E. (2006), ‘On a risk mo<strong>de</strong>l with<br />

<strong>de</strong>pen<strong>de</strong>nce between interclaim arrivals and claim sizes’, Scandinavian Actuarial Journal<br />

2006(5), 265–285. 174<br />

Braeken, J., Tuerlinckx, F. and De Boeck, P. (2007), ‘Copula functions for residual <strong>de</strong>pen<strong>de</strong>ncy’,<br />

Psychometrika 72(3), 393–411. 205<br />

Cai, J. and Li, H. (2005), ‘Multivariate risk mo<strong>de</strong>l of phase type’, Insurance: Mathematics<br />

and Economics 36(2), 137–152. 174<br />

Centeno, M. d. L. (2002a), ‘Excess of loss reinsurance and Gerber’s inequality in the Sparre<br />

An<strong>de</strong>rson mo<strong>de</strong>l’, Insurance: Mathematics and Economics 31(3), 415–427. 174<br />

a<br />

211