Etude des marchés d'assurance non-vie à l'aide d'équilibres de ...

Etude des marchés d'assurance non-vie à l'aide d'équilibres de ...

Etude des marchés d'assurance non-vie à l'aide d'équilibres de ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

tel-00703797, version 2 - 7 Jun 2012<br />

Chapitre 2. Theorie <strong><strong>de</strong>s</strong> jeux et cycles <strong>de</strong> marché<br />

1.0<br />

Prob. Lea<strong>de</strong>rship<br />

0.8<br />

0.6<br />

0.4<br />

1.4<br />

1.6<br />

Lea<strong>de</strong>r<br />

Cap. Sol. Ratio<br />

1.8<br />

2.0<br />

0.4<br />

0.7<br />

0.6<br />

0.5<br />

Market Share<br />

0.4<br />

Prob. Lea<strong>de</strong>rship<br />

0.3<br />

0.2<br />

0.1<br />

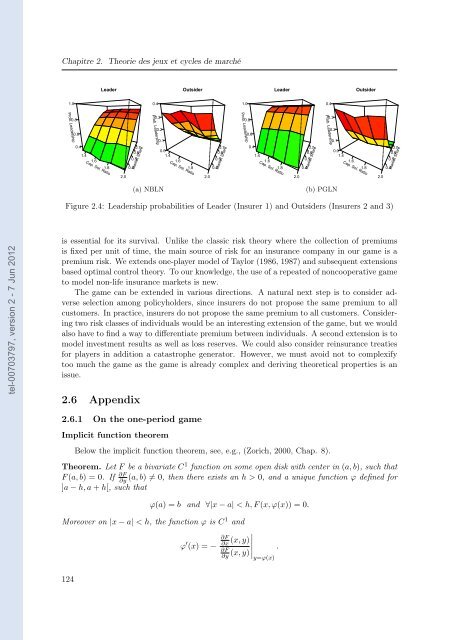

(a) NBLN<br />

0.0<br />

1.4<br />

1.6<br />

Outsi<strong>de</strong>r<br />

Cap. Sol. Ratio<br />

1.8<br />

2.0<br />

0.4<br />

0.7<br />

0.6<br />

0.5<br />

Market Share<br />

1.0<br />

Prob. Lea<strong>de</strong>rship<br />

0.8<br />

0.6<br />

0.4<br />

1.4<br />

1.6<br />

Lea<strong>de</strong>r<br />

Cap. Sol. Ratio<br />

1.8<br />

2.0<br />

0.4<br />

0.7<br />

0.6<br />

0.5<br />

Market Share<br />

0.4<br />

Prob. Lea<strong>de</strong>rship<br />

0.3<br />

0.2<br />

0.1<br />

(b) PGLN<br />

0.0<br />

1.4<br />

1.6<br />

Outsi<strong>de</strong>r<br />

Cap. Sol. Ratio<br />

Figure 2.4: Lea<strong>de</strong>rship probabilities of Lea<strong>de</strong>r (Insurer 1) and Outsi<strong>de</strong>rs (Insurers 2 and 3)<br />

is essential for its survival. Unlike the classic risk theory where the collection of premiums<br />

is fixed per unit of time, the main source of risk for an insurance company in our game is a<br />

premium risk. We extends one-player mo<strong>de</strong>l of Taylor (1986, 1987) and subsequent extensions<br />

based optimal control theory. To our knowledge, the use of a repeated of <strong>non</strong>cooperative game<br />

to mo<strong>de</strong>l <strong>non</strong>-life insurance markets is new.<br />

The game can be exten<strong>de</strong>d in various directions. A natural next step is to consi<strong>de</strong>r adverse<br />

selection among policyhol<strong>de</strong>rs, since insurers do not propose the same premium to all<br />

customers. In practice, insurers do not propose the same premium to all customers. Consi<strong>de</strong>ring<br />

two risk classes of individuals would be an interesting extension of the game, but we would<br />

also have to find a way to differentiate premium between individuals. A second extension is to<br />

mo<strong>de</strong>l investment results as well as loss reserves. We could also consi<strong>de</strong>r reinsurance treaties<br />

for players in addition a catastrophe generator. However, we must avoid not to complexify<br />

too much the game as the game is already complex and <strong>de</strong>riving theoretical properties is an<br />

issue.<br />

2.6 Appendix<br />

2.6.1 On the one-period game<br />

Implicit function theorem<br />

Below the implicit function theorem, see, e.g., (Zorich, 2000, Chap. 8).<br />

Theorem. Let F be a bivariate C1 function on some open disk with center in (a, b), such that<br />

F (a, b) = 0. If ∂F<br />

∂y (a, b) = 0, then there exists an h > 0, and a unique function ϕ <strong>de</strong>fined for<br />

]a − h, a + h[, such that<br />

ϕ(a) = b and ∀|x − a| < h, F (x, ϕ(x)) = 0.<br />

Moreover on |x − a| < h, the function ϕ is C1 and<br />

ϕ ′ <br />

(x, y)<br />

<br />

<br />

(x) = − <br />

(x, y)<br />

124<br />

∂F<br />

∂x<br />

∂F<br />

∂y<br />

y=ϕ(x)<br />

.<br />

1.8<br />

2.0<br />

0.4<br />

0.7<br />

0.6<br />

0.5<br />

Market Share