R+V Versicherung AG Annual Report

R+V Versicherung AG Annual Report

R+V Versicherung AG Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business developments in the individual<br />

insurance classes<br />

Life<br />

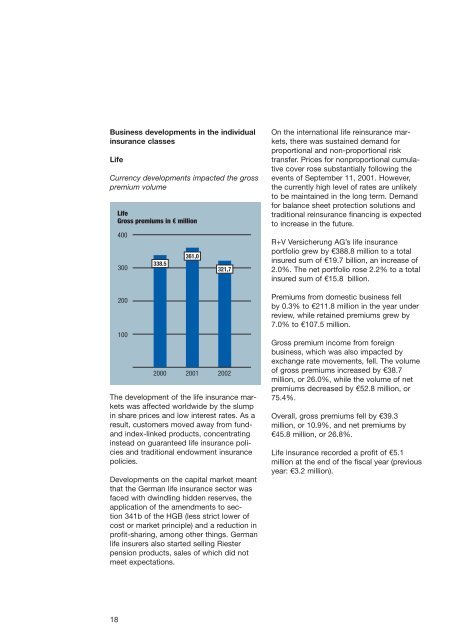

Currency developments impacted the gross<br />

premium volume<br />

18<br />

Life<br />

Gross premiums in € million<br />

400<br />

300<br />

200<br />

100<br />

338.5<br />

361,0<br />

2000 2001<br />

321,7<br />

2002<br />

The development of the life insurance markets<br />

was affected worldwide by the slump<br />

in share prices and low interest rates. As a<br />

result, customers moved away from fundand<br />

index-linked products, concentrating<br />

instead on guaranteed life insurance policies<br />

and traditional endowment insurance<br />

policies.<br />

Developments on the capital market meant<br />

that the German life insurance sector was<br />

faced with dwindling hidden reserves, the<br />

application of the amendments to section<br />

341b of the HGB (less strict lower of<br />

cost or market principle) and a reduction in<br />

profit-sharing, among other things. German<br />

life insurers also started selling Riester<br />

pension products, sales of which did not<br />

meet expectations.<br />

On the international life reinsurance markets,<br />

there was sustained demand for<br />

proportional and non-proportional risk<br />

transfer. Prices for nonproportional cumulative<br />

cover rose substantially following the<br />

events of September 11, 2001. However,<br />

the currently high level of rates are unlikely<br />

to be maintained in the long term. Demand<br />

for balance sheet protection solutions and<br />

traditional reinsurance financing is expected<br />

to increase in the future.<br />

<strong>R+V</strong> <strong>Versicherung</strong> <strong>AG</strong>’s life insurance<br />

portfolio grew by €388.8 million to a total<br />

insured sum of €19.7 billion, an increase of<br />

2.0%. The net portfolio rose 2.2% to a total<br />

insured sum of €15.8 billion.<br />

Premiums from domestic business fell<br />

by 0.3% to €211.8 million in the year under<br />

review, while retained premiums grew by<br />

7.0% to €107.5 million.<br />

Gross premium income from foreign<br />

business, which was also impacted by<br />

exchange rate movements, fell. The volume<br />

of gross premiums increased by €38.7<br />

million, or 26.0%, while the volume of net<br />

premiums decreased by €52.8 million, or<br />

75.4%.<br />

Overall, gross premiums fell by €39.3<br />

million, or 10.9%, and net premiums by<br />

€45.8 million, or 26.8%.<br />

Life insurance recorded a profit of €5.1<br />

million at the end of the fiscal year (previous<br />

year: €3.2 million).