VS 2.4 - RICS

VS 2.4 - RICS

VS 2.4 - RICS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>RICS</strong> <strong>RICS</strong> 估价 估价 估价 - 专业标准<br />

专业标准<br />

2012 2012 年 3 月<br />

(<strong>RICS</strong>|世界范围的物业专业主义标志)

前言<br />

前言<br />

2012 2012年3月 此版本红皮书对现有标准作出了一些变更,使其完全符合新的国际估价标准(I<strong>VS</strong>)。<strong>RICS</strong>标准采用的 是2011年7月出版、2012年1月1日起生效的I<strong>VS</strong>标准,并在某些情况下对其作出补充。 2012<br />

格式提供。 I<strong>VS</strong>的一项重大更改是扩大了应用范围,不仅应用于物业房地产,还包括所有类型的资产;其中“资产” 为了方便用户,本标准对I<strong>VS</strong>2011进行了整篇转载,印刷版以附件形式提供,对于电子用户,则以PDF<br />

法达到一致。然而,跟以往一样,<strong>RICS</strong>标准仍然详细涉及针对不动产形式的资产(土地、房屋及其中 的权益)的估价,因此,为了清晰起见,必要之处仍然使用“物业房地产”一词。 一词在适当情况下也包括“债务”。相应地,此版本<strong>RICS</strong>某些参考条目也作出了更改,与I<strong>VS</strong>措辞方<br />

查工作正全面展开,其中将包括业务估价及无形资产等方面的新材料以及其他改进内容。审查后的版本 按计划将于2013年完成并出版。 读者应认识到,此版本红皮书是为了保证现有材料与I<strong>VS</strong>相符而发行的暂行版本。目前,对红皮书的审<br />

标准变更的全部细节及说明载于下表。<br />

参考条目 所作变更 引言 第1款进行了重新排序。 参考条目<br />

将“物业”一词更改为“资产”。此外,修订后的第2款强调“符合本标准的估价 亦必将符合I<strong>VS</strong>标准”这条原则。 第2款增添了新内容,使<strong>RICS</strong>标准与I<strong>VS</strong>标准达到一致,并说明本标准的某些部分<br />

在该网站均有提供。 第5.2款新增了<strong>RICS</strong>红皮书版块的网站地址。征求意见稿及其它有关红皮书的资料<br />

同于或晚于本版标准 第6.1款进行了修订,以确认本标准的适用范围是:估价时点<br />

• 术语表 为了采用I<strong>VS</strong> 2011的定义,进行了多处修订: 生效日期的估价。基于网站的标准也已经针对此变更进行了更新。<br />

现在指的是“假设”而非“原则”; 价值基准 术语表<br />

• 新增成本计算法<br />

• 修改公允价值<br />

• 新增收益还原法<br />

• 新增商誉<br />

定义; 定义;<br />

定义; 定义;<br />

ii

• 新增投资物业<br />

• 修改投资价值<br />

• 新增市场比较法<br />

• 修改市场租金<br />

• 新增不动产<br />

• 修改了特殊假设<br />

• 修改特殊购买者<br />

• 修改协同价值<br />

• 优先使用估价时点(Valuation<br />

定义; 投资性房地产定义;<br />

定义; 定义;<br />

两个定义; 的定义; 和固定财产<br />

定义; 定义,现在是指“某个特定的买家”。<br />

一词,而估价日期(date of valuation)仅作为对该定义的交叉引用; date)<br />

1.1 <strong>VS</strong> 1.1 <strong>VS</strong> 1.1 <strong>VS</strong> 1.1 对各种例外情形进行排序编号,更加清晰。第5款的新增内容是为了提请读者注意 如果估价意图落在例外情形范围,仍需顾及I<strong>VS</strong>标准的应用。 <strong>VS</strong><br />

版(2010)。 对“IRRV行为准则”的摘录进行了扩充,提及“<strong>RICS</strong>执业准则:评级顾问”第3<br />

1.2 <strong>VS</strong> 1.2 <strong>VS</strong> 1.2 <strong>VS</strong> 1.2 插入新的一款,用以解释本标准如何符合I<strong>VS</strong>标准。 <strong>VS</strong> 1.7 <strong>VS</strong> 1.7 <strong>VS</strong> 1.7 <strong>VS</strong> 1.7 增添新的一款,要求估价师必须在工作底稿中保留关于利益冲突的解决的笔记。 <strong>VS</strong><br />

2.1 <strong>VS</strong> 2.1 <strong>VS</strong> 2.1 <strong>VS</strong> 2.1 该条标准进行了扩充,以确认已经包含I<strong>VS</strong> 101 “工作范围”的所有要求。该清单 <strong>VS</strong><br />

• (a)提到“其它预期用户”; 进行了修改,以包含I<strong>VS</strong>标准的下列特定用语:<br />

• (e)用“资产或负债”代替“物业房地产”一词;<br />

• (i)进行了扩充,要求指出哪名估价师是负责者;<br />

• (p)进行了扩充,指出在适当情况下,应对估价的I<strong>VS</strong>合规性进行确认。<br />

101的所有相似条款。 <strong>VS</strong> 2.3 <strong>VS</strong> 2.3 <strong>VS</strong> 2.3 <strong>VS</strong> 2.3 第4款涉及“强制出售”的部分进行了修改,以达到与I<strong>VS</strong>框架一致。 增添了一条陈述,指出最低要求清单包含I<strong>VS</strong><br />

<strong>VS</strong> 3.1 <strong>VS</strong> 3.1 <strong>VS</strong> 3.1 <strong>VS</strong> 3.1 第2款提到I<strong>VS</strong>框架对价值基准的注解。 <strong>VS</strong> 3.2 <strong>VS</strong> 3.2 <strong>VS</strong> 3.2 <strong>VS</strong> 3.2 该条标准现在与I<strong>VS</strong>框架直接关联。<br />

iii

3.3 <strong>VS</strong> 3.3 <strong>VS</strong> 3.3 <strong>VS</strong> 3.3 修改并全文引述了市场租金 的解释。 <strong>VS</strong> 3.4 <strong>VS</strong> 3.4 <strong>VS</strong> 3.4 <strong>VS</strong> 3.4 该条标准现在与I<strong>VS</strong>框架直接关联。 <strong>VS</strong><br />

3.5 <strong>VS</strong> 3.5 <strong>VS</strong> 3.5 <strong>VS</strong> 3.5 该条标准已经彻底改写,以突出I<strong>VS</strong>及国际会计标准委员会(IASB)采用的公允价 值 的定义不同,现在该条标准与I<strong>VS</strong>框架直接关联。 <strong>VS</strong><br />

4 <strong>VS</strong> 4 <strong>VS</strong> 4 <strong>VS</strong> 4 该条标准已经彻底改写,改写后包含提到两类I<strong>VS</strong>应用(财会报表及抵押贷款)的 <strong>VS</strong><br />

<strong>VS</strong> 5.1 <strong>VS</strong> 5.1 <strong>VS</strong> 5.1 该条标准进行了扩充,强调估价师需要充分保留有关估价的笔记。 内容。该条标准并未原样转载I<strong>VS</strong>材料,而是指明了其内容。<br />

• 6.1 <strong>VS</strong> 6.1 <strong>VS</strong> 6.1 <strong>VS</strong> 6.1 该条标准进行了扩充,以确认已经包含I<strong>VS</strong> 103“报告”的所有要求。该清单进行 5.1<br />

(a)提到“其它预期用户”; 了修改,以包含I<strong>VS</strong>的下列具体要求: <strong>VS</strong><br />

• (e)用“资产或负债”代替“物业房地产”一词;<br />

• (i)进行了扩充,要求指出哪名估价师是负责者;<br />

• (p)进行了扩充,指出在适当情况下,应对估价的I<strong>VS</strong>合规性进行确认。<br />

103的所有相似条款。 <strong>VS</strong> 6.9 <strong>VS</strong> 6.9 <strong>VS</strong> 6.9 <strong>VS</strong> 6.9 提及“国家”(state)之处,改为“国家”(country)。 增添了一条陈述,指出最低要求清单已经包含I<strong>VS</strong><br />

• 附录 2 引言部分进行了修改,以解释该附录与I<strong>VS</strong> 101及<strong>VS</strong> 2.1的修订条款的关系。该附 录进行了修改,以包含I<strong>VS</strong> 101的下列新增材料及重新措辞: (a)该项进行了扩充,提到“其它预期用户”。 附录<br />

• (c)提到以资产群或组合资产方式持有的资产。<br />

• (f)进行了修改,强调在采用公允价值<br />

• (h)新增内容提到<strong>VS</strong><br />

• (i)提出一个重要的注意事项,确认<strong>RICS</strong>不允许一项估价由事务所<br />

• (m)新增词语“无需进一步核实”。<br />

• (p)该项进行了扩充,要求视情况用一条评论指出该估价符合I<strong>VS</strong>。<br />

1.7.4。 时,价值基准的识别认定要正确。<br />

这与I<strong>VS</strong>不同。始终必须指出哪名估价师是负责者。 完成,<br />

iv

•<br />

附录 6 引言部分进行了修改,以解释本附录与I<strong>VS</strong> 103的关系。该附录进行了修改,以合 并I<strong>VS</strong> 103当中的下列新增材料及重新措辞:该附录进行了修改,以合并I<strong>VS</strong> 101 的下列新增材料及重新措辞: 附录<br />

(a)该项进行了扩充,提到“其它预期用户”。<br />

• (c)提到作为资产群或组合资产持有的资产。<br />

• (f)进行了修改,强调在采用公允价值<br />

• (h)新增内容提到<strong>VS</strong><br />

• (i)提出一个重要的注意事项,确认<strong>RICS</strong>不允许一项估价由事务所<br />

• (p)该项进行了扩充,要求视情况用一条评论指出该项估价符合I<strong>VS</strong>。<br />

• (q)要求注明估价推理已经修改,现在与I<strong>VS</strong>的对应部分相似。<br />

• (s)新增针对估价时点<br />

• (t)这里的注解部分确认估价报告的编制人不可签署为“某事务所”。<br />

1.7.4。 时,价值基准的识别认定要正确。<br />

这与I<strong>VS</strong>不同。始终必须指出哪名估价师是负责者。 完成,<br />

用户指南:投资意图估价不确定性体现》(2011)。 之后发生的重大变化进行评论的要求,并提到《<strong>RICS</strong><br />

附录 7 新增第(<strong>2.4</strong>)款,提醒注意<strong>VS</strong> 1.9的披露要求。 附录<br />

附录 9 新增一个附录,提供现行I<strong>VS</strong>版本与本版红皮书的详细对比。 GN 4 GN 4 GN 4 GN 4 项目清单进行了修改,现在与<strong>VS</strong> 2.1的清单完全一致。 附录<br />

7 GN 7 GN 7 GN 7 该指南 已经撤销,将另外单独出版。 国际估价标准 <strong>RICS</strong>标准的电子版及印刷版均转载了2012年1月1日发布的I<strong>VS</strong>全文。<br />

GN<br />

v

声明<br />

声明<br />

•<br />

• 产估价的指南; 《<strong>RICS</strong>评估与估价手册》最初出版时,分为两个标题: 《资产估价实践与指南陈述》第1版(1976)、第2版(1981)和第3版(1990),提供资 《估价指南手册》第1版(1980)、第2版(1981年3月)和第3版(1992年4月)。<br />

《<strong>RICS</strong>评估与估价标准》于2003年第一次出版,2003年3月至2007年4月共作出9次修订。 《<strong>RICS</strong>评估与估价手册》于1993年、1996年(两次)、1998年、2000年和2002年重印。<br />

年7月再次修订,2010年4月再次重印。 第7版书名更改为《<strong>RICS</strong>估价-全球和英国标准》,出版于2011处4月。 《<strong>RICS</strong>估价标准》第6版于2008年第一次出版,2008年9月进行了修订,2009年3月重印,2009<br />

发表的内容所包含信息的准确性,I<strong>VS</strong>C不承担任何责任。I<strong>VS</strong>C不定时出版的I<strong>VS</strong>英文版本是I<strong>VS</strong>C标 准的唯一正式版本。 经过国际估价标准委员会(I<strong>VS</strong>C)的版权许可,此次出版对《国际估价标准2011》进行了转载。对<strong>RICS</strong><br />

41号(邮编:EC2R 6PP),也可登录网 站www.ivsc.org查找。 附录8的内容版权归欧洲抵押贷款联合会,经其许可予以转载。 该唯一正式版本可从以下地址获取:英国伦敦Moorgate<br />

15)“有形固定资产”的版权归会计准则委员会,经其善意许可,予以部分 转载。 英国估价标准(UK<strong>VS</strong>)第2.6节以及附录9内容版权归金融服务管理局(FSA),经其许可予以转载。 财务报告准则第15号(FRS<br />

特许公共财务会计师协会(CIPFA)在英国标准附录5的修订中给予了帮助,<strong>RICS</strong>特此鸣谢。 (虽然使用FSA材料,并不表示FSA认可本出版物或其材料、观点。)<br />

5“地区当局按低于最优对价处置土地”的修订 “社区和当地政府”部(原副首相办公室)在英国标准GN<br />

英国估价标准(UK<strong>VS</strong>)第1.15条内容版权归财政部,经其许可予以转载。<br />

中给予了帮助,<strong>RICS</strong>特此鸣谢。<br />

vi

与以下单位合作出版:<br />

IRRV是地方税务、福利与估价方面的专业团体。地址:伦敦 高霍尔303-305号 5楼 诺森伯兰宿舍 邮 与IRRV合作出版。<br />

7691 8988<br />

020 7831 2048<br />

www.irrv.org.uk 网址: 传真:<br />

020 电话: 7JZ 编:WC1V<br />

有<strong>RICS</strong>和IRRV双重会员资格。<br />

英国收益评级与估价协会(IRRV)是国税、收益及估价领域英国最大的专业团体。IRRV估价师通常具<br />

vii

目录<br />

目录<br />

..................................................................................................................... ii<br />

.................................................................................................................... vi<br />

..................................................................................................................... 1<br />

1 .............................................................................................. 1<br />

2 .................................................................................... 1<br />

前言<br />

3 ......................................................................................................... 3<br />

声明<br />

4 .............................................................................................. 3<br />

引言<br />

5 ........................................................................................... 5<br />

6<br />

本标准的目的<br />

生效日....................................................................................................... 5<br />

国际估价标准(I<strong>VS</strong>)<br />

.................................................................................................................. 6<br />

<strong>VS</strong> 1 .....................................................................................<br />

出版<br />

12 修订案及讨论稿 本标准的编排<br />

合规性和道德要求 术语表<br />

........................................................... 12 本标准的编排:适用范围和例外情形 1.1 <strong>VS</strong><br />

........................................................... 16<br />

......................................................................... <strong>VS</strong> 1.3 <strong>RICS</strong>国家协会估价标准 合规性、监管和披露方面的背离要求 1.2 <strong>VS</strong><br />

19<br />

............................................................................................ 19 聘用条款 1.4 <strong>VS</strong><br />

......................................................................................... 20 估价师资格 1.5 <strong>VS</strong><br />

......................................................................................... 20 知识与技能 1.6 <strong>VS</strong><br />

.................................................................................... 22<br />

........................................................................... <strong>VS</strong> 1.8 独立性的额外判断准则 独立性与客观性 1.7 <strong>VS</strong><br />

24<br />

............................... 24<br />

............................................................................................ <strong>VS</strong> 2 聘用条款协议 对涉及公众利益的或者第三方可能依赖的估价进行额外披露 1.9 <strong>VS</strong><br />

29<br />

.................................................................................... 29 聘用条款确认书 2.1 <strong>VS</strong><br />

............................................................................................ 30<br />

.............................................................................. <strong>VS</strong> 2.3 营销约束与强制出售 特殊假设 2.2 <strong>VS</strong><br />

32<br />

<strong>VS</strong> <strong>2.4</strong> ......................................................................................... 32<br />

<strong>VS</strong> 2.5 ........................................................................... 33<br />

<strong>VS</strong> 2.6 ......................................................................................... 34<br />

<strong>VS</strong> 3 .................................................................................................. 35<br />

<strong>VS</strong> 3.1 ............................................................................................ 35<br />

限制性信息<br />

<strong>VS</strong> 3.2 ............................................................................................ 36<br />

重新估价而不重新勘查<br />

<strong>VS</strong> 3.3 ............................................................................................ 36<br />

批判性审查<br />

<strong>VS</strong> 3.4 ............................................................................................ 37<br />

<strong>VS</strong><br />

价值基准<br />

3.5 ............................................................................................ 37<br />

价值基准<br />

<strong>VS</strong> 4 ....................................................................................................... 38<br />

市场价值<br />

<strong>VS</strong> 4.1 ........................................................................ 38<br />

市场租金<br />

<strong>VS</strong> 4.2 .............................................................................. 40<br />

41<br />

投资价值<br />

42<br />

42<br />

45<br />

45<br />

46<br />

46<br />

47<br />

公允价值 用于担保贷款的估价 用于财务报表的估价项目 应用<br />

47<br />

.....................................................<br />

.......................................................................................................<br />

.........................................................................................<br />

..................................................................................................<br />

...................................................................... 勘测 <strong>VS</strong> 5.1 勘查与勘测 <strong>VS</strong> 6 估价报告 <strong>VS</strong> 4.3<br />

......................................................................................<br />

为财务报告目的对公共部门资产进行估价<br />

.................................................................................<br />

............................................................................................<br />

<strong>VS</strong><br />

........................................................................<br />

5<br />

怎样描述报告 <strong>VS</strong> 6.3 怎样报告价值基准 <strong>VS</strong> 6.4 特殊假设 <strong>VS</strong> 6.1 估价报告至少应包括的内容 6.2 <strong>VS</strong> 私营部门的折旧重置成本 6.5 <strong>VS</strong><br />

viii

48<br />

48<br />

49<br />

49<br />

50<br />

50<br />

51<br />

52<br />

53<br />

57<br />

65<br />

.................................................................................................... 69<br />

.......................................................................................... 72<br />

........................................................................... 附录 6关于估价报告内容的最低要求 附录5商业抵押贷款估价 特殊假设 附录4<br />

........................................................................<br />

.....................................................<br />

...............................................................................................<br />

..............................................................................<br />

...................................................................................... 折旧重置成本估价与备择市场价值的比较 <strong>VS</strong> 6.8 负价值 <strong>VS</strong> 6.9 位于多个国家的物业 <strong>VS</strong> 6.6<br />

......................................................................................<br />

公共部门的折旧重置成本<br />

......................................................................................<br />

...........................................................<br />

<strong>VS</strong><br />

..................................................<br />

6.7<br />

初步估价意见 <strong>VS</strong> 6.12 公开发表陈述 <strong>VS</strong> 6.13 公开出版物对背离及特殊假设的引用 <strong>VS</strong> 6.10<br />

...............................................................................................<br />

..........................................................................................................<br />

合并其它估价 <strong>VS</strong> 6.11<br />

假设 附录3 确定聘用条款 附录2 保密职责、独立性与客观性面临的威胁、利益冲突 附录1<br />

78<br />

........................................................................ 公开出版物引用估价报告的例子 7 附录<br />

83<br />

.......................................................... 85<br />

................................................................. 88 附录9 《<strong>RICS</strong>估价-专业标准》与I<strong>VS</strong>的比较 欧洲抵押贷款协会关于抵押贷款价值的文件 8 附录<br />

94<br />

98<br />

105<br />

107<br />

112<br />

116<br />

............................................................................................<br />

..............................................................................<br />

.......................................................................<br />

................................................................................................<br />

............................................................................................. 个体贸易相关物业的估价 GN 3 物业资产组合与物业群的估价 GN 4 个人财产 GN 1<br />

............................................................<br />

估价的确定性 GN 2<br />

用于财务报告的折旧重置成本估价方法 6 GN 厂房与设备 5 GN<br />

ix

引言<br />

引言<br />

1 本标准的目的<br />

本标准的目的<br />

1.1<br />

1.2<br />

此<strong>RICS</strong>标准旨在使估价服务的用户确信,由<strong>RICS</strong>合格估价师提供的估价服务是按照最高专业 标准进行的,是独立而且客观的,符合I<strong>VS</strong>C制定的国际公认标准。<br />

执行与交付过程提供了最佳实践的框架,但并不指导估价师针对具体案例如何估价。注册接受<strong>RICS</strong>监 本标准按照“<strong>RICS</strong>行为规则”,规定了估价师应当遵守的程序规则及指南,它为各种目的估价<br />

1.3 本标准的要求及定义如下: 管的个别估价师或公司有强制义务遵循本标准,若出现重大违约,将受到有效制裁。<br />

1.4 此版本是《<strong>RICS</strong>估价-专业标准》的2012版。原标准于1976年出版,通常被称为“红皮书”。<br />

• 估价师必须具有适当的从业资格,这种资格是通过明确的标准而评判认定的。<br />

• 估价师所用方法必须具有独立性、客观性。<br />

• 雇用条件必须清晰,包括需要提及哪些事项以及需要作出哪些披露。<br />

• 价值基准方面的清晰性,任何假设或重大对价均需考虑。<br />

• 估价报告内容方面的最低标准。<br />

• 如果第三方需要依赖估价结果,则应进行充分且适当的披露。<br />

2 国际估价标准(I<strong>VS</strong><br />

国际估价标准 I<strong>VS</strong>)<br />

国际估价标准 I<strong>VS</strong><br />

2.1 期审查,是国际公认的高水准估价原则及定义。<strong>RICS</strong>标准采用并(在适当情形)补充I<strong>VS</strong>标准,这在红 皮书一系列版本中均有体现。I<strong>VS</strong>标准成为<strong>RICS</strong>标准整体框架的一部分,由全面的监管方案对其提供支 国际估价标准委员会(I<strong>VS</strong>C)是<strong>RICS</strong>的赞助者之一。国际估价标准(I<strong>VS</strong>)由该委员会出版并定<br />

2.2 <strong>RICS</strong>标准首次整篇转载I<strong>VS</strong>标准。尽管某些<strong>RICS</strong>标准表述方式与I<strong>VS</strong>有所不同,但是两者原 持,确保有效落实与交付。<br />

则、目标及定义的术语均相同。<strong>RICS</strong>认为,按照红皮书展开的估价亦将符合I<strong>VS</strong>标准。<br />

1

2.3 I<strong>VS</strong><br />

产”这个词被视为适当情况下也包括“负债”(详见I<strong>VS</strong> 2011的一项重大更改是扩大了应用范围,除物业房地产外,还包括所有类型的资产;其中“资<br />

<strong>2.4</strong> 使用词语“物业房地产”而非“资产”。 2011“引言”部分)。本标准(<strong>RICS</strong>标准)大部分<br />

200 或210标准并遵守<strong>RICS</strong>标准的其它 提醒承接企业估价及无形资产估价任务的会员遵循I<strong>VS</strong> 是针对不动产(土地、房屋及其中权益)、个人财产以及厂房与设备的估价,因此,为清晰起见,优先<br />

一般要求。<strong>RICS</strong>预期将针对这些特殊类别的资产发布进一步指南。<br />

2

2.5<br />

3 出版<br />

内容,请参阅I<strong>VS</strong>C网站www.ivsc.org <strong>RICS</strong>标准合并了2012年1月1日起生效的I<strong>VS</strong>2001全篇。至于2012年1月之后修订或新增<br />

出版<br />

3.1 估价标准、指南、讨论稿、估价警报以及其它估价资料,并且包括本版本(第8版)生效日之后发布的<br />

•<br />

本标准主要资源来自<strong>RICS</strong>网站(www.rics.org/redbook)。该网站提供了国际标准、国家协会<br />

<strong>RICS</strong>估价-专业标准,第8版(2012年3月)<br />

3.2 本标准的所有版本均可直接向<strong>RICS</strong>索取,分为以下几册: 所有修订或新增出版材料。<br />

• <strong>RICS</strong>估价–专业标准及英国估价标准合订本,第8版(2012年3月)<br />

• <strong>RICS</strong>估价–专业标准及印度估价标准合订本,第2版(2012年3月)。<br />

3.3<br />

4 本标准的编排<br />

以下语言版本的<strong>RICS</strong>标准仅能从网站获取:中文、荷兰语、英语、法语、德语、意大利语、俄<br />

3.4 可用的国家协会估价标准包括:香港、爱尔兰、荷兰、法国以及英国标准。 语、葡萄牙语以及西班牙语版本。<br />

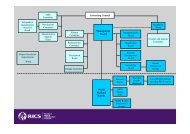

4.1 本标准编排结构如下:<br />

本标准的编排<br />

引言 术语表 估价标准 引言<br />

1 合规性与道德要求 <strong>VS</strong> 2 聘用条款 <strong>VS</strong><br />

3 价值基准 <strong>VS</strong> 4 应用 <strong>VS</strong><br />

5 勘测 <strong>VS</strong> 6 估价报告<br />

<strong>VS</strong><br />

3

4.2 估价标准使用<strong>VS</strong>参考号作为标记(例如<strong>VS</strong><br />

附录 指南 国际估价标准 国际估价标准2011 2011 附录<br />

述或称“规则”,并视情况在其后给出注解,以提供关于其解释与应用的更多信息。<br />

1.1)。每条标准在上述<strong>VS</strong>标记后紧跟一条简短陈<br />

4

4.3 每篇附录提供的是标准的解说当中引用的支持信息,有助于了解相关具体标准的背景。<br />

4.4<br />

4.5 标准当中如果使用了术语表定义的词语,则该词语以斜体显示。引用其它出版物的内容,则如下 指南部分针对指定实例给出建议,并包括“最佳实践”条目,即:<strong>RICS</strong>认为按照高标准达到专 业称职的操作程序。 显示:<br />

4. 会员应能够按客户所预期的熟练、谨慎和勤勉程度展开专业工作,并正确参照技术标准。<br />

<strong>RICS</strong>会员行为规则2010,第4条<br />

5 修订案及讨论稿<br />

修订案及讨论稿<br />

修订案及讨论稿<br />

5.1 修订与补充将在基于WEB的刊物发表,但是对于印刷版,修订与补充内容将仅在接下来的重印当中予<br />

5.3<br />

<strong>RICS</strong>对本标准内容定期进行审查,并根据需要,不时发布修订案及补充内容。根据需要,临时<br />

这些内容才能收入红皮书。评论意见经过<strong>RICS</strong>估价委员会的考虑以及最终批准之后,讨论稿案文将在发 征求意见稿旨在使会员能够对通过批准的案文进行评论,并且如有可能,指明其中的缺陷;之后<br />

5.2 如果某些修订将产生重大影响,例如需要改写一篇附录或指南,则此等修订将以讨论稿形式发表 。讨论稿将包含经过<strong>RICS</strong>估价标准委员会授权,由公众进行评论的内容(详见www.rics.org/redbook) 以收录,一般情况下,每年重印一次。<br />

。<br />

5.4 <strong>RICS</strong>估价委员会也很乐意收到关于收录其它材料的建议,或者对案文进行澄清的要求。 表之后第一次更新日开始具有强制效力。<br />

6 生效日<br />

生效日<br />

6.1 此版本的标准自2012年3月30日起生效,适用于当天或之后开展的估价工作。如果2012年1<br />

6.2 任何指定日期的现存的案文副本可从<strong>RICS</strong>图书馆获取。 月2日之后作出任何修订,将在每条估价标准、附录或指南末尾注明相关的生效日。<br />

5

术语表<br />

术语表<br />

规定的含义。如果某术语按照本部分的定义使用,则以斜体表示。如果本部分术语表包括I<strong>VS</strong>定义的术 语,则采用的是I<strong>VS</strong>的措词方法。 术语表部分定义了本标准使用的具有特殊或限定含义的术语。本部分未出现的术语,视为具有普通词典<br />

假设 国家协会估价标准当中可能使用了其它术语,这些术语按照国家协会特定估价标准的上下文定义。<br />

被认定为真实的一项推定。其中涉及的事实、条件或状况对一项估价的对象或途径<br />

师为证明某事的真实性而进行具体勘测的地方需要做出假设。 有影响,但根据约定,在估价过程中无需由估价师进行验证。通常,在不要求估价<br />

价值基准 关于一项估价的基本衡量假设的陈述。 价值基准<br />

成本计算法 用这种方法提供资产价值的指征,是指估价过程使用经济原则,资产的买方支付的 额度不超过获取(无论购买或建造)同等效用资产所需的成本。 成本计算法<br />

报告日期 估价师签署报告的日期。 报告日期<br />

估价日期 估价日期(date of date of date of date of valuation valuation) 参见估价时点(valuation date)。 估价日期<br />

背离 是指一些特殊情况下,完全按照估价标准进行估价是不恰当或不切实际的,或者客 户要求估价师按照非<strong>RICS</strong>估价标准进行估价。 背离<br />

折旧重置成本 (DRC DRC DRC) 使用新式等效资产重置某项资产的时价成本,扣除物理损坏以及各种形式的折旧与 优化。<br />

折旧重置成本<br />

6

外部估价师 与客户、代表客户行为的代理人、或任务的对象没有实质联系的估价师及其协作人 。 外部估价师<br />

公允价值 1. 知晓行情的、自愿的各方之间,资产或债务转让时对各方各自利益均有所体现的 估计价格。 公允价值<br />

在衡量当天,市场参与者之间完成资产出售应收到的价格,或完成债务转让应支 付的价格(参见IFRS 13)。 2.<br />

3.5及<strong>VS</strong> 4.1。) (关于这些定义的详细解释,见<strong>VS</strong><br />

财务报表 个人或法人实体财务状况的书面报告,是按照规定的内容和格式撰写的正式财务记 录。将它们公布的目的是为广大的不特定第三方用户提供信息。财务报表是在会计 财务报表<br />

标准和相关法律的监管框架之下发展而成的、考查是否对公众负责任的衡量标准。<br />

事务所 估价师为其工作,或者成员通过其进行交易的事务所或机构。 事务所<br />

商誉 来源于某个企业或在某个企业拥有的权益的远期经济利益;也可以是来源于不可分 商誉<br />

割的资产群的使用。<br />

指南 指南中提供有关适用于特定类型情况的良好估价执业惯例的详细内容和信息。这些 指南为特定的专业任务推荐了工作程序,其目的是将“最佳执业惯例”具体化。<strong>RICS</strong> 指南<br />

和IRRV认为,正常情况下会员应采纳这些程序,以体现必要的专业能力水准。<br />

7

收益还原法 这种估价方法是把未来现金流量转换成单一的资本现值,从而提供资产价值的一种 指征指证。 收益还原法<br />

勘查 对物业进行的实地访问,其目的是检查并获取相关信息,从而提供物业价值的专业 意见。 勘查<br />

无形资产 一种非货币性资产,它以其经济属性来证明其自身。它不具有实体物质形态,但能 向其所有者授予权利和经济收益。 无形资产<br />

内部估价师 是指该估价师受雇的企业是被估价资产的拥有者,或其受雇的会计事务所是为该企 业编制财务记录和/或报告的负责者。一般情况下,内部估价师能够符合所有的独立 性要求,以及<strong>VS</strong> 1.5至<strong>VS</strong> 1.8对专业客观性的要求,但是,由于向公众表述和法 内部估价师<br />

1.9中额外的独 立性要求。 规方面的原因,在某些类型的任务中内部估价师并不总是能满足<strong>VS</strong><br />

国际财务报告标 准(IFRS IFRS IFRS) 为了实现会计原则的一致性而由国际会计标准委员会设立的标准。该标准是在一个 概念性框架之内发展而成,从而使用一种普遍适用的方式来确定和处理财务报表的 国际财务报告标<br />

各个要素。IFRS标准就是以前所谓的国际会计标准(IAS)。<br />

投资物业 投资物业投资性 投资性 房地产 土地或一个建筑(或一个建筑的一部分)或两者都有的等物业房地产,业主持有该 物业是为了赚取租金或资本增值而持有,而非用于以下目的: 投资物业<br />

用于生产或供应货物或服务,或用于办公行政目的,或:<br />

以通常业务运作方式出售用于日常业务过程中的出售。<br />

8

投资价值 投资价值(或称 或称 或称: 所有值 所有值) 一项资产对其业主或准业主而言,用于个人投资或经营目标的价值。(有时也称作 “所有值”。) 投资价值<br />

市场比较法 指参照有明确价格信息的、与被估价对象相同或类似的资产,从而给出被估价资产 的价值的一种指征证的方法。 市场比较法<br />

市场租金 在进行了适当的营销(其中各方均以知晓行情、谨慎的方式参与,且无强制因素) 之后,自愿买家和自愿卖家以公平交易的方式,在估价时点对一项物业进行租用的 市场租金<br />

估算金额。<br />

市场价值 在进行了适当的营销(其中各方均以知晓行情、谨慎的方式参与,且无强制因素) 市场价值<br />

交换的估算金额。 之后,自愿买家和自愿卖家以公平交易的方式,在估价时点对一项资产或债务进行<br />

联姻价值 见协同价值。 联姻价值<br />

会员 英国皇家特许测量师协会(<strong>RICS</strong>)的研究员、专业会员、准会员或名誉会员,或收 益评级与估价协会(IRRV)的研究员、持证会员或名誉会员。 会员<br />

公开市场价值 红皮书最初四个版本支持的一条价值基准。现在不再作为定义术语。使用该基准, 公开市场价值<br />

与使用市场价值所得结果相同。<br />

9

(real estate) 土地以及无论地面上方或下方的所有物体,这些物体可能自然属于土地一部分(如<br />

不动产 树木、矿物质),或附着于土地(如建筑、现场改善),或属于建筑的永久附件(如 服务于建筑的机械和电气厂房)。 不动产<br />

固定财产 固定财产(即物 即物 业)房地产 房地产 (realproperty) 固定财产 与不动产的所有权相关的所有权利、利益及收益,包括正面的和负面的(即义务、 产权负担或债务)。<br />

<strong>RICS</strong> <strong>RICS</strong>注册的 注册的 注册的/注 册接受 册接受<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>监管 监管 的 (a) 遵照<strong>RICS</strong>章程在<strong>RICS</strong>注册接受监管的事务所。 (b) 遵照<strong>RICS</strong>的《估价师注册方案》注册为估价师的会员。 在<strong>RICS</strong><br />

特殊假设 特殊假设是指这个假设当中的事实与估价时点的实际情况不同,或者在估价时点的 一次交易当中市场参与者通常不会做出这样的假设。 特殊假设<br />

特殊购买者 特殊购买者是指某项特定资产对于该购买者具有特殊价值,因为如果该购买者拥有 该资产,将产生好处,而对于市场上的普通购买者,则不会产生这种好处。 特殊购买者<br />

特殊价值 反应一项资产或债务的特殊属性的一个数额,这种特殊属性仅对特殊购买者具有价 值。 特殊价值<br />

特殊物业 是指该物业由于特性、设计、构造、大小、位置或其他因素带来的独特性,而极少 或从不在市场上出售(除非作为企业或实体的一部分共同出售)。 特殊物业<br />

协同价值 协同价值(或联姻 或联姻 价值 价值) 由于两个或多个利益的结合而产生的一个附加价值要素,它使得结合之后的价值高 于原有各利益的价值之和。(有时也称作“联姻价值”)。<br />

10

聘用条款 适用于承办并报告一项估价的条款条件的书面确认,这些条件可能是由会员提议的, 或者会员与客户已经达成一致的。 聘用条款<br />

第三方 除客户之外,可能与估价或估价结果有利益关系的任何另外一方。 第三方<br />

与贸易有关的 与贸易有关的物 业房地产 房地产 专为某种特定类型的业务而设计的物业,该物业的价值反映的是该业务的贸易潜力 。 与贸易有关的<br />

经营存货 通常业务运作中持有的待售存货。例如,在物业方面,是指建筑商和开发公司持有 的土地和建筑物。 经营存货<br />

估价时点 估价意见适用的日期。 估价时点<br />

估价标准 会员提供书面估价时适用的、最高水准的专业标准的陈述。 估价标准<br />

所有值 见投资价值。<br />

所有值<br />

11

估价标准<br />

估价标准<br />

<strong>VS</strong> 1 合规性和道德要求<br />

<strong>VS</strong> <strong>VS</strong> 1.1 1.1 本标准的编排<br />

本标准的编排:适用范围和例外情形<br />

本标准的编排<br />

适用范围和例外情形<br />

<strong>RICS</strong> <strong>RICS</strong>和IRRV IRRV IRRV的全部 的全部 的全部会员 会员 会员,以及接受 以及接受 以及接受<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>监管的全部 监管的全部 监管的全部事务所 事务所 事务所,在承办任何事务时 在承办任何事务时 在承办任何事务时,若需进行书面估价 若需进行书面估价 若需进行书面估价, 则必须遵守 则必须遵守<strong>VS</strong> 1 <strong>VS</strong> 1 <strong>VS</strong> 1 <strong>VS</strong> 1的规定 的规定 的规定。 <strong>RICS</strong><br />

•<br />

<strong>RICS</strong><br />

下列情形下 下列情形下,不必强制应用 不必强制应用 不必强制应用<strong>VS</strong> 2 <strong>VS</strong> 2 <strong>VS</strong> 2 <strong>VS</strong> 2 至<strong>VS</strong> 6 <strong>VS</strong> 6 <strong>VS</strong> 6 <strong>VS</strong> 6(但是只要具有可行性 但是只要具有可行性 但是只要具有可行性,仍应从原则上遵循这些 仍应从原则上遵循这些 仍应从原则上遵循这些估价标准 估价标准 估价标准): ):<br />

• 估价意见是特意地明确地为谈判或可能的诉讼而准备的 估价意见是特意地明确地为谈判或可能的诉讼而准备的,或者是在这样的谈判或诉讼过程中提 或者是在这样的谈判或诉讼过程中提 供的 供的。 下列情形下<br />

估价师执行法定职能 估价师执行法定职能,或者估价师必须遵守指定的法定或法律程序 或者估价师必须遵守指定的法定或法律程序 或者估价师必须遵守指定的法定或法律程序。 估价师执行法定职能<br />

•<br />

•<br />

•<br />

该项估价专供内部用途。 与特定的代理工作或经纪工作相关而提供的估价 与特定的代理工作或经纪工作相关而提供的估价。 该项估价专供内部用途<br />

为了保险用途在估价报告中提供或另外单独提供一个重置成本数字。 每条估价标准之后带有注解 每条估价标准之后带有注解,如果注解要求估价师采取特定行动 如果注解要求估价师采取特定行动 如果注解要求估价师采取特定行动,则视为具有强制性 则视为具有强制性 则视为具有强制性。至于附录 附录 附录当中的 中的 材料 材料,如果与之关联的估价标准如 如果与之关联的估价标准如 如果与之关联的估价标准如此指出,则该 则该 则该材料 材料 材料具有强制性 具有强制性 具有强制性,否则仅建议 仅建议 仅建议采取而 采取而 采取而非强制 强制 强制。 为了保险用途在估价报告中提供或另外单独提供一个重置成本数字<br />

注解<br />

注解<br />

1.<br />

2. 本标准针对<strong>RICS</strong>行为规则和IRRV行为准则在估价业务当中的应用,提出强制要求和指导,以保 本标准吸收采纳了I<strong>VS</strong>标准,是经过<strong>RICS</strong>知识委员会和IRRV共同批准的、用于其成员估价工作 的实践与交付的一整套全面的技术标准。<br />

能够确信,估价工作是按照高水准的称职要求及正直要求承办的,并且完全符合公认的相关的国内(英 证估价师在资格、知识、技能及经验等方面达到并维持指定的水准。进行,估价结果的索要者或依赖者<br />

3. <strong>RICS</strong>或IRRV的任何成员参与承办任何估价业务时,必须强制应用这些标准;但是本部分第5 国)协会及国际估价标准。<br />

的任何人。这可能包括单位内部仅参与估价报告的制作而未参与其签署的个人,以及反之,仅签署估价 款特别指出的例外情形除外。“承办估价业务”包括计算和签署书面估价意见并对此负全面或部分责任<br />

4. 这些标准是按照应用于估价师的标准写成的。如果需要考虑某条标准如何应用于在<strong>RICS</strong>注册并 报告而未参与其制作的个人。<br />

接受监管的事务所,则尚待作出相应的诠释。<br />

12

例外情形<br />

例外情形<br />

5. <strong>VS</strong><br />

(a) 特意地明确地为谈判或可能的诉讼而提前准备的估价意见,或者在这样的谈判或诉讼过程中准备 的估价意见。 2至<strong>VS</strong> 6不必强制适用的情形如下:<br />

法院裁决,请估价师务必参考第(b)款的注解。 与这种例外情形相关的估价意见是指,该意见是按照当前或即将进行的谈判的可能结果而提供的;或者 按照请求,该意见提供的数字将用于与这种谈判相关的报价。如果与谈判相关的事项最终将由仲裁庭或 这种例外情形还包括向正在考虑采取与法定或法律程序有关的行动(例如:租金审查、向当地物业课税<br />

(b) 估价师执行法定职能,或者估价师必须遵守指定的法定或法律程序。<br />

额的自我评估),则该例外情形不适用。 价格提出质疑、发起收购权等)的客户提供估价意见。如果估价结果将用于法定申报表(例如:应纳税<br />

• 编制各种价值清单用于为地方或国家税收(例如:物业税)提供一个基准。 本项下的例外情形包括:<br />

• 须符合法定要求或假设,或者它可能受到规定程序的管辖。在优先符合此等要求的前提下,采用 本标准当中相关且可行的原则与定义会使证据更加可靠,并且能协助估价师经受得起质证。 编制的估价意见预期将作为专家鉴定人在法院、仲裁庭或委员会提供证据。此等估价行为可能必<br />

• 为了解决争议的目的,指定的仲裁员、独立专家以及调解人作出的判决与报告。<br />

(c)<br />

应用”范围内的目的,也不适用于“<strong>VS</strong> 1.3 <strong>RICS</strong>国家协会估价标准”范 围内的任何标准。 这条例外情形不适用于“<strong>VS</strong> 4<br />

该项估价专供内部用途。<br />

字)均不会对任何第三方可见,或向任何第三方传达。 采用本条例外情形时,估价师应注意保证所给意见是适度有保留意见,并且在聘用条款中应由双方明确 这条例外情形适用于提供的估价意见仅限于接收人单位内部使用,而估价报告的任何部分(包括估价数<br />

(d) 与特定的代理工作或经纪工作相关而提供的估价。 承认并同意估价意见的范围及用途是有限的并且不承担任何责任的。<br />

包括针对是否应当接受或做出某项特定报价而提出意见。这条例外情形包括属于《<strong>RICS</strong>指南-不动产和<br />

(e)<br />

书,则这条例外情形不适用。 这条例外情形适用于为代理机构预期或当下的指令提供的估价,用于处置或收购物业当中的一份权益; 经纪标准》(2011年7月起生效)范围内的估价工作。如果客户要求提供其中包含一项估价的收购报告<br />

为了保险用途在估价报告中提供或另外单独提供一个重置成本数字。<br />

13

14<br />

这条例外情形适用于提供的重置成本数字用于保险目的,无论这个数字是在估价报告当中提供还是独立<br />

于估价报告另外提供。如果该数字在估价报告当中提供(通常用于住宅按揭贷款目的),则聘用条款当<br />

中应包括对计算该数字时采用的基准的解释。这条例外情形不适用于为了保险目的为个人财产提供估价<br />

(详见GN 4 个人财产)。<br />

某些情况下,尽管估价目的符合上述例外情形之一,却可能仍然要求估价师遵守I<strong>VS</strong>标准。在这些情况<br />

下,应当确认尽管在<strong>VS</strong> 2至<strong>VS</strong> 6不强制适用的情形下,估价意见仍然符合I<strong>VS</strong>标准。<br />

6. 无论在特定情形下<strong>VS</strong> 2至<strong>VS</strong> 6是否适用,会员以及注册接受<strong>RICS</strong>监管的事务所始终受<strong>RICS</strong><br />

行为规则(2011修订版)和IRRV行为准则的约束,其中的关键要求摘录如下:<br />

适用于会员<br />

会员<br />

会员<br />

会员:<br />

道德<br />

道德<br />

道德<br />

道德行为<br />

行为<br />

行为<br />

行为<br />

3.<br />

3.<br />

3.<br />

3.会员应<br />

会员应<br />

会员应<br />

会员应始终诚信<br />

始终诚信<br />

始终诚信<br />

始终诚信行事<br />

行事<br />

行事<br />

行事,避免利<br />

避免利<br />

避免利<br />

避免利益冲突<br />

冲突<br />

冲突<br />

冲突,避免<br />

避免<br />

避免<br />

避免任何与专业<br />

任何与专业<br />

任何与专业<br />

任何与专业义务不一<br />

务不一<br />

务不一<br />

务不一致的行为与情<br />

的行为与情<br />

的行为与情<br />

的行为与情况。<br />

称职<br />

称职<br />

称职<br />

称职<br />

4.会员应能够按客户所预期的熟练、谨慎和勤勉程度展开专业工作,并正确参照技术标准。<br />

服务<br />

5.会员展开专业工作应当及时,并且按照客户的期望良好地顾及服务标准和顾客关怀。<br />

适用于事务所<br />

事务所<br />

事务所<br />

事务所:<br />

专业行为<br />

3.事务所应始终诚信行事,避免利益冲突,避免任何与专业义务不一致的行为与情况。<br />

称职<br />

称职<br />

称职<br />

称职<br />

4.事务所应能够按客户所预期的熟练、谨慎和勤勉程度展开专业工作,并正确参照技术标准。

5.事务所展开专业工作应当迅速,并且按照客户的期望良好地顾及服务标准以及顾客关怀。 服务<br />

IRRV IRRV行为准则 行为准则 IRRV<br />

2.<br />

行为准则摘录:<br />

会员行事应当勤奋、正直、诚实,以其行为方式宣传提升其所在机构及机构会员的良好专业<br />

7.<br />

8.<br />

声誉。<br />

会员应保证在知识、技能和称职等方面跟上时代步伐,以按照最高标准展开专业工作,并且 应遵守所在机构酌情加于他们的持续专业发展要求。 会员应遵守其所属专业团体的专业行为规则,如果会员的行为违反了IRRV准则,也违反了<br />

10. 会员应遵守IRRV不时制定的技术指南及实践陈述,无论此等指南或陈述(包括但不限于附 其所在其它团体的准则,该团体可以自行采取行为。<br />

件所列出的那些)可能是由IRRV发布或认可的,也可能是由其职能部门发布或认可的。<br />

1.由IRRV、皇家特许测量师协会、评级测量师协会联合发布,2004年4月1日起生效的《英国 附件<br />

2. 由英国收益评级与估价协会(IRRV)和皇家特许测量师协会(<strong>RICS</strong>)联合发布的《估价标准 评级顾问执业准则》及该执业准则的后续版本。<br />

-红皮书》。<br />

15<br />

2011年1月,©IRRV版权所有

<strong>VS</strong> <strong>VS</strong> 1.2 1.2 合规性 合规性、监管和披露<br />

合规性<br />

监管和披露<br />

监管和披露等方面的背离<br />

监管和披露 方面的背离<br />

注解<br />

注解<br />

事务所的合规性<br />

事务所的合规性<br />

<strong>RICS</strong> <strong>RICS</strong>和IRRV IRRV IRRV的全部会员承办估价业务时 的全部会员承办估价业务时 的全部会员承办估价业务时,无论以个 以个 以个人身份 人身份 人身份进行 进行 进行,或从事 或从事 或从事于某 于某 于某个事务所 事务所 事务所,也无论该事 该事 务所是 务所是否受<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>监管 监管 监管,均需遵守本标准 需遵守本标准 需遵守本标准。 <strong>RICS</strong><br />

<strong>RICS</strong> <strong>RICS</strong>会员估价师还必须遵守 会员估价师还必须遵守 会员估价师还必须遵守《<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>估价师注册方 估价师注册方 估价师注册方案》中的要求 中的要求 中的要求,其中<strong>VS</strong> 2 <strong>VS</strong> 2 <strong>VS</strong> 2 <strong>VS</strong> 2至<strong>VS</strong> 6 <strong>VS</strong> 6 <strong>VS</strong> 6 <strong>VS</strong> 6强制 强制 强制适用。 <strong>RICS</strong><br />

1. 遵守这些估价标准是全部<strong>RICS</strong>会员<br />

•<br />

•<br />

受<strong>RICS</strong><br />

不受<br />

员从业的事务所。该事务所 是否受<strong>RICS</strong>监管对估价师的影响如下: <strong>RICS</strong> <strong>RICS</strong>监管的 监管的 监管的事务所 事务所 事务所:该事务所 以及从事于该事务所 的<strong>RICS</strong>全部会员 必须保证所 的个人责任。此等责任如何落实,一定程度上取决于该会<br />

。 不受 不受<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>监管的 监管的 监管的事务所 事务所 事务所:虽然据了解,此等事务所 可能有自己的企业流程,而<strong>RICS</strong> 有的流程和估价工作完全符合本标准。这包括估价工作并非单一<strong>RICS</strong>会员责任的情形<br />

的个人会员 负责估价时,要求遵守本标准。<br />

无权控制,但是从事于此等事务所<br />

16

• 确信这种背离不会造成客户被误导或造成不道德行为;<br />

• 在估价报告中指出因受到阻止而不能遵守本标准的地方,并注明背离的原因;<br />

• 尽最大努力遵守本标准的其它各方面。<br />

的标准更严格,必须遵守本标准;但是,该事务所 的流程可能明确阻止遵守本 标准的某特定方面。这种情况下,估价师有权背离此条特定估价标准 ,但是该估价师必须: 如果本标准比该事务所<br />

仅为一项估价的协助者而非负责人时,该会员 亦应尽量使提供的协助符合本标准。 如果会员<br />

针对其它 针对其它估价标准<br />

针对其它 针对其它 估价标准 的合规性<br />

估价标准 的合规性<br />

2. (截止2012年1月)。<strong>RICS</strong>认为符合本标准的估价也将符合I<strong>VS</strong>标准,关于这一点,可以在估价报告 按要求,估价师可能需要提供符合I<strong>VS</strong>标准的报告。本<strong>RICS</strong>标准在原则及定义上均与I<strong>VS</strong>一致<br />

• 定义 中作出陈述(详见附录6(p))。I<strong>VS</strong>标准由以下几部分组成:<br />

• I<strong>VS</strong>框架<br />

• 一般标准<br />

• 资产标准<br />

• 估价应用<br />

本标准全文转载了2012年1月出版生效的I<strong>VS</strong>标准。转载内容是2011年7月1日发表的I<strong>VS</strong>标准原封<br />

3.<br />

不动的版本。因为<strong>RICS</strong>标准包含更多材料,某些部分的表述方式可能与I<strong>VS</strong>不同。但是,附录9提供了 本标准与I<strong>VS</strong>标准的详细比较,可以协助估价师回应与特定I<strong>VS</strong>标准合规性相关的问题。<br />

并入)的估价报告。任何情况下,估价师必须作出陈述,声明估价工作符合《<strong>RICS</strong>估价-专业标准》(详 <strong>RICS</strong>承认估价师可能需按要求提供符合其它标准而非《<strong>RICS</strong>估价-专业标准》(已将I<strong>VS</strong>标准<br />

背离<br />

背离 6.1款),同时也符合其它任何指定标准的一项或多项特定要求。 2.1款和<strong>VS</strong> 见<strong>VS</strong><br />

4. 如果估价师背离本标准,必须在聘用条款<br />

5. 如果在特殊情形下,认定不适宜应用某条特定估价标准<br />

以及估价报告中就此作出明确陈述。<br />

的整体或部分,必须在估价报告之前就 此背离作出确认并与客户达成一致。<br />

17

6. 原因不满意,或对此等背离 的申报或证明方式不满意,两个机构均有权采取纪律措施。<br />

作出背离的估价师可能需按要求向<strong>RICS</strong>或IRRV证明其原因。如果<strong>RICS</strong>或IRRV对转达的此等<br />

18

7. 不为本标准所认可,则构成背离 ,聘用条款 以及估价报告当中必须对此作 出明确陈述。估价报告还须指出所采用的基准与本标准认可的最接近的等效基准之间的差异。 如果采用的价值基准<br />

监管 监管:对是否符合<br />

监管 对是否符合<br />

对是否符合本标准<br />

对是否符合 本标准 本标准进行监控<br />

本标准 进行监控<br />

8. 会员承办估价业务,如果本标准的<strong>VS</strong><br />

9.<br />

对 IRRV 会员的适用性<br />

<strong>RICS</strong>作为一个自我监管的机构,有责任监控和设法确保其成员以及受其监管的事务所遵守本标<br />

6适用,则该会员必须按照指定的时标和流程加 入《<strong>RICS</strong>估价师注册方案》。关于该方案的细节详见www.rics.org的监管章节。 2至<strong>VS</strong><br />

见www.rics.org的监管章节。 准。按照其章程,<strong>RICS</strong>有权从会员或事务所索取信息。行使此等与估价相关的权力的程序详<br />

10. IRRV行为准则(见<br />

IRRV 会员的适用性<br />

由<strong>RICS</strong>和IRRV联合发表,因而对IRRV的估价师会员具有约束力。IRRV行为准则的执行事宜由该协会 www.irrv.net)要求其会员遵守该协会发表的或认可的技术指南。本标准是<br />

准则的行为,制裁手段包括暂停或取消会员资格。IRRV和<strong>RICS</strong>可以彼此要求对方处理在这两个机构具 有双重会员资格的估价师涉嫌违反本标准的行为;两个机构也可以为了保证合规性而共享信息。 的专业操守委员会负责,该委员会针对会员的期望值提供指导,并处理收到的投诉。对于经证明违反该<br />

<strong>VS</strong> <strong>VS</strong> 1.3 1.3 <strong>RICS</strong> <strong>RICS</strong> 国家协会 国家协会估价标准<br />

国家协会 估价标准 估价标准<br />

注解<br />

注解<br />

1. <strong>RICS</strong>国家协会估价标准<br />

2.<br />

<strong>VS</strong> 1.4 聘用条款<br />

准与客户协商一致。 如果估价涉及的资产位于两个或多个国家并且估价标准不同,则估价师必须就该指令适用哪种标<br />

<strong>RICS</strong> <strong>RICS</strong>国家协会 协会 协会发布 发布 发布或采用的 或采用的 或采用的估价标准 估价标准 在适用的国 用的国 用的国家具有强制 具有强制 具有强制效力 效力 效力。 <strong>RICS</strong><br />

,以便满足地方法定或监管要求。如果 两者存在冲突,则全车协会估价标准 优先,不得解释为所施加的标准比国际标准次要。 旨在扩展或修订国际估价标准<br />

<strong>VS</strong> 1.4<br />

注解<br />

注解<br />

聘用条款<br />

会员 会员在发布 发布 发布估价报告之 估价报告之 估价报告之前,始终 始终 始终要与 要与 要与客户 客户 客户确认承办该项估价的聘用条款 承办该项估价的聘用条款 承办该项估价的聘用条款。<br />

19

1. 一条基本而重要的原则是在估价项目得出结论之后,发布报告之前,估价师应使客户知悉所有相<br />

2所述。估价用途属于<strong>VS</strong> 1.1所述例外情形范围的除外。<strong>VS</strong> 2.1特 别规定了条款应包含内容的最低要求。如果估价用途属于<strong>VS</strong> 1.1所述例外情形范围,则可以使用简短的 聘用条款。 的标准如下文<strong>VS</strong><br />

协议进行<br />

2. 。 聘用条款 的任何修订 关事项,并适当记录在案。这样是为了保证估价报告不包含客户不知晓的针对最初聘用条款<br />

3. 记载或证明。 由于估价完成之后,时经多年仍可能产生争议,因此必须使用全面的文档对聘用条款<br />

<strong>VS</strong> <strong>VS</strong> 1.5 1.5 估价师资格<br />

注解<br />

注解<br />

1. 检查一个个体是否具有承担一项估价责任的恰当资格时,应结合下列内容:<br />

• 学术/专业资格,以表明具有技术能力;<br />

• 专业机构的会员资格,以表明对道德标准的承诺;<br />

本标准 本标准适用的任何一项估价 用的任何一项估价 用的任何一项估价,必须 必须 必须由具有 具有 具有恰当 恰当 恰当资格的估价师 的估价师 的估价师编制或监 制或监 制或监督,并由 并由 并由该估价师承 该估价师承 该估价师承担责 担责 担责任。 本标准<br />

• 作为估价师的实践经验;<br />

• 遵守该国管辖估价执业权利的法律法规;<br />

• 如果<br />

2. <strong>RICS</strong>的会员必须在培训与称职能力方面达到和维持指定标准。但是,由于会员活跃于范围广泛 估价师是<strong>RICS</strong>的会员,则应按照《估价师注册方案》进行注册。<br />

的专业领域和市场,因此即使具有<strong>RICS</strong>会员资格或已经注册为估价师,也并不意味着该个体在某特定<br />

3. 在某些国家,估价师按要求需获取证书或执照才能承办特定估价业务,这种情况下,应适用<strong>VS</strong> 领域或市场具有必要的执业经验。<br />

<strong>VS</strong> 1.6 知识与技能<br />

<strong>VS</strong> 1.6 1.2.2的规定。此时可以根据客户意愿或<strong>RICS</strong>国家协会的估价标准施加更严格的要求。<br />

注解<br />

注解<br />

估价师必须 估价师必须掌握 掌握 掌握关于特定市场的地方 特定市场的地方 特定市场的地方、国家和国际 和国际 和国际(视情 视情 视情况)的现有知识 知识 知识,并具备称职地承办估价业务 称职地承办估价业务 所需的 所需的必要 必要 必要技能与理解能 能与理解能 能与理解能力。<br />

20

1. 需要哪些协助,进而收集和解释来自其它专业人士(如专家估价师、环境测量师、会计和律师等)的相 如果估价师不具备妥善处理所接受委任的某些方面所需的必要专业知识水准,那么他或她应决定<br />

关信息。<br />

21

2.<br />

3. 如果估价师提议聘用另外的事务所 来完成该任务对象的部分估价工作,则必须获得客户的许可 个人知识与技能要求可以由从事于同一事务所的多名估价师集体满足,但是每一个这样的估价师<br />

6.10 合并其它估价)。 均须达到本条估价标准的全部其它要求。 (另见<strong>VS</strong><br />

4.<br />

<strong>VS</strong> 1.7 独立性与客观性<br />

1的全部要求。 则工作底稿上必须保留这些估价师的名单,并书面确认每个署名的估价师均已经遵守<strong>VS</strong> 估价任务由多名估价师一同承办或协助的,如果为了查验合规性或监管目的,需要提供审计线索,<br />

<strong>VS</strong> 1.7<br />

注解<br />

注解<br />

1. 按照<strong>RICS</strong>行为规则的规定,会员<br />

独立性与客观性<br />

承办估价项目的估价师必须独 承办估价项目的估价师必须独立、诚信 诚信 诚信、客观 客观 客观地行事 地行事 地行事。 承办估价项目的估价师必须独<br />

始终应诚信行事,避免与其专业义务不符的行为或情况发生<br />

符<br />

2. 估价师按要求应在执行估价指令时始终保持独立与客观,顾及潜在的利益冲突的可能影响。 。IRRV行为准则也规定了类似的义务。<br />

3. 附录1提供了关于保密性的指南以及如何识别针对独立性与客观性存在的威胁、如何识别和设<br />

价指令是否值得接受。应当顾及将来由于两方客户各自利益分歧可能造成的利益冲突。如果估价师得出<br />

1.8)的估价师,意味着该估价师能够确认他或她可以被认定是在 合本条规定(适当情况下还应符合<strong>VS</strong><br />

4.<br />

按照独立估价师行事。<br />

2.1和<strong>VS</strong> 6.1)。 对过去或当前的牵连事宜作出披露时,估价师必须同时顾及维持客户保密性方面的要求。通常, 须在聘用条款当中指出该条披露(见<strong>VS</strong> 法处理与估价项目明确相关的利益冲突。如果会员披露一条潜在的冲突之后,估价指令仍被确认,则必<br />

5. 不必揭露机密信息即可作出有效披露。如若不然,必须谢绝承办该项估价指令。<br />

6.<br />

在拟进行的交易中,估价师可能按要求代表双方当事人行事。这种情况下应当慎重考虑这样的估<br />

为了提供针对合规性或监管目的的审计线索,必须在工作底稿中完整保留关于利益冲突的检查以 方当事人的同意书,并且在估价报告中应指出该同意书。 结论,认为同时代表双方当事人行事并非不适宜或不明智之举,则该估价师在接受委任之前应当获取双<br />

7 如果在估价项目完成之前,就其结果与客户或者其它利益相关方进行讨论,则可能对估价师的客 及这些冲突的解决方案。<br />

观性造成威胁。如果此等讨论并非不适宜,并且确实对估价师与客户均有裨益,则估价师必须提高警惕, 注意此等讨论可能对他或她履行根本职责以便提供客观估价意见造成潜在影响。如果与客户进行了此等<br />

22

估价结果,则必须仔细注明理由。(另见<strong>VS</strong> 6.11。)<br />

谈话,估价师必须对任何此等会议或讨论做好书面记录;如果此等谈话造成估价师决定改变先前的临时<br />

23

24<br />

<strong>VS</strong> 1.8<br />

<strong>VS</strong> 1.8<br />

<strong>VS</strong> 1.8<br />

<strong>VS</strong> 1.8 独立性的额外判断准则<br />

独立性的额外判断准则<br />

独立性的额外判断准则<br />

独立性的额外判断准则<br />

如果一项估价的意<br />

如果一项估价的意<br />

如果一项估价的意<br />

如果一项估价的意图决<br />

图决<br />

图决<br />

图决定了需要<br />

定了需要<br />

定了需要<br />

定了需要对独立性设<br />

性设<br />

性设<br />

性设立具体判断准则<br />

准则<br />

准则<br />

准则,那么<br />

那么<br />

那么<br />

那么估价师必须制定<br />

估价师必须制定<br />

估价师必须制定<br />

估价师必须制定此等<br />

此等<br />

此等<br />

此等判断准则<br />

准则<br />

准则<br />

准则,并且<br />

并且<br />

并且<br />

并且<br />

在聘用条款<br />

聘用条款<br />

聘用条款<br />

聘用条款以及估价报告中确<br />

以及估价报告中确<br />

以及估价报告中确<br />

以及估价报告中确认该等估价师<br />

估价师<br />

估价师<br />

估价师满足此等<br />

满足此等<br />

满足此等<br />

满足此等独立性准则<br />

性准则<br />

性准则<br />

性准则。<br />

注解<br />

注解<br />

注解<br />

注解<br />

1. 对于某些估价意图,可能会存在法规、规章、监管机构的规则或客户的特殊要求等,规定了估价<br />

师必须满足具体判断准则才能达到指定的独立状态。通常此等额外判断准则会对可接受的独立性水准作<br />

出定义,其中可能使用“独立专家”、“专家估价师”、“独立估价师”、“有名望独立估价师”或“适<br />

宜的估价师”等术语。很重要的一点是,估价师在确认承接估价指令时,以及在估价报告中,均应确认<br />

他或她合乎此等判断准则。这样,客户以及任何依赖该估价报告的第三方能够确信估价师满足额外的判<br />

断准则。<br />

2. 尽管估价师可能满足了针对特定的委任设定的判断准则,但是<strong>VS</strong> 1.6以及<strong>VS</strong> 1.7当中的一般要<br />

求仍然适用。估价师仍然必须识别对其独立性及客观性可能存在的威胁,并采取适宜行动,然后才能承<br />

接估价指令。<br />

<strong>VS</strong> 1.9<br />

<strong>VS</strong> 1.9<br />

<strong>VS</strong> 1.9<br />

<strong>VS</strong> 1.9 对涉及公众利益的或者第三方可能依赖的估价进行额外披露<br />

对涉及公众利益的或者第三方可能依赖的估价进行额外披露<br />

对涉及公众利益的或者第三方可能依赖的估价进行额外披露<br />

对涉及公众利益的或者第三方可能依赖的估价进行额外披露<br />

如果提供的估价<br />

如果提供的估价<br />

如果提供的估价<br />

如果提供的估价将包含于涉<br />

将包含于涉<br />

将包含于涉<br />

将包含于涉及公<br />

及公<br />

及公<br />

及公众利<br />

众利<br />

众利<br />

众利益的或者第三方可能需要<br />

益的或者第三方可能需要<br />

益的或者第三方可能需要<br />

益的或者第三方可能需要依赖<br />

依赖<br />

依赖<br />

依赖的文件<br />

文件<br />

文件<br />

文件中公开<br />

中公开<br />

中公开<br />

中公开发表,则估价师应<br />

则估价师应<br />

则估价师应<br />

则估价师应当做<br />

当做<br />

当做<br />

当做<br />

出以下<br />

以下<br />

以下<br />

以下披露<br />

披露<br />

披露<br />

披露:<br />

1 如果估价的<br />

如果估价的<br />

如果估价的<br />

如果估价的对象<br />

对象<br />

对象<br />

对象是该估价师或<br />

是该估价师或<br />

是该估价师或<br />

是该估价师或其事务所<br />

事务所<br />

事务所<br />

事务所以前进行过估价的物业<br />

进行过估价的物业<br />

进行过估价的物业<br />

进行过估价的物业,并且<br />

并且<br />

并且<br />

并且估价意<br />

估价意<br />

估价意<br />

估价意图相同<br />

相同<br />

相同<br />

相同,则:<br />

• 在聘用条款中<br />

在聘用条款中<br />

在聘用条款中<br />

在聘用条款中,应当阐明该事务所<br />

事务所<br />

事务所<br />

事务所关于估价师<br />

估价师<br />

估价师<br />

估价师对该项估价<br />

该项估价<br />

该项估价<br />

该项估价轮换负责<br />

轮换负责<br />

轮换负责<br />

轮换负责的政策<br />

政策<br />

政策<br />

政策;<br />

• 在估价报告以及引用估价报告的公开<br />

在估价报告以及引用估价报告的公开<br />

在估价报告以及引用估价报告的公开<br />

在估价报告以及引用估价报告的公开发表材料<br />

材料<br />

材料<br />

材料中,应当阐明该估价师为了报告<br />

该估价师为了报告<br />

该估价师为了报告<br />

该估价师为了报告当中所<br />

中所<br />

中所<br />

中所述目的<br />

目的<br />

目的<br />

目的,<br />

作为<br />

作为<br />

作为<br />

作为向客户<br />

向客户<br />

向客户<br />

向客户提供的估价的<br />

提供的估价的<br />

提供的估价的<br />

提供的估价的签署<br />

签署<br />

签署<br />

签署者已经多长<br />

多长<br />

多长<br />

多长时间,以及该估价师所在的<br />

以及该估价师所在的<br />

以及该估价师所在的<br />

以及该估价师所在的事务所<br />

事务所<br />

事务所<br />

事务所为该<br />

为该<br />

为该<br />

为该客户<br />

客户<br />

客户<br />

客户执行<br />

执行<br />

执行<br />

执行估价<br />

估价<br />

估价<br />

估价<br />

指令已经多长<br />

多长<br />

多长<br />

多长时间;<br />

2 该估价师所在<br />

该估价师所在<br />

该估价师所在<br />

该估价师所在事务所<br />

事务所<br />

事务所<br />

事务所与该<br />

与该<br />

与该<br />

与该客户<br />

客户<br />

客户<br />

客户业务关<br />

业务关<br />

业务关<br />

业务关系的范围<br />

范围<br />

范围<br />

范围与持续<br />

持续<br />

持续<br />

持续时间(这里所说的业务关<br />

的业务关<br />

的业务关<br />

的业务关系不限<br />

于本次估价意<br />

估价意<br />

估价意<br />

估价意图);<br />

3 如果该估价报告以及引用该报告的任何公开<br />

如果该估价报告以及引用该报告的任何公开<br />

如果该估价报告以及引用该报告的任何公开<br />

如果该估价报告以及引用该报告的任何公开发表材料包含客户<br />

材料包含客户<br />

材料包含客户<br />

材料包含客户在估价时点<br />

估价时点<br />

估价时点<br />

估价时点之前的12<br />

12<br />

12<br />

12个月内收购<br />

个月内收购<br />

个月内收购<br />

个月内收购<br />

的一项或<br />

的一项或<br />

的一项或<br />

的一项或多项物业<br />

项物业<br />

项物业<br />

项物业,并且<br />

并且<br />

并且<br />

并且估价师或<br />

估价师或<br />

估价师或<br />

估价师或其事务所<br />

事务所<br />

事务所<br />

事务所具有与<br />

具有与<br />

具有与<br />

具有与此等<br />

此等<br />

此等<br />

此等物业有关的下列行为<br />

物业有关的下列行为<br />

物业有关的下列行为<br />

物业有关的下列行为:<br />

• 接受了一<br />

接受了一<br />

接受了一<br />

接受了一笔介绍费<br />

笔介绍费<br />

笔介绍费<br />

笔介绍费,或<br />

• 在此等<br />

此等<br />

此等<br />

此等收购<br />

收购<br />

收购<br />

收购当中代表<br />

中代表<br />

中代表<br />

中代表客户<br />

客户<br />

客户<br />

客户进行了谈判<br />

进行了谈判<br />

进行了谈判<br />

进行了谈判;则:<br />

4 在估价报告以及任何引用该报告的公开<br />

在估价报告以及任何引用该报告的公开<br />

在估价报告以及任何引用该报告的公开<br />

在估价报告以及任何引用该报告的公开发表材料<br />

材料<br />

材料<br />

材料中,应当陈述<br />

当陈述<br />

当陈述<br />

当陈述该客户在上<br />

在上<br />

在上<br />

在上述一年<br />

一年<br />

一年<br />

一年当中<br />

支付<br />

支付<br />

支付<br />

支付的总费<br />

总费<br />

总费<br />

总费用,在该估价师所在<br />

在该估价师所在<br />

在该估价师所在<br />

在该估价师所在事务所<br />

事务所<br />

事务所<br />

事务所 的上<br />

的上<br />

的上<br />

的上述年度收费收入总额当<br />

入总额当<br />

入总额当<br />

入总额当中所<br />

中所<br />

中所<br />

中所占比例是极小<br />

极小<br />

极小<br />

极小的、显<br />

著的抑或重<br />

或重<br />

或重<br />

或重大的。

注解<br />

注解<br />

1. 适用的估价项目是指除委任或接收该估价报告的客户外,尚有第三方需要依赖该 估价结果。例如,用于以下意图的估价项目属于此种类型: 此条估价标准<br />

2. 尽管<strong>VS</strong><br />

公开发表的财务报表; (b) 证券交易所或类似机构; (a)<br />

出版物、招股说明书或通告; (d) 投资方案;或 (c)<br />

公司收购或合并。 (e)<br />

3.<br />

轮换政策<br />

此条估价标准的基本原则可以进行扩展以涵盖适用于某个具体国家的要求,此等修订将被纳入公<br />

轮换政策<br />

披露其与客户之间的工作关系。在作出上述额外披露的过程中,据预期估价师不可能面面俱到地确立并 评估每一系列情形,但是,应当从原则上反映出其节操与本意。如果存在疑问,则建议作出披露。 1.7从更广泛的意义上明确要求估价师必须独立、诚信、客观行事,但并未要求估价师<br />

1.3)当中。 开发表所在地的相关国家协会估价标准(见<strong>VS</strong><br />

4. 仅当估价师在一段时间内提供了一系列估价时,才会产生披露事务所<br />

5.<br />

轮换政策的义务。如果该<br />

1.5的规定对估价项目负责的估价师承担该项责任达数年之久,这种对客户或对被 估价是第一次或仅一次估价指令,对轮换政策进行评论显然是不恰当的。 如果按照<strong>VS</strong><br />

6.<br />

估价资产的熟悉程度很容易使人认为它对估价师独立性与客观性构成了妥协。运用轮换政策安排其它估<br />

如何安排估价项目负责人的轮换,应当由该事务所 决定,视情况也可先与客户商讨。但 价师对该估价项目负责可以尽量减少这种情况发生。 事务所<br />

7. 如果一个事务所<br />

的估价师是否轮换负责,签署估价报告的负责人担负这种责任的持续时间 应控制在数年之内。具体的期限长度将取决于:估价次数是否频繁;用于促进估价流程的准确性和客观 性的控制及审查程序(例如“估价专门小组”)是否到位;良好的执业实践等。<strong>RICS</strong>认为,估价师轮 是,<strong>RICS</strong>建议,无论事务所<br />

换负责的间隔最好不超过七年。<br />

规模太小而无法轮换签署人,或者已经拥有如第6款所述的“估价专门小组”, 则可以在遵守本条标准的原则的前提下,做出其它安排。例如,在定期收到同样的估价指令情况下,可 以安排另一名估价师周期性地审查该估价项目,间隔不超过第6款的规定,这样有助于表明负责的估价 师采取了步骤来保证客观性的维持,从而保持估价依赖方的信任。<br />

25

负责签署的时长<br />

负责签署的时长<br />

8.<br />

9. 持续为同一客户针对同一物业展开估价的持续 时间,以及事务所 与客户业务关系的范围与持续时间。 此条要求的目的,是使依赖估价结果的第三方知悉估价师持续作为一系列相同意图的估价项目的<br />

其负责该估价项目的持续时间。该估价师可能 签署人的持续时间。同时,亦要求披露估价师所在事务所<br />

如上文所述的轮换政策,曾有一段时间该估价师不 是先前的同一意图的估价报告的签署人,由于事务所 对于估价师来说,该项披露应指出截止报告日期<br />

10. 不要求估价师提供其事务所 为该客户承办的所有工作的全面信息。简单明了地陈述并披露事务 承担这种签署责任。披露当中不要求指出先前的这段时间。<br />

为该客户完成的其它工作的本质以及这种业务关系的持续时间,即完全可以满足本要求。如果除了当 所<br />

以往牵连<br />

以往牵连 与客户没有其它业务关系,应作出相应陈述以指明这一点。 前的估价指令,事务所<br />

11. 本条要求旨在揭示在估价师或估价师的事务所<br />

12. 国家协会估价标准 或地方法规可以通过施加额外要求对本要求进行延伸。 物业事宜当中有牵连的情况下,可能造成的潜在利益冲突。 在估价时点的前一年内曾经在同一客户购买同一<br />

费用比例 费用比例<br />

费用比例<br />

13.<br />

客户及事务所的识别<br />

小于5%的费用比例可以认定为“极小的”。5%至25%之间的比例视为“显著的”,超过25%则<br />

14. 国家协会估价标准 或地方法规可以通过施加额外标准对本要求进行延伸。 视为“重大的”。<br />

客户及事务所的识别<br />

15. 考虑本条估价标准<br />

16. 各种不同的业务关系类型往往会造成有必要对客户和事务所<br />

17. 一个集团内部的密切相关的各公司应当恰当地认定为单一客户或事务所。但是,由于当今业务本<br />

进行识别。一般认为,要与聘用条 款 最低要求(见<strong>VS</strong> 2.1(a))以及报告最低要求(见<strong>VS</strong> 6.1(a))相一致,则“客户”是指赞同聘 要求作出的披露时,有必要识别“客户”及“事务所”各指什么。<br />

和接收估价报告的实体,而“事务所”是指在聘用条款的确认书及估价报告中认定的实体。 用条款<br />

质的复杂性,经常出现其它实体与客户之间仅具有疏远的法律或商业联系,而估价师的事务所也在同时 为这些实体提供服务。其它的实际操作困难还包括对此等业务关系的识别与量化,例如,估价师的事务 所 和客户在其它国家的联营机构之间的业务关系。有些时候,估价师与某当事方的商业关系比客户方面<br />

26

存在的潜在业务关系,只需从原则上坚持本条标准的意图即可。<br />

更容易造成对独立性的潜在威胁。据预计,估价师应当做出合理的查询,但是不必面面俱到地确立可能<br />

27

18.<br />

• 发出估价指令的控股公司的附属公司; 如下: 披露方面的要求将涉及并包括第三方(除给出估价指令的实体之外的其它方)在内的情形,举例<br />

• 估价指令由某一附属公司发出的情况下,与同一控股公司有联系的其它公司;或<br />

• 作为各种法律实体的代理发出估价指令的第三方,例如某不动产基金的经理。<br />

19. 的范围时,应考虑类似的因素;可能存在分开的法律实体, 位于不同的地区或承接不同类型的工作。把与承接估价项目的事务所 有联系的所有组织均考虑在内可能 为披露目的,识别估价师的事务所<br />

业估价意见。然而,如果客户方面存在紧密联系的、从事相同风格交易的一系列实体,则应披露客户与 所有此等实体的业务关系范围。<br />

显得不太切题,因为这些组织的作业活动可能是疏远的或非商业性质的——例如,它们从不参与提供物<br />

28

<strong>VS</strong> <strong>VS</strong> 22<br />

2 2 聘用条款协议<br />

聘用条款协议<br />

聘用条款协议<br />

<strong>VS</strong> <strong>VS</strong> 2.1 2.1 聘用条款确认书<br />

按照 按照<strong>VS</strong> 1.4 <strong>VS</strong> 1.4 <strong>VS</strong> 1.4 <strong>VS</strong> 1.4的规定提供的聘用条款 的规定提供的聘用条款 的规定提供的聘用条款,必须以书面形 必须以书面形 必须以书面形式提供 提供 提供,且至少应包括 包括 包括下列条款 下列条款 下列条款: (a) 对客户 对客户和其它预 其它预 其它预期用 期用 期用户进行 进行 进行识别认 识别认 识别认定; 按照<br />

本次估价的意 估价的意 估价的意图; (c) 本次估价的 估价的 估价的对象 对象 对象; (d) 有待估价的 估价的 估价的权益; (b)<br />

资产或 资产或负债 负债 负债的类型 类型 类型,以及 以及 以及客户 客户 客户如何 如何 如何使用它或如何 或如何 或如何对其分级 对其分级 对其分级; (e)<br />

价值基准 价值基准; (g) 估价时点 估价时点; (h) 对重大牵连 大牵连 大牵连进行 进行 进行披露 披露 披露,或指 或指 或指出不存在 不存在 不存在此类 此类 此类重大牵连 大牵连 大牵连; (f)<br />

负责 负责本次估价的估价师的 估价的估价师的 估价的估价师的识别认 识别认 识别认定,并且 并且 并且如有要求 如有要求 如有要求,指出该估价师的 该估价师的 该估价师的状态 状态 状态; (j) 视情 视情况确定是 确定是 确定是否需要指 需要指 需要指出采用的 采用的 采用的币种 币种 币种; (i)<br />

任何 任何假设 假设 假设、特殊假设 特殊假设 特殊假设、保留意见 意见 意见、特殊指 特殊指 特殊指令或背离 背离 背离; (k)<br />

估价师勘 估价师勘测的范围 范围 范围; (m) 估价师所 估价师所依赖 依赖 依赖的信息 信息 信息的性 的性 的性质及来源 来源 来源; (n) 同意或 同意或限制公开 制公开 制公开发表; (l)<br />

限制或 制或 制或豁免 豁免 豁免估价师 估价师 估价师对其它 对其它 对其它方(除客户 除客户 除客户外)的责任; (p) 确认将按照 认将按照 认将按照<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>标准承办该估价项目 标准承办该估价项目 标准承办该估价项目,并且 并且 并且视情 视情 视情况指出也将符合 出也将符合 出也将符合I<strong>VS</strong> I<strong>VS</strong> I<strong>VS</strong>标准 标准 标准; (q) 确认估价师具备必要的 估价师具备必要的 估价师具备必要的知识 知识 知识、技能和理解能 能和理解能 能和理解能力,能够称职地承办该估价项目 称职地承办该估价项目 称职地承办该估价项目; (o)<br />

计算 计算费用时 用时 用时将依据哪 将依据哪 将依据哪些基准 些基准 些基准; (r)<br />

如果该 如果该事务所 事务所 属于 属于注册接受 注册接受 注册接受<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>监管的事务所 监管的事务所 ,则应提及该 则应提及该 则应提及该事务所 事务所 处理投诉 理投诉 的流程,如有要求 如有要求 如有要求,提供一 提供一 提供一份副 份副 份副本; (t) 指出在合乎 合乎 合乎本标准方面 本标准方面 本标准方面,可以接受 可以接受 可以接受<strong>RICS</strong> <strong>RICS</strong> <strong>RICS</strong>行为和纪律规定的监 行为和纪律规定的监 行为和纪律规定的监控。 (s)<br />

述最低 述最低要求列表的第 要求列表的第 要求列表的第(a)至(q)项连同<strong>VS</strong> 2.2 <strong>VS</strong> 2.2 <strong>VS</strong> 2.2 <strong>VS</strong> 2.2至<strong>VS</strong> 2.6 <strong>VS</strong> 2.6 <strong>VS</strong> 2.6 <strong>VS</strong> 2.6包含 包含 包含了I<strong>VS</strong> 101 I<strong>VS</strong> 101 I<strong>VS</strong> 101 I<strong>VS</strong> 101“工作 工作 工作范围 范围 范围”的 所有要求 所有要求。对于两 对于两 对于两个列表之 个列表之 个列表之间的详细 详细 详细比较 比较 比较,请参阅附录 附录 附录9。第(r)至(t)项是 项是 项是适用于<strong>RICS</strong> <strong>RICS</strong> 会员的 会员的额外要求 外要求 外要求。<br />

上述最低<br />

29

注解<br />

注解<br />

1. 最低要求列表的进一步指南请参阅附录2.<br />

2. 由客户与估价师在首次收到并承接估价指令时(估价指令的初始确认书)进行 协商确定。然而,鉴于一次估价委任可能涉及单一物业,也可能涉及庞大资产组合,因此在初始确认时, 通常,聘用条款<br />

3. 一条基本而重要的原则是在估价项目得出结论之后,发布报告之前,估价师应使客户知悉所有相 聘用条款 的最低要求能够全部得到确认的程度也可能各不相同。<br />

。 关事项,并适当记录在案。这样是为了保证估价报告不包含客户不知晓的针对最初聘用条款 的任何修订<br />

,其中可能包括本标准要求的最 的标准表格或一直使用的聘用条款 可能备有聘用条款<br />

4. 低条件。估价师可能需要对这种表格进行修订,以便指出日后才能澄清的事项。 事务所<br />

5. 或特殊假 设 最为适宜,并把这些内容记录到聘用条款 中。最初聘用条款 确定之后,如果识别并认定了其它假设 估价师可能需要根据具体情形和估价的具体意图,讨论和商定怎样的勘测范围、假设<br />

6. 致,并且应将这些内容记录到修订后的聘用条款 当中。 由于估价项目完成之后,时经多年仍可能产生争议,因此必须使用全面的文档对聘用条款 协议 或额外事项,需要在估价报告当中指出的,则估价师必须在发布估价报告之前与客户协商一 、特殊假设<br />

7. 附录3提供了关于适用于大多数估价项目的假设 的指南。 进行记载或证明。<br />

<strong>VS</strong> <strong>VS</strong> 2.2 2.2 特殊假设<br />

注解 注解<br />

注解<br />

1. 商定特殊假设<br />

如果需要 如果需要建立 建立 建立必要的 必要的 必要的特殊假设 特殊假设 特殊假设才能按客户 按客户 按客户要求 要求 要求向其 向其 向其提供 提供 提供适当 适当 适当的估价 的估价 的估价服务,则必须在 则必须在 则必须在发表估价报告之 表估价报告之 表估价报告之前与 客户 客户商定这些 商定这些 商定这些特殊假设 特殊假设 特殊假设并予 并予 并予以书面确 以书面确 以书面确认。只有在参 只有在参 只有在参照估价项目的具 估价项目的具 估价项目的具体情形 情形 情形,合理地 理地 理地认定此等 此等 此等特殊假设 特殊假设 特殊假设为 实际、切题 切题 切题和有 和有 和有效的前提下 提下 提下,才能做出 做出 做出这样的 这样的 这样的特殊假设 特殊假设 特殊假设。 如果需要<br />

的确切本质,估价师必须确保 在发布估价报告之前与客户书面确认这些内容。 之后,为了确认估价师和客户均理解这些特殊假设<br />

2. 估价师可以在估价报告中就这些特殊假设<br />

3. 如果客户要求估价项目建立在某个特殊假设<br />

得到满足的可能性进行评论或评估。例如,对于“开 发土地的许可已经授予”这个特殊假设 ,可能需要在各种可能施加的条件对价值的影响上有所体现。 基准之上,而估价师认为该特殊假设是不切实际的, 则应拒绝承接此估价指令。<br />

30

4. 附录4提供了关于特殊假设<br />

的使用方法的指南。<br />

31

<strong>VS</strong> <strong>VS</strong> 2.3 2.3 营销约束与强制出售<br />

注解<br />

注解<br />

1.<br />

2.<br />

如果一项物业不能够自由地或充分地推向市场,则很可能对其价格有不利影响。在接受此等估价<br />

等约束条件应当在聘用条款 中予以指出,并明确说明估价工作将在此等基准上展开。也可以在“此种约 如果固有约束条件得到识别认定,且在估价时点<br />

如果估价师或 如果估价师或客户识别认 客户识别认 客户识别认定一项估价需要 定一项估价需要 定一项估价需要对实 对实 对实际的或 际的或 际的或预期的营 期的营 期的营销约束 销约束 销约束有所 有所 有所体现 体现 体现,则应 则应 则应当商定该 商定该 商定该约束 约束 约束条件 的细节 细节 细节,并在聘用条款 聘用条款 中予以阐明。不得使 得使 得使用“迫卖 迫卖 迫卖价格”这个术语 这个术语 这个术语。 如果估价师或<br />

的固有属性导致的,还是客户方面的特殊情况导致的。 实际存在,通常即可评估其对价值的影响。此 指令、对约束条件的可能影响提出估价意见之前,估价师应当弄清此等约束是被估价的物业或其中权益<br />

3. 的基准上,提供备择估价方案,以表明其影响。 需要加倍小心的是,虽然在估价时点 不存在某条固有约束,但是该约束可能是特定事件或事件 序列的可预见后果。作为选择,客户也可以要求在指定的营销限制基准之上做出估价。这种情况下,可 不存在”这个特殊假设 束在估价时点<br />

4. 强制出售出现的前提是特定卖家被迫在规定的时间内出售,例如,因为需要集资,或需要在指定<br />

的。因此,尽管估价师可以对强制出售情形下资产变现的可能性提出估价意见,但是该术语只是对出售 售情形下能够达到的价格与市场价值之间即使存在任何联系,也属于巧合;这种估价是不可能提前确定<br />

已经出现”这样的特殊假设 进行估价。此等约束或限制条件的确切本 质必须在聘用条款 中予以指出。另一种适宜的做法是,在不作出特殊假设 的基准上提供估价,以便表 明如果约束条件出现,会造成什么影响。 以提出“该约束条件在估价时点<br />

限制并非仅仅是卖家的偏好。为了确定在可用的时间长度内可以达到什么价格,需要以同等的重要性考 虑这些外部因素的实质和未能完成销售的后果。尽管估价师可以协助卖家确定在强制出售情形下应当接 受何种价格,但是,这种估价将仅仅是一个商业判断,体现的是资产对特定卖家而言的所有值 。强制出 日期之前偿清负债。将一次出售称作“强制的”是指卖家受制于外部法律或商业因素的作用,这种时间<br />

5. 如果一条特殊假设 仅仅指明了处置资产的时间限制,却没有描述这种限制的理由,则它不是一 条合理的假设 。如果不能够明确约束条件的理由,则估价师不能够确定该条件对适销性、销售谈判及可 。 行为发生的情景的描述,而不可用作价值基准<br />

<strong>VS</strong> <strong>2.4</strong> 限制性信息<br />

和强制出售情形的更多指南,请参阅 附录4。 实现价格的影响,也不能够给出有意义的估价意见。关于特殊假设<br />

如果估价师 如果估价师按要求需在 要求需在 要求需在限制性 制性 制性信息 信息 信息的基准之上承办估价项目 的基准之上承办估价项目 的基准之上承办估价项目,则必须在 则必须在 则必须在发布 发布 发布估价报告之 估价报告之 估价报告之前与客户 客户 客户商定这 商定这 种限 种限制的本 制的本 制的本质,并就其对 并就其对 并就其对估价 估价 估价结果的可能 果的可能 果的可能影响 影响 影响进行书面确 进行书面确 进行书面确认。<br />

如果估价师<br />

32

1. 注解<br />

2. 客户可以要求估价师提供有限制的服务;例如,准备报告的时间太紧,可能导致无法建立某些事 实,这些事实通常情况下本来可以通过勘查、正常查询或基于自动估价模型的估价进行核实。 注解<br />

3.<br />

注解<br />

估价。 如果客户某些时候要求提供这种水准的服务,则是可接受的,但是这种情况下估价师有责任在发 布报告之前与客户讨论其要求及需要。这种估价指令通常称作“飞车射击式”、“桌面式”或“人行道”<br />

等估价指令,例如,不得将估价结果发布或披露给第三方。 估价师应当参照估价项目的意图,考虑限制条件是否合理。估价师可以考虑在特定前提下承接此<br />

4. 。 如果估价师认为即使在提出限制条件的基础上仍无法提供此类估价,则应拒绝承接此等估价指令<br />

估价报告”。)<br />

5. 由此产生的任何假设、以及它对估价准确性造成的影响。(另见“<strong>VS</strong> 6 估价师在确认承接此等估价指令时,应清楚地告知客户,在估价报告中将会指出此等限制条件、<br />

<strong>VS</strong> 2.5 重新估价而不重新<br />

重新估价而不重新勘查<br />

重新估价而不重新 勘查<br />

如果估价师或 如果估价师或事务所 事务所 以前对 前对 前对相关物业进行过估价 相关物业进行过估价 相关物业进行过估价,现在要求重 在要求重 在要求重新估价而不进行重 估价而不进行重 估价而不进行重新勘查 勘查 勘查,则估价师必 则估价师必 须确 须确信该物业的物理 该物业的物理 该物业的物理属性以及所在 性以及所在 性以及所在位置的本 置的本 置的本质自 质自 质自上次勘查 勘查 以来,未曾发生 未曾发生 未曾发生过重 过重 过重大改 大改 大改变;否则不可承接 则不可承接 此重新估价项目 估价项目 估价项目。 如果估价师或<br />

注解<br />

注解<br />

1. 则 可能是不必要的。只要估价师以前已经对此物业进行过勘查,并且客户确认物业及其所在区域的物理属 据公认,客户可能需要对其物业的估价结果定期进行更新,然而每次均对物业进行重新勘查<br />

2. 。 估价师必须从客户方面获取关于投资物业的租金收入的变化信息,以及关于每处物业的非物理属 性的重大变化信息,例如租借条件、规划许可、法定通告等。 性未曾发生过重大变化,则可以承接此重新估价项目。这种情况下必须在聘用条款 中指明该条假设<br />

师专业判断的事项之一,对此,估价师应顾及物业的类型、位置及其它因素。 的重新估价是不适宜承 的时间间隔始终是影响估价 变化,则必须对物业进行重新勘查。另外,无论物业是否发生过变化,勘查<br />

3.<br />

4.<br />

如果客户告知估价师,该物业曾发生过重大变化,或者估价师通过其它方式察觉可能发生过此等<br />

接的。尽管如此,只要客户在估价师交付报告之前,书面确认此行估价仅用于内部管理目的并且不会向 鉴于重大变化、时间推移或其它原因,估价师可以决定不进行重新勘查<br />

发布,则估价师仍可承接此等估价指令。这种情况下,应在估价报告中毫不含糊地给出宣布这一 立场的声明以及该报告不得公开发表的声明。<br />

第三方<br />

33

<strong>VS</strong> 2.6 批判性审查<br />

注解<br />

注解<br />

1.<br />

3.<br />

这条陈述的适用情形是,客户向一名估价师提供另一名估价师先前完成的估价报告并要求其作出<br />

于另一名估价师报告中的物业进行另外的独立估价。 非常重要的是,针对一项估价的批判性审查,一定要明确区分于针对一项估价的审计或者对包含<br />

估价师不 估价师不得承接 承接 承接对另一 另一 另一名估价师 估价师 估价师完成的 成的 成的、用于披露 于披露 于披露或公开 或公开 或公开发表意 表意 表意图的估价项目进行 的估价项目进行 的估价项目进行批判性 判性 判性审查的任 查的任 务;除非 除非 除非后估价师 估价师 估价师完全掌握 掌握 掌握了前估价师所 估价师所 估价师所依赖 依赖 依赖的所有事 的所有事 的所有事实及信息 信息 信息。 一名估价师不<br />

2.<br />

估价师不<br />

除非后估价师完全了解前估价师承接的估价指令并且掌握着相同的事实,否则这种情形下的审查 批判性审查,目的可能是对最初的估价结果进行公开质疑。例如,敌意收购情况下的当事方可能希望委<br />

。也可能对前估价师的声誉造成不公正的损害。 托估价师给出一份报告,用于批判对立方委托完成的估价项目,而非另作一项独立的估价。 很可能严重误导第三方<br />

4. 可以通过很恰当的方式参与文件的审查、方法的审计、针对已提供的估价项目(包括针对 物业样本的选择性估价)的协助性质的勘查,或与其它估价师商讨估价方法。然而,如果一项审查并非 会员<br />

在同意其工作成果被其它公开文件或通告引用之前,一定要提高警惕 。<br />

用于客户的组织内部目的,则会员<br />

34

<strong>VS</strong> 3 价值基准 基准<br />

<strong>VS</strong> 3.1 价值基准 基准<br />

注解<br />

注解<br />

1. 价值基准<br />

针对将 针对将要包含 包含 包含在报告中的每项估价 在报告中的每项估价 在报告中的每项估价,估价师必须确定 估价师必须确定 估价师必须确定适宜 适宜 适宜的价值基准 价值基准 价值基准。 针对将<br />

2.<br />

针对将<br />

基准是适宜的。 I<strong>VS</strong>框架的第27至29条概述了常见的价值基准,并指出了其与估价方法、资产类型和状态、特 是指在一项估价中对基本衡量假设 的陈述,本标准针对一般估价项目规定了哪些价值<br />

等的区别。 殊假设<br />

3. 或特殊假设 成对出现,用这些假设指出资产在估价时点 假定 的状态或所处的条件。典型的假设可能涉及占用情况,例如,“以租赁为条件的市场价值”。典型的特 通常价值基准总是与适宜的假设<br />

4.<br />

反“估价报告不得模棱两可或令人误解”的规定(见<strong>VS</strong><br />

对于大多数估价项目,适宜的做法是使用I<strong>VS</strong>框架认可并且本标准认定的基准之一,连同必要<br />

5. 本标准认可的价值基准 2.1)。<br />

• 市场价值(见<strong>VS</strong> • 市场租金(见<strong>VS</strong> 3.3)<br />

• 所有值(投资价值)(见<strong>VS</strong> 3.4)<br />

3.2)<br />

• 公允价值(见<strong>VS</strong> 6. 市场价值是最常要求的价值基准。原因是它描述了无关联的、在市场自由经营的当事方之间的交 易,而忽略由特殊价值 或协同价值 引起的任何价格反常,它代表在很大范围的情形下一项物业最有可<br />

3.5)<br />

可能是假定一项物业以某些明确的方式进行了更改,例如,“在‘工程已完工’这个特殊假设 下 的市场价值”。附录3和附录4详细描述了假设 和特殊假设 的使用方法。 殊假设<br />

或特殊假设 。<strong>RICS</strong>不鼓励使用未经本标准认可的其它基准。然而,如果对于特定的估价任务, 认可的价值标准均不合适,会员应当明确地对采用的基准进行定义,并在估价报告中解释为什么未采用 本标准认可的基准。会员应当注意,使用未经认可的或自行定制的价值基准而未给出正当原因将导致违 的假设<br />

包括以下这些:<br />

7. 然而,估价指令可以合法地要求会员按照其它判断标准提供估价意见,并相应地采用其它的价值 基准。客户可以要求估价师针对特定物业对于该客户而言的价值提出意见,这可能意味着估价师将需要 能达到的价格。市场租金 应用的是类似的判断准则,不过它用于预计周期性付款而非本金总额。<br />

方之间进行的交易,预计怎样的价格是公平的,此时采用的某些判断准则可能无法在更广义的市场上复 而言的所有值进行评估。公允价值(不包括在IFRS背景下)可能使用的场合是,估价师需要针对特定双 把特殊的判断准则考虑在内,这些准则只针对该客户而并非适用于整个市场。这将涉及该物业对该客户<br />

制,例如,当价格受特殊价值或协同价值的影响时。<br />

35

8. 不一定具有排它性。一项物业对于特定的当事方而言的所有 值,或一项物业在特定双方的交易当中的公允价值,尽管使用的评估判断准则不同,也可能均与市场价 需要特别注意的是,这些价值基准<br />

9. 如果采用不同于市场价值 的其它基准,得出的价值可能不能够在一次实际销售中获得,也不能 够在一般市场中出售获得,因此,估价师必须明确地提出假设,这些假设或者不同于适用于预测市场价 值一致。<br />

<strong>VS</strong> 3.2 市场价值 市场价值<br />

市场价值<br />

设的典型的假设。 值的那些,或者带有附加条件,要区分开来。下文在适宜的标题下讨论不同于市场价值评估所使用的假<br />

市场价值 市场价值(MV)的估价项目应采用国际估价标准 的估价项目应采用国际估价标准 的估价项目应采用国际估价标准委员会 员会 员会(I<strong>VS</strong>C)确定的定 确定的定 确定的定义和概念框架 概念框架 概念框架,即: 在进行了 在进行了适当 适当 适当的营 的营 的营销(其中各方均以知晓 知晓 知晓行情 行情 行情、谨慎 谨慎 谨慎的方 的方 的方式参与 参与 参与,且无强制 无强制 无强制因素 因素 因素)之后 之后 之后,自愿 自愿 买家和自愿卖家 自愿卖家 自愿卖家以公 以公 以公平交 平交 平交易的方 易的方 易的方式,在估价时点 估价时点 对一项资产或 一项资产或 一项资产或负债 负债 负债进行 进行 进行交换 交换 交换的估 的估 的估计金额。 基于市场价值<br />

注解<br />

注解<br />

1. 应用市场价值<br />

2. 市场价值<br />

3 在任何情况下,估价师均应确保在估价指令及报告中均清晰描述了价值基准。 时,还应顾及I<strong>VS</strong>框架第31-35条规定的概念框架。<br />

忽略加于物业的任何现有按揭、债权证或其它费用。 这条基准是国际公认的定义。它表示在估价时点在假想的销售合同中将出现的数字。 市场价值<br />

4. 的基准下,特殊价值(其定义见I<strong>VS</strong>框架第44-47条)应予忽略,但是如果 一般市场的准买家的出价对将来物业所处情境的改变的预期有所体现,则市场价值中对“希望价值”因 尽管在市场价值<br />

• 当前尚未获得开发许可的情况下,希望中的发展前景; 素有所体现。以下是“将来会产生或获取附加价值”这个希望值可能影响市场价值的几个例子:<br />

5.<br />

• 前景。 将来与该物业当中的另一项物业或权益合并将会产生的协同效应(其定义见I<strong>VS</strong>框架第48条)<br />

应用于特定类型资产的应用指南。<br />

GN 2,GN 4及GN 5提供了市场价值<br />

<strong>VS</strong> 3.3 市场租金<br />

市场租金<br />

市场租金 市场租金(MR)的估价项目应采用 的估价项目应采用 的估价项目应采用I<strong>VS</strong>C确定的定 确定的定 确定的定义:<br />

基于市场租金<br />

36

37<br />

在进行了<br />

在进行了<br />

在进行了<br />

在进行了适当<br />

适当<br />

适当<br />

适当的营<br />

的营<br />

的营<br />

的营销(其中各方均以知晓<br />

知晓<br />

知晓<br />

知晓行情<br />

行情<br />

行情<br />

行情、谨慎<br />

谨慎<br />

谨慎<br />

谨慎的方<br />

的方<br />

的方<br />

的方式参与<br />

参与<br />

参与<br />

参与,且无强制<br />

无强制<br />

无强制<br />

无强制因素<br />

因素<br />

因素<br />

因素)之后<br />

之后<br />

之后<br />

之后,自愿<br />

自愿<br />

自愿<br />

自愿<br />

买家和自愿卖家<br />

自愿卖家<br />

自愿卖家<br />

自愿卖家以公<br />

以公<br />

以公<br />

以公平交<br />

平交<br />

平交<br />

平交易的方<br />

易的方<br />

易的方<br />

易的方式,在估价时点<br />

在估价时点<br />

在估价时点<br />

在估价时点对一项<br />

一项<br />

一项<br />

一项物业<br />

物业<br />

物业<br />

物业房地产<br />

房地产<br />

房地产<br />

房地产进行租用的估算金<br />

进行租用的估算金<br />

进行租用的估算金<br />

进行租用的估算金额。<br />

注解<br />

注解<br />

注解<br />

注解<br />

1. 市场租金 的定义是对市场价值 定义的修改;更多注解请参阅I<strong>VS</strong> 200的第C10和第C11条。<br />

2. 根据假定的租赁合同的不同条款,市场租金会有显著不同。租赁条款通常应当对该物业房地产所<br />

处的市场中的现行实践有所体现方为适宜;但是根据目的不同,可能需要规定特殊的条款。诸如租赁期<br />

限、租金审查的频率及各方对于维修和支出的责任等事宜均将对市场租金有影响。基某些国家,法定因<br />

素可能对租赁协议条款的约定有所限制,或对条款的效力有所影响。视情况,应将这些因素考虑在内。<br />

3. 因此,估价师基于市场租金提供估价意见时,应当注意明确地列出假定的主要租赁条款。如果市场<br />

规范规定在租金当中应包含一项付款或让步,作为一方向另一方提供的签订租赁协议的激励措施,并且<br />

租金的一般水平对此有所体现,则应指出市场租金是建立在此等基准之上。估价师必须在陈述假定的租<br />

赁条款的同时,指出此等激励措施的本质。通常,市场租金用于表征一项空置物业房地产可以怎样的金<br />

额出租,或者当前租契终止后一项物业房地产可以怎样的金额重租。如果按照租契规定,应当在租金审<br />

议条款中商定应支付租金的数额,则市场租金不是合适的价值基准,因为必须使用实际的定义和假设。<br />

<strong>VS</strong> 3.4 投资价值<br />

投资价值<br />

投资价值<br />

投资价值<br />

基于投资价值<br />

投资价值<br />

投资价值<br />

投资价值的估价项目应采用<br />

的估价项目应采用<br />

的估价项目应采用<br />

的估价项目应采用I<strong>VS</strong>C确定的定<br />

确定的定<br />

确定的定<br />

确定的定义:<br />

投资价值<br />

投资价值<br />

投资价值<br />

投资价值是指一项资产<br />

是指一项资产<br />

是指一项资产<br />

是指一项资产对其<br />

对其<br />

对其<br />

对其业主或准业<br />

或准业<br />

或准业<br />

或准业主而言<br />

而言<br />

而言<br />

而言,用于个人投资目标或经营目标的价值<br />

投资目标或经营目标的价值<br />

投资目标或经营目标的价值<br />

投资目标或经营目标的价值。<br />

注解<br />

注解<br />

注解<br />

注解<br />

1. 更多关于此定义的注解,请参阅I<strong>VS</strong>框架第38条。<br />

2. 投资价值有时也称作“所有值”。<br />

<strong>VS</strong> 3.5 公允价<br />

公允价<br />

公允价<br />

公允价值<br />

基于公允价值<br />

公允价值<br />

公允价值<br />

公允价值 的估价项目应<br />

的估价项目应<br />

的估价项目应<br />

的估价项目应当采用下列<br />

采用下列<br />

采用下列<br />

采用下列两个定<br />

个定<br />

个定<br />

个定义之一<br />

之一<br />

之一<br />

之一:<br />

1. I<strong>VS</strong>C采用的定<br />

采用的定<br />

采用的定<br />

采用的定义:<br />

知晓<br />

知晓<br />

知晓<br />

知晓行情的<br />

行情的<br />

行情的<br />

行情的、自愿<br />

自愿<br />

自愿<br />

自愿的各方之<br />

方之<br />

方之<br />

方之间,转让<br />

转让<br />

转让<br />

转让一项<br />

一项<br />

一项<br />

一项资产或<br />

资产或<br />

资产或<br />

资产或负债<br />

负债<br />

负债<br />

负债的估计价<br />

的估计价<br />

的估计价<br />

的估计价格,该价<br />

该价<br />

该价<br />

该价格对各<br />

格对各<br />

格对各<br />

格对各方各自<br />

各自<br />

各自<br />

各自<br />

利益均有所<br />

有所<br />

有所<br />

有所体现<br />

体现<br />

体现<br />

体现。<br />

2. 国际会计标准<br />

国际会计标准<br />

国际会计标准<br />

国际会计标准委员会<br />

员会<br />

员会<br />

员会(IASB)采用的定<br />

采用的定<br />

采用的定<br />

采用的定义:<br />

在计<br />

在计<br />

在计<br />

在计量日期<br />

日期<br />

日期<br />

日期,市场参与者之<br />

市场参与者之<br />

市场参与者之<br />

市场参与者之间进行有序<br />

进行有序<br />

进行有序<br />

进行有序交易,出售<br />

出售<br />

出售<br />

出售一项资产时<br />

一项资产时<br />

一项资产时<br />

一项资产时将会收<br />

会收<br />

会收<br />

会收到的,或转让<br />

转让<br />

转让<br />

转让一项<br />

一项<br />

一项<br />

一项负债<br />

负债<br />

负债<br />

负债时<br />

将会支付<br />

支付<br />

支付<br />

支付的价<br />

的价<br />

的价<br />

的价格。

注解<br />

注解<br />

1. 很重要的一点是,要认识到公允价值<br />

2. 估价师一定要针对估价目的,建立正确的定义,并在聘用条款和估价报告中予以全面陈述。 应用I<strong>VS</strong>定义时,应指出以I<strong>VS</strong>框架第39-43条为参考。 作为估价基准时, 的这两条定义是不同的。采用公允价值<br />

3. IFRS 13的指南包括:<br />

公允价值 公允价值衡量 衡量 衡量方法 方法<br />

B2:公允价值衡量的目标是预测在当前的市场状况下,在测量时点,市场参与者之间为 公允价值<br />

定以下内容: 了出售资产或转让负债而完成一次有序交易所需的价格。公允价值衡量要求一个实体确<br />

作为衡量对象的特定资产或负债(始终如一地附带计量单位) (b) 对于非金融资产,什么样的估价前提对本次衡量(始终一致地考虑其最高及最 (a)<br />

(c) 佳用途)是适宜的<br />

哪个或哪些估价技术对本次衡量是适宜的,其中要顾及数据的可用性,以这些<br />

©国际会计标准委员会(IASB),国际财务报告标准(IFRS)13<br />

数据为输入,代表市场参与者在为资产或负债定价时将使用的假设,以及对输 该资产或负债的主要(或最有利)市场<br />

4. IFRS<br />

(d) 入进行分类的公允价值层级水平。<br />

13提及市场参与者以及出售行为之处,清楚地指出了对于大部分实际目的,公允价值与市场<br />

4.1。<br />

5. 有关财务报表当中如何应用公允价值的更详细指南,请参阅<strong>VS</strong> 价值的概念是一致的。<br />

<strong>VS</strong> 4 应用<br />

<strong>VS</strong> 4.1 用于财务报表的估价项目<br />

用于财务报表的估价项目<br />

如果承接的估价项目 如果承接的估价项目将用于财务报表 财务报表 财务报表,则提供该估价时应 则提供该估价时应 则提供该估价时应当遵守该 遵守该 遵守该实体 实体 实体所采用的财务报告标准 所采用的财务报告标准 所采用的财务报告标准。 如果承接的估价项目<br />

注解<br />

注解<br />

38

1. 能发布了对估价要求进行解释的相关标准(见<strong>VS</strong> 2. 《I<strong>VS</strong><br />

1.3)。<br />

3. 如果该实体采用了IFRS标准,则应当使用公允价值(见<strong>VS</strong> 3.5)作为价值基准并且IFRS<br />

如果该实体未采用IFRS,估价师必须遵守适用的财务报告标准。在某些国家,<strong>RICS</strong>国家协会可<br />

当适用。 300:用于财务报告的估价》提供了针对此目的的一般指南。<br />

13应<br />

4. IFRS 特别是披露方面的要求,以确保提供估价时符合适用的IFRS标准。IFRS • 公允价值的定义;<br />

13讨论的事项包括以下内容:<br />

13详细说明了用于计算公允价值的估价方法。至关重要的是,估价师必须熟悉这些要求,<br />

• 资产或负债;<br />

• 交易;<br />

• 市场参与者;<br />

• 价格;<br />

• 针对非金融资产的应用;<br />

• 初始确认阶段的公允价值;<br />

• 估价技术;<br />

• 估价技术的输入参数;<br />

• 公允价值的层次结构;<br />

•<br />

IFRS 13还包括一个应用指南附录。IFRS 13可从从www.iasb.org获取。<br />

5. I<strong>VS</strong><br />

披露。<br />

300包含关于IFRS应用的指南,该部分内容的标题如下:<br />

• 公允价值<br />

• 合并计算<br />

• 估价输入参数及公允价值层次结构<br />

• 负债<br />

• 折旧<br />

• 租契<br />

• 购买价格分配<br />

• 减损测试<br />

39

<strong>VS</strong> 4.2 用于担保贷款的估价<br />

进行估价时,应顾及《I<strong>VS</strong> 于担 于担保贷款的 款的 款的物业 物业 物业房地产 房地产 房地产进行估价时 进行估价时<br />

310:用于担 于担 于担保贷款的 款的 款的物业 物业 物业房地产 房地产 房地产权益估价 益估价 益估价》 的要求 的要求。 在对用于担 于担<br />

310还涉及关于特殊假设和额外<br />

注解<br />

注解<br />

1. I<strong>VS</strong> 310规定,通常情况下均采用市场价值作为价值基准。I<strong>VS</strong><br />

2. I<strong>VS</strong> 310的注解提供了关于以下内容的应用指南: 报告要求的内容。<br />

3. 附录5提供了关于针对担保贷款目的估价的额外要求。<br />

• 物业房地产权益<br />

• 激励措施<br />

• 估价方法<br />

• 物业房地产类型<br />

• 投资物业投资性房地产<br />

• 业主自用物业房地产<br />

• 特殊物业房地产<br />

• 与贸易有关的物业房地产<br />

• 开发物业房地产<br />

• 递耗资产<br />

4. 的一定比例计算。称为“偿付能力比率”。在国际背景下,巴塞尔银行监管委员会发布的协议规定了贷 款机构应当保持的最低偿付能力比率以及计算这些比率的方法。这些规定均通过国家法律强制执行,对 各大银行及其它放款人受制于相关规定,能够出借的总额是有一定限度的,这个限度按照其资产<br />

5.<br />

• 担保资产的市场价值;或 应用的风险判断准则不同: 巴塞尔协议规定,评估商业地产代表的抵押权的价值时,可以采用以下两种估价方法之一,两者<br />

• 抵押贷款价值(MLV)<br />

。 于欧盟,则按照《欧盟指令》执行。在计算偿付能力比率时,使用的是放款人拥有抵押权的资产的价值<br />

6. MLV是一项长期风险评估技术。因此它不作为价值基准——即,对假定在特定日期发生的交易<br />

的价值的预测。MLV为欧盟许多国家所采用。附录8提供了欧洲抵押贷款联合会的一份解释性文件。<br />

40

7.<br />

<strong>VS</strong> 4.3 为财务报告目的对公共部门资产进行估价<br />

银行要求计算MLV的个体必须按照国家方案进行认证,应用的方法也必须按照联邦法规的规定。 国法规的相关要求,包括关于哪些人可以承接此等任务的限制规定。例如,在德国,MLV非常普遍,各 不同国家的MLV应用方法也可能不同。因此在承接计算MLV的指令之前,会员应确保自己熟悉该<br />

<strong>VS</strong> 4.3<br />

注解<br />

注解<br />

1. 《I<strong>VS</strong><br />

为财务报告目的对公共部门资产进行估价<br />

为财务报告目的 为财务报告目的对公共部门资产进行估价时应 资产进行估价时应 资产进行估价时应当按照 当按照 当按照I<strong>VS</strong> 300 I<strong>VS</strong> 300 I<strong>VS</strong> 300 I<strong>VS</strong> 300附件的要求进行 的要求进行 的要求进行。 为财务报告目的<br />

2.<br />

为财务报告目的<br />

考www.ifac.org/publicsector。 300:公共部门的物业以及厂房与设备》的附件实际上采用了国际公共部门会计准则(IPSAS) 作为针对公共部门实体的适宜标准。它特别指出鉴于IPSAS随时间的推移可能改变,现存的标准应参<br />

如果在此类情形下产生任何背离,必须在报告中指出并作出明确解释。<br />

根据立法、监管、会计或判例的要求,在某些国家或在某些条件下可能需要对此应用进行修改。<br />

41

<strong>VS</strong> <strong>VS</strong> 5 5 勘测<br />

<strong>VS</strong> <strong>VS</strong> 5.1 5.1 勘查 勘查与勘测<br />

勘查<br />

与勘测<br />

注解<br />

注解<br />

1.<br />

2.<br />

商定聘用条款时,估价师必须必须就被估价物业的勘查范围达成一致,以及在怎样的范围内展开<br />

达到<strong>VS</strong><br />

为了 为了针对 针对 针对估价意 估价意 估价意图提供 提供 提供足够 足够 足够专业的估价 专业的估价 专业的估价,必须 必须 必须总是在必要的 是在必要的 是在必要的范围 范围 范围内展开勘查 勘查 勘查与勘 与勘 与勘测。 为了<br />

及与客户商定的聘用条款。 1.6判断准则的估价师应当熟悉(擅长则更好)影响物业类型以及位置等方面的许多事 勘测。对物业进行勘查之后,会需要进行不同程度的现场勘测,这取决于物业的本质、估价的意图、以<br />

项。如果本来通过对物业或紧邻场所的勘查或常规查询即可明显发现对价值有影响的问题或潜在问题,<br />

3. 预期买家通常会作出的假设,那么就应当将该假设视为特殊假设(见<strong>VS</strong> 2.2)。然而,这些事项很少能 而估价师却轻率作出“这些问题并不存在”的假设,就会产生严重的误导作用。<br />

4. 此等因素。 客户可以要求或同意作出“不存在任何问题”的假设。如果在一次勘查之后,估价师认为这不是<br />

如果经过约定,可以仅展开有限的勘查与勘测工作,那么该估价项目很可能应建立在限制性信息 够完全被忽略。一旦发现可能影响估价的现场不利因素,估价师在发布估价报告以前应当提请客户注意<br />

5. 勘查过程可以轻易发现很多对物业价值的市场感知有影响的事项。这些事项可能包括: <strong>2.4</strong>应当适用。 的基准之上,同时<strong>VS</strong><br />

周围区域的特性以及对价值有影响的交通状况、便利设施等因素; b) 物业的特性; c) 土地与建筑物的尺寸与面积; a)<br />

建筑物的结构及大概役龄; e) 土地与建筑物的用途; f) 房客的类型; d)<br />

装置、便利设施及服务的情况; g)<br />

固定物、配件及装修情况; i) 是否存在通常作为整个建筑物的一部分的厂房与设备; j) 明显的维修与调整状况; h)<br />

环境因素,例如异常地面状况、以前的开矿或采石作业、海岸侵蚀、洪灾风险、邻近高压 设备等; l) 污染,例如地面内或地面建筑内的潜在危险或有害物质——例如重金属、油、溶剂、毒药 k)<br />

或污染源物质被吸收或融合到物业之内,不通过攻击手段或专业手段则难以移除(例如通 过开挖才能移除由于地下油罐泄露而污染的底土)——或存在氡气;<br />

42

6. 可能需要包括的其它信息有:<br />

危险材料,例如建造物内或土地上存在潜在有害物质,但是尚未造成污染,只要采用适当 的预防措施并遵守监管规定即可迅速移除——例如,从地下罐清除燃油(气)或从绝缘材 料当中清除石棉或消耗臭氧层物质。 m)<br />

不利材料,例如随着役龄增长而退化的建筑材料,造成结构上的问题,例如高铝水泥、氯 化钙、木丝模板等; o) 视情况,是否存在物理限制而不利于进一步开发。 n)<br />

•<br />

• 所见或地面测量所得那样简单。如果估价师无法勘查租契或因为缺乏许可证记录,以至于无法确 认改造或装修的程度,那么估价师应当在阐明的假设基准之上着手工作; 租赁物业房地产的装修情况:在对租赁及归还物业进行估价时,如果当初出租的物业可能经过改 造或装修,那么应注意确定哪些内容需要进行估价。针对特定权益的估价,可能并非如表面观察<br />

域的了解程度决定。估价师必须考虑物业的本质、估价的目的、物业的范围和承接任务的大小, 规划(分区)控制:规划控制方面,各个国家可能不同,需要作出查询的范围将由估价师对该区<br />

• 地区或国家房产税率;<br />

• 庞大支出或运行成本方面的信息,以及可以从房客追偿的水平;<br />

• 物业房地产所在国家可能作出的强加配额或其它经营限制等信息;<br />

• 出售之前,通过正常法律咨询流程披露的信息。<br />

7.<br />

8. 为了将来的查询能够得到有效回应,必须制定并保留清晰的笔记(可以包括照片)对勘测结果进 虽然估价师有职责采取合理的谨慎措施,以核实所提供或获取的信息,但是必须明确声明这方面<br />

行记录,特别要记录勘查的局限性以及是在怎样的形势下展开的。在这些笔记中还应记录关键输入值以<br />

才能确定在多大程度上勘测可以或可能对规划方面有影响的监管措施;<br />

的职责是有限的。<br />

<strong>VS</strong> 5.2信息认证 及得出估价结果时涉及的所有计算、勘测与分析过程。<br />

1. 补充<br />

信息认证 信息认证<br />

应与客户确认所依 赖任何必要 “假设”。 估价师在准备估价时必须采取合适的步骤来认证评估所依赖的信息。如未事先同意,<br />

并在合适的地方指出信息出处。<br />

2.就每一案例, 估价师均必须评估所依赖信息的可靠程度。 如果别无选择, 只能接受可能不可靠的信 估价师有责任明确指出所依赖的信息,<br />

息, 则在接受的条款里应列出相应的 “假设”。<br />

3.在为财务声明准备估价报告时, 估价师应准备与客户的审计师、 其他专业建议师及制定规则人士讨 论任何“假设”的合适性。<br />

43

估价师也应有意愿表达意见)。 估价师 必须在报告中先明确指出任何由客户或有意向的另一方的律师认证的信息, 评估的价格才值得信赖或能 够得以公布。<br />

4.客户将期待估价师就影响价格的法律事宜发表意见(同样,<br />

44

45<br />

<strong>VS</strong> 6<br />

<strong>VS</strong> 6<br />

<strong>VS</strong> 6<br />

<strong>VS</strong> 6 估价报告<br />

估价报告<br />

估价报告<br />

估价报告<br />

<strong>VS</strong> 6.1<br />

<strong>VS</strong> 6.1<br />

<strong>VS</strong> 6.1<br />

<strong>VS</strong> 6.1 估价报告至少应包括的内容<br />

估价报告至少应包括的内容<br />

估价报告至少应包括的内容<br />

估价报告至少应包括的内容<br />

估价报告应<br />

估价报告应<br />

估价报告应<br />

估价报告应当清晰<br />

当清晰<br />

当清晰<br />

当清晰而准确地<br />

而准确地<br />

而准确地<br />

而准确地阐明估价<br />

明估价<br />

明估价<br />

明估价结论<br />

结论<br />

结论<br />

结论,不得模棱两<br />

得模棱两<br />

得模棱两<br />

得模棱两可或<br />

可或<br />

可或<br />

可或令人误<br />

令人误<br />

令人误<br />

令人误解,不得造<br />

得造<br />

得造<br />

得造成假<br />

成假<br />

成假<br />

成假象。并且<br />

并且<br />

并且<br />

并且,对于客户<br />

对于客户<br />

对于客户<br />

对于客户<br />

与估价师<br />

与估价师<br />

与估价师<br />

与估价师双方在聘用条款中<br />

方在聘用条款中<br />

方在聘用条款中<br />

方在聘用条款中约定的所有事项<br />

定的所有事项<br />

定的所有事项<br />

定的所有事项,报告<br />

报告<br />

报告<br />

报告均应予以处理,至少应包括<br />

包括<br />

包括<br />

包括以下<br />

以下<br />

以下<br />

以下信息<br />

信息<br />

信息<br />

信息(如果<br />

如果<br />

如果<br />

如果按照客户<br />

按照客户<br />

按照客户<br />

按照客户<br />

提供的表<br />

提供的表<br />

提供的表<br />

提供的表格给出报告则<br />

报告则<br />

报告则<br />

报告则除外):<br />

):<br />

):<br />

):<br />

(a) 对客户<br />

对客户<br />

对客户<br />

对客户和其它预<br />

其它预<br />

其它预<br />

其它预期用<br />

期用<br />

期用<br />

期用户进行<br />

进行<br />

进行<br />

进行识别认<br />

识别认<br />

识别认<br />

识别认定;<br />

(b) 本次估价的意<br />

估价的意<br />

估价的意<br />

估价的意图;<br />

(c) 本次估价的<br />

估价的<br />

估价的<br />

估价的对象<br />

对象<br />

对象<br />

对象;<br />

(d) 有待估价的<br />

估价的<br />

估价的<br />

估价的权益;<br />

(e) 资产或<br />

资产或<br />

资产或<br />

资产或负债<br />

负债<br />

负债<br />

负债的类型<br />

类型<br />

类型<br />

类型,以及<br />

以及<br />

以及<br />

以及客户<br />

客户<br />

客户<br />

客户如何<br />

如何<br />

如何<br />

如何使用它或如何<br />

或如何<br />

或如何<br />

或如何对其分级<br />

对其分级<br />

对其分级<br />

对其分级;<br />

(f) 价值基准<br />

价值基准<br />

价值基准<br />

价值基准;<br />

(g) 估价时点<br />

估价时点<br />

估价时点<br />

估价时点;<br />

(h) 对重大牵连<br />

大牵连<br />

大牵连<br />

大牵连进行<br />

进行<br />

进行<br />

进行披露<br />

披露<br />

披露<br />

披露,或指<br />

或指<br />

或指<br />

或指出不存在<br />

不存在<br />

不存在<br />

不存在此类<br />

此类<br />

此类<br />

此类重大牵连<br />

大牵连<br />

大牵连<br />

大牵连;<br />

(i) 负责<br />

负责<br />

负责<br />

负责本次估价的估价师的<br />

估价的估价师的<br />

估价的估价师的<br />

估价的估价师的识别认<br />

识别认<br />

识别认<br />

识别认定,并且<br />

并且<br />

并且<br />

并且如有要求<br />

如有要求<br />

如有要求<br />

如有要求,指出该估价师的<br />

该估价师的<br />

该估价师的<br />

该估价师的状态<br />

状态<br />

状态<br />

状态;<br />

(j) 视情<br />

视情<br />

视情<br />

视情况,指出将<br />

出将<br />

出将<br />

出将要采用的<br />

要采用的<br />

要采用的<br />

要采用的币种<br />

币种<br />

币种<br />

币种;<br />

(k) 任何<br />

任何<br />

任何<br />

任何假设<br />

假设<br />

假设<br />

假设、特殊假设<br />

特殊假设<br />

特殊假设<br />

特殊假设、保留意见<br />

意见<br />

意见<br />

意见、特殊指<br />

特殊指<br />

特殊指<br />

特殊指令或背离<br />

背离<br />

背离<br />

背离;<br />

(l) 估价师勘<br />

估价师勘<br />

估价师勘<br />

估价师勘测的范围<br />

范围<br />

范围<br />

范围;<br />

(m) 估价师<br />

估价师<br />

估价师<br />

估价师依赖<br />

依赖<br />

依赖<br />

依赖的信息<br />

信息<br />

信息<br />

信息的本<br />

的本<br />

的本<br />

的本质及来源<br />

来源<br />

来源<br />

来源;<br />

(n) 同意或<br />

同意或<br />

同意或<br />

同意或限制公开<br />

制公开<br />

制公开<br />

制公开发表;<br />

(o) 限制或<br />

制或<br />

制或<br />

制或豁免<br />

豁免<br />

豁免<br />

豁免估价师<br />

估价师<br />

估价师<br />

估价师对其它<br />

对其它<br />

对其它<br />

对其它方(除客户<br />

除客户<br />

除客户<br />

除客户外)的责任;<br />

(p) 确认该项估价<br />

该项估价<br />

该项估价<br />

该项估价符合<br />

符合<br />

符合<br />

符合本标准<br />

本标准<br />

本标准<br />

本标准;<br />

(q) 阐明估价方法的<br />

明估价方法的<br />

明估价方法的<br />

明估价方法的选择<br />

选择<br />

选择<br />

选择与理<br />

与理<br />

与理<br />

与理由;<br />

(r) 阐明该估价师具备必要的<br />

明该估价师具备必要的<br />

明该估价师具备必要的<br />

明该估价师具备必要的知识<br />

知识<br />

知识<br />

知识、技能和理解能<br />

能和理解能<br />

能和理解能<br />

能和理解能力,能够称职地承办该估价项目<br />

称职地承办该估价项目<br />

称职地承办该估价项目<br />

称职地承办该估价项目;<br />

(s) 用数字及<br />

用数字及<br />

用数字及<br />

用数字及文字(即大写和小写金额)表述的估价意见<br />

的估价意见<br />

的估价意见<br />

的估价意见;<br />

(t) 签名<br />

签名<br />

签名<br />

签名及报告日期<br />

报告日期<br />

报告日期<br />

报告日期;<br />

该最低限度<br />

最低限度<br />

最低限度<br />

最低限度应有条款列表的第<br />