harris corporation

harris corporation

harris corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

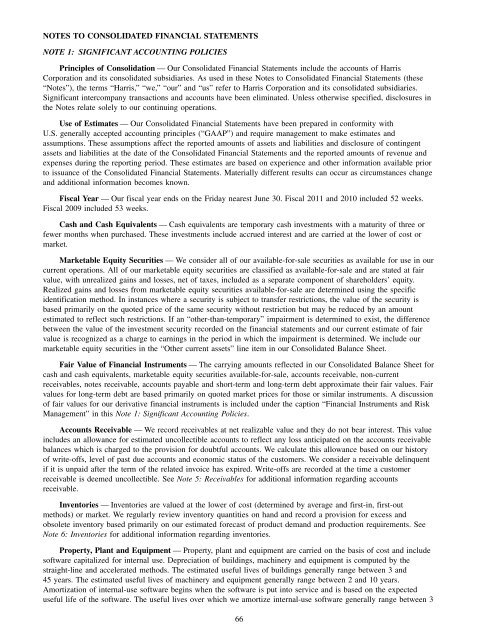

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTE 1: SIGNIFICANT ACCOUNTING POLICIES<br />

Principles of Consolidation — Our Consolidated Financial Statements include the accounts of Harris<br />

Corporation and its consolidated subsidiaries. As used in these Notes to Consolidated Financial Statements (these<br />

“Notes”), the terms “Harris,” “we,” “our” and “us” refer to Harris Corporation and its consolidated subsidiaries.<br />

Significant intercompany transactions and accounts have been eliminated. Unless otherwise specified, disclosures in<br />

the Notes relate solely to our continuing operations.<br />

Use of Estimates — Our Consolidated Financial Statements have been prepared in conformity with<br />

U.S. generally accepted accounting principles (“GAAP”) and require management to make estimates and<br />

assumptions. These assumptions affect the reported amounts of assets and liabilities and disclosure of contingent<br />

assets and liabilities at the date of the Consolidated Financial Statements and the reported amounts of revenue and<br />

expenses during the reporting period. These estimates are based on experience and other information available prior<br />

to issuance of the Consolidated Financial Statements. Materially different results can occur as circumstances change<br />

and additional information becomes known.<br />

Fiscal Year — Our fiscal year ends on the Friday nearest June 30. Fiscal 2011 and 2010 included 52 weeks.<br />

Fiscal 2009 included 53 weeks.<br />

Cash and Cash Equivalents — Cash equivalents are temporary cash investments with a maturity of three or<br />

fewer months when purchased. These investments include accrued interest and are carried at the lower of cost or<br />

market.<br />

Marketable Equity Securities — We consider all of our available-for-sale securities as available for use in our<br />

current operations. All of our marketable equity securities are classified as available-for-sale and are stated at fair<br />

value, with unrealized gains and losses, net of taxes, included as a separate component of shareholders’ equity.<br />

Realized gains and losses from marketable equity securities available-for-sale are determined using the specific<br />

identification method. In instances where a security is subject to transfer restrictions, the value of the security is<br />

based primarily on the quoted price of the same security without restriction but may be reduced by an amount<br />

estimated to reflect such restrictions. If an “other-than-temporary” impairment is determined to exist, the difference<br />

between the value of the investment security recorded on the financial statements and our current estimate of fair<br />

value is recognized as a charge to earnings in the period in which the impairment is determined. We include our<br />

marketable equity securities in the “Other current assets” line item in our Consolidated Balance Sheet.<br />

Fair Value of Financial Instruments — The carrying amounts reflected in our Consolidated Balance Sheet for<br />

cash and cash equivalents, marketable equity securities available-for-sale, accounts receivable, non-current<br />

receivables, notes receivable, accounts payable and short-term and long-term debt approximate their fair values. Fair<br />

values for long-term debt are based primarily on quoted market prices for those or similar instruments. A discussion<br />

of fair values for our derivative financial instruments is included under the caption “Financial Instruments and Risk<br />

Management” in this Note 1: Significant Accounting Policies.<br />

Accounts Receivable — We record receivables at net realizable value and they do not bear interest. This value<br />

includes an allowance for estimated uncollectible accounts to reflect any loss anticipated on the accounts receivable<br />

balances which is charged to the provision for doubtful accounts. We calculate this allowance based on our history<br />

of write-offs, level of past due accounts and economic status of the customers. We consider a receivable delinquent<br />

if it is unpaid after the term of the related invoice has expired. Write-offs are recorded at the time a customer<br />

receivable is deemed uncollectible. See Note 5: Receivables for additional information regarding accounts<br />

receivable.<br />

Inventories — Inventories are valued at the lower of cost (determined by average and first-in, first-out<br />

methods) or market. We regularly review inventory quantities on hand and record a provision for excess and<br />

obsolete inventory based primarily on our estimated forecast of product demand and production requirements. See<br />

Note 6: Inventories for additional information regarding inventories.<br />

Property, Plant and Equipment — Property, plant and equipment are carried on the basis of cost and include<br />

software capitalized for internal use. Depreciation of buildings, machinery and equipment is computed by the<br />

straight-line and accelerated methods. The estimated useful lives of buildings generally range between 3 and<br />

45 years. The estimated useful lives of machinery and equipment generally range between 2 and 10 years.<br />

Amortization of internal-use software begins when the software is put into service and is based on the expected<br />

useful life of the software. The useful lives over which we amortize internal-use software generally range between 3<br />

66