Ársskýrsla Landsbankans - Landsbankinn

Ársskýrsla Landsbankans - Landsbankinn

Ársskýrsla Landsbankans - Landsbankinn

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

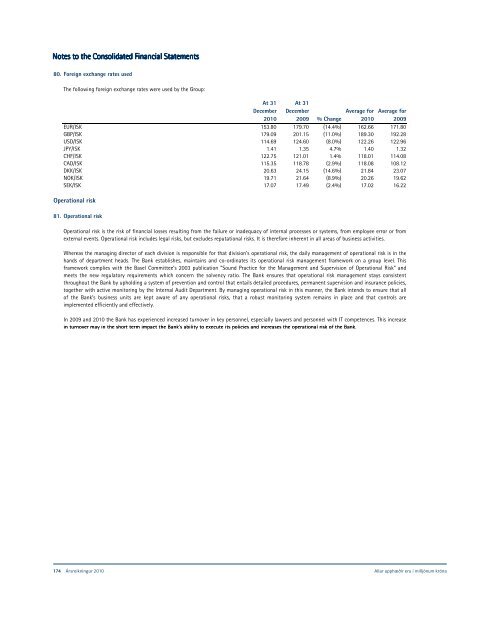

80. Foreign exchange rates used<br />

The following foreign exchange rates were used by the Group:<br />

At 31<br />

December<br />

2010<br />

At 31<br />

December<br />

2009 % Change<br />

Average for Average for<br />

2010 2009<br />

EUR/ISK 153.80 179.70 (14.4%) 162.66 171.80<br />

GBP/ISK 179.09 201.15 (11.0%) 189.30 192.28<br />

USD/ISK 114.69 124.60 (8.0%) 122.26 122.96<br />

JPY/ISK 1.41 1.35 4.7% 1.40 1.32<br />

CHF/ISK 122.75 121.01 1.4% 118.01 114.08<br />

CAD/ISK 115.35 118.78 (2.9%) 118.08 108.12<br />

DKK/ISK 20.63 24.15 (14.6%) 21.84 23.07<br />

NOK/ISK 19.71 21.64 (8.9%) 20.26 19.62<br />

SEK/ISK 17.07 17.49 (2.4%) 17.02 16.22<br />

Operational risk<br />

81. Operational risk<br />

Operational risk is the risk of financial losses resulting from the failure or inadequacy of internal processes or systems, from employee error or from<br />

external events. Operational risk includes legal risks, but excludes reputational risks. It is therefore inherent in all areas of business activities.<br />

Whereas the managing director of each division is responsible for that division’s operational risk, the daily management of operational risk is in the<br />

hands of department heads. The Bank establishes, maintains and co-ordinates its operational risk management framework on a group level. This<br />

framework complies with the Basel Committee’s 2003 publication "Sound Practice for the Management and Supervision of Operational Risk" and<br />

meets the new regulatory requirements which concern the solvency ratio. The Bank ensures that operational risk management stays consistent<br />

throughout the Bank by upholding a system of prevention and control that entails detailed procedures, permanent supervision and insurance policies,<br />

together with active monitoring by the Internal Audit Department. By managing operational risk in this manner, the Bank intends to ensure that all<br />

of the Bank’s business units are kept aware of any operational risks, that a robust monitoring system remains in place and that controls are<br />

implemented efficiently and effectively.<br />

In 2009 and 2010 the Bank has experienced increased turnover in key personnel, especially lawyers and personnel with IT competences. This increase<br />

in turnover may in the short term impact the Bank's Bank s ability to execute its policies and increases the operational risk of the Bank Bank.<br />

NBI hf. Consolidated Financial Statements 2010 74<br />

All amounts are in ISK million<br />

174 Ársreikningur 2010 Allar upphæðir eru í milljónum króna