Ársskýrsla Landsbankans - Landsbankinn

Ársskýrsla Landsbankans - Landsbankinn

Ársskýrsla Landsbankans - Landsbankinn

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

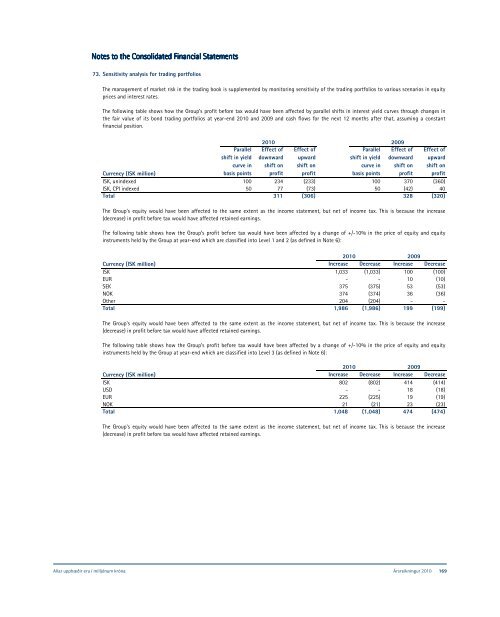

73. Sensitivity analysis for trading portfolios<br />

The management of market risk in the trading book is supplemented by monitoring sensitivity of the trading portfolios to various scenarios in equity<br />

prices and interest rates.<br />

The following table shows how the Group’s profit before tax would have been affected by parallel shifts in interest yield curves through changes in<br />

the fair value of its bond trading portfolios at year-end 2010 and 2009 and cash flows for the next 12 months after that, assuming a constant<br />

financial position.<br />

Currency (ISK million)<br />

Parallel<br />

shift in yield<br />

curve in<br />

basis points<br />

2010<br />

Effect of<br />

downward<br />

shift on<br />

profit<br />

Effect of<br />

upward<br />

shift on<br />

profit<br />

Parallel<br />

shift in yield<br />

curve in<br />

basis points<br />

2009<br />

Effect of<br />

downward<br />

shift on<br />

profit<br />

Effect of<br />

upward<br />

shift on<br />

profit<br />

ISK, unindexed 100 234 (233) 100 370 (360)<br />

ISK, CPI indexed 50 77 (73) 50 (42) 40<br />

Total 311 (306) 328 (320)<br />

The Group's equity would have been affected to the same extent as the income statement, but net of income tax. This is because the increase<br />

(decrease) in profit before tax would have affected retained earnings.<br />

The following table shows how the Group’s profit before tax would have been affected by a change of +/-10% in the price of equity and equity<br />

instruments held by the Group at year-end which are classified into Level 1 and 2 (as defined in Note 6):<br />

2010 2009<br />

Currency (ISK million) Increase Decrease Increase Decrease<br />

ISK 1,033 (1,033) 100 (100)<br />

EUR - - 10 (10)<br />

SEK 375 (375) 53 (53)<br />

NOK 374 (374) 36 (36)<br />

Other 204 (204) - -<br />

Total 1,986 (1,986) 199 (199)<br />

The Group's equity would have been affected to the same extent as the income statement, but net of income tax. This is because the increase<br />

(decrease) in profit before tax would have affected retained earnings.<br />

The following table shows how the Group’s profit before tax would have been affected by a change of +/-10% in the price of equity and equity<br />

instruments held by the Group at year-end which are classified into Level 3 (as defined in Note 6):<br />

2010 2009<br />

Currency (ISK million) Increase Decrease Increase Decrease<br />

ISK 802 (802) 414 (414)<br />

USD - - 18 (18)<br />

EUR 225 (225) 19 (19)<br />

NOK 21 (21) 23 (23)<br />

Total 1,048 (1,048) 474 (474)<br />

The Group's equity would have been affected to the same extent as the income statement, but net of income tax. This is because the increase<br />

(decrease) in profit before tax would have affected retained earnings.<br />

NBI hf. Consolidated Financial Statements 2010 69<br />

All amounts are in ISK million<br />

Allar upphæðir eru í milljónum króna Ársreikningur 2010 169