Ársskýrsla Landsbankans - Landsbankinn

Ársskýrsla Landsbankans - Landsbankinn

Ársskýrsla Landsbankans - Landsbankinn

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

65. Derivative instruments<br />

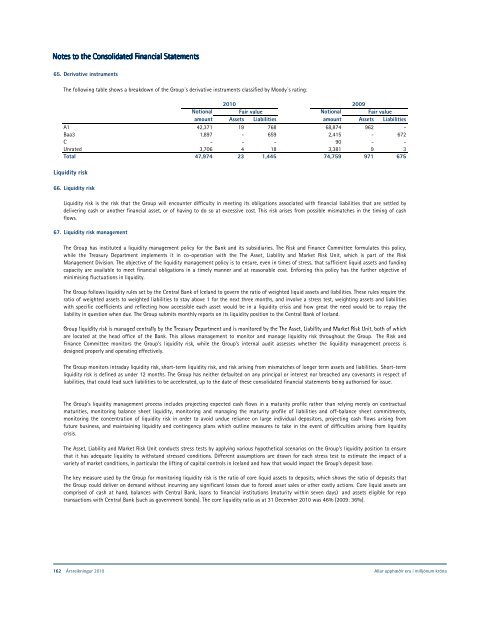

The following table shows a breakdown of the Group´s derivative instruments classified by Moody´s rating:<br />

2010 2009<br />

Notional Fair value<br />

Notional Fair value<br />

amount Assets Liabilities amount Assets Liabilities<br />

A1 42,371 19 768 68,874 962 -<br />

Baa3 1,897 - 659 2,415 - 672<br />

C - - - 90 - -<br />

Unrated 3,706 4 18 3,381 9 3<br />

Total 47,974 23 1,445 74,759 971 675<br />

Liquidity risk<br />

66. Liquidity risk<br />

Liquidity risk is the risk that the Group will encounter difficulty in meeting its obligations associated with financial liabilities that are settled by<br />

delivering cash or another financial asset, or of having to do so at excessive cost. This risk arises from possible mismatches in the timing of cash<br />

flows.<br />

67. Liquidity risk management<br />

The Group has instituted a liquidity management policy for the Bank and its subsidiaries. The Risk and Finance Committee formulates this policy,<br />

while the Treasury Department implements it in co-operation with the The Asset, Liability and Market Risk Unit, which is part of the Risk<br />

Management Division. The objective of the liquidity management policy is to ensure, even in times of stress, that sufficient liquid assets and funding<br />

capacity are available to meet financial obligations in a timely manner and at reasonable cost. Enforcing this policy has the further objective of<br />

minimising fluctuations in liquidity.<br />

The Group follows liquidity rules set by the Central Bank of Iceland to govern the ratio of weighted liquid assets and liabilities. These rules require the<br />

ratio of weighted assets to weighted liabilities to stay above 1 for the next three months, and involve a stress test, weighting assets and liabilities<br />

with specific coefficients and reflecting how accessible each asset would be in a liquidity crisis and how great the need would be to repay the<br />

liability in question when due. The Group submits monthly reports on its liquidity position to the Central Bank of Iceland.<br />

GGroup liquidity li idit risk ikiis managedd centrally t ll bby the th Treasury T Department D t t andd is i monitored it d by b the th Th The Asset, A t Liability Li bilit andd Market M ktRi Riskk Unit, U it both b th off which hi h<br />

are located at the head office of the Bank. This allows management to monitor and manage liquidity risk throughout the Group. The Risk and<br />

Finance Committee monitors the Group's liquidity risk, while the Group's internal audit assesses whether the liquidity management process is<br />

designed properly and operating effectively.<br />

The Group monitors intraday liquidity risk, short-term liquidity risk, and risk arising from mismatches of longer term assets and liabilities. Short-term<br />

liquidity risk is defined as under 12 months. The Group has neither defaulted on any principal or interest nor breached any covenants in respect of<br />

liabilities, that could lead such liabilities to be accelerated, up to the date of these consolidated financial statements being authorised for issue.<br />

The Group’s liquidity management process includes projecting expected cash flows in a maturity profile rather than relying merely on contractual<br />

maturities, monitoring balance sheet liquidity, monitoring and managing the maturity profile of liabilities and off-balance sheet commitments,<br />

monitoring the concentration of liquidity risk in order to avoid undue reliance on large individual depositors, projecting cash flows arising from<br />

future business, and maintaining liquidity and contingency plans which outline measures to take in the event of difficulties arising from liquidity<br />

crisis.<br />

The Asset, Liability and Market Risk Unit conducts stress tests by applying various hypothetical scenarios on the Group's liquidity position to ensure<br />

that it has adequate liquidity to withstand stressed conditions. Different assumptions are drawn for each stress test to estimate the impact of a<br />

variety of market conditions, in particular the lifting of capital controls in Iceland and how that would impact the Group’s deposit base.<br />

The key measure used by the Group for monitoring liquidity risk is the ratio of core liquid assets to deposits, which shows the ratio of deposits that<br />

the Group could deliver on demand without incurring any significant losses due to forced asset sales or other costly actions. Core liquid assets are<br />

comprised of cash at hand, balances with Central Bank, loans to financial institutions (maturity within seven days) and assets eligible for repo<br />

transactions with Central Bank (such as government bonds). The core liquidity ratio as at 31 December 2010 was 46% (2009: 36%).<br />

NBI hf. Consolidated Financial Statements 2010 62<br />

All amounts are in ISK million<br />

162 Ársreikningur 2010 Allar upphæðir eru í milljónum króna