SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- 28 -<br />

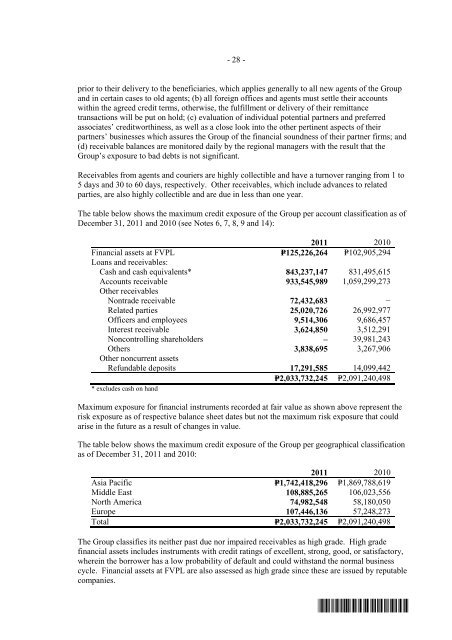

prior to their delivery to the beneficiaries, which applies generally to all new agents of the Group<br />

and in certain cases to old agents; (b) all foreign offices and agents must settle their accounts<br />

within the agreed credit terms, otherwise, the fulfillment or delivery of their remittance<br />

transactions will be put on hold; (c) evaluation of individual potential partners and preferred<br />

associates’ creditworthiness, as well as a close look into the other pertinent aspects of their<br />

partners’ businesses which assures the Group of the financial soundness of their partner firms; and<br />

(d) receivable balances are monitored daily by the regional managers with the result that the<br />

Group’s exposure to bad debts is not significant.<br />

Receivables from agents and couriers are highly collectible and have a turnover ranging from 1 to<br />

5 days and 30 to 60 days, respectively. Other receivables, which include advances to related<br />

parties, are also highly collectible and are due in less than one year.<br />

The table below shows the maximum credit exposure of the Group per account classification as of<br />

December 31, <strong>20</strong>11 and <strong>20</strong>10 (see Notes 6, 7, 8, 9 and 14):<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Financial assets at FVPL P=125,226,264 P=102,905,294<br />

Loans and receivables:<br />

Cash and cash equivalents* 843,237,147 831,495,615<br />

Accounts receivable 933,545,989 1,059,299,273<br />

Other receivables<br />

Nontrade receivable 72,432,683 −<br />

Related parties 25,0<strong>20</strong>,726 26,992,977<br />

Officers and employees 9,514,306 9,686,457<br />

Interest receivable 3,624,850 3,512,291<br />

Noncontrolling shareholders – 39,981,243<br />

Others 3,838,695 3,267,906<br />

Other noncurrent assets<br />

Refundable deposits 17,291,585 14,099,442<br />

P=2,033,732,245 P=2,091,240,498<br />

* excludes cash on hand<br />

Maximum exposure for financial instruments recorded at fair value as shown above represent the<br />

risk exposure as of respective balance sheet dates but not the maximum risk exposure that could<br />

arise in the future as a result of changes in value.<br />

The table below shows the maximum credit exposure of the Group per geographical classification<br />

as of December 31, <strong>20</strong>11 and <strong>20</strong>10:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Asia Pacific P=1,742,418,296 P=1,869,788,619<br />

Middle East 108,885,265 106,023,556<br />

North America 74,982,548 58,180,050<br />

Europe 107,446,136 57,248,273<br />

Total P=2,033,732,245 P=2,091,240,498<br />

The Group classifies its neither past due nor impaired receivables as high grade. High grade<br />

financial assets includes instruments with credit ratings of excellent, strong, good, or satisfactory,<br />

wherein the borrower has a low probability of default and could withstand the normal business<br />

cycle. Financial assets at FVPL are also assessed as high grade since these are issued by reputable<br />

companies.<br />

*SGVMC116502*