SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

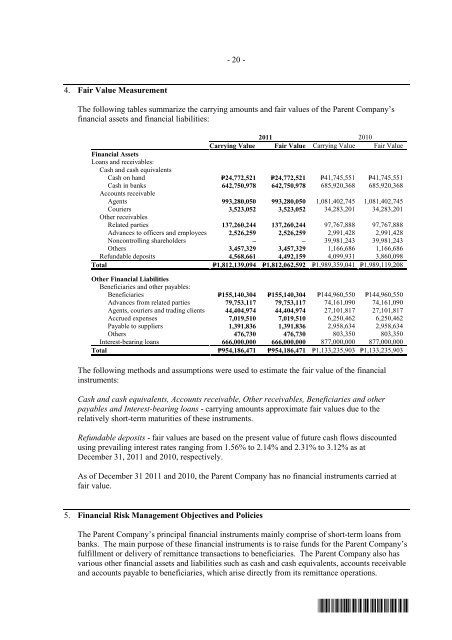

4. Fair Value Measurement<br />

- <strong>20</strong> -<br />

The following tables summarize the carrying amounts and fair values of the Parent Company’s<br />

financial assets and financial liabilities:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Carrying Value Fair Value Carrying Value Fair Value<br />

Financial Assets<br />

Loans and receivables:<br />

Cash and cash equivalents<br />

Cash on hand P=24,772,521 P=24,772,521 P=41,745,551 P=41,745,551<br />

Cash in banks<br />

Accounts receivable<br />

642,750,978 642,750,978 685,9<strong>20</strong>,368 685,9<strong>20</strong>,368<br />

Agents 993,280,050 993,280,050 1,081,402,745 1,081,402,745<br />

Couriers<br />

Other receivables<br />

3,523,052 3,523,052 34,283,<strong>20</strong>1 34,283,<strong>20</strong>1<br />

Related parties 137,260,244 137,260,244 97,767,888 97,767,888<br />

Advances to officers and employees 2,526,259 2,526,259 2,991,428 2,991,428<br />

Noncontrolling shareholders – – 39,981,243 39,981,243<br />

Others 3,457,329 3,457,329 1,166,686 1,166,686<br />

Refundable deposits 4,568,661 4,492,159 4,099,931 3,860,098<br />

Total P=1,812,139,094 P=1,812,062,592 P=1,989,359,041 P=1,989,119,<strong>20</strong>8<br />

Other Financial Liabilities<br />

Beneficiaries and other payables:<br />

Beneficiaries P=155,140,304 P=155,140,304 P=144,960,550 P=144,960,550<br />

Advances from related parties 79,753,117 79,753,117 74,161,090 74,161,090<br />

Agents, couriers and trading clients 44,404,974 44,404,974 27,101,817 27,101,817<br />

Accrued expenses 7,019,510 7,019,510 6,250,462 6,250,462<br />

Payable to suppliers 1,391,836 1,391,836 2,958,634 2,958,634<br />

Others 476,730 476,730 803,350 803,350<br />

Interest-bearing loans 666,000,000 666,000,000 877,000,000 877,000,000<br />

Total P=954,186,471 P=954,186,471 P=1,133,235,903 P=1,133,235,903<br />

The following methods and assumptions were used to estimate the fair value of the financial<br />

instruments:<br />

Cash and cash equivalents, Accounts receivable, Other receivables, Beneficiaries and other<br />

payables and Interest-bearing loans - carrying amounts approximate fair values due to the<br />

relatively short-term maturities of these instruments.<br />

Refundable deposits - fair values are based on the present value of future cash flows discounted<br />

using prevailing interest rates ranging from 1.56% to 2.14% and 2.31% to 3.12% as at<br />

December 31, <strong>20</strong>11 and <strong>20</strong>10, respectively.<br />

As of December 31 <strong>20</strong>11 and <strong>20</strong>10, the Parent Company has no financial instruments carried at<br />

fair value.<br />

5. Financial Risk Management Objectives and Policies<br />

The Parent Company’s principal financial instruments mainly comprise of short-term loans from<br />

banks. The main purpose of these financial instruments is to raise funds for the Parent Company’s<br />

fulfillment or delivery of remittance transactions to beneficiaries. The Parent Company also has<br />

various other financial assets and liabilities such as cash and cash equivalents, accounts receivable<br />

and accounts payable to beneficiaries, which arise directly from its remittance operations.<br />

*SGVMC116501*