SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance SEC Form 20-IS - iRemit Global Remittance

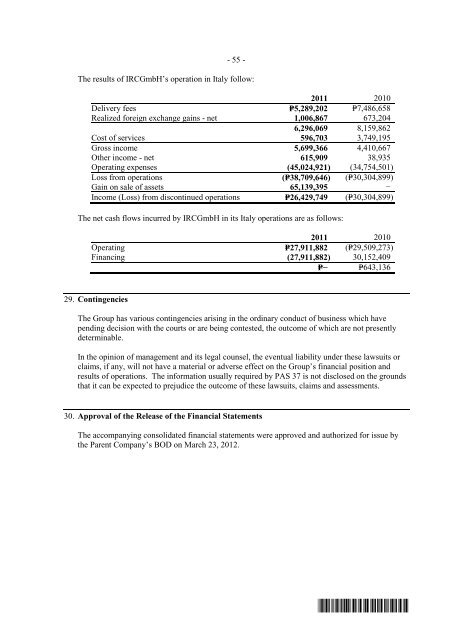

- 55 - The results of IRCGmbH’s operation in Italy follow: 2011 2010 Delivery fees P=5,289,202 P=7,486,658 Realized foreign exchange gains - net 1,006,867 673,204 6,296,069 8,159,862 Cost of services 596,703 3,749,195 Gross income 5,699,366 4,410,667 Other income - net 615,909 38,935 Operating expenses (45,024,921) (34,754,501) Loss from operations (P=38,709,646) (P=30,304,899) Gain on sale of assets 65,139,395 − Income (Loss) from discontinued operations P=26,429,749 (P=30,304,899) The net cash flows incurred by IRCGmbH in its Italy operations are as follows: 2011 2010 Operating P=27,911,882 (P=29,509,273) Financing (27,911,882) 30,152,409 P= − P=643,136 29. Contingencies The Group has various contingencies arising in the ordinary conduct of business which have pending decision with the courts or are being contested, the outcome of which are not presently determinable. In the opinion of management and its legal counsel, the eventual liability under these lawsuits or claims, if any, will not have a material or adverse effect on the Group’s financial position and results of operations. The information usually required by PAS 37 is not disclosed on the grounds that it can be expected to prejudice the outcome of these lawsuits, claims and assessments. 30. Approval of the Release of the Financial Statements The accompanying consolidated financial statements were approved and authorized for issue by the Parent Company’s BOD on March 23, 2012. *SGVMC116502*

- Page 68 and 69: - 5 - Changes in Accounting Policie

- Page 70 and 71: - 7 - deferred cumulative amount pr

- Page 72 and 73: - 9 - For all other financial instr

- Page 74 and 75: - 11 - Estimates of changes in futu

- Page 76 and 77: - 13 - Gains or losses arising from

- Page 78 and 79: - 15 - Once a financial asset or a

- Page 80 and 81: - 17 - Income Taxes Current tax Cur

- Page 82 and 83: - 19 - Related party relationships

- Page 84 and 85: - 21 - PFRS 13, Fair Value Measurem

- Page 86 and 87: - 23 - d. Discontinued Operations M

- Page 88 and 89: - 25 - As of December 31, 2011 and

- Page 90 and 91: - 27 - The following methods and as

- Page 92 and 93: - 29 - As at December 31, 2011, the

- Page 94 and 95: - 31 - Change in nominal 2010 Chang

- Page 96 and 97: 6. Cash and Cash Equivalents This a

- Page 98 and 99: 10. Other Current Assets This accou

- Page 100 and 101: Office and Communication Equipment

- Page 102 and 103: - 39 - value of the additional inte

- Page 104 and 105: 16. Interest-Bearing Loans - 41 - T

- Page 106 and 107: - 43 - The Group’s objective is t

- Page 108 and 109: The major categories of plan assets

- Page 110 and 111: - 47 - (f) On July 1, 2011, the Par

- Page 112 and 113: - 49 - In the ordinary course of bu

- Page 114 and 115: - 51 - The table below shows the in

- Page 116 and 117: - 53 - Segment information as of an

- Page 120 and 121: I-REMIT, INC. AND SUBSIDIARIES INDE

- Page 122 and 123: - 2 - I-REMIT, INC. SCHEDULE OF ALL

- Page 124 and 125: - 4 - Schedule II Page 3 of 5 Phili

- Page 126 and 127: - 6 - Schedule II Page 5 of 5 Appli

- Page 128 and 129: Name of issuing entity and associat

- Page 130 and 131: Name of Debtor - 10 - I-Remit, Inc.

- Page 132 and 133: Title of issue and type of obligati

- Page 134 and 135: Name of issuing entity of securitie

- Page 136: P I - R E M I T , I N C . (Company

- Page 145 and 146: Associates: IRemit Singapore Pte Lt

- Page 147 and 148: - 4 - Financial Instruments Initial

- Page 149 and 150: - 6 - takes the form of a guarantee

- Page 151 and 152: - 8 - Depreciation and amortization

- Page 153 and 154: - 10 - life of the financial instru

- Page 155 and 156: - 12 - Income Taxes Current tax Cur

- Page 157 and 158: - 14 - Standards Issued but not yet

- Page 159 and 160: - 16 - estate directly or through s

- Page 161 and 162: - 18 - b. Impairment of nonfinancia

- Page 163 and 164: 4. Fair Value Measurement - 20 - Th

- Page 165 and 166: - 22 - The table below shows the ma

- Page 167 and 168: - 24 - Financial assets Maturity pr

- 55 -<br />

The results of IRCGmbH’s operation in Italy follow:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Delivery fees P=5,289,<strong>20</strong>2 P=7,486,658<br />

Realized foreign exchange gains - net 1,006,867 673,<strong>20</strong>4<br />

6,296,069 8,159,862<br />

Cost of services 596,703 3,749,195<br />

Gross income 5,699,366 4,410,667<br />

Other income - net 615,909 38,935<br />

Operating expenses (45,024,921) (34,754,501)<br />

Loss from operations (P=38,709,646) (P=30,304,899)<br />

Gain on sale of assets 65,139,395 −<br />

Income (Loss) from discontinued operations P=26,429,749 (P=30,304,899)<br />

The net cash flows incurred by IRCGmbH in its Italy operations are as follows:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Operating P=27,911,882 (P=29,509,273)<br />

Financing (27,911,882) 30,152,409<br />

P= − P=643,136<br />

29. Contingencies<br />

The Group has various contingencies arising in the ordinary conduct of business which have<br />

pending decision with the courts or are being contested, the outcome of which are not presently<br />

determinable.<br />

In the opinion of management and its legal counsel, the eventual liability under these lawsuits or<br />

claims, if any, will not have a material or adverse effect on the Group’s financial position and<br />

results of operations. The information usually required by PAS 37 is not disclosed on the grounds<br />

that it can be expected to prejudice the outcome of these lawsuits, claims and assessments.<br />

30. Approval of the Release of the Financial Statements<br />

The accompanying consolidated financial statements were approved and authorized for issue by<br />

the Parent Company’s BOD on March 23, <strong>20</strong>12.<br />

*SGVMC116502*