SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

SEC Form 20-IS - iRemit Global Remittance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 51 -<br />

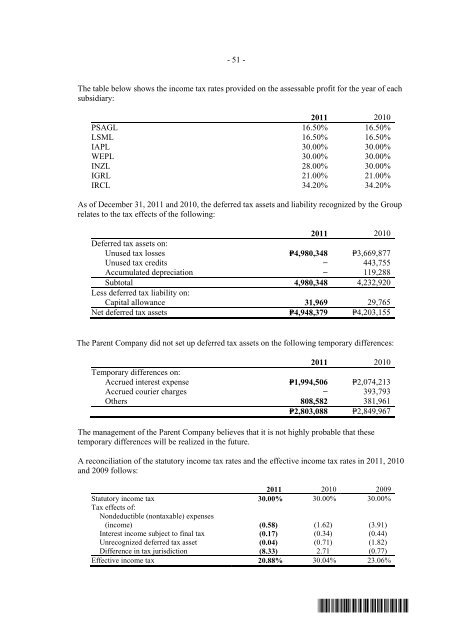

The table below shows the income tax rates provided on the assessable profit for the year of each<br />

subsidiary:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

PSAGL 16.50% 16.50%<br />

LSML 16.50% 16.50%<br />

IAPL 30.00% 30.00%<br />

WEPL 30.00% 30.00%<br />

INZL 28.00% 30.00%<br />

IGRL 21.00% 21.00%<br />

IRCL 34.<strong>20</strong>% 34.<strong>20</strong>%<br />

As of December 31, <strong>20</strong>11 and <strong>20</strong>10, the deferred tax assets and liability recognized by the Group<br />

relates to the tax effects of the following:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Deferred tax assets on:<br />

Unused tax losses P=4,980,348 P=3,669,877<br />

Unused tax credits − 443,755<br />

Accumulated depreciation − 119,288<br />

Subtotal<br />

Less deferred tax liability on:<br />

4,980,348 4,232,9<strong>20</strong><br />

Capital allowance 31,969 29,765<br />

Net deferred tax assets P=4,948,379 P=4,<strong>20</strong>3,155<br />

The Parent Company did not set up deferred tax assets on the following temporary differences:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Temporary differences on:<br />

Accrued interest expense P=1,994,506 P=2,074,213<br />

Accrued courier charges − 393,793<br />

Others 808,582 381,961<br />

P=2,803,088 P=2,849,967<br />

The management of the Parent Company believes that it is not highly probable that these<br />

temporary differences will be realized in the future.<br />

A reconciliation of the statutory income tax rates and the effective income tax rates in <strong>20</strong>11, <strong>20</strong>10<br />

and <strong>20</strong>09 follows:<br />

<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09<br />

Statutory income tax 30.00% 30.00% 30.00%<br />

Tax effects of:<br />

Nondeductible (nontaxable) expenses<br />

(income) (0.58) (1.62) (3.91)<br />

Interest income subject to final tax (0.17) (0.34) (0.44)<br />

Unrecognized deferred tax asset (0.04) (0.71) (1.82)<br />

Difference in tax jurisdiction (8.33) 2.71 (0.77)<br />

Effective income tax <strong>20</strong>.88% 30.04% 23.06%<br />

*SGVMC116502*