Annual Report 2007 - Muehlhan AG

Annual Report 2007 - Muehlhan AG

Annual Report 2007 - Muehlhan AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ManaGeMent divisions share Group ManaGeMent report group Consolidated FinanCial stateMents<br />

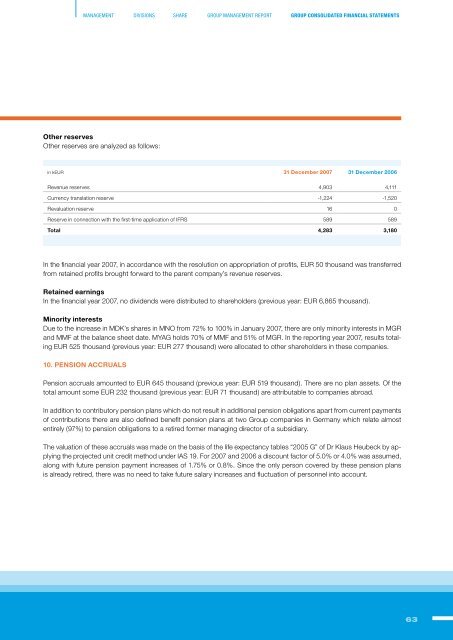

Other reserves<br />

other reserves are analyzed as follows:<br />

in kEur 31 December <strong>2007</strong> 31 December 2006<br />

revenue reserves 4,903 4,111<br />

Currency translation reserve -1,224 -1,520<br />

revaluation reserve 16 0<br />

reserve in connection with the first-time application of ifrS 589 589<br />

Total 4,283 3,180<br />

in the financial year <strong>2007</strong>, in accordance with the resolution on appropriation of profits, Eur 50 thousand was transferred<br />

from retained profits brought forward to the parent company’s revenue reserves.<br />

Retained earnings<br />

in the financial year <strong>2007</strong>, no dividends were distributed to shareholders (previous year: Eur 6,865 thousand).<br />

Minority interests<br />

due to the increase in MdK’s shares in MNo from 72% to 100% in January <strong>2007</strong>, there are only minority interests in MGr<br />

and MMf at the balance sheet date. MyaG holds 70% of MMf and 51% of MGr. in the reporting year <strong>2007</strong>, results totaling<br />

Eur 525 thousand (previous year: Eur 277 thousand) were allocated to other shareholders in these companies.<br />

10. PENSION ACCRUALS<br />

pension accruals amounted to Eur 645 thousand (previous year: Eur 519 thousand). there are no plan assets. of the<br />

total amount some Eur 232 thousand (previous year: Eur 71 thousand) are attributable to companies abroad.<br />

in addition to contributory pension plans which do not result in additional pension obligations apart from current payments<br />

of contributions there are also defined benefit pension plans at two Group companies in Germany which relate almost<br />

entirely (97%) to pension obligations to a retired former managing director of a subsidiary.<br />

the valuation of these accruals was made on the basis of the life expectancy tables “2005 G” of dr Klaus Heubeck by applying<br />

the projected unit credit method under iaS 19. for <strong>2007</strong> and 2006 a discount factor of 5.0% or 4.0% was assumed,<br />

along with future pension payment increases of 1.75% or 0.8%. Since the only person covered by these pension plans<br />

is already retired, there was no need to take future salary increases and fluctuation of personnel into account.<br />

63