Q1-02 US GAAP - MKS

Q1-02 US GAAP - MKS

Q1-02 US GAAP - MKS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

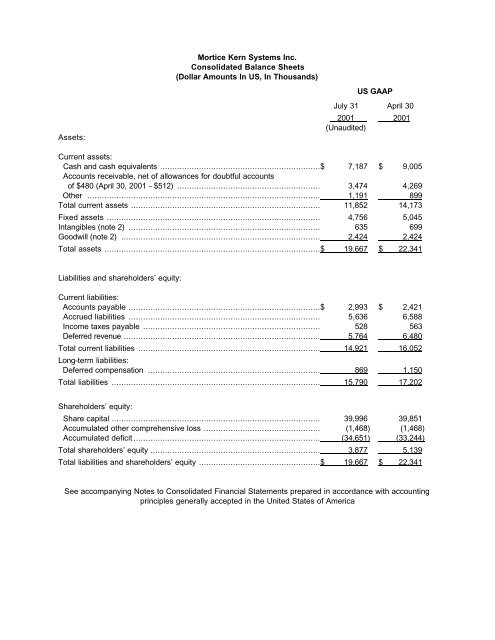

Assets:<br />

Mortice Kern Systems Inc.<br />

Consolidated Balance Sheets<br />

(Dollar Amounts In <strong>US</strong>, In Thousands)<br />

<strong>US</strong> <strong>GAAP</strong><br />

July 31 April 30<br />

2001 2001<br />

(Unaudited)<br />

Current assets:<br />

Cash and cash equivalents ..................................................................$ 7,187 $ 9,005<br />

Accounts receivable, net of allowances for doubtful accounts<br />

of $480 (April 30, 2001 - $512) ........................................................... 3,474 4,269<br />

Other ................................................................................................ 1,191 899<br />

Total current assets .............................................................................. 11,852 14,173<br />

Fixed assets ........................................................................................ 4,756 5,045<br />

Intangibles (note 2) ............................................................................... 635 699<br />

Goodwill (note 2) .................................................................................. 2,424 2,424<br />

Total assets .........................................................................................$ 19,667 $ 22,341<br />

Liabilities and shareholders’ equity:<br />

Current liabilities:<br />

Accounts payable ...............................................................................$ 2,993 $ 2,421<br />

Accrued liabilities ............................................................................... 5,636 6,588<br />

Income taxes payable ......................................................................... 528 563<br />

Deferred revenue ................................................................................. 5,764 6,480<br />

Total current liabilities ........................................................................... 14,921 16,052<br />

Long-term liabilities:<br />

Deferred compensation ....................................................................... 869 1,150<br />

Total liabilities ...................................................................................... 15,790 17,2<strong>02</strong><br />

Shareholders’ equity:<br />

Share capital ...................................................................................... 39,996 39,851<br />

Accumulated other comprehensive loss ................................................ (1,468) (1,468)<br />

Accumulated deficit ............................................................................. (34,651) (33,244)<br />

Total shareholders’ equity ...................................................................... 3,877 5,139<br />

Total liabilities and shareholders’ equity ..................................................$ 19,667 $ 22,341<br />

See accompanying Notes to Consolidated Financial Statements prepared in accordance with accounting<br />

principles generally accepted in the United States of America

Mortice Kern Systems Inc.<br />

Consolidated Statements of Operations<br />

(Dollar Amounts in <strong>US</strong>, In Thousands, Except Per Share Data)<br />

<strong>US</strong> <strong>GAAP</strong><br />

Three Months Ended July 31<br />

2001 2000<br />

(Unaudited)<br />

Revenue:<br />

License ......................................................................................... $ 5,101 $ 4,917<br />

Service .......................................................................................... 1,543 1,593<br />

Total revenue ..................................................................................... 6,644 6,510<br />

Cost of revenue:<br />

License ......................................................................................... 143 247<br />

Service .......................................................................................... 1,305 1,456<br />

Total cost of revenue .......................................................................... 1,448 1,703<br />

Gross profit ....................................................................................... 5,196 4,807<br />

Operating expenses:<br />

Sales and marketing ....................................................................... 3,581 5,536<br />

Research and development .............................................................. 2,<strong>02</strong>5 1,900<br />

General and administrative .............................................................. 957 1,379<br />

Amortization of intangibles ............................................................... 64 272<br />

Write down of intangibles ................................................................ – 8,091<br />

Reorganization expense .................................................................. – 668<br />

Total operating expenses ................................................................... 6,627 17,846<br />

Loss from operations ......................................................................... (1,431) (13,039)<br />

Interest income - net .......................................................................... 24 27<br />

Loss before income taxes .................................................................. (1,407) (13,012)<br />

Income tax recovery ........................................................................... – 537<br />

Net loss ............................................................................................ (1,407) (12,475)<br />

Accumulated deficit, beginning of period .............................................. (33,244) (6,589)<br />

Accumulated deficit, end of period ....................................................... $ (34,651) $ (19,064)<br />

Loss per share:<br />

Basic and diluted ............................................................................ $ (0.04) $ (0.72)<br />

Weighted average number of shares outstanding ............................... 32,169 17,438<br />

See accompanying Notes to Consolidated Financial Statements prepared in accordance with accounting<br />

principles generally accepted in the United States of America

Balances at April 30, 2000 17,325 $ 26,635<br />

Mortice Kern Systems Inc.<br />

Consolidated Statements of Shareholders’ Equity<br />

(Dollar Amounts In <strong>US</strong>, In Thousands)<br />

<strong>US</strong> <strong>GAAP</strong><br />

Common Shares<br />

Additional<br />

Paid In<br />

Warrants<br />

Number Amount Capital Number Amount<br />

$<br />

– –<br />

Accumulated<br />

Other<br />

Comprehensive<br />

Loss<br />

$<br />

– $ (1,468)<br />

Retained<br />

Earnings<br />

(Deficit) Total<br />

$<br />

(6,589) $ 18,578<br />

Issuance of common<br />

shares for cash 114 420 – – – – – 420<br />

Net loss – – – – – – (12,475) (12,475)<br />

Balances at July 31, 2000 17,439 $ 27,055<br />

$<br />

– –<br />

$<br />

– $ (1,468)<br />

$<br />

(19,064) $ 6,523<br />

Cancellation of shares<br />

related to prepaid<br />

compensation (35) (101) – – – – – (101)<br />

Issuance of Secured<br />

Special Debentures – 1,265 – 8,163 1,713 – – 2,978<br />

Repayment/conversion<br />

of Secured Special<br />

Debentures 4,731 1,991 – – – – – 1,991<br />

Issuance of special<br />

warrants for cash – – – 9,260 7,089 – – 7,089<br />

Issuance of<br />

compensation warrants – – – 926 – – – –<br />

Issuance of acquisition<br />

warrants – – – 561 506 – – 506<br />

Issuance of common<br />

shares for cash 2 3 – – – – – 3<br />

Stock based<br />

compensation – – 330 – – – – 330<br />

Net loss – – – – – – (14,180) (14,180)<br />

Balances at April 30, 2001 22,137 $ 30,213 $ 330 18,910 $ 9,308 $ (1,468)<br />

$<br />

(33,244) $ 5,139<br />

Conversion of special<br />

warrants into common<br />

shares (Unaudited) 9,260 7,089 – (9,260) (7,089) – – –<br />

Exercise of purchase<br />

warrants for cash<br />

(Unaudited) 340 120 – (340) – – – 120<br />

Issuance of common<br />

shares for cash<br />

(Unaudited) 63 25 – – – – – 25<br />

Exercise of acquisition<br />

warrants for cash<br />

(Unaudited) 561 506 – (561) (506) – – –<br />

Net loss – – – – – – (1,407) (1,407)

Balances at July 31, 2001<br />

(Unaudited) 32,361 $ 37,953 $ 330 8,749 $ 1,713 $ (1,468)<br />

$<br />

(34,651) $ 3,877<br />

See accompanying Notes to Consolidated Financial Statements prepared in accordance with accounting<br />

principles generally accepted in the United States of America

Mortice Kern Systems Inc.<br />

Consolidated Statements of Cash Flows<br />

(Dollar Amounts in <strong>US</strong>, In Thousands, Unaudited)<br />

<strong>US</strong> <strong>GAAP</strong><br />

Three Months Ended July 31<br />

2001 2000<br />

(Unaudited)<br />

Cash flows from operating activities:<br />

Net loss ............................................................................................ $ (1,407) $ (12,475)<br />

Adjustments to reconcile net loss to net cash<br />

provided by (used for) operating activities:<br />

Deferred income taxes .................................................................. – (549)<br />

Depreciation and amortization of fixed assets................................... 365 314<br />

Amortization of intangibles ............................................................. 64 272<br />

Write down of intangibles .............................................................. – 8,091<br />

Interest on deferred compensation .................................................. 29 30<br />

Change in operating assets and liabilities, net of acquired balances:<br />

Accounts receivable ...................................................................... 795 3,186<br />

Other current assets ..................................................................... (294) 480<br />

Accounts payable, net of deferred compensation ............................. 446 286<br />

Accrued liabilities ......................................................................... (952) (298)<br />

Income taxes payable ................................................................... (35) (439)<br />

Deferred revenue ........................................................................... (716) (1,<strong>02</strong>7)<br />

Net cash used for operating activities .................................................. (1,705) (2,129)<br />

Cash flows from investing activities:<br />

Purchase of fixed assets ................................................................. (76) (471)<br />

Net cash used for investing activities ................................................... (76) (471)<br />

Cash flows from financing activities:<br />

Proceeds on issuance of common shares ......................................... 145 420<br />

Payments of deferred compensation ................................................. (182) –<br />

Net cash provided by (used for) financing activities ................................ (37) 420<br />

Effect of exchange rate changes on cash balances ............................... – 126<br />

Change in cash and cash equivalents .................................................. (1,818) (2,054)<br />

Cash and cash equivalents, beginning of period .................................... 9,005 8,193<br />

Cash and cash equivalents, end of period ............................................ $ 7,187 $ 6,139<br />

Supplemental schedules:<br />

Cash paid for:<br />

Interest .......................................................................................... $ 3 $ 32<br />

Income taxes ................................................................................. $ 35 $ 360<br />

See accompanying Notes to Consolidated Financial Statements prepared in accordance with accounting<br />

principles generally accepted in the United States of America

1. Significant accounting policies<br />

a) Basis of presentation:<br />

Mortice Kern Systems Inc.<br />

Notes to Consolidated Financial Statements<br />

(Dollar Amounts in <strong>US</strong>, In Thousands, Except Per Share Data, Unaudited)<br />

The accompanying consolidated financial statements of Mortice Kern Systems Inc. (“<strong>MKS</strong>” or the<br />

“Company”) as at July 31, 2001 and for the three month periods ended July 31, 2001 and 2000 are unaudited<br />

and have been prepared in accordance with generally accepted accounting principles in the United States<br />

for interim financial information, using the same accounting policies and methods of application as used in<br />

the April 30, 2001 financial statements, except for item 1(b) and 1(c) listed below. Accordingly, they do not<br />

include all of the information and footnotes required by generally accepted accounting principles for annual<br />

financial statements. In the opinion of management, all adjustments, consisting only of normal recurring<br />

adjustments necessary for a fair presentation, have been included. The results for the interim periods<br />

presented are not necessarily indicative of the results that may be expected for any future period. The<br />

following information should be read in conjunction with the consolidated financial statements and notes<br />

thereto included in the Company’s Annual Report for the year ended April 30, 2001.<br />

b) Change in classification of revenue:<br />

As outlined in Note 1(c) to the April 30, 2001 financial statements, the Company’s revenue is derived from<br />

license elements, comprised of license fees, upgrades and royalties from technology licenses, and service<br />

elements, which include maintenance, installation and training. The Company delivers product upgrades in<br />

the form of licenses to its customers and, accordingly, has changed the classification of revenue in the<br />

statements of operations in the quarter ended July 31, 2001.<br />

<strong>MKS</strong> bills its existing customers for ongoing maintenance, which includes both support and upgrade<br />

licenses. The Company’s revenue recognition policy is to allocate such revenue between license and<br />

service elements to the extent of their fair values where vendor specific objective evidence exists of the fair<br />

value of the elements. The Company has reviewed its methodology for the classification of revenue in its<br />

consolidated statements of operations relating to annual support contracts and has retroactively changed<br />

the classification of license and service revenue. Although the Company continues to recognize upgrade<br />

license revenue ratably over the term of the related support agreement and has, therefore, not changed its<br />

accounting policy or the method of application, the Company has determined that upgrade license revenue<br />

is more appropriately classified as license revenue and that service revenue reflects the cost of providing<br />

maintenance service plus an estimated margin. Accordingly, the Company has increased license revenue<br />

and decreased service revenue for the period ended July 31, 2000 by $1,793. This change in classification<br />

has no impact on previously reported total revenue or net loss.<br />

c) Recent accounting pronouncements:<br />

Effective May 1, 2001, the Company adopted the recommendations in Statement of Financial Accounting<br />

Standards No. 142, “Goodwill and Other Intangible Assets” (SFAS 142). This standard requires ceasing<br />

amortization of goodwill, and allocating the goodwill to reporting units subject to at least an annual<br />

impairment test. An impairment loss is determined under this test by comparing the book value of goodwill<br />

to the fair value of the reporting unit to which the goodwill relates. The Company continues to amortize its<br />

other intangible assets on the balance sheet over a three year period.

1. Significant accounting policies:<br />

Mortice Kern Systems Inc.<br />

Notes to Consolidated Financial Statements<br />

(Dollar Amounts in <strong>US</strong>, In Thousands, Except Per Share Data)<br />

c) Recent accounting pronouncements: con’t<br />

On May 1, 2001, the Company assigned its goodwill balances to reporting units that coincided with the<br />

Company’s reportable operating segments as follows:<br />

May 1<br />

2001<br />

Software Configuration Management $ 2,424<br />

Interoperability -<br />

$ 2,424<br />

The impact on the July 31, 2001 interim quarterly financial statements is a reduction of amortization<br />

expense of $208, or a reduction of loss of $0.01 per share. Had SFAS 142 been in effect in July 31, 2000,<br />

there would be no impact on the financial statements given the Company did not have any goodwill at this<br />

point of time.<br />

2. Intangibles and goodwill:<br />

Intangibles:<br />

July 31 April 30<br />

2001 2001<br />

Purchased software, gross $ 681 $ 681<br />

Other intangibles, gross 356 356<br />

Accumulated amortization (4<strong>02</strong>) (336)<br />

Intangibles, net $ 635 $ 701<br />

Goodwill, gross $ 2,493 $ 2,493<br />

Accumulated amortization (69) (69)<br />

Goodwill, net $ 2,424 $ 2,424<br />

3. Segmented information:<br />

The Company evaluates operational performance based on two operating segments:<br />

Software Configuration Management (SCM) and Interoperability (IO). The segments are managed separately<br />

because each requires unique marketing strategies and is exposed to different economic environments. The<br />

SCM segment develops and markets software solutions that assist programmers in the creation of<br />

traditional and Web-based software, and in the management of the software development process. The IO<br />

segment encompasses products that address the issues surrounding cross-platform development,<br />

application migration, systems administration and network management.<br />

It is the Company’s policy to price internal sales or transfer values for services on an equivalent basis as<br />

that used for external pricing.

3. Segmented information: con’t<br />

Mortice Kern Systems Inc.<br />

Notes to Consolidated Financial Statements<br />

(Dollar Amounts in <strong>US</strong>, In Thousands, Except Per Share Data)<br />

The following schedules provide required segmented information disclosure.<br />

Quarter Ended<br />

July 31, 2001 July 31, 2000<br />

SCM IO Total SCM IO Total<br />

Revenue:<br />

License........................... $ 2,599 $ 2,5<strong>02</strong> $ 5,101 $ 2,667 $ 2,250 $ 4,917<br />

Service ............................ 1,258 285 1,543 1,328 265 1,593<br />

Total revenue .................... $ 3,857 $ 2,787 $ 6,644 $ 3,995 $ 2,515 $ 6,510<br />

Segment profit (loss)....... (1,863) 432 (1,431) (13,143) 104 (13,039)<br />

Interest and income taxes 24 564<br />

Net loss .............................. $ (1,407) $ (12,475)<br />

July 31, 2001 April 30, 2001<br />

Identifiable assets ........... $ 16,724 $ 2,943 $ 19,667 $ 18,771 $ 3,570 $ 22,341<br />

Geographic segmentation of revenue is determined based on the location of the customer.<br />

4. Reclassification:<br />

Quarter Ended<br />

July 31, 2001 July 31, 2000<br />

SCM IO Total SCM IO Total<br />

Revenue:<br />

North America................ $ 3,006 $ 2,334 $ 5,340 $ 2,593 $ 2,059 $ 4,652<br />

Europe & Other.............. 851 453 1,304 1,4<strong>02</strong> 456 1,858<br />

Total revenue .................... $ 3,857 $ 2,787 $ 6,644 $ 3,995 $ 2,515 $ 6,510<br />

Certain comparative figures have been reclassified to conform with the current period’s financial statement<br />

presentation.