Population Profile Barangay Count - DILG

Population Profile Barangay Count - DILG

Population Profile Barangay Count - DILG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

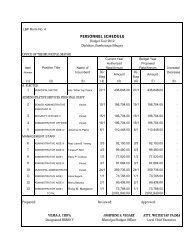

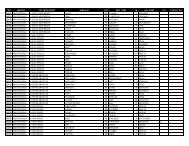

Financial <strong>Profile</strong>:<br />

Revenue Generation<br />

Source: LGPMS, 2011<br />

IRA Dependency<br />

Highest IRA Dependency Lowest IRA<br />

(Local Revenues vs. IRA)<br />

Dependency<br />

Prov’l Ave. 89% Lanao del Sur<br />

99.97%<br />

Bataan<br />

46%<br />

City Ave. 65% Himamaylan City,<br />

Negros Occidental<br />

Municipal Ave. 88% Hadji Panglima<br />

Tahil, Sulu<br />

95.68% Makati City 7%<br />

99.96% Sual, Pangasinan 20%<br />

Locally-Sourced Revenues,<br />

Highest Locally-Sourced Lowest Locally-Sourced<br />

in PhP Million<br />

Revenues<br />

Revenues<br />

Prov’l Ave. 129.07 Cavite 808.24 Lanao del Sur<br />

Tangub City,<br />

0.36<br />

City Ave. 455.14 Makati City 8,355.83 Misamis<br />

Occidental<br />

8.21<br />

Municipal Ave. 12.99<br />

Cabuyao,<br />

Laguna<br />

456.49<br />

Hadji<br />

Panglima Tahil<br />

0.01007<br />

IRA Share, in PhP Million<br />

Highest IRA Share<br />

Lowest IRA Share<br />

Prov’l Ave. 842.53 Pangasinan 1,804.63 Siquijor 203.59<br />

City Ave.<br />

464.89<br />

Davao City 2,615.74<br />

El Salvador City,<br />

Misamis Oriental<br />

San Benito,<br />

60.72<br />

Municipal Ave.<br />

Bacoor, Cavite 368.00 Surigao del<br />

2.30<br />

63.61<br />

Norte<br />

LGUs’ Total Income,<br />

in PhP Million<br />

Highest Total Income<br />

Lowest Total Income<br />

Prov’l Ave. 777.77 Cavite 2,481.57 Siquijor<br />

El Salvador City,<br />

227.93<br />

City Ave. 1,001.58 Quezon City 12,761.67 Misamis<br />

Oriental<br />

San Benito,<br />

89.055<br />

Municipal Ave.<br />

Notes:<br />

82.24 Bacoor, Cavite 750.00 Surigao del<br />

Norte<br />

2.68<br />

1. Computation of IRA Dependency:<br />

IRA Dependency = (IRA/Regular Revenue)*100<br />

Regular Revenue = (IRA+Locally-Sourced Revenues)<br />

2. Computation is based on data from 79 provinces, 135 cities, and 1,468 municipalities.<br />

3. Locally Sourced Revenues are from Local Tax and Non-Tax Revenues.<br />

4. LGUs’ Total Income is obtained from locally-sourced revenues and external sources like IRA, other<br />

shares from national tax collections, inter-local transfer, extraordinary receipts, grants and donations.