Nokia falls into the arms of Microsoft

Nokia falls into the arms of Microsoft

Nokia falls into the arms of Microsoft

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

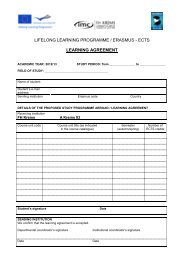

Because <strong>of</strong> <strong>the</strong> variety <strong>of</strong> topics (also resembling <strong>the</strong> chair-structure <strong>of</strong> <strong>the</strong><br />

Export-oriented Management programme), applicants receive 2 texts with<br />

different focus areas, and select <strong>the</strong> one that <strong>the</strong>y prefer to discuss. We<br />

want to give applicants a good chance that <strong>the</strong>y get a text <strong>the</strong>y want to<br />

work with. A selection <strong>of</strong> texts used for <strong>the</strong> application process (admission<br />

<strong>of</strong> <strong>the</strong> 2011/12 cohort) can be found below; <strong>the</strong> articles might be a good<br />

read, actually. Enjoy!<br />

<strong>Nokia</strong> <strong>falls</strong> <strong>into</strong> <strong>the</strong> <strong>arms</strong> <strong>of</strong><br />

Micros<strong>of</strong>t<br />

Feb 11th 2011, 9:57 by The Economist online<br />

IT LOOKS, in a way, like a stealth takeover. In September Stephen Elop,<br />

one <strong>of</strong> Micros<strong>of</strong>t's leading lights, becomes boss <strong>of</strong> <strong>Nokia</strong>, a troubled<br />

Finnish handset-maker. Five months later, Mr Elop will make Windows<br />

Phone, Micros<strong>of</strong>t's operating system for smartphones, its "primary<br />

platform" for such devices. Yet this is only one <strong>of</strong> <strong>the</strong> radical decisions<br />

<strong>Nokia</strong>'s new boss announced on February 11th, shortly after sending his<br />

staff an apocalyptic memo warning <strong>the</strong>m that <strong>the</strong>y were standing on a<br />

burning oil platform and risked being consumed by <strong>the</strong> flames. The firm<br />

will henceforth have just two distinct businesses, smartphones and massmarket<br />

mobiles, and get a new operational structure and leadership team,<br />

more <strong>of</strong> whom will come from outside Finland.<br />

This is an astonishing upheaval for what was once one <strong>of</strong> Europe‟s hottest<br />

firms. <strong>Nokia</strong>‟s problems are symptomatic for much <strong>of</strong> Europe‟s mobilephone<br />

industry. In <strong>the</strong> 1990s Europe appeared to have beaten even<br />

Silicon Valley in mobile technology. European telecoms firms had settled<br />

on a single standard for mobile phones. Handsets became affordable,

Europe was <strong>the</strong> biggest market for <strong>the</strong>m and <strong>the</strong> old continent‟s standard<br />

took over <strong>the</strong> world, with Europe leading <strong>the</strong> way with constant<br />

innovation.<br />

This changed with <strong>the</strong> emergence <strong>of</strong> smartphones, in particular Apple‟s<br />

iPhone in 2007. <strong>Nokia</strong> still ships a third <strong>of</strong> all handsets, but Apple pulls in<br />

more than half <strong>of</strong> <strong>the</strong> pr<strong>of</strong>its, despite having a market share <strong>of</strong> barely 4%.<br />

More Americans now have smartphones than Europeans.<br />

<strong>Nokia</strong>, along with <strong>the</strong> rest <strong>of</strong> Europe‟s mobile industry, is also being<br />

squeezed in both simple handsets and networking equipment. Cheap<br />

mobile phones based on chips from MediaTek, a company based in<br />

Taiwan, are increasingly popular in developing countries. This system and<br />

its users now account for more than one-third <strong>of</strong> <strong>the</strong> phones sold globally.<br />

At its most fundamental, this shift is <strong>the</strong> result <strong>of</strong> Moore‟s Law, which<br />

holds that microprocessors double in computing power every 18 months.<br />

The first generations <strong>of</strong> modern mobile phones were purely devices for<br />

conversation and text messages. The money lay in designing desirable<br />

handsets, manufacturing <strong>the</strong>m cheaply and distributing <strong>the</strong>m widely. This<br />

played to European strengths. The necessary skills overlapped most <strong>of</strong> all<br />

in Finland, which explains why <strong>Nokia</strong>, a company that grew up producing<br />

rubber boots and paper, could become <strong>the</strong> world leader in handsets.<br />

Nowadays <strong>the</strong> focus is on s<strong>of</strong>tware and data services. This is where<br />

America, in particular Silicon Valley, is hard to beat. Companies like Apple<br />

and Google know how to build overarching technology platforms. And <strong>the</strong><br />

Valley boasts an unparalleled ecosystem <strong>of</strong> entrepreneurs, venture<br />

capitalists and s<strong>of</strong>tware developers who regularly spawn innovative<br />

services.

The perils <strong>of</strong> dallying<br />

<strong>Nokia</strong> realised its world was changing and was working on a touch-screen<br />

phone much like <strong>the</strong> iPhone as early as 2004. Realising <strong>the</strong> importance <strong>of</strong><br />

mobile services, it launched Ovi, an online storefront for such things in<br />

2007, a year before Apple opened its highly successful App Store.<br />

But turning a Finnish hardware-maker <strong>into</strong> a provider <strong>of</strong> s<strong>of</strong>tware and<br />

services is no easy undertaking. <strong>Nokia</strong> dallied and lost <strong>the</strong> initiative.<br />

Historically, <strong>Nokia</strong> has been a highly efficient manufacturing and logistics<br />

machine capable <strong>of</strong> churning out a dozen handsets a second and selling<br />

<strong>the</strong>m all over <strong>the</strong> world. Planning was long-term and new devices were<br />

developed by separate teams, sometimes competing with each o<strong>the</strong>r—<strong>the</strong><br />

opposite <strong>of</strong> what is needed in s<strong>of</strong>tware, where <strong>the</strong>re is a premium on<br />

collaborating and doing things quickly.<br />

Teaming up with Micros<strong>of</strong>t has its benefits, says Ben Wood <strong>of</strong> CCS Insight,<br />

ano<strong>the</strong>r market-research firm. Given his background, Mr Elop could surely<br />

make such a partnership work. And it could help <strong>Nokia</strong> make a comeback<br />

in America, where its market share is in <strong>the</strong> low single digits. On <strong>the</strong> o<strong>the</strong>r<br />

hand, argues Mr Wood, Windows Phone 7 has not been a huge success so<br />

far<br />

Still, <strong>the</strong> partnership is good news for Micros<strong>of</strong>t, which has struggled to<br />

create momentum behind Windows Phone 7 despite a huge investment in<br />

development and marketing. Both firms will now focus on establishing <strong>the</strong><br />

platform as an alternative to Android and <strong>the</strong> iPhone.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main points in<br />

2-3 minutes.<br />

QUESTION 2: Why are more and more people switching to smartphones?<br />

QUESTION 3: <strong>Nokia</strong> is also producing a range <strong>of</strong> smartphones. Why is<br />

<strong>Nokia</strong> still losing ground to Apple and o<strong>the</strong>r manufacturers?

Who needs paper?<br />

A new digital paper tests a new<br />

model for news<br />

Rupert Murdoch's iPad Daily<br />

Feb 3rd 2011 | from ECONOMIST PRINT EDITION<br />

EIGHT years ago Apple launched iTunes, a digital store selling music<br />

singles for 99 cents apiece. For record companies ravaged by piracy, it<br />

seemed like a good deal. Only later did many come to regret allowing<br />

ano<strong>the</strong>r company to set retail prices and to get between <strong>the</strong>m and <strong>the</strong>ir<br />

customers. On February 2nd Apple and Rupert Murdoch‟s News<br />

Corporation launched <strong>the</strong> Daily, an iPad newspaper that will cost 99 cents<br />

a week. It will not dominate <strong>the</strong> digital news market <strong>the</strong> way iTunes came<br />

to rule <strong>the</strong> digital music market. But it sets a disruptive precedent or two.<br />

The Daily is a mixture <strong>of</strong> <strong>the</strong> newfangled and <strong>the</strong> old-fashioned. It has<br />

whizzy graphics, including video and “360-degree” pictures. Sport fans<br />

can receive <strong>the</strong> twitterings <strong>of</strong> <strong>the</strong>ir favourite players. Unlike most<br />

websites, though, <strong>the</strong> Daily is available only in America. It features<br />

outmoded things such as editorials and paid reporters. Although it can be<br />

updated to take in breaking news, it is primarily a daily, not an hourly.<br />

In one sense it is a trailblazer. The Daily is <strong>the</strong> first product to <strong>of</strong>fer<br />

recurring subscriptions through Apple‟s store. So far most publishers have<br />

been obliged to sell single issues <strong>of</strong> newspapers and magazines on <strong>the</strong><br />

iPad. As a result, sales are erratic: Wired, a technology magazine with a<br />

beautiful app, sold 100,000 digital copies last June but just 24,400 in<br />

December. The Daily‟s sales model is better than that. But not much<br />

better.<br />

There is <strong>the</strong> price, for one thing. Ken Doctor, <strong>the</strong> author <strong>of</strong><br />

“Newsonomics”, reckons many people will be willing to pay 99 cents a<br />

week for news. That “what-<strong>the</strong>-hell price” could become a benchmark. The<br />

Daily is thinly staffed and will cost less than half a million dollars a week<br />

to put out. Many established newspapers and magazines, including some<br />

owned by News Corporation, want to charge considerably more than 99<br />

cents a week. They believe <strong>the</strong> experience <strong>of</strong> reading a newspaper or<br />

magazine on <strong>the</strong> iPad is a good substitute for <strong>the</strong> original thing, and fear<br />

undercutting <strong>the</strong>ir paper products.

They have a bigger worry. In <strong>the</strong> absence <strong>of</strong> a means to sell subscriptions<br />

through <strong>the</strong> app store, publications from People magazine to The<br />

Economist to News Corporation‟s Wall Street Journal have deployed <strong>the</strong>ir<br />

own systems for controlling access. Some sell single issues while allowing<br />

free access to people who already pay for <strong>the</strong> paper or web product<br />

(“existing print subscribers click here”). In effect, <strong>the</strong>y are using <strong>the</strong> iPad<br />

as a delivery system for content paid for outside Apple‟s ecosystem. That<br />

means Apple does not take a 30% cut <strong>of</strong> sales. More important,<br />

particularly for ad-dependent American publications, it means <strong>the</strong>y can<br />

keep tabs on subscribers.<br />

This opportunity may be closing. In <strong>the</strong> past month Apple has advised at<br />

least two European publishers to stop bypassing its payment system. It is<br />

unclear whe<strong>the</strong>r, having set up a subscription system for <strong>the</strong> Daily, Apple<br />

will try to force publishers to use it. As Mr Murdoch acknowledged this<br />

week, Apple rules <strong>the</strong> tablet market. Publishers have come to wish it were<br />

not so.<br />

The Daily totaled $30 million to set up and will cost $500,000 to run<br />

weekly. Subscription will be <strong>the</strong> larger part <strong>of</strong> <strong>the</strong>ir revenue model at first,<br />

but <strong>the</strong>y expect to be moving towards a 50/50 revenue split with ads later<br />

in <strong>the</strong> year. Launch advertisers include HBO, Macy‟s, Paramount, Pepsi<br />

Max, Range Rover, Verizon, and Virgin Atlantic Airways.<br />

Murdoch expects The Daily to be on all major tablets, but says “last year,<br />

this year and maybe next year belong to iPad.” Murdoch sees <strong>the</strong> The<br />

Daily has a revival <strong>of</strong> quality journalism in <strong>the</strong> digital realm.<br />

Murdoch‟s o<strong>the</strong>r publications, The Wall Street Journal, The Times and The<br />

Sunday Times, have all introduced paywalls for <strong>the</strong>ir websites. The Daily<br />

joins <strong>the</strong> ranks <strong>of</strong> o<strong>the</strong>r paid-for newspaper apps on <strong>the</strong> iPad including<br />

Esquire, <strong>the</strong> New Yorker, Vanity Fair and Glamour.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main points in<br />

2-3 minutes.<br />

QUESTION 2: What is <strong>the</strong> role <strong>of</strong> newspapers today?<br />

QUESTION 3: How does a newspaper generate revenue?

The abominable gas man:<br />

How technological change and<br />

new pipelines improve energy<br />

security<br />

Europe's gas pipelines<br />

Oct 14th 2010 | from ECONOMIST PRINT EDITION<br />

FOR years, <strong>the</strong> idea that Europe might get gas from <strong>the</strong> Caucasus and<br />

beyond, breaking Russia‟s monopoly on east-west pipelines, seemed<br />

fanciful. Not anymore. The leading contender, <strong>the</strong> Nabucco pipeline,<br />

backed by <strong>the</strong> European Union, is gaining speed (see map). Last month<br />

<strong>the</strong> project won promises <strong>of</strong> $5 billion in loans from <strong>the</strong> World Bank, <strong>the</strong><br />

European Investment Bank and <strong>the</strong> European Bank for Reconstruction and<br />

Development.<br />

Nabucco is not yet a done deal. Two big members <strong>of</strong> <strong>the</strong> consortium, RWE<br />

<strong>of</strong> Germany and OMV <strong>of</strong> Austria, said on October 8th that <strong>the</strong>y had<br />

postponed to next year a final decision on whe<strong>the</strong>r to invest.<br />

Ano<strong>the</strong>r problem is <strong>the</strong> source <strong>of</strong> gas. At first Nabucco needs 8 billion<br />

cubic metres (bcm) a year from Azerbaijan, but it wants a lot more to be

fully viable. Turkmenistan is <strong>the</strong> best option: it has fallen out with Russia,<br />

thawed relations with Azerbaijan, and built a pipeline from its onshore<br />

gasfields to <strong>the</strong> Caspian coast. Gas could continue from <strong>the</strong>re ei<strong>the</strong>r by a<br />

pipeline across <strong>the</strong> Caspian (though Russia objects) or, more<br />

cumbersomely, by tanker.<br />

Nabucco is not <strong>the</strong> only party interested in Azeri gas. The authorities in<br />

Baku continue to flirt with Russia (though any pipeline going northward<br />

would have to cross <strong>the</strong> unstable north Caucasus). Two rival projects aim<br />

to bring Azeri gas to sou<strong>the</strong>rn Italy via Turkey and Greece. That would not<br />

help gas-hungry central Europe. But <strong>the</strong> costs and politics <strong>of</strong> <strong>the</strong> Adriatic<br />

route are simpler.<br />

As Turkey flexes its muscles, o<strong>the</strong>r countries plot to bypass it. A new<br />

scheme, <strong>the</strong> Azerbaijan-Georgia-Romania Interconnector (AGRI), aims to<br />

use an existing trans-Caucasus pipeline, and <strong>the</strong>n tankers across <strong>the</strong> Black<br />

Sea. From <strong>the</strong> Romanian port <strong>of</strong> Constanta, it would <strong>the</strong>n go through an<br />

existing pipeline to Hungary. AGRI will not carry as much gas as<br />

Nabucco‟s planned annual target <strong>of</strong> 38 bcm. But it is cheaper to build,<br />

costing perhaps €1.2 billion ($1 billion), and will save on Turkish transit<br />

fees.<br />

For its part, Russia is continuing to push its rival South Stream project,<br />

which would go, expensively, across <strong>the</strong> bottom <strong>of</strong> <strong>the</strong> Black Sea,<br />

bypassing Ukraine. But crucial bits are missing. Russia‟s ill-run and debtridden<br />

gas industry has little extra capacity. Bulgaria is still furious about<br />

having its gas supplies cut <strong>of</strong>f during <strong>the</strong> Russian-Ukrainian gas row in<br />

January 2009. S<strong>of</strong>ia wants to lessen <strong>the</strong> country‟s energy dependence on<br />

Russia, not increase it.<br />

Russia may be down, but it is not out. The Nord Stream pipeline on <strong>the</strong><br />

Baltic seabed is being built, bringing Russian gas directly to Germany and<br />

reducing dependence on transit countries such as Belarus and Ukraine.<br />

Russia‟s new gas contract with Poland could tie that country to supplies<br />

from <strong>the</strong> east until 2037.<br />

Stealthily but successfully, <strong>the</strong> commission has been liberalising Europe‟s<br />

gas market. A new directive makes it compulsory for all gas pipelines to<br />

be reversible, meaning that <strong>the</strong>y can be used not just for funnelling gas<br />

<strong>into</strong> Europe, but also for moving it around <strong>the</strong> continent. That weakens<br />

<strong>the</strong> position <strong>of</strong> monopoly suppliers such as Russia.<br />

The most important shift, however, is not on land but at sea. The big<br />

worries over European energy security came when <strong>the</strong> world gas market<br />

was tight. But <strong>the</strong> price <strong>of</strong> gas has plunged, chiefly because America, now<br />

well supplied with shale gas, has stopped importing it.<br />

Nabucco remains important as an insurance policy, and as a sign that <strong>the</strong><br />

EU‟s common energy policy is more than talk. But it also looks like an

answer to a problem that technology and <strong>the</strong> market may already be<br />

solving.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main<br />

points in 2-3 minutes.<br />

QUESTION 2: What do we need (natural) gas for?<br />

QUESTION 3: Why is <strong>the</strong>re such a strong political debate on gas supply?<br />

The takeover <strong>of</strong> Cadbury by Kraft<br />

seems to symbolise a hollowingout<br />

<strong>of</strong> corporate Britain. The<br />

truth is ra<strong>the</strong>r more complicated<br />

Foreign takeovers in Britain<br />

Mar 25th 2010 | from ECONOMIST PRINT EDITION<br />

THE Thames Valley provides two contrasting examples <strong>of</strong> what happens<br />

when foreign companies buy British ones. Any day now <strong>the</strong> Scottish &<br />

Newcastle (S&N) brewery beside <strong>the</strong> M4 motorway at Reading will brew its<br />

last barrel after more than 150 years <strong>of</strong> operation. Its closure was

announced two years ago, weeks after S&N was bought by Carlsberg, <strong>of</strong><br />

Denmark, and Heineken, <strong>of</strong> <strong>the</strong> Ne<strong>the</strong>rlands, and carved up between<br />

<strong>the</strong>m. There‟s little <strong>of</strong> Scotland, Newcastle or Berkshire left in what is now<br />

Heineken UK, a subsidiary <strong>of</strong> a Dutch lager-maker. Heads <strong>of</strong> departments<br />

such as marketing and product development are now in Amsterdam.<br />

About 40km to <strong>the</strong> north, <strong>the</strong> BMW MINI factory in Oxford makes more<br />

than 200,000 cars a year. MINI is a survivor <strong>of</strong> BMW‟s o<strong>the</strong>rwise failed<br />

attempt to turn around Britain‟s ailing Rover group in <strong>the</strong> 1990s. Whereas<br />

<strong>the</strong> original Mini sold in large numbers but was an underpriced lossmaker,<br />

foreign ownership and capital have made <strong>the</strong> new version a global<br />

commercial success. Four out <strong>of</strong> five cars made in Oxford are exported;<br />

one in six BMWs sold is a MINI. The o<strong>the</strong>r surviving bit <strong>of</strong> Rover, Jaguar<br />

Land Rover, is on its third foreign owner—Tata Motors, <strong>of</strong> India—after<br />

Ford failed to turn it round. Tata‟s first move was to proclaim a ten-year<br />

plan to develop <strong>the</strong> two British brands; <strong>the</strong>ir outlook is at last looking<br />

brighter.<br />

Britons <strong>the</strong>se days are more likely to be found crying <strong>into</strong> <strong>the</strong>ir beer than<br />

celebrating successes like MINI. Cadbury, a venerable chocolate-maker, is<br />

just <strong>the</strong> latest household name to be swallowed by foreigners after a<br />

hostile takeover bid. Its recent purchase by Kraft Foods, an American<br />

company, has come to illustrate a complex set <strong>of</strong> anxieties: that Britain<br />

will lose jobs and skills, and that whereas British firms are open to<br />

takeover, <strong>the</strong>ir foreign predators are <strong>of</strong>ten protected against becoming<br />

prey <strong>the</strong>mselves. There is something to <strong>the</strong>se worries, but it is far from<br />

clear that Britain is a net loser. Purchases go both ways—and many British<br />

firms have found new strength under foreign owners.<br />

For 30 years <strong>the</strong> consensus has been that Britain has more to gain than to<br />

lose from its open embrace <strong>of</strong> globalisation. It has welcomed <strong>the</strong> presence<br />

<strong>of</strong> foreign investors, by and large, as a vote <strong>of</strong> confidence in <strong>the</strong> country‟s<br />

business climate. British companies have also been eager purchasers<br />

abroad: this month Prudential, an insurer, agreed to pay $35.5 billion for<br />

<strong>the</strong> Asian assets <strong>of</strong> once-mighty American International Group.<br />

Repatriated earnings have flowed <strong>into</strong> British pension funds.<br />

Britain has enjoyed a strong inflow <strong>of</strong> foreign direct investment. It has<br />

consistently attracted more than any o<strong>the</strong>r European country. According<br />

to Dealogic, a financial-information firm, foreigners have spent $1 trillion<br />

on acquiring 5,400 British companies in <strong>the</strong> past decade. The British have<br />

spent less on foreign firms, $750 billion, but have snapped up a larger<br />

number, just over 6,000 (see chart).

Now Britons aren‟t so sure that <strong>the</strong>y have got a good deal and fear factory<br />

closures and job losses. As head <strong>of</strong>fices close, power shifts abroad and<br />

Britain risks becoming a “branch factory” economy. When companies need<br />

to cut capacity, <strong>the</strong>y will chop factories far from home first. Renault shut<br />

its Belgian factory in <strong>the</strong> late 1990s, ra<strong>the</strong>r than close one in France;<br />

Peugeot closed its British one a few years ago for <strong>the</strong> same reason. Kraft‟s<br />

purchase <strong>of</strong> Cadbury has also touched this nerve. Cadbury had intended to<br />

close its factory at Keynsham, near Bristol; Kraft said during <strong>the</strong> takeover<br />

battle that it would keep <strong>the</strong> plant open, but <strong>the</strong>n changed its mind.<br />

The worry is not just about <strong>the</strong> quantity <strong>of</strong> jobs but also about <strong>the</strong>ir<br />

quality. The moan is that high-value head-<strong>of</strong>fice jobs and R&D skills will<br />

drift abroad. For Cadbury this means that as <strong>the</strong> head <strong>of</strong>fice in Uxbridge<br />

yields to Kraft‟s in Illinois, British knowledge will be dissipated. Talented<br />

Britons may have to search for work abroad if <strong>the</strong>re are fewer outlets for<br />

<strong>the</strong>ir skills at home. As <strong>the</strong> pool <strong>of</strong> know-how dries up, Britain will in turn<br />

become less attractive to foreign businesses seeking to do anything more<br />

complicated than basic work or serving <strong>the</strong> local market.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main points in<br />

2-3 minutes.<br />

QUESTION 2: Why do consumers eat chocolate?<br />

QUESTION 3: Why are <strong>the</strong> British so unhappy about <strong>the</strong> sale <strong>of</strong><br />

Cadbury‟s?

Hollywood goes global<br />

Feb 17th 2011 | LOS ANGELES | from ECONOMIST PRINT EDITION<br />

THE film-awards season, which<br />

reaches its tearful climax with <strong>the</strong><br />

Oscars next week, has long been<br />

only loosely related to <strong>the</strong> film<br />

business. And this year‟s awards<br />

are less relevant than ever. The<br />

true worth <strong>of</strong> a film is no longer<br />

decided by <strong>the</strong> crowd that<br />

assembles in <strong>the</strong> Kodak Theatre—<br />

or, indeed, by any American. It is<br />

decided by youngsters in countries<br />

such as Russia, China and Brazil.<br />

Hollywood has always been an<br />

international business, but it is<br />

becoming dramatically more so. In <strong>the</strong> past decade total box-<strong>of</strong>fice<br />

spending has risen by about one-third in North America while more than<br />

doubling elsewhere (see chart). Thanks to Harry Potter, Sherlock Holmes<br />

and “Inception”, Warner Bros made $2.93 billion outside North America<br />

last year, smashing <strong>the</strong> studio‟s previous record <strong>of</strong> $2.24 billion. Falling<br />

DVD sales in America, by far <strong>the</strong> world‟s biggest home-entertainment<br />

market, mean Hollywood is even more dependent on foreign punters.<br />

The rising foreign tide has lifted films that were virtually written <strong>of</strong>f in<br />

America, such as “Prince <strong>of</strong> Persia” and “The Chronicles <strong>of</strong> Narnia: <strong>the</strong><br />

Voyage <strong>of</strong> <strong>the</strong> Dawn Treader”. Despite starring <strong>the</strong> popular Jack Black,<br />

“Gulliver‟s Travels” had a disappointing run in North America, taking $42m<br />

at <strong>the</strong> box <strong>of</strong>fice so far. But strong turnout in Russia and South Korea<br />

helped it reach almost $150m in sales elsewhere.<br />

The growth <strong>of</strong> <strong>the</strong> international box <strong>of</strong>fice is partly a result <strong>of</strong> <strong>the</strong> dollar‟s<br />

weakness. It was also helped by “Avatar”, an eco-fantasy that made a<br />

startling $2 billion outside North America. But three things are particularly<br />

important: a cinema boom in <strong>the</strong> emerging world, a concerted effort by<br />

<strong>the</strong> major studios to make films that might play well outside America and<br />

a global marketing push to make sure <strong>the</strong>y do.<br />

Russia, with its shrinking teenage population, is an unlikely spot for a box<strong>of</strong>fice<br />

boom. Yet cinema-building is proceeding apace, and supply has<br />

created demand. Last year 160m cinema tickets were sold in Russia—<strong>the</strong><br />

first time in recent years that sales have exceeded <strong>the</strong> country‟s<br />

population. Plus <strong>the</strong> times are getting harder for Russian movie-makers:<br />

This month Vladimir Putin, Russia‟s prime minister, said <strong>the</strong> government

would spend less money supporting Russian film-makers and more on<br />

expanding <strong>the</strong> number <strong>of</strong> screens.<br />

Growth is much quicker in China, where box-<strong>of</strong>fice receipts reached $1.5<br />

billion last year. China‟s regulator has claimed that cinema screens are<br />

going up at a rate <strong>of</strong> three per day. The government allows only 20 non-<br />

Chinese films <strong>into</strong> <strong>the</strong> market each year, virtually guaranteeing big<br />

audiences for those that make <strong>the</strong> cut. Punters and censors alike warm to<br />

family films and movies that seem to reflect China‟s central place in <strong>the</strong><br />

world. Thus, expect long queues for “Kung Fu Panda 2” this summer.<br />

Unfortunately, Hollywood has learned that great sales in China do not<br />

always translate <strong>into</strong> great pr<strong>of</strong>its. In America distributors tend to receive<br />

50-55% <strong>of</strong> box-<strong>of</strong>fice receipts. In China, where Hollywood must use a<br />

domestic distributor, <strong>the</strong> proportion is roughly 15%. American films may<br />

be yanked in favour <strong>of</strong> domestic ones (“Avatar” had to make way for<br />

“Confucius” last year). The World Trade Organisation has ordered China to<br />

reform, but few moguls expect it to.<br />

The success <strong>of</strong> a film outside America is not purely a marketing matter. As<br />

foreign box-<strong>of</strong>fice sales have become more important, <strong>the</strong> people who<br />

manage international distribution have become more influential, weighing<br />

in on “green-light” decisions about which films are made. The studios are<br />

careful to seed films with actors, locations and, occasionally, languages<br />

that are well-known in target countries. Sony cites <strong>the</strong> foreign success <strong>of</strong><br />

“The Green Hornet” (Taiwanese hero, Austrian-German villain) and<br />

“Resident Evil: Afterlife” (Japanese location) as evidence <strong>of</strong> that strategy.<br />

The growing internationalisation <strong>of</strong> <strong>the</strong> film business suits <strong>the</strong> biggest<br />

outfits, and not just because <strong>the</strong>y can afford explosions. The major<br />

studios‟ power lies not so much in <strong>the</strong>ir ability to make good films—plenty<br />

<strong>of</strong> smaller operations can do that—but in <strong>the</strong>ir ability to wring every<br />

possible drop <strong>of</strong> revenue from a film. With <strong>the</strong>ir superior global marketing<br />

machines and <strong>the</strong>ir ability to anticipate foreign tastes, <strong>the</strong>y are<br />

increasingly dominating <strong>the</strong> market. For everyone else, <strong>the</strong>re is a chance<br />

to win a gold statue.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main<br />

points in 2-3 minutes.<br />

QUESTION 2: Why are <strong>the</strong> foreign markets increasingly important for<br />

Hollywood?<br />

QUESTION 3: What is <strong>the</strong> role <strong>of</strong> <strong>the</strong> distributors in <strong>the</strong> movie industry?

Hungry for power<br />

Electricity in Brazil<br />

Feb 10th 2011 | SÃO PAULO | from ECONOMIST PRINT EDITION<br />

IT WAS not a “blackout”, said Edison Lobão, merely a “temporary<br />

interruption <strong>of</strong> <strong>the</strong> electricity supply”. Brazil‟s energy minister was<br />

speaking on February 4th after nearly 50m people across eight states in<br />

<strong>the</strong> country‟s north-east had spent most <strong>of</strong> <strong>the</strong> night without power.<br />

Engineers are still investigating, but <strong>the</strong>ir preliminary conclusion is that a<br />

component in a substation failed just after midnight. That caused safety<br />

systems to malfunction, and transmission lines and <strong>the</strong>n a power station<br />

to shut down.<br />

Mr Lobão is trying to reserve <strong>the</strong> b-word [blackout] for something more<br />

serious, which his government is determined to avoid: a big and sustained<br />

mismatch between electricity supply and demand. That last happened in<br />

2001-02, after decades <strong>of</strong> growing energy use and low investment were<br />

followed by drought (70% <strong>of</strong> Brazil‟s power comes from hydroelectric<br />

dams.) Back <strong>the</strong>n, only rationing kept <strong>the</strong> lights on, and <strong>the</strong> after-effects<br />

dampened demand for some years.<br />

Electricity use is growing strongly once more, rising by 7.8% last year.<br />

That is partly because Brazil‟s economy is booming. But even if this<br />

changes, power use is unlikely to fall. Brazilians who have recently levered<br />

<strong>the</strong>mselves out <strong>of</strong> poverty would give up much else before unplugging<br />

<strong>the</strong>ir first-ever fridges and washing machines. Luz Para Todos (Light for<br />

All), a government rural-electrification programme launched by Dilma<br />

Rousseff, <strong>the</strong> president, when she was energy minister, has hooked up<br />

more than 2.4m homes since 2003, and is continuing. The government<br />

reckons demand for electricity will rise by 5% a year over <strong>the</strong> next decade.<br />

Officials plan to mobilise investment totalling some 214 billion reais ($128<br />

billion), from both private and public sources, in order to meet it.<br />

Some <strong>of</strong> that will go on new fossil-fuel and nuclear plants, and some on<br />

biomass and wind energy. But <strong>the</strong> biggest chunk is for new hydroelectric<br />

projects. They are controversial, particularly <strong>the</strong> Belo Monte dam<br />

approved for <strong>the</strong> Xingu, a tributary <strong>of</strong> <strong>the</strong> Amazon in <strong>the</strong> nor<strong>the</strong>rn state <strong>of</strong><br />

Pará. This has been redesigned to avoid throwing a huge wall across <strong>the</strong><br />

river. But it will still be Brazil‟s second-biggest hydroelectric plant (after<br />

Itaipu), generating up to 11,230MW, will flood 500 square kilometres and<br />

will displace 20,000 people, mainly Indians.

On January 26th <strong>the</strong> environment ministry gave contractors <strong>the</strong> go-ahead<br />

to start clearing land for Belo Monte. Like o<strong>the</strong>r big projects, it has been<br />

repeatedly delayed by legal challenges from environmentalists, who prefer<br />

biomass, wind and energy-saving measures, and by <strong>the</strong> need to obtain<br />

environmental licences at each stage. Those are reasons why Brazilian<br />

firms want to build dams across <strong>the</strong> border in Peru. It would be better for<br />

Brazil‟s government to decide on each scheme according to <strong>the</strong> overall<br />

trade-<strong>of</strong>f between energy security and environmental protection, with <strong>the</strong><br />

environment ministry <strong>the</strong>reafter restricting itself to overseeing<br />

implementation, says Rodrigo Moita, an energy specialist at Insper, a São<br />

Paulo business school.<br />

One way or ano<strong>the</strong>r, Brazil is likely to avoid a new energy crunch,<br />

concluded a recent study by IPEA, a government-linked think-tank. But<br />

both cost and reliability are growing problems. Taxes mean that on<br />

average electricity costs two-thirds more in Brazil than in <strong>the</strong> United<br />

States. But <strong>the</strong> IPEA researchers expect <strong>the</strong> average price to rise fur<strong>the</strong>r.<br />

Relying on hydro-generation in <strong>the</strong> Amazon means that electricity supply<br />

will be vulnerable to droughts and depend on long distribution lines to<br />

bring power to <strong>the</strong> populous south. These will be hard to maintain.<br />

The strain is starting to show. Brazil suffered 91 big blackouts during 2010,<br />

up from 48 in 2008. In big cities short, localised power cuts are becoming<br />

common. One occurred when The Economist recently visited <strong>the</strong> research<br />

laboratory in Rio de Janeiro <strong>of</strong> Petrobras, Brazil‟s oil giant. They have been<br />

happening at least once a week this (sou<strong>the</strong>rn-hemisphere) summer, said<br />

<strong>the</strong> lab‟s boss. Brazilians may have to get used to “temporary<br />

interruptions” every time <strong>the</strong>y turn up <strong>the</strong>ir air-conditioners.

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main points in<br />

2-3 minutes.<br />

QUESTION 2: Luz Para Todos (Light for All) is Brazil‟s programme to<br />

connect rural areas to <strong>the</strong> power grid. Why is it important to have<br />

electricity available?<br />

QUESTION 3: Brazilian firms want to build dams across <strong>the</strong> border in Peru.<br />

What are <strong>the</strong>ir reasons behind this wish?<br />

Angela in Wunderland - What<br />

Germany’s got right, and what it<br />

hasn’t<br />

Germany's economy<br />

Feb 3rd 2011 | from ECONOMIST PRINT EDITION<br />

THE West has rightly marvelled at China‟s economic miracle. Less noticed<br />

is a minor miracle in its own midst. It is time to pay attention to<br />

Germany‟s new Wirtschaftswunder.<br />

Germany had a savage recession as manufacturing orders dried up, but its<br />

economy has since bounced back strongly, expanding by 3.6% last year,<br />

far faster than most o<strong>the</strong>r rich economies. For sure, this was partly a<br />

“bungee effect” after a particularly deep downturn, but it is no one-year<br />

wonder. By several measures, including keeping unemployment down (it<br />

is at its lowest since 1992) and <strong>the</strong> prosperity reflected in <strong>the</strong> growth <strong>of</strong><br />

GDP per head, Germany was <strong>the</strong> star performer among <strong>the</strong> rich G7<br />

countries over <strong>the</strong> past ten years Germans entered 2011 in <strong>the</strong>ir most

optimistic mood since 2000, according to Allensbach‟s polls. Business<br />

confidence is at its highest since <strong>the</strong> Ifo institute began tracking it 20<br />

years ago.<br />

What‟s Germany‟s secret? It helps that <strong>the</strong> country did not experience a<br />

property or credit bubble, and that it has kept its public finances<br />

admirably under control. But above all Germany‟s success has been<br />

export-driven: unlike most o<strong>the</strong>r big rich economies it has maintained its<br />

share <strong>of</strong> world exports over <strong>the</strong> past decade, even as China has risen.<br />

This is not—advocates <strong>of</strong> an active industrial policy please note—thanks to<br />

a special genius among German policymakers for picking winners, though<br />

businesses have benefited from strong state-supported research<br />

institutions. Luck has played a part. Germany has a cheaper-labour<br />

hinterland right on its doorstep in central Europe that has helped<br />

companies raise efficiency and hold down pay. Meanwhile, German firms<br />

happen to produce exactly <strong>the</strong> things that a booming China wants, from<br />

luxury cars to <strong>the</strong> machinery that enables Chinese factories to be <strong>the</strong><br />

workshops <strong>of</strong> <strong>the</strong> world. So Germany has been a big winner on both <strong>the</strong><br />

supply side and <strong>the</strong> demand side <strong>of</strong> globalisation. The euro also provided a<br />

bonanza, thanks to (unsustainable) demand in places like Spain and<br />

Greece.<br />

But <strong>the</strong>re has been plenty <strong>of</strong> skill, too. German companies have excelled<br />

at seeking out unglamorous but pr<strong>of</strong>itable niches, and <strong>the</strong>n focusing<br />

relentlessly on being <strong>the</strong> best. This is particularly true <strong>of</strong> <strong>the</strong> Mittelstand,<br />

<strong>the</strong> small and not-so-small companies that are <strong>the</strong> backbone <strong>of</strong> <strong>the</strong><br />

German economy. The likes <strong>of</strong> Koenig & Bauer (which makes printing<br />

presses), Leitz (wood-processing machines) and RUD (industrial chains)<br />

may not be household names, but <strong>the</strong>y are world-beaters.<br />

Such traditional German virtue is now all <strong>the</strong> more effective thanks to<br />

liberalising reforms <strong>of</strong> recent years. Under Gerhard Schröder, a Social<br />

Democrat who was Angela Merkel‟s predecessor as chancellor, <strong>the</strong> socalled<br />

Hartz reforms made labour markets more flexible and made work a<br />

bit more attractive compared with living on unemployment benefits. And<br />

with <strong>the</strong> loosening <strong>of</strong> banks‟ cross-shareholdings, German business is a<br />

less cosy and cosseted affair; bosses are freer to cull underperforming<br />

operations and to focus on growth.<br />

German businesses also took a gamble during <strong>the</strong> downturn. With <strong>the</strong><br />

help <strong>of</strong> government subsidies <strong>the</strong>y held on to <strong>the</strong>ir workers, betting that<br />

order books would quickly fill up again. They did, so German companies<br />

retained <strong>the</strong> skills and <strong>the</strong> manpower to respond quickly to <strong>the</strong> upturn.<br />

All this explains why German leaders can sound a little smug <strong>the</strong>se days.<br />

In Davos last week Mrs Merkel invited fellow Europeans to learn from<br />

Germany‟s experience. Follow <strong>the</strong> German model, <strong>the</strong> message seems to<br />

be, and all will be well.

However this recipe can be questioned as well: Germany‟s economic boost<br />

dependents on foreign demand, reflected in an excessive current-account<br />

surplus <strong>of</strong> 5% <strong>of</strong> GDP last year, while consumer spending is feeble. If<br />

every European country followed that example it would be a recipe for a<br />

slump.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main<br />

points in 2-3 minutes.<br />

QUESTION 2: Describe <strong>the</strong> economic ties between Germany and China.<br />

QUESTION 3: What are <strong>the</strong> main reasons for <strong>the</strong> new<br />

“Wirtschaftswunder”?

Bling is back<br />

A surprising recovery in luxury<br />

goods<br />

Luxury goods<br />

Oct 21st 2010 | from ECONOMIST PRINT EDITION<br />

“IN THE dark days <strong>of</strong> <strong>the</strong> recession people didn‟t want to show <strong>the</strong> bling.”<br />

(bling is a slang term for jewellery) says Alisa Moussaieff, owner and<br />

managing director <strong>of</strong> Moussaieff, a London jewellery shop. Some <strong>of</strong> her<br />

wealthy customers bought diamonds or o<strong>the</strong>r gems as an investment<br />

during <strong>the</strong> financial crisis, since paper assets seemed so dodgy at <strong>the</strong><br />

time. Ra<strong>the</strong>r than flaunting <strong>the</strong>ir purchases before recession-pinched<br />

passers-by, however, <strong>the</strong>y asked for plain white shopping bags. As <strong>the</strong><br />

global economy mends, such restraint is wearing <strong>of</strong>f. Yet even <strong>the</strong> luxury<br />

industry‟s boosters did not expect such a cork-popping recovery.<br />

On October 14th Moët Hennessy Louis Vuitton (LVMH), <strong>the</strong> world‟s biggest<br />

luxury-goods company by sales, reported a 14% increase in sales in <strong>the</strong><br />

first nine months <strong>of</strong> <strong>the</strong> year, after correcting for such factors as currency<br />

fluctuation. Burberry, a British clothing firm, also reported double-digit<br />

sales growth in <strong>the</strong> six months to <strong>the</strong> end <strong>of</strong> <strong>the</strong> September. On October<br />

28th, PPR, a French retail and luxury group, is expected to report strong<br />

results.<br />

“The strength <strong>of</strong> <strong>the</strong> recovery was a surprise,” says Claudia D‟Arpizio, a<br />

luxury-goods expert in <strong>the</strong> Milan <strong>of</strong>fice <strong>of</strong> Bain & Company, a consultancy.<br />

Big brands such as Louis Vuitton and Hermès are <strong>the</strong> main winners. With<br />

<strong>the</strong>ir deep pockets, <strong>the</strong>y were able to continue to open new shops and<br />

invest in <strong>the</strong> business during <strong>the</strong> crisis.<br />

Luxury has always been a cyclical industry, but in <strong>the</strong> past decade it has<br />

soared and plunged like a well-dressed bungee-jumper. The early 2000s<br />

were grim: terrorist attacks in America, a global outbreak <strong>of</strong> SARS and <strong>the</strong><br />

war in Iraq all tempered people‟s appetites for international travel and<br />

frivolous purchases. From 2004 to 2007, however, luxury shoppers<br />

worked <strong>the</strong>mselves <strong>into</strong> a frenzy <strong>of</strong> indulgence. Then, as <strong>the</strong> financial<br />

crisis bit, <strong>the</strong>y stopped. Last year <strong>the</strong> global luxury market shrank by 8%.<br />

But <strong>the</strong> luxury recovery that began towards <strong>the</strong> end <strong>of</strong> 2009 has now<br />

ga<strong>the</strong>red momentum. Bain predicts 10% growth for this year.

Pockets <strong>of</strong> confidence in America help. Luxury sales <strong>the</strong>re slumped by<br />

18% last year. This year shoppers are feeling less shy about showing <strong>of</strong>f,<br />

and department stores are gleefully stocking up with pretty stuff for <strong>the</strong><br />

holiday season.<br />

The mood in China is even blingier. Luxury sales grew 20% even during<br />

<strong>the</strong> industry‟s annus horribilis last year and are forecast to boom by an<br />

astounding 30% this year. In five years China, which already accounts for<br />

a tenth <strong>of</strong> global demand for luxury goods, is predicted to be <strong>the</strong> thirdlargest<br />

market for <strong>the</strong>m.<br />

The boom has caught some firms with <strong>the</strong>ir elegant trousers down.<br />

Despite nationwide strikes in France, Louis Vuitton, a peddler <strong>of</strong> posh<br />

handbags, does not have sufficient stock to cater to <strong>the</strong> sudden increase<br />

in demand. Anxious to save enough goodies for Christmas, <strong>the</strong> company is<br />

closing its flagship shop on <strong>the</strong> Champs-Elysées in Paris earlier each day<br />

and raising its prices in <strong>the</strong> euro zone.<br />

Yet <strong>the</strong> good times for luxury firms will probably not last. Next year Bain<br />

predicts that growth will slow to 3-5%. The strength <strong>of</strong> <strong>the</strong> euro will hurt<br />

<strong>the</strong> top firms, which are disproportionately Italian or French and <strong>of</strong>ten<br />

lovingly hand-craft <strong>the</strong>ir products within <strong>the</strong> euro area. Tax increases in<br />

Europe will make <strong>the</strong> rich feel poorer and less inclined to splash out.<br />

Consumer confidence is crucial. If people feel glum, <strong>the</strong>y don‟t buy<br />

baubles.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main<br />

points in 2-3 minutes.<br />

QUESTION 2: How would you define “luxury products”?<br />

QUESTION 3: Who buys luxury products?

A more complicated game:<br />

The West’s financial crisis has<br />

shaken public confidence in its<br />

leading central banks. Yet it has<br />

also led to an expansion <strong>of</strong> <strong>the</strong>ir<br />

duties and powers<br />

Feb 17th 2011 | WASHINGTON, DC | from ECONOMIST PRINT EDITION<br />

IN TWO days, two prominent central bankers, one on each side <strong>of</strong> <strong>the</strong><br />

Atlantic, headed for <strong>the</strong> exit. Few people were surprised when Kevin<br />

Warsh tendered his resignation from <strong>the</strong> Federal Reserve on February<br />

10th. Ra<strong>the</strong>r more people were taken aback when rumours started to fly<br />

that Axel Weber would stand down as president <strong>of</strong> Germany‟s Bundesbank<br />

and thus rule himself out as <strong>the</strong> next president <strong>of</strong> <strong>the</strong> European Central<br />

Bank (ECB), a job for which he had been <strong>the</strong> front-runner. The rumours<br />

were confirmed on February 11th.<br />

The timing was coincidental. Yet <strong>the</strong> two men have something in common.<br />

Both were uneasy about changes in <strong>the</strong> way that central banks conduct<br />

<strong>the</strong>mselves—specifically, about <strong>the</strong> unprecedented forays <strong>into</strong> financial<br />

markets by <strong>the</strong> Fed and <strong>the</strong> ECB. Mr Weber publicly opposed <strong>the</strong> ECB‟s<br />

decision last May to start buying <strong>the</strong> bonds <strong>of</strong> member countries‟<br />

governments. His colleagues, he believed, were intruding dangerously <strong>into</strong><br />

fiscal policy. Mr Warsh, similarly though more quietly, fretted that <strong>the</strong><br />

Fed‟s policy <strong>of</strong> quantitative easing (QE)—<strong>the</strong> purchase <strong>of</strong> government<br />

bonds with newly printed money—was fomenting new imbalances in <strong>the</strong><br />

global economy and steering <strong>the</strong> Fed <strong>into</strong> treacherous political waters.

Since <strong>the</strong> financial crisis in 2007<br />

central banks have expanded <strong>the</strong>ir<br />

remits, ei<strong>the</strong>r at <strong>the</strong>ir own initiative<br />

or at governments‟ behest, well<br />

beyond conventional monetary<br />

policy. They have not only<br />

extended <strong>the</strong> usual limits <strong>of</strong><br />

monetary policy by buying<br />

government bonds and o<strong>the</strong>r assets<br />

(see chart). They are also taking on<br />

more responsibility for <strong>the</strong><br />

supervision <strong>of</strong> banks and <strong>the</strong><br />

stability <strong>of</strong> financial systems. Their new duties require new<br />

“macroprudential” policies: in essence, this means regulating banks with<br />

an eye on any dangers for <strong>the</strong> whole economy. And <strong>the</strong>ir old monetarypolicy<br />

tasks are not getting any easier to perform. Central banking is<br />

becoming a more complicated game.<br />

The new duties also bring new risks. Before <strong>the</strong> crisis, a political<br />

consensus had emerged: central banks should be run by technocrats, free<br />

<strong>of</strong> interference by government, pursuing one goal, price stability, with one<br />

tool, short-term interest rates. Many gave up <strong>the</strong> supervision <strong>of</strong> banks to<br />

o<strong>the</strong>r regulators. The connection between interest rates and inflation may<br />

not have been exact, but at least central banks had plenty <strong>of</strong> <strong>the</strong>ory and<br />

evidence to guide <strong>the</strong>m. In contrast, <strong>the</strong> effects <strong>of</strong> unconventional<br />

monetary policy, such as bond purchases, are largely unknown.<br />

Proponents argue that with interest rates at or near zero, it is a sensible<br />

way <strong>of</strong> keeping credit flowing and preventing deflation. Opponents say<br />

that it bails out pr<strong>of</strong>ligate treasuries and risks recreating <strong>the</strong> speculative<br />

bubbles that led to <strong>the</strong> financial crisis in <strong>the</strong> first place.<br />

Financial stability is politically a more treacherous mission than price<br />

stability, notes David Archer <strong>of</strong> <strong>the</strong> Bank for International Settlements<br />

(BIS), a co-ordinating body for central banks. During booms,<br />

macroprudential measures, such as restraints on lending, will tend to<br />

arouse anger, and if <strong>the</strong>y avert a crisis, <strong>the</strong> public will never know. Yet if a<br />

crisis strikes, <strong>the</strong> public, with perfect hindsight, will blame <strong>the</strong> central<br />

bank for not acting sooner. “The relationship between <strong>the</strong> central bank<br />

and government is likely to become more difficult and more political,” he<br />

adds.<br />

The way we were<br />

In a sense, central banks have returned to <strong>the</strong>ir roots. The first central<br />

banks were created to handle <strong>the</strong> sovereign‟s financial affairs and issue a<br />

national currency. That endowed <strong>the</strong>m with competitive advantages that<br />

led naturally to becoming lenders <strong>of</strong> last resort to commercial banks.<br />

Because such lending created moral hazard and <strong>the</strong> risk <strong>of</strong> loss, <strong>the</strong>y also<br />

became those banks‟ supervisors. Only later did monetary policy—<br />

managing economic growth and inflation—become a primary duty. Charles<br />

Goodhart, a monetary historian and a former member <strong>of</strong> <strong>the</strong> Bank <strong>of</strong>

England‟s monetary-policy committee, has noted, “The monetary (macro)<br />

functions <strong>of</strong> central banks were largely grafted onto <strong>the</strong> supervisory<br />

functions.”<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main<br />

points in 2-3 minutes.<br />

QUESTION 2: What is <strong>the</strong> name <strong>of</strong> <strong>the</strong> Austrian central bank?<br />

QUESTION 3: What are <strong>the</strong> primary duties <strong>of</strong> <strong>the</strong> cental banks?

The Panama Canal<br />

A plan to unlock prosperity<br />

Ten years ago this month Panama took possession <strong>of</strong> <strong>the</strong> canal that bears<br />

its name. It has high hopes for a $5.25 billion expansion <strong>of</strong> <strong>the</strong> waterway<br />

Dec 3rd 2009 | PANAMA CITY | From The Economist print edition<br />

The Panama is a vital artery <strong>of</strong> world trade. Since <strong>the</strong> 1970s, however,<br />

merchant vessels have been growing too big to pass through it. The<br />

largest container ships today can carry more than 12,000 boxes, whereas<br />

<strong>the</strong> biggest that can fit in <strong>the</strong> canal carry only 4,500. Since <strong>the</strong> mid-1990s<br />

it has become obvious that <strong>the</strong> bottleneck would need to be cleared, or<br />

<strong>the</strong> canal would become a backwater.<br />

In September 2007, even as <strong>the</strong> world economy slid <strong>into</strong> recession and<br />

global trade fell for <strong>the</strong> first time in a quarter <strong>of</strong> a century, <strong>the</strong> Panama<br />

Canal Authority (ACP) started digging. The whole project should be<br />

finished in 2014 at a cost <strong>of</strong> $5.25 billion, more than a fifth <strong>of</strong> Panama‟s<br />

GDP last year. Of this, $3 billion will come from retained earnings, <strong>the</strong> rest<br />

from bilateral and multilateral lenders, led by <strong>the</strong> Japan Bank for<br />

International Cooperation, <strong>the</strong> European Investment Bank and <strong>the</strong> Inter-<br />

American Development Bank.<br />

The expansion—one <strong>of</strong> <strong>the</strong> world‟s biggest transport projects—was<br />

controversial when first mooted in around 2001. Some feared that it<br />

would cripple a small country whose public debt <strong>the</strong>n amounted to 71% <strong>of</strong><br />

GDP, and that extra dams would flood rural land, displacing peasants and<br />

threatening water supplies. Yet Panamanians voted heavily in favour <strong>of</strong><br />

expansion in a referendum in 2006 after concessions to s<strong>of</strong>ten <strong>the</strong><br />

environmental impact: <strong>the</strong>re will be no extra dam and <strong>the</strong> new locks will<br />

recycle most water.<br />

The ACP will also been able to charge more. Since 1998 <strong>the</strong> average toll<br />

has risen by 70%. In May, for example, <strong>the</strong> price per container went up<br />

from $63 to $72. (Container ships are usually charged by capacity,<br />

regardless <strong>of</strong> load. Cruise liners pay $120 per berth.) The canal has<br />

revenues <strong>of</strong> $2 billion and costs <strong>of</strong> only $600m. Spare cash goes <strong>into</strong> <strong>the</strong><br />

Panamanian treasury, through a revenue royalty and dividends. In <strong>the</strong><br />

fiscal year that ended in September, <strong>the</strong> treasury pocketed $760m.<br />

The ACP believes that <strong>the</strong> expansion, once completed, will boost Panama‟s<br />

annual growth rate by 1.2 percentage points, helping GDP grow to 2.5<br />

times <strong>the</strong> 2005 level by 2025. That, estimates <strong>the</strong> authority, would lift<br />

100,000 Panamanians out <strong>of</strong> poverty: today 1m are poor in a population<br />

<strong>of</strong> 3.4m. But <strong>the</strong> mechanism by which a wider canal will raise <strong>the</strong> living

standards <strong>of</strong> <strong>the</strong> country‟s people—particularly its least fortunate—remains<br />

murky.<br />

At <strong>the</strong> Atlantic end <strong>of</strong> <strong>the</strong> canal lies <strong>the</strong> Colón Free Zone, <strong>the</strong> world‟s<br />

second-biggest re-export centre, trailing Hong Kong. Last year $9.1<br />

billion-worth <strong>of</strong> merchandise was unloaded <strong>the</strong>re; re-exports, after<br />

relabelling, repackaging and so forth, amounted to $9.7 billion. At <strong>the</strong><br />

Pacific terminus, Panama City is home to dozens <strong>of</strong> banks, serving<br />

Colombians and Venezuelans with dollar savings as well as Central<br />

Americans, and thousands <strong>of</strong> companies, attracted by its favourable tax<br />

treatment <strong>of</strong> <strong>of</strong>fshore business. Despite <strong>the</strong> global recession, <strong>the</strong> skyline<br />

continues to sprout apartment towers <strong>of</strong> dizzying heights.<br />

It is too much to expect even such a huge project to solve all a country‟s<br />

economic troubles. It will bring jobs in ancillary services; and <strong>the</strong> extra<br />

money could, if used wisely, ease some pressing problems. Most people<br />

think that economic diversification is <strong>the</strong> best way to reduce poverty.<br />

Given that so many poor people work in farming, improving productivity<br />

<strong>the</strong>re is most important. This means bringing techniques, equipment and<br />

seeds up to global standards, and cultivating Panama‟s most promising<br />

crops, such as bananas and c<strong>of</strong>fee (its Geisha bean is especially prized).<br />

In particular, Panama is short <strong>of</strong> refrigeration capacity to preserve its<br />

produce.<br />

On top <strong>of</strong> this, social services, primarily health care and education, also<br />

need improvement. Although Panama‟s social spending per person is<br />

among <strong>the</strong> highest in Latin America, its students‟ standardised test results<br />

rank near <strong>the</strong> bottom. Both Mr Martinelli‟s ministers and independent<br />

analysts attribute this disappointing showing to a powerful teachers‟ union<br />

and an inefficient civil service.<br />

The government could use its extra income to foster rural development in<br />

any number <strong>of</strong> ways. It could also build more schools, universities, clinics<br />

and hospitals, or hire more or better teachers or doctors.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong><br />

main points in 2-3 minutes.<br />

QUESTION 2: Why is transportation by ship so important nowadays?<br />

QUESTION 3: What are <strong>the</strong> reasons for expanding <strong>the</strong> canal?

Toyota Hegemony<br />

Fades as `Big Damage'<br />

Brings Sony-Style<br />

Decline<br />

By Alan Ohnsman, Makiko Kitamura and Jeff Green - Jan 12, 2011<br />

1:25 AM GMT+0100 BLOOMBERG BUSINESSWEEK<br />

After owning several Toyota Motor Corp. vehicles<br />

over <strong>the</strong> past 17 years, Randy Sterling traded in<br />

his Tacoma pickup this month for Ford Motor<br />

Co.‟s F-150 truck.<br />

“The recent problems with Toyota caused me to have a closer look at Ford,”<br />

said Sterling, a contractor in Blenheim, Ontario, referring to record recalls <strong>of</strong><br />

more than 8 million vehicles, most for defects tied to unintended acceleration.<br />

“The recalls, how <strong>the</strong>y‟d treated some <strong>of</strong> <strong>the</strong>ir customers, it just concerned<br />

me.”<br />

Customers such as Sterling underscore <strong>the</strong> challenge Toyota President Akio<br />

Toyoda, in Detroit this week for <strong>the</strong> North American International Auto Show,<br />

faces as he seeks to put <strong>the</strong> recall crisis behind him. With its reputation<br />

tarnished, <strong>the</strong> Toyota City, Japan-based company‟s 2010 U.S. sales dropped<br />

even as industrywide car demand rose. The loss <strong>of</strong> once-tried-and-true<br />

customers marks <strong>the</strong> beginning <strong>of</strong> <strong>the</strong> world‟s largest automaker‟s quest to<br />

restore its image and win back market share, said analyst Maryann Keller.<br />

“In terms <strong>of</strong> quality, <strong>the</strong>y were <strong>the</strong> default brand,” said Keller, founder <strong>of</strong><br />

Maryann Keller & Associates, a consulting company in Stamford, Connecticut.<br />

“Now <strong>the</strong>y‟re just one <strong>of</strong> <strong>the</strong> pack.”<br />

Toyota was <strong>the</strong> only large automaker to post a sales decline last year in <strong>the</strong><br />

U.S., historically its most pr<strong>of</strong>itable market. Its deliveries fell 0.4 percent to<br />

1.76 million Toyota, Lexus and Scion vehicles, in contrast to an industrywide<br />

increase <strong>of</strong> 11 percent, <strong>the</strong> first since 2005.<br />

Sony Analogy<br />

Just as Japanese electronics makers such as Sony Corp. lost ground in <strong>the</strong><br />

past decade to Apple Inc. in music players and to Samsung Electronics Co.<br />

and LG Electronics Inc. in televisions, damage to Toyota‟s brand has left it<br />

vulnerable to a growing challenge from rivals including Ford and Hyundai<br />

Motor Co.<br />

“The reason Toyota became famous was one word, and that was „quality,‟”<br />

said Jez Frampton, chief executive <strong>of</strong>ficer <strong>of</strong> Interbrand Corp. in New York “In<br />

<strong>the</strong> same way, you used to buy a Sony because you believed in something,<br />

and that something was quality.”

The recalls inflicted “big damage” on Toyota, Toyoda told reporters Jan. 10 in<br />

Detroit. Still, <strong>the</strong> carmaker‟s Camry sedan remained <strong>the</strong> top-selling U.S.<br />

passenger car while its Lexus brand led luxury car sales, he said.<br />

“Toyota cars are safe,” <strong>the</strong> chief executive said. “I‟d like you to expect more<br />

good things to come from us.”<br />

Rising Challengers<br />

Toyoda‟s job is likely to get more difficult this year. A resurgent General<br />

Motors Co. has emerged from bankruptcy and targeted Toyota‟s Prius hybrid<br />

with <strong>the</strong> Chevrolet Volt while Nissan Motor Co. has introduced <strong>the</strong> all-electric<br />

Leaf, for which Toyota has no equivalent. Hyundai has climbed up <strong>the</strong> quality<br />

rankings to seize market share and in China, <strong>the</strong> world‟s biggest market,<br />

GM‟s and Volkswagen AG‟s manufacturing capabilities and sales dwarf those<br />

<strong>of</strong> Toyota.<br />

“Toyota‟s real challenge will be in <strong>the</strong> coming years as new buyers, who do<br />

not automatically assume that Toyota is <strong>the</strong> safest and most reliable vehicle,<br />

put <strong>the</strong> Toyota products up against competitors,” said Alexander Edwards,<br />

president <strong>of</strong> San Diego-based market researcher Strategic Vision Inc.<br />

Toyota dropped 17 percent in Tokyo trading in 2010, making <strong>the</strong> shares <strong>the</strong><br />

biggest drag on Japan‟s Topix index, which declined 1 percent. Nissan fell 4.6<br />

percent last year, while Ford rose 68 percent in New York and Hyundai<br />

climbed 43 percent in Seoul. Toyota gained 1.6 percent to 3,510 yen as <strong>of</strong><br />

9:22 a.m. today in Tokyo.<br />

Prius Hybrid<br />

Toyota pioneered <strong>the</strong> hybrid car with <strong>the</strong> Prius. It hasn‟t yet brought out an<br />

electric vehicle, falling behind Nissan and Mitsubishi Motors Corp. If <strong>the</strong><br />

technology proves successful and Toyota doesn‟t keep up, it will be similar to<br />

Sony‟s failure to dominate <strong>the</strong> transition to compact discs from cassette<br />

players, according to Yuuki Sakurai, who helps oversee <strong>the</strong> equivalent <strong>of</strong> $8.4<br />

billion as chief executive <strong>of</strong>ficer at Fukoku Capital Management Inc. in Tokyo.<br />

“The key is whe<strong>the</strong>r Toyota can ride this wave,” he said. “More and more<br />

competitors will appear, and <strong>the</strong> question will be: Who can build it <strong>the</strong><br />

cheapest?”<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main<br />

points in 2-3 minutes.<br />

QUESTION 2: What is <strong>the</strong> advantage <strong>of</strong> a hybrid car?<br />

QUESTION 3: Why is Toyota losing its once-loyal customers?

Who's to blame?<br />

Oct 11th 2010, 19:53 by A.L.B. | BUDAPEST<br />

LIKE Chernobyl and Bhopal, Kolontar never wanted to be on <strong>the</strong> map. Not<br />

like this, anyway, painted red as though an angry God had directed a tidal<br />

wave <strong>of</strong> toxic sludge on to this sleepy hamlet. People, livestock, vehicles<br />

and possessions were all swept away until, suddenly, it stopped, leaving<br />

houses marked with precise tidemarks.<br />

The good news is that after days<br />

<strong>of</strong> emergency work, <strong>the</strong> walls <strong>of</strong><br />

<strong>the</strong> reservoir in western Hungary<br />

which gushed out 1 million cubic<br />

metres <strong>of</strong> toxic sludge are holding.<br />

The bad news is government<br />

<strong>of</strong>ficials say <strong>the</strong> reservoir is so<br />

damaged that <strong>the</strong>y expect it to<br />

give way at any moment,<br />

unleashing a fresh deluge.<br />

Meanwhile Zoltan Bakonyi, <strong>the</strong><br />

head <strong>of</strong> MAL Zrt, <strong>the</strong> aluminium<br />

company at <strong>the</strong> heart <strong>of</strong> Hungary‟s<br />

worst-ever environmental disaster,<br />

has been detained by police on suspicion <strong>of</strong> endangering public safety,<br />

causing multiple deaths and damaging <strong>the</strong> environment. Anna Nagy, a<br />

government spokeswoman, said today that Mr Bakonyi had been held for<br />

72 hours. The company itself will be put under <strong>the</strong> control <strong>of</strong> a state<br />

commissioner.<br />

This evening <strong>the</strong> death toll rose to eight after <strong>the</strong> body <strong>of</strong> an elderly<br />

woman was found near Devecser, in western Hungary. This town, and <strong>the</strong><br />

nearby village <strong>of</strong> Kolontar, were hit particularly hard by <strong>the</strong> disaster. Yet<br />

<strong>the</strong>re may be more to come. A week after <strong>the</strong> flood began, when <strong>the</strong> wall<br />

<strong>of</strong> a reservoir at <strong>the</strong> MAL plant in Ajka fractured, <strong>of</strong>ficials admit that <strong>the</strong><br />

reservoir walls are riven with cracks and a fur<strong>the</strong>r breach is almost<br />

inevitable. Four thousand rescue workers are engaged in a race against<br />

time to build a massive dyke to hold back <strong>the</strong> next wave <strong>of</strong> sludge. The<br />

news that <strong>the</strong> second eruption should be easier to deal with, <strong>the</strong><br />

reservoir‟s contents now being mostly toxic mud ra<strong>the</strong>r than water, was<br />

meagre compensation.<br />

A team <strong>of</strong> five EU toxicology and environmental experts has arrived in<br />

Hungary, and will spend <strong>the</strong> week ascertaining <strong>the</strong> precise extent <strong>of</strong> <strong>the</strong><br />

damage to arable land, rivers and air quality. Tests by Greenpeace have<br />

show high levels <strong>of</strong> arsenic, mercury and chrome. An unlikely extra<br />

headache is provided by <strong>the</strong> wea<strong>the</strong>r. Unseasonable dry heat is drying out<br />

<strong>the</strong> top layer <strong>of</strong> <strong>the</strong> sludge, leading to fears it could evaporate and form a

toxic cloud. In Kolontar, <strong>of</strong>ficials say that air toxicity levels are safe, but<br />

<strong>the</strong>y have none<strong>the</strong>less issued rescue workers with masks and goggles.<br />

The village has now been completely evacuated and closed <strong>of</strong>f, with<br />

access controlled by armed police. All 800 <strong>of</strong> its residents have been<br />

relocated. Kolontar's lower part, which was worst hit, will probably never<br />

be habitable again. Plans have also been drawn up for an emergency<br />

evacuation <strong>of</strong> Devecser. Many residents have already fled; those<br />

remaining have been instructed to have a bag packed and be ready to<br />

leave at an hour‟s notice.<br />

O<strong>the</strong>r welcome news is that <strong>of</strong>ficials say <strong>the</strong>y have now largely eliminated<br />

<strong>the</strong> danger to <strong>the</strong> Danube. Relief workers have been dumping large<br />

quantities <strong>of</strong> gypsum and acetic acid <strong>into</strong> <strong>the</strong> affected waterways to<br />

reduce <strong>the</strong>ir alkalinity levels, which initially reached a pH level <strong>of</strong> 13.<br />

(Seven, or neutral, is considered ideal.) Recent checks in <strong>the</strong> Danube have<br />

showed 8.3 at Komarom, on <strong>the</strong> Hungarian-Slovak border, and 8.18 at<br />

Szob, north <strong>of</strong> Budapest.<br />

Viktor Orban, <strong>the</strong> prime minister, has handled <strong>the</strong> crisis well, striding<br />

around <strong>the</strong> stricken villages in gumboots, and channelling public anger<br />

towards those responsible. MAL‟s initial <strong>of</strong>fer <strong>of</strong> 100,000 forints ($510)<br />

compensation to affected families caused fury (<strong>the</strong> company's executives<br />

are believed to be among <strong>the</strong> richest in <strong>the</strong> country).<br />

There are also questions about <strong>the</strong> role <strong>of</strong> state environmental regulators.<br />

MAL firmly denies negligence and says recent inspections at <strong>the</strong> reservoir<br />

found everything to be in order. Mr Orban disputes that, telling parliament<br />

today that some <strong>of</strong> <strong>the</strong> company's employees may have been aware <strong>of</strong> <strong>the</strong><br />

state <strong>of</strong> <strong>the</strong> reservoir‟s walls but chose to do nothing about <strong>the</strong> problem.<br />

QUESTION 1: Please summarise <strong>the</strong> article so that you can explain <strong>the</strong> main points in<br />

2-3 minutes.<br />

QUESTION 2: Who was affected by <strong>the</strong> toxic spill?<br />

QUESTION 3: Do you know <strong>of</strong> some o<strong>the</strong>r regions with serious<br />

environmental problems?

The Romani row, revisited<br />

BUCHAREST was once known as <strong>the</strong> "Paris <strong>of</strong> <strong>the</strong> east". But Parisians<br />

might be advised to steer clear <strong>of</strong> <strong>the</strong> Romanian capital, at least until <strong>the</strong><br />

latest row between <strong>the</strong> French and Romanian governments blows over.<br />

Relations between <strong>the</strong> two countries have largely been smooth since<br />

Romania's accession to <strong>the</strong> European Union in 2007. At least until last<br />

August, when Nicolas Sarkozy ordered <strong>the</strong> expulsion <strong>of</strong> Romanies illegally<br />

living in France, most <strong>of</strong> whom had Romanian citizenship. It wasn't long<br />

until accusations <strong>of</strong> opportunism and even racism came flying France's<br />

way.<br />

Last month <strong>the</strong> European Commission organised a two-day conference in<br />

Bucharest. The ostensibly bland <strong>the</strong>me <strong>of</strong> <strong>the</strong> event—“Contribution <strong>of</strong> EU<br />

funds to <strong>the</strong> integration <strong>of</strong> Roma”—was enlivened by <strong>the</strong> politically<br />

charged atmosphere following Nicolas Sarkozy‟s decision in <strong>the</strong> summer to<br />

expel thousands <strong>of</strong> Romani migrants, most <strong>of</strong> <strong>the</strong>m Romanian, from<br />

France. The event was <strong>the</strong> first real get-toge<strong>the</strong>r <strong>of</strong> Romani leaders,<br />

Romanian government representatives and <strong>the</strong> EU since <strong>the</strong> expulsions.<br />

No clear consensus emerged on <strong>the</strong> impact <strong>of</strong> EU funds on Romania's<br />