Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

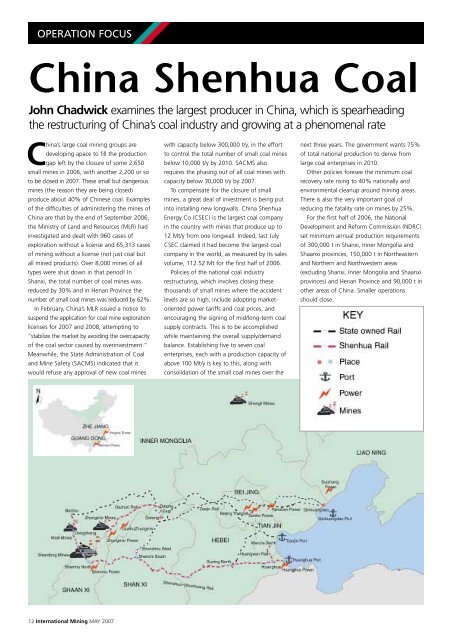

OPERATION FOCUS<br />

<strong>China</strong> <strong>Shenhua</strong> <strong>Coal</strong><br />

John Chadwick examines the largest producer in <strong>China</strong>, which is spearheading<br />

the restructuring of <strong>China</strong>’s coal industry and growing at a phenomenal rate<br />

<strong>China</strong>’s large coal mining groups are<br />

developing apace to fill the production<br />

gap left by the closure of some 2,650<br />

small mines in 2006, with another 2,200 or so<br />

to be closed in 2007. These small but dangerous<br />

mines (the reason they are being closed)<br />

produce about 40% of Chinese coal. Examples<br />

of the difficulties of administering the mines of<br />

<strong>China</strong> are that by the end of September 2006,<br />

the Ministry of Land and Resources (MLR) had<br />

investigated and dealt with 960 cases of<br />

exploration without a license and 65,313 cases<br />

of mining without a license (not just coal but<br />

all mined products). Over 8,000 mines of all<br />

types were shut down in that period! In<br />

Shanxi, the total number of coal mines was<br />

reduced by 30% and in Henan Province the<br />

number of small coal mines was reduced by 62%.<br />

In February, <strong>China</strong>’s MLR issued a notice to<br />

suspend the application for coal mine exploration<br />

licenses for 2007 and 2008, attempting to<br />

“stabilize the market by avoiding the overcapacity<br />

of the coal sector caused by overinvestment.”<br />

Meanwhile, the State Administration of <strong>Coal</strong><br />

and Mine Safety (SACMS) indicated that it<br />

would refuse any approval of new coal mines<br />

12 International Mining MAY 2007<br />

with capacity below 300,000 t/y, in the effort<br />

to control the total number of small coal mines<br />

below 10,000 t/y by 2010. SACMS also<br />

requires the phasing out of all coal mines with<br />

capacity below 30,000 t/y by 2007.<br />

To compensate for the closure of small<br />

mines, a great deal of investment is being put<br />

into installing new longwalls. <strong>China</strong> <strong>Shenhua</strong><br />

Energy Co (CSEC) is the largest coal company<br />

in the country with mines that produce up to<br />

12 Mt/y from one longwall. Indeed, last July<br />

CSEC claimed it had become the largest coal<br />

company in the world, as measured by its sales<br />

volume, 112.52 Mt for the first half of 2006.<br />

Policies of the national coal industry<br />

restructuring, which involves closing these<br />

thousands of small mines where the accident<br />

levels are so high, include adopting marketoriented<br />

power tariffs and coal prices, and<br />

encouraging the signing of mid/long-term coal<br />

supply contracts. This is to be accomplished<br />

while maintaining the overall supply/demand<br />

balance. Establishing five to seven coal<br />

enterprises, each with a production capacity of<br />

above 100 Mt/y is key to this, along with<br />

consolidation of the small coal mines over the<br />

next three years. The government wants 75%<br />

of total national production to derive from<br />

large coal enterprises in 2010.<br />

Other policies foresee the minimum coal<br />

recovery rate rising to 40% nationally and<br />

environmental cleanup around mining areas.<br />

There is also the very important goal of<br />

reducing the fatality rate on mines by 25%.<br />

For the first half of 2006, the National<br />

Development and Reform Commission (NDRC)<br />

set minimum annual production requirements<br />

of 300,000 t in Shanxi, Inner Mongolia and<br />

Shaanxi provinces, 150,000 t in Northeastern<br />

and Northern and Northwestern areas<br />

(excluding Shanxi, Inner Mongolia and Shaanxi<br />

provinces) and Henan Province and 90,000 t in<br />

other areas of <strong>China</strong>. Smaller operations<br />

should close.

<strong>China</strong>’s total run-of-mine (ROM) coal<br />

production in 2005 was 2,190 Mt, and in the<br />

first nine months of 2006 was 1,478 Mt. In<br />

2005, what the MLR describes as ‘large and<br />

super-large coalfields’ were discovered at<br />

Qingyang (Gansu Province), Yuzhou (Henan<br />

Province), Hengshui (Hebei Province), Changji<br />

(Xinjiang Autonomous Region) and Yushe<br />

(Shanxi Province). During the year a number of<br />

new coal development projects were initiated<br />

or came on stream, undertaken by CSEC,<br />

Huaneng Group, Pingdingshan <strong>Coal</strong> Group,<br />

Yanzhou <strong>Coal</strong> Group and others.<br />

NDRC says total production will be capped<br />

at 2,600 Mt/y by 2010, and it forecasts demand<br />

in 2007 will rise 4.2% to 2,500 Mt, fuelling<br />

about 70% of <strong>China</strong>'s power output. “The key<br />

missions are to control output, form big<br />

players, consolidate small and medium-size<br />

suppliers and eliminate those with low recovery<br />

rates and poor safety,” the commission said in<br />

its outline of the 11th Five-Year Plan (2006-<br />

2010) for the coal industry. The 2,600 Mt/y<br />

cap would mean limiting the average annual<br />

rate of increase in production to 2%, which<br />

seems unlikely with recent annual increases of<br />

up to 11%. By 2010, these planners also<br />

expect small mines to provide only 700 Mt<br />

(27%), while large complexes produce 1,450<br />

Mt (56%) and medium size mines produce<br />

450 Mt (17%).<br />

CSEC the leader<br />

CSEC’s biggest production group, <strong>China</strong><br />

<strong>Shenhua</strong> Shendong <strong>Coal</strong>, exemplifies the huge<br />

achievements of the company. Shendong’s<br />

eight mines last year produced 107 Mt, but<br />

only 12 years before, in 1994, there was<br />

nothing. Last August Shendong’s Bulianta mine<br />

(one of the world’s biggest underground<br />

operations) produced 2.1 Mt of raw coal in the<br />

month (2 Mt clean), breaking its own coal<br />

production record. In 2006, it became the first<br />

underground coal mine in the world to<br />

produce over 20 Mt.<br />

Despite its rapid growth, Shendong has not<br />

forsaken environmental management and in<br />

2005 was a winner as one of <strong>China</strong>’s best<br />

enterprises for environmental protection. Even<br />

more important, CSEC is a leader in mine<br />

safety. For the first half of 2006, its fatality<br />

rate/Mt was 0.028, compared with 0.6 for the<br />

key state-owned mines and the national<br />

average of 2.2.<br />

As well as being the largest coal producer,<br />

CSEC is also the largest export coal producer in<br />

<strong>China</strong>, and has the largest reserves of quality<br />

coal reserve in <strong>China</strong>. In 2005, CSEC’s<br />

marketable coal reserves were 5,740 Mt. CSEC<br />

owns dedicated rail lines and ports, being the<br />

only coal company in <strong>China</strong> that owns and<br />

operates a large-scale integrated coal<br />

transportation network. It controls one of the<br />

two primary dedicated eastbound coal freight<br />

rail lines in <strong>China</strong>, which not only helps solve<br />

the transportation bottleneck that faces<br />

Chinese coal companies, but also provides<br />

great synergy as well as transportation cost<br />

advantages. CSEC also has a sizeable and<br />

rapidly growing power generation business,<br />

complementary to its coal business.<br />

<strong>China</strong>’s Ministry of Railways is also working<br />

to improve coal transport. Its priorities for this<br />

year are the construction of rail lines for<br />

passenger transport, coal transport and<br />

inter-regional connections. It has allocated<br />

RMB332 billion to construct new lines and the<br />

purchase of rolling stock this year.<br />

CSEC currently operates through four<br />

mining groups – Shendong, Wanli, Zhunge’er<br />

and Shengli – with a total of 21 operating<br />

mines in western and northern <strong>China</strong>.<br />

Shendong and Wanli are primarily underground<br />

mines while the Zhunge’er and Shengli<br />

mines are open pits. Shendong is the largest of<br />

the 13 large-scale coal bases in <strong>China</strong>.<br />

In 2005, CSEC's commercial (clean) coal<br />

production exceeded 121 Mt, representing a<br />

year-on-year increase of 20.1 Mt, or an<br />

increase of 19.8%. <strong>Coal</strong> sales volume amounted<br />

to 144 Mt, representing a year-on-year<br />

increase of 17.45 Mt, or an increase of 13.8%.<br />

In 2006, clean coal production rose over 15<br />

Mt, to 136.6 Mt and sales rose to 171.1 Mt.<br />

Exports were 23.9 Mt. During the year, CSEC<br />

benefited from a steady increase in coal price.<br />

Its average production cost was RMB57.3/t in<br />

2005 and for the first half of 2006 it was<br />

05/07<br />

RMB56.3/t (when the costs broke down as<br />

RMB10.3/t for raw materials, fuel and power;<br />

RMB7.7/t for labour; RMB8.9/t for maintenance<br />

and RMB14.1/t, others). Adding in transportation<br />

costs, the totals were RMB131.7/t and<br />

RMB125.1/t, respectively. Those same unit<br />

costs including third party coal purchases were<br />

RMB145/t and RMB149.8/t, respectively.<br />

In 2005, CSEC’s raw coal production<br />

accounted for 6.2% of national production and<br />

12% of the national thermal coal production,<br />

and its export sales accounted for 33% of<br />

national exports.<br />

CSEC plans to achieve a clean coal output<br />

level of 170 Mt by next year, and to exceed<br />

200 Mt by 2010. Longer term, the goal is 800<br />

Mt by 2020. The annual rail capacity of CSEC<br />

is targeted to reach 200 Mt/y and port<br />

shipment capacity 140 Mt/y by 2008. Total<br />

installed power generation capacity is to reach<br />

20,000 MW by 2010.<br />

Capital expenditure between 2006 and<br />

2008 will be split between the coal mines<br />

(40%), power generation (38%) and railways<br />

and ports (22%). CSEC intends to invest<br />

RMB30.4 billion in its coal mines, mainly for<br />

technology upgrades, equipment replacement<br />

and the construction of key projects such as<br />

the Buertai underground mine in the Wanli<br />

<strong>Coal</strong> Group and the Ha’erwusu open pit. It<br />

was November 2005 that CSEC announced<br />

the start of construction at the Ha’erwusu<br />

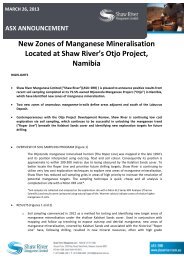

A Bucyrus 8750 dragline like this is the first large<br />

dragline of any manufacture to be sold into <strong>China</strong>. It<br />

is also the first dragline to be entirely powered with a<br />

Siemens AC static drive system and with a direct<br />

(gearless) drive system for hoist and drag motions.<br />

MAY 2007 International Mining 13

OPERATION FOCUS<br />

mine, located in the Zhunge’er coalfield near<br />

Hohhot, Inner Mongolia, and adjacent to<br />

Heidaigou mine. <strong>Coal</strong> transport from<br />

Ha’erwusu will use the Da-Zhun rail line, which<br />

is one part of CSEC’s dedicated rail system.<br />

The estimated probable reserves are some<br />

1,585 Mt under the <strong>China</strong> national standard.<br />

The coal characteristics are favourable for<br />

power generation. The design capacity is 20<br />

Mt/y and will include a processing plant.<br />

As part of the Ha’erwusu development,<br />

Terex is delivering a large number of Unit Rig<br />

trucks. The trucks are being delivered and<br />

on-going service and support provided by Terex<br />

NHL Mining Equipment Co, a new joint<br />

venture company established between Terex<br />

and Inner Mongolia North Hauler Joint Stock<br />

Co, located in Baotou, Inner Mongolia. The<br />

joint venture company will also participate in<br />

certain aspects of the fabrication and<br />

component manufacturing for these trucks.<br />

The Terex contract, valued at some $150<br />

million, covers 18 MT4400AC 240-t class<br />

dump trucks and 37 MT5500B 360-t class<br />

trucks. They are to be delivered to the mine<br />

between January and September this year. In<br />

January 2006 Bucyrus International was the<br />

successful bidder to supply four electric rope<br />

mining shovels to Ha’erwusu. The public bid<br />

release indicated that the scope of supply<br />

would include four 55-60 m3 shovels.<br />

Neighbouring Heidaigou is the second<br />

largest open-pit coal mine in <strong>China</strong>. The mine<br />

uses what CSEC describes as ‘the truck and<br />

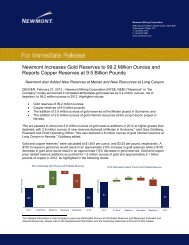

Joy Mining is delivering a 7LS shearer and the AFC for a new<br />

longwall at Shendong’s Yujialiang mine. These machines will<br />

operate on the longest face thus far developed in the world,<br />

at 413 m.<br />

14 International Mining MAY 2007<br />

conveyor mining method’ but is in the process<br />

of introducing dragline mining. It achieved<br />

clean coal production of 19.77 Mt, with a<br />

resource recovery rate of 98%, in 2005.<br />

It was Bucyrus that won the Heidaigou<br />

dragline contract which, the company said,<br />

“marks the start of a new era in dragline<br />

technology. The dragline, a model 8750 with a<br />

90 m3 bucket, is the first large dragline of any<br />

manufacture to be sold into <strong>China</strong>. It is also<br />

the first dragline to be entirely powered with a<br />

Siemens AC static drive system and with a<br />

direct (gearless) drive system for the hoist and<br />

drag motions.”<br />

The mine also chose to have the productivity<br />

enhancing, maintenance reducing “D3 ”(Direct<br />

Drive for Draglines) technology. Stuart Cotterill,<br />

Vice President and General Manager for <strong>China</strong><br />

Operations, highlighted the selection of<br />

Bucyrus, “We are truly appreciative of the<br />

approach taken by Zhunge’er in the selection<br />

of this dragline following considerable<br />

technical discussions and visits to several<br />

mining operations. The recognition of the long<br />

term benefits of the machine's features is a<br />

tribute to their appreciation of the latest<br />

technological advances.<br />

Bucyrus and Siemens worked closely together<br />

to make D3 a reality. The application of D3 is<br />

made possible through the use of Siemens'<br />

AFE (Active Front-End) AC electrical technology.<br />

The maximum achievable production improvement<br />

that can be gained by using D3 is a function of<br />

the specific dragline configuration and its use<br />

in the mine plan. An analysis of several existing<br />

dragline operations has identified significant<br />

productivity increases, well in excess of 20%.<br />

Substantial productivity increases such as this<br />

provide opportunities to further reduce mining<br />

costs by optimizing overburden removal<br />

methods. Tim Sullivan, President and COO of<br />

Bucyrus commented at the time, “Thirty years<br />

ago Bucyrus machines were the first western<br />

manufactured shovels and drills to be sold to<br />

the <strong>China</strong> market and many of those units still<br />

operate today. We are extremely pleased to<br />

follow that tradition by supplying the first large<br />

walking dragline.<br />

In November last year CSEC announced that<br />

the construction of a new coal processing plant<br />

at the Zhunge’er Heidaigou open-pit mine had<br />

been completed. Now, the coal processing<br />

capacity at Zhunge’er has been upgraded to<br />

20-25 Mt/y, making it the largest such facility<br />

in Asia.<br />

<strong>Coal</strong> infrastructure<br />

The RMB16.6 to be invested by CSEC in railways<br />

and ports between 2006 and 2008 is mainly to<br />

increase the capacities of the Shen-Shupo<br />

and Da-Zhun railways, and to construct key<br />

projects such as the Huang-Wan railway and<br />

the Tianjin coal terminal. Most of the RMB28.6<br />

billion in power generation spending is for<br />

new capacity at the Ninghai, Huanghua,<br />

Taishan and Jingjie power projects.<br />

CSEC’s coal mine merger and acquisition<br />

plans include gradually completing the acquisition

STATIONARY<br />

RECLAIM<br />

McLanahan Feeder-Breakers are designed with cutting edge<br />

features and concepts. We were the first manufacturer to eliminate<br />

chain drives and shear pins and incorporate the use of direct drive<br />

reducers and hydraulic motors to power the breaker and chain<br />

conveyor system. But beyond that, we have set the new standard for<br />

providing the most rugged and reliable Feeder-Breakers ever made.<br />

UNDERGROUND<br />

CRAWLER MOUNTED<br />

Call Or Visit Our Website Today To Learn<br />

How You Can Improve Your Operations<br />

With A McLanahan Feeder-Breaker!<br />

MINERAL PROCESSING DIVISION<br />

EQUIPMENT, SYSTEMS & PROCESS INNOVATION – SINCE 1835<br />

WORLD HEADQUARTERS 200 Wall Street, Hollidaysburg, PA 16648 USA<br />

Ph: 814-695-9807 • Fax: 814-695-6684 • E-mail: sales@mclanahan.com<br />

AUSTRALIAN OFFICE 8/9 Tonella Centre, 125 Bull Street, Newcastle West, NSW 2302 Australia<br />

Ph: +02 49 248 248 • Fax: +02 4926 2514 • E-mail: sales@mclanahan.com.au<br />

www.mclanahan.com

OPERATION FOCUS<br />

of Xi Sanju, Baorixile of Inner Mongolia, Ningmei,<br />

<strong>China</strong> <strong>Shenhua</strong> Xinjiang, Hungyuchuan <strong>Coal</strong>field,<br />

Mengxi <strong>Coal</strong> Chemical, Wuhai Coking <strong>Coal</strong><br />

Chemical and the Jinshen project. Overseas,<br />

CSEC is looking at coal business opportunities<br />

in Vietnam, Mongolia and Australia.<br />

The Shendong giant<br />

The Shendong mines use fully-mechanized<br />

longwall mining technology and centralized<br />

production management and safety systems.<br />

The longwall panels range from 240 to 360 m<br />

(and now going to over 400 m) in width and<br />

from 4,000 to 6,000 m in length. Among the<br />

Shendong mines, there are three working<br />

faces each with an annual output of at least<br />

10 Mt. Shendong’s commercial coal production<br />

rocketed from 47.1 Mt in 2002 to 94.95 Mt in<br />

2005. With the commencement of operations<br />

of Halagou’s longwall system at the end of<br />

2004, Shendong had built five 10-Mt/y mines<br />

– Daliuta, Bulianta, Yujialiang, Halagou and<br />

Shangwan. In 2005, Shendong’s coal production<br />

accounted for 78.2% of CSEC’s total output.<br />

Mining efficiency at Shendong’s underground<br />

mines has seen steady and significant<br />

improvement. In 2004 it was 28,320<br />

t/y/employee, and then rose to 29,813 t in<br />

2005 and for the first half of 2006 was up at<br />

31,502 t. Joy Mining is a major supplier to<br />

Shendong, where its fleet includes 25 shearers,<br />

24 AFCs and five PRS. The majority of the Joy<br />

units are 7LS or 6LS shearers.<br />

Joy Mining is delivering a 7LS1A shearer<br />

and the AFC for a new longwall at Shendong’s<br />

Yujialiang mine. These machines will operate<br />

on the longest face thus far developed in the<br />

world, at 413 m.<br />

In January this year, Poland’s Kopex also<br />

signed a $33.15 million contract for this<br />

project that covers the delivery of Tagor (part<br />

of the ZZM-Kopex Group) longwall<br />

mechanized roof supports together with an<br />

electro-hydraulic monitoring and control<br />

system to be supplied by Marco, to be<br />

completed by the end of October this year.<br />

Shendong’s future plans include expansion<br />

into adjacent areas to further enhance<br />

exploration of resources in the southern area<br />

of Shendong. The coal group is also promoting<br />

its own equipment manufacturing and recently<br />

developed the first Chinese built 40-t shield<br />

mover, together with the Taiyuan Branch of<br />

<strong>China</strong> <strong>Coal</strong> Research, which has now gone to<br />

work underground in the Shendong mines.<br />

CTL and more<br />

CSEC is set to become the world leader in<br />

coal-to-liquids (CTL). It started developing its<br />

CTL programme at a pilot plant in Shanghai,<br />

16 International Mining MAY 2007<br />

which now has successfully achieved<br />

sustainable output of diesel oil and gasoline<br />

from a feed of 6 t/d of coal. This facility has<br />

allowed CSEC to become comfortable with the<br />

technology and to accumulate know-how on<br />

cost control and operations management.<br />

Shendong is developing the first commercial<br />

project in Inner Mongolia. Project construction<br />

was 50% complete at the beginning of 2006,<br />

with the coal liquefaction reactors (each<br />

weighing 2,250 t) successfully installed. Full<br />

production is expected by the end of this year,<br />

some 20,000 barrels/d (b/d) of oil from coal.<br />

However, the plans go far beyond this one<br />

plant. CSEC plans to operate eight liquefaction<br />

plants by 2020. Together they will yield in<br />

excess of 30 Mt/y of CTL oil, which is estimated<br />

to be sufficient to replace over 10% of<br />

<strong>China</strong>’s projected oil imports.<br />

These CTL plans are not only fascinating in<br />

their sheer size; they also involve very<br />

interesting technology. Up to now, all the<br />

world’s CTL has involved the Fischer-Tropsch<br />

(FT) process, which requires coal to be turned<br />

into synthetic gas, and then to be liquefied.<br />

CSEC is using a process developed by Friedrich<br />

Bergius, a decade before the FT process, which<br />

takes the coal directly to liquids. It is certainly<br />

not unproven as it was well used in Nazi Germany.<br />

The <strong>China</strong> <strong>Coal</strong> Research Institute in Beijing<br />

estimates the Bergius process yields significantly<br />

more fuel from each tonne of coal. It expects<br />

the process to capture more than 55% of the<br />

coal’s energy, compared to just 45% for FT.<br />

Basically; the bulk of the coal is pulverized and<br />

blended with CTL oil. It is then exposed to<br />

hydrogen and heated to 450°C.<br />

The benefits of Bergius do not come<br />

without some downsides. Direct liquefaction is<br />

far more complex than FT, requiring separate<br />

power and gasification plants. Also, a great<br />

deal of recycling of oil, hydrogen and coal<br />

sludge is necessary, between different sections<br />

of the plant. CSEC is bravely taking a massive<br />

engineering and economic risk with this first<br />

$1.5 billion CTL plant. Thus far the signs are<br />

promising. If CSEC has got it right, which<br />

seems likely, it will be a great boost for <strong>China</strong>,<br />

and for the world, as its success would surely<br />

lead to more projects that can harness the<br />

energy potential of coal so cleanly. Also, CSEC<br />

says the cost of its synthetic oil will see it make<br />

a profit at a price of about $30/barrel.<br />

However, water could be the ultimate<br />

spanner in the works of these CTL plans. The<br />

Berguis process needs large quantities of water<br />

and <strong>China</strong> has great water problems.<br />

To be safe, the company is also working<br />

with the established FT technology, in partnership<br />

with both Shell and Sasol in northern <strong>China</strong>.<br />

For example, in the Nindong coalfield – one of<br />

13 major coal centres approved for construction<br />

by the Chinese Government, <strong>Shenhua</strong> Ningxia<br />

<strong>Coal</strong> Group (SNCG) and Shell are jointly studying<br />

the technical and commercial feasibility of a<br />

CTL plant with a production capacity of<br />

70,000 b/d of oil and chemical products.<br />

SNCG also, in January, signed a contract for<br />

Siemens Power Generation (PG) Group to<br />

supply key gasification equipment for a<br />

coal-based dimethyl ether project with a<br />

planned output of 830,000 t/y. Siemens PG<br />

also signed a Memorandum of Understanding<br />

to provide equipment for SNCG’s coal-based<br />

propylene project that when completed will be<br />

one of the largest in the world.<br />

In June 2006, in Cape Town, South Africa,<br />

Sasol signed a co-operation agreement with a<br />

consortium led by CSEC for proceeding with<br />

the second stage of feasibility studies to<br />

determine the viability of an 80,000 b/d CTL<br />

plant in Shaanxi Province, about 65 km west of<br />

Beijing. Sasol signed a similar agreement for<br />

another 80,000 b/d CTL project in the Ningxia<br />

Hui Autonomous region, about 1,000 km west<br />

of Beijing, with SNCG the previous day.<br />

Sasol noted, “the drive towards coal for<br />

energy security has been endorsed at the<br />

highest levels in <strong>China</strong> and CTL conversion<br />

technology, in particular, has been earmarked<br />

as having the potential to reduce dependence<br />

on the importation of crude oil and refined<br />

products. <strong>Coal</strong> utilization technologies have<br />

been flagged in the 11th Five Year Plan as an<br />

area for policy intervention and support.”<br />

Having produced more than 1,500 million<br />

barrels of oil equivalent fuel in South Africa,<br />

Sasol is recognized as the world leader in<br />

producing fuel from coal, with an unparalleled<br />

track record of more than 50 years of proven<br />

commercial CTL experience. But, Sasol may yet<br />

lose its crown to CSEC if its Bergius projects<br />

take off.<br />

The combined capacity of these two<br />

proposed Sasol projects, each with a nominal<br />

capacity of delivering 80,000 b/d of liquid fuel,<br />

is roughly equivalent to that of Sasol’s existing<br />

Secunda facility in South Africa.<br />

Sasol reported, “the initial pre feasibility<br />

studies confirmed all key drivers are in place<br />

for establishing a viable CTL business in <strong>China</strong><br />

using Sasol’s low-temperature FT technology.<br />

Each plant is expected to cost more than $5<br />

billion. Should these projects go ahead, they<br />

could be brought into operation as early as<br />

2012. The second stage feasibility studies will<br />

go into more detail in determining capital cost,<br />

feedstock cost, water supply and market conditions<br />

and will also determine most of the<br />

major commercial and funding issues.” IM