ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• wind power: Development, construction and operation of<br />

wind farms in Denmark, the UK, Poland, Norway, Sweden and<br />

Germany as well as an ownership interest in a hydro electric<br />

station in Sweden.<br />

• thermal power: Generation and sale of electricity and heat<br />

from thermal power stations in Denmark as well as ownership<br />

of gas-fi red power stations in the Netherlands and the<br />

UK and a demonstration plant for production of secondgeneration<br />

bioethanol in Denmark.<br />

• <strong>Energy</strong> markets: Optimisation and risk management of<br />

<strong>DONG</strong> <strong>Energy</strong>’s energy portfolio, including trading in natural<br />

gas and electricity with energy producers and wholesale<br />

customers and on European energy hubs and exchanges.<br />

• sales & Distribution: Sales and distribution of electricity<br />

and gas to wholesale and end customers in Denmark,<br />

Germany, the Netherlands and Sweden.<br />

Further details of the Group’s reportable segments are given in<br />

Management’s review.<br />

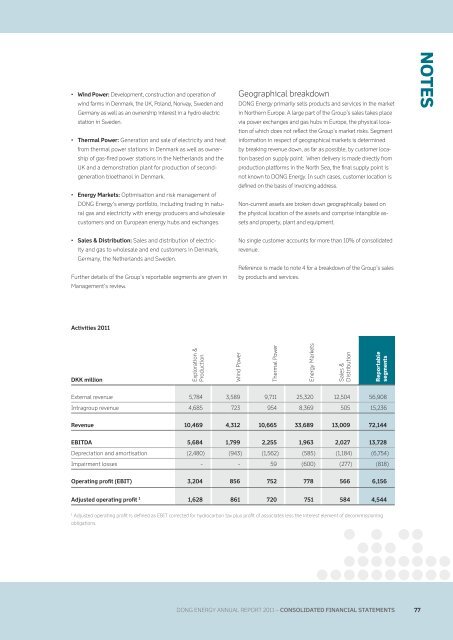

activities <strong>2011</strong><br />

DKK million Exploration &<br />

Production<br />

External revenue 5,784 3,589 9,711 25,320 12,504 56,908<br />

Intragroup revenue 4,685 723 954 8,369 505 15,236<br />

revenue 10,469 4,312 10,665 33,689 13,009 72,144<br />

EBitDa 5,684 1,799 2,255 1,963 2,027 13,728<br />

Depreciation and amortisation (2,480) (943) (1,562) (585) (1,184) (6,754)<br />

Impairment losses - - 59 (600) (277) (818)<br />

Operating profi t (EBit) 3,204 856 752 778 566 6,156<br />

adjusted operating profi t 1 1,628 861 720 751 584 4,544<br />

1 Adjusted operating profi t is defi ned as EBIT corrected for hydrocarbon tax plus profi t of associates less the interest element of decommissioning<br />

obligations.<br />

Wind Power<br />

Geographical breakdown<br />

<strong>DONG</strong> <strong>Energy</strong> primarily sells products and services in the market<br />

in Northern Europe. A large part of the Group’s sales takes place<br />

via power exchanges and gas hubs in Europe, the physical location<br />

of which does not refl ect the Group’s market risks. Segment<br />

information in respect of geographical markets is determined<br />

by breaking revenue down, as far as possible, by customer location<br />

based on supply point. When delivery is made directly from<br />

production platforms in the North Sea, the fi nal supply point is<br />

not known to <strong>DONG</strong> <strong>Energy</strong>. In such cases, customer location is<br />

defi ned on the basis of invoicing address.<br />

Non-current assets are broken down geographically based on<br />

the physical location of the assets and comprise intangible assets<br />

and property, plant and equipment.<br />

No single customer accounts for more than 10% of consolidated<br />

revenue.<br />

Reference is made to note 4 for a breakdown of the Group’s sales<br />

by products and services.<br />

Thermal Power<br />

<strong>DONG</strong> ENERGY <strong>DONG</strong> ENERGY GROUP <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> – COnsOliDatED finanCial statEmEnts<br />

73 77<br />

<strong>Energy</strong> Markets<br />

Sales &<br />

Distribution<br />

Reportable<br />

segments<br />

notes