ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

isk and risk policy Exposure and hedging<br />

price risks for renewable generation<br />

In connection with the development of renewable energy<br />

sources, primarily offshore wind farms, a major part of<br />

the earnings from wind power will come from regulated<br />

pricing. The most important elements are fixed tariffs<br />

(Denmark and Germany) and guaranteed minimum<br />

prices for green certificates (the UK and Poland).<br />

The market price risk for the wind power portfolio is<br />

treated as a direct price risk and managed with a time<br />

frame of up to five years based on a target for Cash-Flowat-Risk.<br />

market trading<br />

When the Group’s desired hedging level has been determined,<br />

the exposures are transferred to the market trading<br />

function, which is then responsible for executing the physical<br />

and financial transactions in the market. It is not always<br />

possible to hedge the transferred price risks in full.<br />

<strong>DONG</strong> <strong>Energy</strong> therefore has some remaining exposure resulting<br />

from these activities.<br />

The market trading function also balances the physical<br />

volumes in the market and, to a lesser extent, engages in<br />

active taking of positions to ensure an ongoing market<br />

presence and thus gain more detailed market insight. Furthermore,<br />

<strong>DONG</strong> <strong>Energy</strong> has assumed the role of market<br />

maker in the Danish electricity market, which entails further<br />

market risks.<br />

Currency risks<br />

The majority of <strong>DONG</strong> <strong>Energy</strong>’s activities entail exposure<br />

to fluctuations in exchange rates. The key currencies are<br />

USD, GBP, NOK, PLN, SEK and EUR. The total net exposure<br />

is calculated on an ongoing, consolidated basis. The<br />

Group aims to minimise its net exposure via forward contracts,<br />

swaps and options. Currency positions are determined<br />

on the basis of estimated operating cash flows in a<br />

five-year time frame. Currency risks in connection with net<br />

investments in foreign subsidiaries and loans without any<br />

time frame are also included.<br />

At the end of <strong>2011</strong>, fixed tariffs and guaranteed minimum<br />

prices for green certificates accounted for two-thirds of expected<br />

earnings from the wind power portfolio in 2012.<br />

Wind Power has hedged 32% of its market price exposure<br />

in 2012.<br />

In 2012, a 10% decrease in the electricity price would<br />

lead to a DKK 82 million decrease in EBITDA.<br />

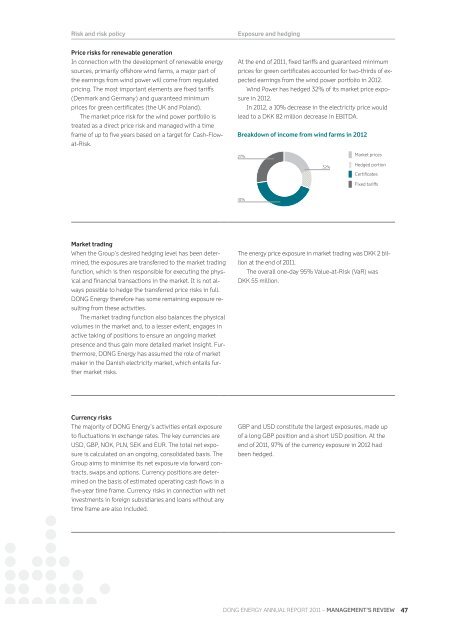

Breakdown of income from wind farms in 2012<br />

27%<br />

41%<br />

32%<br />

Market prices<br />

Hedged portion<br />

Certificates<br />

Fixed tariffs<br />

The energy price exposure in market trading was DKK 2 billion<br />

at the end of <strong>2011</strong>.<br />

The overall one-day 95% Value-at-Risk (VaR) was<br />

DKK 55 million.<br />

GBP and USD constitute the largest exposures, made up<br />

of a long GBP position and a short USD position. At the<br />

end of <strong>2011</strong>, 97% of the currency exposure in 2012 had<br />

been hedged.<br />

<strong>DONG</strong> ENERGY <strong>DONG</strong> ENERGY GROUP <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> – manaGEmEnt’s rEviEw 47