ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

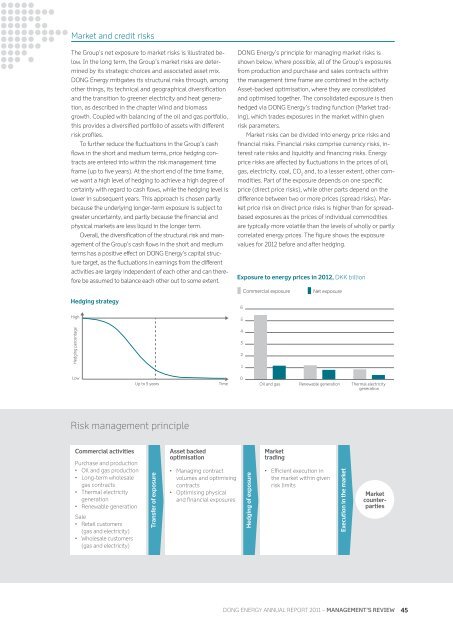

Market and credit risks<br />

The Group’s net exposure to market risks is illustrated below.<br />

In the long term, the Group’s market risks are determined<br />

by its strategic choices and associated asset mix.<br />

<strong>DONG</strong> <strong>Energy</strong> mitigates its structural risks through, among<br />

other things, its technical and geographical diversification<br />

and the transition to greener electricity and heat generation,<br />

as described in the chapter Wind and biomass<br />

growth. Coupled with balancing of the oil and gas portfolio,<br />

this provides a diversified portfolio of assets with different<br />

risk profiles.<br />

To further reduce the fluctuations in the Group’s cash<br />

flows in the short and medium terms, price hedging contracts<br />

are entered into within the risk management time<br />

frame (up to five years). At the short end of the time frame,<br />

we want a high level of hedging to achieve a high degree of<br />

certainty with regard to cash flows, while the hedging level is<br />

lower in subsequent years. This approach is chosen partly<br />

because the underlying longer-term exposure is subject to<br />

greater uncertainty, and partly because the financial and<br />

physical markets are less liquid in the longer term.<br />

Overall, the diversification of the structural risk and management<br />

of the Group’s cash flows in the short and medium<br />

terms has a positive effect on <strong>DONG</strong> <strong>Energy</strong>’s capital structure<br />

target, as the fluctuations in earnings from the different<br />

activities are largely independent of each other and can therefore<br />

be assumed to balance each other out to some extent.<br />

Hedging strategy<br />

High<br />

Hedging percentage<br />

Low<br />

Commercial activities<br />

Purchase and production<br />

• Oil and gas production<br />

• Long-term wholesale<br />

gas contracts<br />

• Thermal electricity<br />

generation<br />

• Renewable generation<br />

Sale<br />

• Retail customers<br />

(gas and electricity)<br />

• Wholesale customers<br />

(gas and electricity)<br />

Up to 5 years<br />

Risk management principle<br />

Transfer of exposure<br />

Asset backed<br />

optimisation<br />

Time<br />

• Managing contract<br />

volumes and optimising<br />

contracts<br />

• Optimising physical<br />

and financial exposures<br />

<strong>DONG</strong> <strong>Energy</strong>’s principle for managing market risks is<br />

shown below. Where possible, all of the Group’s exposures<br />

from production and purchase and sales contracts within<br />

the management time frame are combined in the activity<br />

Asset-backed optimisation, where they are consolidated<br />

and optimised together. The consolidated exposure is then<br />

hedged via <strong>DONG</strong> <strong>Energy</strong>’s trading function (Market trading),<br />

which trades exposures in the market within given<br />

risk parameters.<br />

Market risks can be divided into energy price risks and<br />

financial risks. Financial risks comprise currency risks, interest<br />

rate risks and liquidity and financing risks. <strong>Energy</strong><br />

price risks are affected by fluctuations in the prices of oil,<br />

gas, electricity, coal, CO and, to a lesser extent, other com-<br />

2<br />

modities. Part of the exposure depends on one specific<br />

price (direct price risks), while other parts depend on the<br />

difference between two or more prices (spread risks). Market<br />

price risk on direct price risks is higher than for spreadbased<br />

exposures as the prices of individual commodities<br />

are typically more volatile than the levels of wholly or partly<br />

correlated energy prices. The figure shows the exposure<br />

values for 2012 before and after hedging.<br />

Exposure to energy prices in 2012, DKK billion<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Commercial exposure Net exposure<br />

Hedging of exposure<br />

Oil and gas<br />

Market<br />

trading<br />

Renewable generation<br />

• Efficient execution in<br />

the market within given<br />

risk limits<br />

Execution in the market<br />

Thermal electricity<br />

generation<br />

Market<br />

counterparties<br />

<strong>DONG</strong> ENERGY <strong>DONG</strong> ENERGY GROUP <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> – manaGEmEnt’s rEviEw 45<br />

Efter afdæ<br />

Før afdæk<br />

Husk kategorier i 3 dæk