ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Further information on <strong>DONG</strong> <strong>Energy</strong>’s market risks and<br />

risk-mitigating initiatives are set out in the section on market<br />

and credit risks in the Risk and risk management chapter<br />

on page 44. This section also explains the expected effect<br />

on the business performance results of financial and<br />

physical hedging transactions where the effects on the results<br />

are deferred to subsequent periods.<br />

New activities and other assumptions<br />

Compared with <strong>2011</strong>, EBITDA in 2012 is expected to benefit<br />

from new or significantly expanded activities. This will be<br />

offset by increased costs for the repair work on the Siri<br />

platform, lower income in Thermal Power and the fact that,<br />

in 2012, there will not be a positive effect from renegotiation<br />

of gas contracts.<br />

EBITDA outlook for 2012<br />

Based on the market price outlook referred to above and<br />

price hedging and the described expectations concerning<br />

new activities and other assumptions, business performance<br />

EBITDA is expected to be in line with <strong>2011</strong>.<br />

EBITDA target<br />

Based on planned investments, the target is still a<br />

doubling of EBITDA in the period up to 2015 compared<br />

with 2009, when EBITDA was DKK 8.8 billion.<br />

EBITDA in 2013 is expected to be significantly ahead of<br />

2012 due to the start-up of production of new assets. To<br />

this should be added the full-year effect of new assets that<br />

become operational in 2012.<br />

Outlook for net investments<br />

Net investments in the period <strong>2011</strong>-13 are still expected to<br />

be around DKK 40 billion, remaining unchanged from the<br />

outlook in the 2010 annual report.<br />

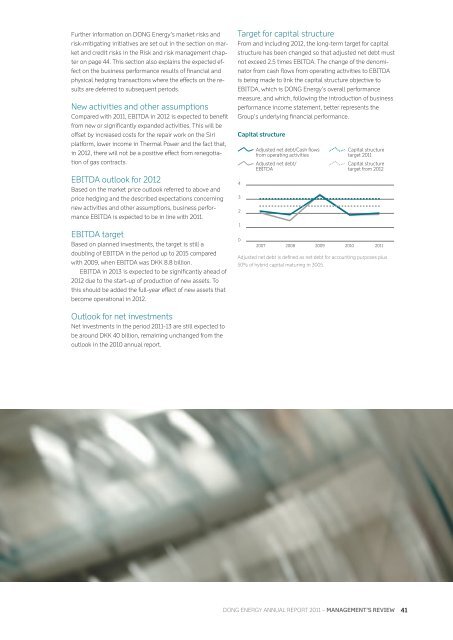

Target for capital structure<br />

From and including 2012, the long-term target for capital<br />

structure has been changed so that adjusted net debt must<br />

not exceed 2.5 times EBITDA. The change of the denominator<br />

from cash flows from operating activities to EBITDA<br />

is being made to link the capital structure objective to<br />

EBITDA, which is <strong>DONG</strong> <strong>Energy</strong>’s overall performance<br />

measure, and which, following the introduction of business<br />

performance income statement, better represents the<br />

Group’s underlying financial performance.<br />

Capital structure<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Adjusted net debt/Cash flows<br />

from operating activities<br />

Adjusted net debt/<br />

EBITDA<br />

2007<br />

2008<br />

2009<br />

Capital structure<br />

target <strong>2011</strong><br />

Capital structure<br />

target from 2012<br />

2010<br />

<strong>2011</strong><br />

Adjusted net debt is defi ned as net debt for accounting purposes plus<br />

50% of hybrid capital maturing in 3005.<br />

<strong>DONG</strong> ENERGY <strong>DONG</strong> ENERGY GROUP <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong> – manaGEmEnt’s rEviEw 41