ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

notes<br />

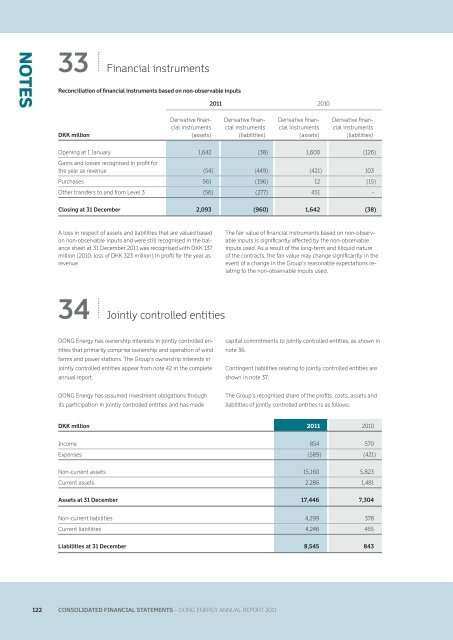

33 Financial instruments<br />

reconciliation of fi nancial instruments based on non-observable inputs<br />

DKK million<br />

Derivative fi nancial<br />

instruments<br />

(assets)<br />

34 Jointly controlled entities<br />

<strong>DONG</strong> <strong>Energy</strong> has ownership interests in jointly controlled entities<br />

that primarily comprise ownership and operation of wind<br />

farms and power stations. The Group’s ownership interests in<br />

jointly controlled entities appear from note 42 in the complete<br />

annual report.<br />

<strong>DONG</strong> <strong>Energy</strong> has assumed investment obligations through<br />

its participation in jointly controlled entities and has made<br />

<strong>2011</strong> 2010<br />

Derivative fi nancial<br />

instruments<br />

(liabilities)<br />

Derivative fi nancial<br />

instruments<br />

(assets)<br />

Derivative fi nancial<br />

instruments<br />

(liabilities)<br />

Opening at 1 January 1,642 (38) 1,600 (126)<br />

Gains and losses recognised in profi t for<br />

the year as revenue (54) (449) (421) 103<br />

Purchases 561 (196) 12 (15)<br />

Other transfers to and from Level 3 (56) (277) 451 -<br />

Closing at 31 December 2,093 (960) 1,642 (38)<br />

A loss in respect of assets and liabilities that are valued based<br />

on non-observable inputs and were still recognised in the balance<br />

sheet at 31 December <strong>2011</strong> was recognised with DKK 137<br />

million (2010: loss of DKK 323 million) in profi t for the year as<br />

revenue.<br />

The fair value of fi nancial instruments based on non-observable<br />

inputs is signifi cantly affected by the non-observable<br />

inputs used. As a result of the long-term and illiquid nature<br />

of the contracts, the fair value may change signifi cantly in the<br />

event of a change in the Group’s reasonable expectations relating<br />

to the non-observable inputs used.<br />

capital commitments to jointly controlled entities, as shown in<br />

note 36.<br />

Contingent liabilities relating to jointly controlled entities are<br />

shown in note 37.<br />

The Group’s recognised share of the profi ts, costs, assets and<br />

liabilities of jointly controlled entities is as follows:<br />

DKK million <strong>2011</strong> 2010<br />

Income 854 570<br />

Expenses (589) (421)<br />

Non-current assets 15,160 5,823<br />

Current assets 2,286 1,481<br />

assets at 31 December 17,446 7,304<br />

Non-current liabilities 4,299 378<br />

Current liabilities 4,246 465<br />

liabilities at 31 December 8,545 843<br />

118 122 COnsOliDatED finanCial statEmEnts – <strong>DONG</strong> ENERGY GROUP <strong>ANNUAL</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>REPORT</strong> <strong>2011</strong><br />

<strong>2011</strong>